Long Run Demand for Energy Services: the Role of Economic and

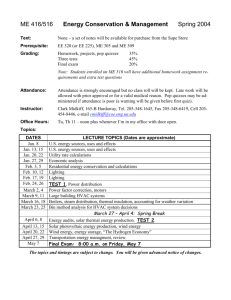

advertisement