2014 Integrated Annual Report

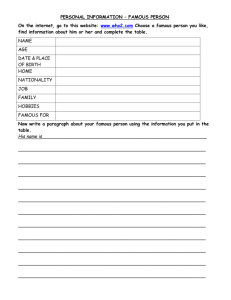

advertisement