10 knacks of using Nikkei Volatility Index Futures

advertisement

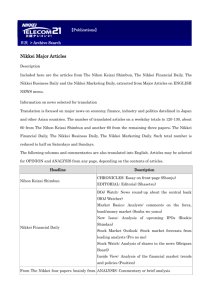

10 knacks of using Nikkei Volatility Index Futures 10 KNACKS OF USING NIKKEI VOLATILITY INDEX FUTURES 1. Nikkei VI is an index indicating how the market predicts the market volatility will be in one month from the spot. ‘For the past two years (April 1, 2012 March 31, 2014), the average was around 24.56 points, so 25 points would be a good reference point. 2. Your magic number is 16. elementary level 3. Nikkei VI Futures are products which predict one month volatility from the expiry of the corresponding Nikkei Futures contract. elementary level 4. Nikkei VI Futures allows you to trade “alert towards the market.” Both Nikkei VI and Nikkei VI Futures tend to go up when the market become more volatile. elementary level 5. There are some cases where hedging by Nikkei VI Futures could prove costly. 6. Volatility Indices related ETFs and ETNs are also available. 7. Let’s create a market alert calendar using Nikkei VI and Nikkei VI Futures. intermediate level 8. Nikkei VI Futures move differently depending on the term structure of volatility. advanced level 9. Make sure to find the most cost efficient condition where there are enough market liquidity and bid-ask spread becomes narrow. advanced level 10. Let’s gather information related to Nikkei VI, Nikkei VI Futures. 1 V elementary level intermediate level elementary level elementary level Nikkei VI is an index indicating how the market predicts the market volatility will be in one month from the spot. For the past two years (April 1, 2012 - March 31, 2014), the average was around 24.56 points, so 25 points would be a good reference point 1. Nikkei Stock Average Volatility Index (Nikkei VI) is an index to indicate how the market predicts the volatility of Nikkei Average will be in one month from the spot. Nikkei VI is calculated based on the complex mathematical formulas using prices of Nikkei 225 Futures and Nikkei 225 Options traded in Osaka Exchange. Similar to Nikkei VI, the CBOE Volatility Index (VIX), which measures the volatility of S&P500, is also a widely known volatility index (VI). Both indices indicate that higher numbers indicate that investors are more alert of the market movement in the future. Taking in account of the recent market conditions, investors are becoming more cautious when the Nikkei VI is higher than 25 points. Therefore, one should be extra careful on their risk management when the index price surpasses this level. (yen) The historical movement of Nikkei Average and Nikkei VI 20,000 (pts) Nikkei Average volatility vs. VI (2007.1 – 2012.3) 100 Nikkei225(left axis) 90 Nikkei VI(right axis) 80 18,000 Nikkei VI 16,000 70 14,000 60 12,000 Nikkei Average 50 40 10,000 30 8,000 20 6,000 4,000 2007/01 10 0 2008/01 Period 2001.9~10 2002.9~10 2007.8 2008.1~3 2008.9~2009.4 2010.5 2011.3 2011.8 2013.5 2009/01 2010/01 2011/01 2012/01 2013/01 The events gave shocks to the market during Jan 2001 to Dec 2013 Peak value (pts) Events 63.44 9-11 terrorist attacks (2001/9/17) 40.71 (2002/10/9) Bank stocks dropped due to the concern about non-performing asset. 47.32 Subprime mortgage problem (2007/8/17) 49.67 Bear Stearns failure (2008/3/17) 92.03 (2008/10/31) Global financial crisis (Lehman shock) 44.00 Greece financial crisis (2010/5/21) 69.88 (2011/3/15) 42.69 (2011/8/9) The Great East Japan Earthquake and nuclear issue S&P downgraded US government bond. 43.74 A big drop in Japanese stocks (2013/ 5/23) 2 Source: Nikkei 2. Your magic number is 16. Volatility is a unit measuring the magnitude of the change in prices. VI is the annualized index of such volatility which measures the magnitude of the change of stock prices in the future. Nikkei VI is one of many VI in the world which measures the magnitude of the change of Nikkei Average by annualizing the expected one month volatility of Nikkei Average implied in the market. What does “Nikkei VI of 24 points” mean? The market expects the annualized volatility of Nikkei Average in one month period will be 24%. If the spot level of Nikkei Average is 15,000 yen・・・ It indicates “if the current market volatility continues for one year, the market will be likely to move ±24% (±3,200 yen) (*1).” Let’s divide Nikkei VI by 16 (*2) so that you can convert it into daily volatility which is easier to understand. Convert it to daily volatility Convert the annualized volatility of 24% to daily volatility by dividing it by 16: approximately 1.5%. Assuming that the spot level of Nikkei Average is 15,000 yen・・・ It indicates that “the market will be likely to move ±1.5% (±225 yen) (*1) from 15,000 yen within a day.” *1 Assuming the return of Nikkei Average is normally distributed with a mean of 0 and a standard deviation of σ, approximately 68% of the return data exist within ±σ (The part with a red frame in the below chart) . We can assume such standard deviation σ by using Nikkei VI <Normal Distribution> (The horizontal axis: return, the vertical axis: the frequency of occurrence of return.) The probability that data exist within ±σ is approximately 68%. (The part with a red frame) σ σ *2 It is known that the annualized volatility can be converted into the daily volatility by dividing the annualized one by 16 which is equal to the square root of approximate 260 - the number of business days for one year. 3 3. Nikkei VI Futures are products which predict one month volatility from the expiry of the corresponding Nikkei Futures contract. Nikkei VI Futures is a product that predicts Nikkei VI in the future. From the price of Nikkei VI Futures, we can get the outlook to show whether the investors are cautious about market movement in the future. For instance, Nikkei VI future with the contract month X predicts level of Nikkei VI at the expiry date of the contract month X. <The summary of Nikkei VI Futures> Trade content Bottom line profits (In case of purchase) Main players The underlying of the future is Nikkei VI. For instance, April 2014 contract of Nikkei VI futures will be settled with the closing level of Nikkei VI at the expiry date of April 2014 contract. In other words, April 2014 contract of Nikkei VI futures is the index future to predict 30 days volatility starting from SQ day in April. (Nikkei VI on the SQ day - Nikkei VI Futures on the trade day) × 10,000 yen × number of contracts Securities firms, foreign investors, retail investors (Example) Buying three contracts of April 2014 Nikkei VI Futures at the price of 30pts Assuming Nikkei VI on SQ (4/9/2014) is 32 points, the bottom line profit of Nikkei VI Futures is + 60,000 yen as follows (not considering the commissions). (32pts - 30pts) × 3 (contracts) × 10,000 yen = + 60,000 yen VI Future 4 4. Nikkei VI Futures allows you to trade “alert towards the market.” Both Nikkei VI and Nikkei VI Futures tend to go up when the market become more volatile. As introduced in the first article, both Nikkei VI and Nikkei VI Futures tend to go up when the market become more volatile. The below chart plots out the relationship between Nikkei Average and the daily return of Nikkei VI Futures Index (*) calculated from Nikkei VI Futures’ prices. From this scatter chart, one can see the following two trends: 1 There is a weak negative correlation between Nikkei Average and Nikkei VI Futures Index. 2 When Nikkei Average makes a big change, Nikkei VI Future Index tends to make a bigger change and the relationship between Nikkei Average and the daily return of Nikkei VI future tends to be convex. → One might profit from long positioning on Nikkei VI Futures when the volatility of Nikkei Average is relatively high, especially in turmoil market, and this might help to hedge against the drastic market movement if you own a lot of equities. <The scatter gram of Nikkei Average and Nikkei VI Futures in 2013 > The daily return of Nikkei VI future 20 15 10 5 0 -5 -10 -8 -6 -4 -2 0 2 4 6 The daily return of Nikkei Average (%) *Nikkei VI Futures Index is designed to be linked to the daily price change of the Nikkei VI Futures which is synthetically replicated with the expiry of 1 month using the first nearby Nikkei VI future contract and the second nearby Nikkei VI future contract of Nikkei VI future. It is useful to know the price change of Nikkei VI Futures. Nikkei VI Futures Index is calculated by the Nihon Keizai Shimbun (Nikkei) newspaper. 5 5. There are some cases where hedging by Nikkei VI Futures could prove costly. Nikkei VI future tends to decrease in value under normal market condition (as introduced in the 8 th article). In such conditions, Nikkei VI future generally trades higher than Nikkei VI and will gradually trend down to the value of Nikkei VI as time passes to expiry. As introduced in the 4 th article, Nikkei VI Futures could be a good hedge tool against drastic market movements, however, on the other hand, the price of the futures has tendency to gradually decline when the market volatility decreases and the market remains stable. This is very important concept. (pts) <The daily change in Nikkei VI and Nikkei VI Futures> 33 Nikkei VI future will converge to Nikkei VI towards the expiry. 31 29 27 25 23 21 19 2013.09 2013.09 Nikkei VI 2013.10 13-Sep 2013.11 2013.11 13-Oct 13-Nov 6 2013.12 2014.01 13-Dec 2014.01 14-Jan 2014.02 14-Feb 6. Volatility Indices related ETFs and ETNs are also available. While Nikkei VI Futures are traded in Osaka Exchange, ETFs and ETNs related to Nikkei VI and other volatility indices are listed in Tokyo Stock Exchange. The following table is a list of volatility indices related ETFs and ETNs listed in Tokyo Stock Exchange. In particular, the ETNs like the NEXT NOTES NIKKEI 225 VI FUTURES INDEX ETN 2035 are directly linked to Nikkei VI Futures Index. This makes it more accessible to the retail investor. <ETF・ETN linked to Volatility Indices listed in Tokyo Stock Exchange> code name characteristic 1552 Kokusai S&P500 VIX SHORT-TERM FUTUREs INDEX ETF This ETF is tracking yen-converted value of S&P500 VIX ShortTerm Futures Index (Total Return) denominated in USD. 1561 Kokusai S&P500 VIX FUTUREs INDEX ETF MID-TERM This ETF is tracking yen-converted value of S&P500 VIX MidTerm Futures Index (Total Return) denominated in USD. 2029 iPath S&P500 VIX Mid-Term Futures ETN This ETN is tracking yen-converted value of S&P500 VIX MidTerm Futures Index (Total Return) denominated in USD. 2030 iPath VIX S&P500 VIX Short-Term Futures ETN This ETN is tracking yen-converted value of S&P500 VIX ShortTerm Futures Index (Total Return) denominated in USD. 2035 NEXT NOTES NIKKEI 225 VI FUTURES INDEX ETN ETF ETN 7 This ETN is tracking Nikkei VI Futures Index denominated in JPY which is synthetically replicated with the expiry of 1 month using the first nearby Nikkei VI future contract and the second nearby Nikkei VI future contract of Nikkei VI future. 7. Let’s create a market alert calendar using Nikkei VI and Nikkei VI Futures. The volatility term structure is a visualized plot, showing market participants’ degree of alertness towards the market condition of the near future. This volatility term structure is plotted with volatility on the vertical axis and the term on the horizontal axis. While Nikkei VI and Nikkei VI Futures predict the volatility for the respective terms, the volatility term structure, created by connecting all these points together, allows investors to visualize when and how much the market will change, much like a forecasting calendar to evaluate the sense of alertness towards the market condition at different times. The below chart indicates the volatility term structure based on Nikkei VI and each Nikkei VI Futures contract. It reveals that the level of alertness towards the market condition remains high, even if the market is expected to calm down gradually over time. Nikkei VI and Nikkei VI Futures (as of February 18, 2014) Nikkei VI 27.67 pts Nikkei VI Futures Apr14 May14 Mar14 26.50 pts 26.10 pts Jun14 26.25 pts 26.25 pts ・Firstly, Nikkei VI and each Nikkei VI future contract are plotted. Volatility (pts) Nikkei VI (27.67) Mar14 (26.50) Spot Mar14 expiry Apr14 expiry May14 (26.25) Apr14 (26.10) May14 expiry Jun14 (26.25) Jun14 expiry Jul14 expiry ・Secondary, the volatility term structure is made by connecting those. Volatility (pts) Nikkei VI (27.67) Mar14 (26.50) Spot Mar14 expiry Apr14 expiry May14 (26.25) Apr14 (26.10) May14 expiry 8 Jun14 expiry Jun14 (26.25) Jul14 expiry 8. Nikkei VI Futures move differently depending on the term structure of volatility. As introduced in the 7th article, the volatility term structure shows the how alert market participants are towards the market movement between terms. The historical data indicates that the volatility term structures are usually upward sloping under normal market conditions while it shifts downwards sloping under volatile market. [Under normal market conditions] The short-term volatilities tend to stay low as the market is expected to be stable. On the other hand, the longer-term volatilities would be higher than the short-term volatilities because there is uncertainty in the outlook for the long term. Thus, the term structure would tend to become the upward sloping in such conditions. [Under volatile market conditions] When the market expects volatile movement in the short term but gradually less volatility in the long term, longerterm volatility would be lower. Thus, the term structure would tend to become downward sloping in such conditions. Volatility Volatility ←Short term ←Short term Long term→ Long term→ Time to option expiry Time to option expiry Nikkei VI Futures tend to move depending on the volatility term structure. As written in the below list, Nikkei VI Futures tend to go down when the volatility term structure would be the upward sloping, and tend to go up when the volatility term structure would be the downward sloping based on data in 2013. th As written in the 5 article, you can find that Nikkei VI Futures tend to go down gradually under the normal market condition (i.e. there is a cost of going long Nikkei VI Futures). Please keep this in mind. <The relationship between the volatility term structure and the performance of Nikkei VI Futures in 2013> # of business days when volatility term structure was upward sloping in 2013 (*1) # of business days when volatility term structure was downward sloping in 2013 (*2) 32/245 business days 128/245 business days Nikkei VI future went up when volatility term structure was upward sloping (*3) Nikkei VI future went down when volatility term structure was upward sloping 14/32 bus days (44%) 18/32 bus days (56%) Nikkei VI future went up when volatility term structure was downward sloping Nikkei VI future went down when volatility term structure was downward sloping 70/128 bus days (55%) 58/128 bus days (45%) The average daily return of Nikkei VI future when volatility term structure was upward sloping The average daily return of Nikkei VI future when volatility term structure was upward sloping -0.23% +0.37% The above analysis was made based for 245 business days during 2013. *1 *2 *3 “Upward sloping” in volatility term structure is defined when “Nikkei VI < first nearby Nikkei VI future” and “first nearby Nikkei VI future < first nearby Nikkei VI future”. “Downward sloping” in volatility term structure is defined when “Nikkei VI > first nearby Nikkei VI future” and “first nearby Nikkei VI future > first nearby Nikkei VI future”. “Nikkei VI future went up when volatility term structure was upward sloping” means “the first nearby Nikkei VI future went up on the next business day immediately following the volatility term structure was upward sloping. 9 Column: Why does the Nikkei VI future tend to change subject to the shape of the volatility term structure? As explained previously, the term structure of volatility could change over time. In such case, Nikkei VI Futures will have fewer days until maturity, which can be illustrated as it moving forward along the implied term structure curve. ♦ When the volatility term structure is upward sloping ▸ ▸ Assuming the volatility term structure remains unchanged through time, Nikkei VI Futures will likely decline over time (Fig. 1 and 2). Holding a Nikkei VI Futures contract is very similar to holding a put option in terms of time decay where the option value decrease over time (paying for the theta). (Fig. 1 and 2) Chapter 5 is an illustration of this tendency. Fig.1:The current volatility term structure and Nikkei VI future with expiry X Fig.2:If the current volatility term structure remains unchanged in 40 days, Nikkei VI future with expiry X will go down. 40 days later Volatility Volatility The current Nikkei VI future with expiry X Nikkei VI future in 40 days Nikkei VI future with expiry X indicates this 30 days’ implied volatility. Forward volatility comes down along the curve. Nikkei VI future with expiry X goes down over time. Term Term Spot Expiry X Spot Expiry X + 30days Expiry X + 30days Expiry X ♦ When the volatility term structure is downward sloping ▸ ▸ Assuming the volatility term structure remains unchanged through time, Nikkei VI Futures will likely rise over time (Fig. 3 and 4). As the market regains its breath, volatility usually declines significantly, and term structure would likely flatten (Fig. 4 red line). In such case, Nikkei VI futures will decline, but the longer term futures contract will have a milder drop than the near term ones. Fig.3:The current volatility term structure and Nikkei VI future with expiry X Fig4:If the current volatility term structure remains unchanged in 40 days, Nikkei VI future with expiry X will go up) 40 days later Volatility Volatility Nikkei VI future in 40 days The current Nikkei VI future with expiry X Forward volatility comes up along the Nikkei VI future with expiry X goes up over time. Term Spot Expiry X Term Spot Expiry X + 30days Expiry X As introduced in the first article, Nikkei option prices affect Nikkei VI because Nikkei VI is calculated using Nikkei option prices. For example, under the normal market conditions, investors tends to buy relatively longer dated options (i.e. not very short term but 2~3months options). Thus, the volatility term structure tends to be upward sloping. The current shape of the volatility term structure is assumed to be supported by this kind of demand-supply trend in the option market. Consequently, the Nikkei VI future tends to move subject to the shape. Expiry X + 30days 10 9. Make sure to find the most cost efficient condition where there are enough market liquidity and bidask spread becomes narrow. One should pay attention to the bid-ask spread when purchasing Nikkei VI Futures. Let’s examine what one should keep in consideration upon purchasing Nikkei VI Futures using the following diagram. Nikkei VI futures (Feb 24 PM 2:40) Spot Bid Offer Open Interest March 2014 27.00 pts 26.65 pts 27.00 pts 490 April 2014 25.80 pts 25.80 pts 26.00 pts 417 …. …. …. …. …. June 2014 -- 25.50 pts 26.60 pts 64 For example, one could buy the April 2014 contract at 26.00 points, however, to profit from selling this contract, the buyer must keep in consideration of the trading cost coming from the bid-ask spread as well as to one’s speculation towards the price in the near future. Therefore, it is important to take in account of the spread cost when making decisions to monetize one’s view. On the other hand, June 2014 contract is offered at 26.60 points but with a 1.10 bid-offer spread, which is much higher than the April 2014 contract. Unless there is particular reason, it might be better to trade in more liquid contracts, or wait for more liquid hours or until the bid-ask spread becomes tighter. 11 10. Let’s gather information related to Nikkei VI, Nikkei VI Futures. OSE GO Click on “Futures & Options” on the OSE homepage. Click on “Nikkei 225 VI Futures” on the OSE homepage. Information about Nikkei VI Futures: -Comprehensive explanation. -Contract specifications. -Detailed trading example under “How to use.” 12 GO Contract Specifications on Nikkei VI Futures Contract Unit Tick Size Trading Hours Contract Months Last Trading Day Settlement Daily Price Limit Nikkei VI × ¥10,000 0.05 points (¥500 per tick) 9:00 - 15:15 (no night sessions) 8 nearest serial contract months A trading day which ends on the business day immediately preceding the day (if it falls upon an OSE non-business day, it will be advanced) that is 30 days prior to the 2nd Friday (if it falls upon an OSE non-business day, it will be advanced) of the calendar month immediately following each contract month 1. Resale or repurchase 2. Final settlement (cash settlement with final settlement price) 1. (a) Price limit range: 10 points above/below the reference price (*) Basically, the upper or lower price limit will be expanded by 5 points when the Circuit Breaker is triggered (no limitation on how many times the price limit range will be expanded). 2. Margin (b) Immediately Executable Price Range: 10 ticks (0.5 points) above/below the midpoint of the latest best bids and offers. Calculated by using SPAN® (Margin offsetting with other stock index futures and options contracts is NOT allowed.) 13 Attention In addition to common risks of futures trading, a short position of Nikkei VI Futures contracts has specific risks based on the characteristics of fluctuation in Nikkei VI. Therefore, investors who do not have sufficient assets and experience should avoid taking a short position in Nikkei VI Futures contracts. Nikkei VI may soar when markets decline. In such case, a short position of Nikkei VI Futures contracts will cause much greater loss than that in stock index futures contracts. Also, Nikkei VI has a tendency to regress to a certain range (around 20pt to 30pt) after a rapid increase. In the following actual case, Nikkei VI rose by approximately 74%, while the Nikkei Stock Average fell by approximately 6% in a day. As shown, Nikkei VI can exhibit extreme moves in a short period. Therefore, it is not advisable to trade Nikkei VI Futures in circumstances where it is not possible to obtain the real-time price information. March 14, 2011(close) Nikkei Stock Average: 9,620.49 yen (-6%) Nikkei VI: 40.72 pts (+74%) March 11, 2011(close) Nikkei Stock Average: 10,254.43 yen Nikkei VI: 23.44 pts The fluctuation of Nikkei VI has characteristics different from that of a stock index such as the Nikkei Stock Average. Please fully understand the characteristics of Nikkei VI before trading Nikkei VI Futures. ●The descriptions in this publication are intended solely for the purpose of providing information on futures and options. Losses may be incurred due to fluctuation of prices of futures and/or options, etc. and the entire deposited margin or a portion of such may be lost. Losses may also exceed the deposited margin. Investors must carefully review the documents provided by their financial services provider before trading futures and/or options, and must trade on their own responsibility based on their own judgment only after fully understanding the product qualities, the trading mechanism, relevant fees, the risk involved, etc. While every effort is taken to ensure the accuracy of the information contained in this publication, Japan Exchange Group, Inc. and its subsidiaries shall not guarantee and be liable for any damages caused by any errors or omissions in this publication. Osaka Exchange, Inc. and its subsidiaries reserve the right to change the contents of this publication without prior notice. ● Nikkei Stock Average" and "Nikkei Average Dividend Index" (collectively referred to as "Nikkei Indexes") are copyrighted works calculated through methods independently developed by Nikkei Inc. (Nikkei). Nikkei owns copyrights and any other intellectual property rights to Nikkei Indexes and the methods used to calculate Nikkei Indexes. All the business and trading regulations on futures contracts based on Nikkei Indexes shall be managed under the responsibilities of Osaka Exchange, Inc. and its participants. Accordingly, Nikkei which manages Nikkei Indexes shall not assume any obligations or responsibilities for related business and trading regulations. Nikkei shall not be obligated to continuously publish Nikkei Indexes. Nikkei shall not be liable for any error, delay or discontinuation of publication of Nikkei Indexes. Nikkei shall have the rights to make any changes in component stocks, calculation methods and any other elements or contents of Nikkei Indexes. Nikkei shall also have the right to discontinue publishing Nikkei Indexes. ● The "Nikkei Stock Average Volatility Index" (hereinafter referred to as "Nikkei VI") is copyrighted works calculated through methods independently developed by Nikkei Inc. (Nikkei). Nikkei owns copyrights and any other intellectual property rights to the Nikkei VI and the methods used to calculate the Nikkei VI. All the business and trading regulations on futures contracts based on the Nikkei VI shall be managed under the responsibilities of Osaka Exchange, Inc. and its participants. Accordingly, Nikkei, which manages the Nikkei VI commissioned by Nikkei, shall not assume any obligations or responsibilities for related business and trading regulations. Nikkei shall not be obligated to continuously publish the Nikkei VI. Nikkei shall not be liable for any error, delay or discontinuation of publication of the Nikkei VI. Nikkei shall have the rights to make any changes in calculation methods and any other elements or contents of the Nikkei VI. Nikkei shall also have the right to discontinue publishing the Nikkei VI. 14 15