Diploma in Capital Markets,

Regulation and Compliance

Short Course: Introduction to US Regulation

30 September-1 October 2008

Diploma in Capital Markets,

Regulation and Compliance

Short Course: Introduction to US Regulation

The Financial Industry Regulatory Authority (FINRA), University of Reading, and their affiliates

(the “Parties”) are not responsible for any errors in or omissions from the information

contained in this document. All such information is provided “as is” without warranty of any

kind. The Parties make no representations and disclaim all express, implied and statutory

warranties of any kind to the user and/or any third party, including any warranties of

accuracy, timeliness, completeness, merchantability and fitness for any particular purpose.

Unless due to willful tortious misconduct or gross negligence, the Parties shall have no tort,

contract or any other liability to user and/or any third party. Under no circumstance shall

the Parties be liable for any lost profits or lost opportunity, indirect, special, consequential,

incidental or punitive damages whatsoever, even if the Parties have been advised of the

possibility of such damages. The terms of this disclaimer may only be amended in a writing

signed by the Parties.

Copyright © 2007 by FINRA and University of Reading. All rights reserved. No portion of this

document may be duplicated, redistributed, or manipulated in any form.

Securities Act of 1933

There were no federal regulations of securities prior to 1933. Commercial banks were allowed to

deal in securities, credit was loose, and market manipulation was rampant. All this led to the market

crash of 1929. In response, Congress passed the “33 Act that regulated Interstate securities

transactions (including the U.S. mail). The Act required that all Non-Exempt new issues be

registered with the federal government (SEC) by filing a Standard Registration Statement or S-1

(Form S-B1 is an abbreviated form for registered offerings of less than $10MM). Once registered,

a Prospectus must accompany the sale or offer of these securities to provide Full and Fair

Disclosure.

The date an S-1 is filed with the SEC is not surprisingly called the Filing date. Within one

business day of the filing date a copy of the registration statement must also be filed with the

FINRA Committee on Corporate Finance. The Committee on Corporate Finance reviews the

Underwriter Agreements to judge the fairness of the underwriter’s compensation package. This

begs the question; What is unreasonable compensation?

Compensation greater than 10% of gross proceeds

Compensation greater than 10% of the shares of total issue

Warrants or options exercisable at a price below the new issue’s offering

price or exercisable for more than five years

Any stock received which is not restricted for at least 1 year

A number of securities are exempt from filing with the Committee on Corporate Financing,

including the following:

Securities that are exempt from registration with the SEC (private

placements, U.S. Governments, and Municipals)

Open-end investment companies (mutual funds)

Variable contracts issued by insurance companies

Non-convertible bond issues rated BBB or higher (investment grade)

Cooling Off and Due Diligence

While the securities are in registration, the SEC mandates a minimum 20-day Cooling-Off Period.

The SEC can extend the cooling-off period with a Stop Order or Deficiency Letter, and the SEC

can also shorten the cooling-off period. During this time, issuers and their underwriters

(Investment Bankers), cannot offer, sell or advertise the securities. They may, however, print a

Preliminary Prospectus (also known as a Red Herring), and send it to potential investors for

Indications of Interest only. In addition, a Tombstone Ad may be run. This is because a

tombstone ad is not considered to be an advertisement, but rather an announcement. Tombstone

ads do not offer to sell the securities (an offer is made only through a prospectus), and may be

run prior to, or after, the effective date. A tombstone ad run prior to the effective date, like a

preliminary prospectus, will not contain two pieces of information: an Offering Price and an

Effective Date. No other communication (such as research reports) is allowed during the cooling-off

period, with the exception of several exemptions which are covered in Rules 137-139.

Rule 137 states that if a broker/dealer is not involved in the underwriting, they are not restricted

from talking about a new issue. An added caveat is that the broker/dealer (or rep) is receiving no

incentive for discussing the issue.

Rule 138 states that if an issuer has filed a registration statement for a non-convertible debt

issue, then a broker/dealer can comment on and sell the common stock of the same issuer

without restriction (and vice versa). This rule reflects an important point. Convertible debt is

© FINRA 2008

1

treated like stock and any restrictions on the offer or sale of the stock would equally apply to a

convertible bond offering. Non-convertible bond offerings have no direct relationship to the stock

and so are treated separately (remember the exemption for filing with the Committee on

Corporate Finance mentioned previously).

Finally, Rule 139 grants an exemption for underwriting common stock that is already outstanding

(an additional primary offering). In such an issue, underwriters may continue to list the security in

a newsletter if all of the following apply:

· The newsletter is published regularly and has included this stock for past 2 years)

· The newsletter contains a comprehensive list of all recommendations

· The current recommendation is no more favorable than previous recommendations

During the cooling-off period, the issuer and underwriters will hold a due diligence meeting to

assure the issue is in compliance with federal and state laws. Any misleading or incorrect

information must be removed from the preliminary prospectus and any missing information must

be added.

The Effective Date or Release Date is the date the SEC allows the securities to be sold to the

public. Purchasers of newly issued securities must receive a confirmation no later than settlement

date, and must also be sent a Final Prospectus. The final prospectus, with final offering price

listed on the cover, must also be sent to customers prior to the completion of the transaction

(settlement date). The prospectus must contain a no approval clause issued by the SEC and

printed on front page of prospectus:

These securities have not been approved or disapproved by the Securities and Exchange

Commission, nor has the commission passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

A final prospectus is required to be provided to purchasers for the following periods:

IPO

25 days for Listed or Nasdaq quoted

90 days Pink sheet (OTCBB)

Additional Public Offering

40 days Pink sheet (OTCBB)

No requirement once distribution complete for Listed / Nasdaq

The Underwriting Process - Underwriting Syndicate Participants

Three different levels of broker/dealers handle the underwriting process: Managing Underwriters,

Syndicate Members, and Selling Group Members. The Manager (lead underwriter) is the

broker/dealer awarded the issue, who generally handles the relationship with the issuer and

oversees the underwriting process. To share the risk, and more efficiently distribute the offering to

the public, broker/dealers will join together in a Joint Trading Account, also called a Syndicate. The

syndicate profits by selling the securities and earning a Spread (i.e., the POP less the amount paid

to the issuer). Syndicate members share the risk and are responsible for any unsold securities.

The Agreement Among Underwriters is a contract between syndicate participants, which is not

found in the prospectus. There are two basic types of syndicate accounts: an Eastern Account

(Undivided) and a Western Account (Divided). In a Western Account, each syndicate member is

responsible for a specific dollar amount only, with no further obligations. Conversely, in an Eastern

Account, syndicate members are responsible for a percentage of any unsold balance of the issue,

the percentage being the same as their initial allotment.

© FINRA 2008

2

For example, in a Western Account, a broker/dealer is allocated 10% of a $100 million offering. The

broker/dealer is only responsible for their allocation, and regardless of how the overall issue fares,

their only obligation is to sell or “eat” their allocation. In the same scenario, under an Eastern

Account, regardless of how much the broker/dealer sells, they are obligated to buy into their own

account a percentage of the leftover securities that were unsold. If they had initially been allocated

10% of the offering, they would be obligated to take 10% of any unsold securities.

The third level is the Selling Group, comprised of broker/dealers chosen to assist the syndicate in

marketing the issue in a broker (agency) capacity. Selling Group firms are not members of the

syndicate, and are not at risk for the securities. All broker/dealers involved in the underwriting of

non-exempt securities must be NASD member firms.

Concessions

Concessions are reductions in the POP that are paid to Selling Group Members and third party

sellers of mutual funds. Concessions can only be paid to NASD member firms. Non-members are

treated like a member of the public, and are allowed no discounts or concessions. The exception

to this rule are foreign firms, or any firm ineligible for NASD membership (e.g. a commercial

bank). A suspended member must be treated like a non-member and cannot receive

concessions, but may continue to receive any payments that were due prior to suspension.

Finally, an NASD member cannot join in a syndicate with non-members unless they are

underwriting exempt securities (e.g. Municipal securities).

Types of Underwritings

The contract between the issuer and the Lead or Managing Underwriter is the Underwriting

Agreement. The agreement states the terms and conditions of the offering, such as, the

Underwriting Spread (i.e., The amount the underwriters make on sales), the Public Offering Price

(POP), and the amount of proceeds from the offering that will go to the issuer. There are two basic

types of commitments made by underwriters to issuers: Firm Commitments and Best Efforts. In a

firm commitment, the issue is purchased from the issuer, marked-up and sold to the public. The

underwriter here is acting as a dealer and is at risk for the unsold securities; whatever securities are

not sold will remain in the underwriter’s inventory. A Standby Underwriting is always used in a

subsequent primary offering of stock that is preceded by a subscription or pre-emptive rights

offering. During the rights offering, the underwriter “stands by”. After the rights offering period has

ended and all rights have been either exercised or expired, the underwriters must take any

unsubscribed securities on a firm commitment basis.

In a best-efforts underwriting, the underwriters act as agents or brokers for the issuer, and attempt

to sell all the securities in the market. The best efforts underwriter is not at risk, and any unsold

securities remain with the issuer. Two sub-types of best efforts are All-or-None and Mini-max. An

all-or-none underwriting may be canceled by the issuer if the entire issue is not sold in a given time

period. A mini-max underwriting requires a minimum amount to be sold. If the underwriter sells the

minimum, they may then attempt to sell the maximum (usually being the entire issue). However, if

the minimum is not sold, the issuer may cancel the underwriting.

All-or-None, Mini-max, and Schedule E (discussed later) are considered Contingent Offerings.

These offerings are contingent in that they may be cancelled, and therefore client money taken in

by a syndicate must be Escrowed. Where these contingent offerings protect the issuer, the

Letter of Intent between the underwriters and issuer typically contain a Market Out Clause to

protect the underwriter. This clause allows the underwriter to cancel an offering if interest is flat.

There are four basic types of primary offerings: Initial Public Offerings (IPO), Additional or

Subsequent Primary Offerings (SPO), Registered Secondary Offerings, and Combined Offerings.

An IPO is securities being offered by an issuer to the public for the first time. An SPO is an

additional offering by the same issuer. In both IPO and SPO, issuers receive the bulk of the sales

© FINRA 2008

3

proceeds. A registered secondary offering is where a shareholder sells stock to the public and

receives the proceeds themselves. A combined offering is where proceeds are divided between

shareholders and the issuer. All require adherence to the '33 Act.

A specific type of subsequent offering is a Shelf Registration. A shelf registration allows for

piggybacking on a registration statement. Although some shares will be offered in the near future,

shelf shares may be held back for up to 2 years before being offered to the public.

Freeriding and Withholding

Once a public offering price (POP) has been set, it must be maintained by the syndicate

throughout the offering period. Purchasers of the shares, however, are free to immediately trade

their stock in the secondary market. If the POP on a new issue was $20, but the same stock was

trading for $30 in the secondary market, the stock would be described as a Hot Issue (i.e., a

newly issued security trading at a premium to its POP on the first day of trading). In this situation,

the underwriters would like to sell directly into the secondary market (taking a free-ride), or

perhaps keep the issue for themselves (withholding). Freeriding and withholding are prohibited. A

hot issue may not be purchased by any broker/dealer, nor by any employee of any broker/dealer,

nor by any Supported Family Member of any broker/dealer employee (generally defined as a

family member that lives in the employee’s home). There must be a bona-fide public offering at

the POP, and the broker/dealer cannot earn any more than their spread on a new issue.

For sales to an undisclosed principal (an order from clients of other dealers) the broker dealer

must inquire if the purchaser is restricted. This conversation must be noted on the trade ticket,

and a principal must initial. This would also apply to issuer directed sales, where the issuer has

requested that certain persons (e.g. a long time supplier) be allocated shares.

Overallotment

In a situation where demand exceeds supply, the underwriters may have the opportunity to

continue filling customer orders. A Green Shoe provision (named after the Green Shoe Co., the

first issuer to use this provision) allows for a 15% overallotment from issuer. This provision must

be included in the prospectus. The underwriters can also use Short Covering and sell to

customers with borrowed stock, The syndicate is taking a risk in this situation and any

subsequent losses will be divided amongst syndicate members.

Stabilization

A Stabilization clause enables the managing underwriter to keep the stock's secondary market

price stable. A stabilization plan must be included in the prospectus, and allows for stabilizing bids

that are no higher than the highest independent bid in the market, and never higher than the POP.

A stabilization plan must be included in the prospectus. At-the market offerings cannot be stabilized.

Let’s say XYZ is being offered at a POP of $20/share. But, the original purchasers immediately sell

their IPO shares into the secondary market. Now those shares are trading at a Bid of 19 and an Ask

of 19 ¼. Once the POP has been set, it is fixed for the duration of the offering period. But, a

stabilization plan would allow the managing underwriter to enter bids of 19 in the secondary market

to attempt to place a floor under the stock’s price. Although stabilization is defined as market

manipulation, it is perfectly legal. The managing underwriter can also pull the bid off and/or replace

it if market conditions change. Suppose the secondary market price is now 19 7/8 - 20. The

syndicate manager could enter a stabilizing bid at $20. But, if the secondary market was 20 201/8, no stabilizing bid could be entered.

The managing underwriter must notify the NASD prior to entering a stabilizing bid, and the

stabilizing bid itself will be labeled as such on Nasdaq (otherwise it might appear to be a onesided quote entered in error). The SEC must also be notified within 3 business days of entering a

© FINRA 2008

4

stabilizing bid. Additionally, securities taken in during stabilization are reported as 0 volume.

A final point regarding stabilization relates to Penalty vs. No-penalty bids. To discourage

"flipping", the managing underwriter may designate the stabilizing bid as a penalty bid. In this

case, syndicate members whose customers sell their stock back will lose their share of the

spread on the original sale.

If the interest in the offering remains flat, the managing underwriter may allow the securities to be

sold at a price below the POP. The syndicate remains in effect until broken by the managing

underwriter, typically after all the shares have been sold. The maximum life of a syndicate

however, is 90 days from the date the securities are available to syndicate members, the point at

which a final settlement of the joint account must be done.

Schedule E Underwritings

Schedule E covers self-underwriting by broker dealers for themselves, or for an affiliate (i.e.,

where there is a cross ownership of 10% or more between the broker and the issuer). An

example of an affiliate underwriting would be when Dean Witter underwrote a Sears offering, at a

time when the firm was owned by Sears. In any case, the issuer must have been in business for a

minimum of 5 years.

During an IPO a broker dealer cannot be the lead underwriter for their own securities, and

therefore, must bring in another firm to both price and lead the issue. There is no such restriction

for additional offerings. Since any issuer may wish to direct sales to their employees, the

freeriding and withholding rules do not apply for a Schedule E (i.e., employees can buy hot

issues). IPO shares are restricted for employee purchasers who must hold IPO shares for a

minimum of 5 months. There is no restriction for additional offerings.

As mentioned earlier, Schedule E are contingent offerings, and client checks must be escrowed

pending net capital computation (net capital will be covered later in this text). This requirement

does not apply to affiliate underwritings. There is also no discretion allowed for these

underwritings, and sales to discretionary accounts still require written customer permission.

Filing and Registration Exemptions under the Act of 1933 - Exempt securities

The '33 Act specifically exempted certain issuers from the registration requirements. Some of

these issuers include U.S. government and municipal issues, Fixed Insurance Policies and Fixed

Annuities, Private Investment Companies or Small Business Investment Companies (i.e., Hedge

Funds), Commercial Bank Stock, Insurance Company Stock, and securities issued by charitable,

non-profit organizations. In addition, debt securities with maturities no longer than 270 days, such

as Commercial Paper and Bankers Acceptances are also exempt from the '33 Act. Although a

security may be exempt from registration, no parties are exempt from anti-fraud provisions.

Exempt offerings

The Act also exempts securities from registration due to the manner in which they are sold.

Exempt offerings/exempt transactions include: Intrastate Offerings (Rule 147), Regulation A

Offerings and Regulation D Offerings (Private Placements).

SEC Rule 147 (Intrastate Offerings)

Intrastate offerings are exempt from federal registration but are not exempt from state (Blue-Sky)

registration. In order to qualify, there are three 80% rules. The company’s home office and 80% of

its business, 80% of it’s sales/revenues and 80% of the proceeds of the offering must originate or

be used in one particular state. In addition, 100% of initial purchasers must be principal residents

© FINRA 2008

5

of that state, and the securities cannot be re-sold to out-of-state residents until nine months after

the effective date.

Regulation A Offerings

Reg. A offerings are for small issuers offering $5,000,000 or less of securities in any 12 months and

no more than $1.5 million offered by current shareholders (This closes a potential loophole for

avoiding Rule 144) to an unlimited number of investors. These securities are exempt from full

registration, but are required to file an offering circular with the SEC. The offering circular must be

delivered 48 hours prior to a sale.

Regulation D (Private placement)

Reg. D covers privately placed stock that is sold to “Sophisticated Investors” and is therefore

covered by fewer rules. Reg. D stock can be referred to as Closely Held, Restricted stock, Letter

stock or Legend stock. Closely held because the stock is not publicly offered, but privately placed.

Letter stock because the investor must sign an investment letter stating that they agree to not sell

the stock except under certain restrictions. Legend stock because the legend “restricted” is actually

stamped on the certificates. The stock is called Restricted because it cannot be resold for 1 year.

Since the offering is primarily limited to sophisticated investors, the stock is exempt from the

standard registration process, and therefore there would be no prospectus for this stock. Instead,

the issuer would prepare an Offering Memorandum.

Another term for sophisticated investors is Accredited Investors. Accredited investors include

institutions (e.g., banks, insurance companies, investment companies, S&L's, pension funds,

broker/dealers), Insiders (e.g., Officers, Directors and owners of 10% or more of the issuing

corporation’s stock) and relatively wealthy individuals. The exact definition of relatively wealthy is as

follows:

Net worth over $1,000,000, excluding real estate, and/or

Income over $200,000 in each of last two years and expectation of as much in the

coming year ($300,000 for joint accounts)

In addition to an unlimited number of accredited investors, the stock can be issued to no more than

35 Non-accredited investors. Thus, the term "private placement" is used, since there can be no

general solicitations, and the number of non-wealthy investors is limited. Broker/dealers may act as

an agent or market maker, but they may not solicit prospective purchasers.

Rule 144

Rule 144, (Not a type of offering!) applies to the sale of Reg. D stock during the second year of

holding, and to any sales of Control Stock (i.e., stock owned by an insider: director, partner,

officer of the issuer or 10% shareholder or affiliate). Restricted stock must be held fully paid for at

least one year before it can be resold to anyone. Between the first and second year of holding,

there are also volume restrictions. In any 90-day period, the shareholder can sell no more than the

greater of:

1% of outstanding number of shares

The average of the last four weeks' trading volume

It is the responsibility of the shareholder selling restricted stock to file a 144 Letter no later than

concurrently with the sale. The filing is effective for 90 days and the volume restrictions apply to that

period of time. An exception to the filing requirement is the sale of 500 shares or less, and $10,000

or less in value.

After being held for two years, sales are no longer restricted for a non-affiliate. The 144 volume

restrictions continue, however, for insiders and affiliates (e.g., accountants, attorneys and

immediate family members of insiders), and whether the stock is a private placement or not, an

© FINRA 2008

6

insider of any publicly traded company is always held to the Rule 144 requirements. In addition,

insiders may not short their issuer’s stock, nor benefit from Short Swing Profits. Insiders are

prohibited from taking profits on stock sold within 6sixmonths of purchase. Any such profits must be

Disgorged and remitted to the issuer (the insider is still liable for the taxes on the gain, however).

Secondary Market transactions of restricted stock must be done on an agency basis unless the

B/D is a market maker in the stock. This means there can be no riskless principal transactions

(these transactions will be discussed in more detail in Chapter 2). In addition, there can be no

general solicitations for secondary market transactions. When offering restricted stock to a

customer, the customer must have expressed a previous interest in buying the security within the

past 10 business days. For solicitations of another B/D, an interest must have been expressed

within the past 60 calendar days.

Rule 144A is an exemption for Qualified Domestic Institutional Buyers (QIBs) investors trading

privately placed foreign stock. Securities sold under this exemption have no holding period

requirements or volume limitations. Rule 145 deals with the reclassification of securities, such

as for mergers and acquisitions. The important test point is that there is no separate registration

required for stock dividends or stock splits.

The Trust Indenture Act of 1939

The Trust Indenture Act is a Federal regulation that covers corporate debt issuers who issue over

$5 million in debt. The Act stipulates that there be an indenture (an agreement), between the

issuer and a trustee for the benefit of the bondholders. A copy of a bond's indenture must be filed

with SEC including the covenants, features, and provisions of the bond.

Blue Sky Registration

Issuers who wish to offer securities in a particular state, must register in that state under the

Uniform Securities Act. There are three methods of registering (i.e., "bule skying") the issue:

Coordination – already filed with SEC and now doing so with the state

Notification (filing) – already well-established company already registered

federally and maybe in some states, now just wants to notify the State

Administrator that they would like to register in that state

Qualification – a not so well established company which already registered

federally, but would still need to qualify them in that state. This could also be

used for SEC Rule 147 Intrastate securities offering

You do not need to know anything about these methods, merely that they are the ones used.

You also need to be aware of state recission laws. Any discovered illegal or unsuitable

transactions are subject to Recission in which B/D offers to buy back at CMV or original

purchase price + interest. The customer has 30 days to accept the offer in writing.

Reg. M

Reg. M mostly deals with subsequent offerings and includes restrictions on issuers and broker

dealer activities. Often, these activities take place in the secondary market.

Tender Offers

A tender offer refers to a third party's attempt to purchase shares directly from shareholders at a

certain price. The offer must be open for at least 20 days and the party making the tender offer is

prohibited from buying the stock in the pen market at the same time. The short tender rule states

that a shareholder cannot tender short stock. For example, if a customer is long 500 share and

short 200 shares, they can only tender 300 shares (i.e., the net long position).

© FINRA 2008

7

Issuer Repurchases in the Secondary Market

An issuer that is repurchasing its own stock in the secondary market can only use 1 market

maker per day. In addition they cannot buy in first or last ½ hour of trading and the total amount of

purchases cannot exceed 25% of that days trading volume.

Proceeds Transactions

A proceeds transaction is where a customer is using the proceeds of a sale to purchase some

other security. We will discuss this process again in the next chapter, but the main point here is

that the customer cannot be overpaid. A Broker/dealer cannot pay more than the highest

independent bid for sales when the proceeds are being used to buy primary offerings

underwritten by same B/D.

Subsequent Offerings

A customer cannot buy shares of a subsequent offering at the POP to cover short positions which

were established within the 5 days prior to offering. In addition, a market maker must withdraw

their quotes on the day before the offering if they will be acting as an underwriter. If, however, the

security is "actively traded", the underwriter may continue as a “passive market maker” (i.e., they

cannot raise or lower the inside quote), but their purchases cannot exceed 30% of the daily

trading volume.

Filing requirements with the SEC

Non-exempt securities which are registered with the SEC are required to make the following

filings:

10K – annual financial report made by the company to the SEC

10Q – Quarterly financial report to SEC

10C (Change) – Filed with the SEC and the NASD 10 business days if an issuer has a

change of at least 5% in any class of securities or a company's name changes.

8K – Filed to report a news event that materially effects the financial condition or share

price (e.g., change in ownership or control, merger and acquisition, fiscal year change) of

registered domestic companies (i.e., ADRs are exempt).

13D – Filed within 10 days by shareholders if the individual become a 5% beneficial

owner of a company.

13G – Filed within 45 days if a mutual fund becomes a 5% beneficial owner

13D and G reports are filed with SEC, the market where security trades, and the Issuer (not

Other Shareholders).

© FINRA 2008

8

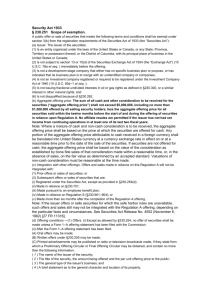

Registration Time-line

Pre-registration

period

-- Prepare documents

-- Due diligence

-- No discussions with

customers

filing date

“Cooling-off” period

-- 20 days

-- Deficiency letter

-- Preliminary prospectus

(“red herring”)

-- Indications of interest

-- No sales

-- No $ accepted

effective date

Post-registration period

-- Sales confirmed

-- Final prospectus

*at or before confirmation

-- Prospectuses must be sent to

all purchasers for 25 days from

Effective date (if trading will be on

an exchange or Nasdaq)

I. 40 Days non-Nasdaq new

issue

II. 90 Days non-Nasdaq IPO

© FINRA 2008

9