Grace Matthews

Chemical & Materials Overview

Grace Matthews Chemicals Practice Overview

Internationally Recognized Chemicals Transaction Advisors

Services

Strong, experienced and well-respected chemicals focused transaction advisors

Business sales – strategic and private equity

National presence with global reach

Corporate divestitures

Founded in 1999

Recapitalizations and management buy-outs

Sixteen employees

Going-private transactions

Ten professionals dedicated to our chemicals practice

Acquisitions

Collectively, our chemicals professionals have:

Capital raises

Completed over 100 chemicals assignments

Fairness opinions and valuations

Over 150 years in chemicals M&A, finance, production, engineering and

executive management positions

Strategic alternatives analysis

Typical Engagements

Transaction Breakdown

Clients include privately-held businesses, private equity funds, and large,

multi-national corporations

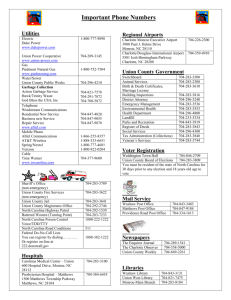

Buy-Side

20%

End-to-end transaction advisory services

Typical transaction sizes range from $20 to $500 million

Sell-Side

65%

Recapitalizations / Other

10%

Fairness Opinions/

Strategic Alternatives

5%

2

Transactional Capabilities

Sell-side

Strategic vs. Financial Buyers

Client profiles

80% of GM sell-side clients were acquired by strategic buyers

High quality public and privately-held companies

Global 2000 corporate divestitures

Private Equity

20%

Private equity portfolio companies

Process types

Limited, confidential strategic sales (1-6 strategic buyers)

Transitional auctions

Strategic

80%

Broad auctions

Recapitalizations

Management buy-outs

Special situations

Buy-side

Global Access to Strategic Buyers and Financing Sources

Client profiles

Track record of high level access to global strategic buyers

Large multinational corporations

Incumbent management with active MBO opportunity

Process types

Exclusive, focused searches in specific industry sectors

Single target engagements

Broad scope searches with multi-year engagement resulting in

multiple acquisitions

One-third of transactions are cross-border

Long-term relationships with hundreds of leading private equity firms and

private investors

Extensive relationships with a variety of financing sources

Banks

Private Equity

Alternative Sources

3

Established Relationships with Industry Leaders

GM principals have completed assignments with all below

Also, direct ties to hundreds of other global and regional chemical companies

4

Established Relationships with Private Equity Groups

GM principals have completed assignments with all below

Strong relationships with chemicals and materials focused private equity groups

Regular attendees of ACG Intergrowth & Capital Connect Events

5

Dedication to Specialty Chemicals

Chemical Whitepaper Published Annually

Deep Industry Expertise

Over 100 chemicals assignments completed in the sectors below

Experience across virtually the entire spectrum of specialty chemicals

Oil & Gas

Process

Chemicals

Agricultural

Chemicals

Paints,

Industrial

Coatings & Inks

Food

Ingredients

Fine &

Organic

Chemicals

Personal Care,

Soaps &

Cleaners

Chemicals &

Materials

Inorganics,

Ceramics &

Catalysts

Adhesives,

Sealants &

Tapes

Plastics,

Polymers &

Resins

Colorants &

Additives

Contract

Packaging

Construction

Materials

Industry Associations

Regular Speaking Engagements at Chemicals Events

American Coatings Association, April 2015 “M&A’s Changing Landscape: Chemicals, Coatings,

and Distribution”

Danish-American Business Forum, January 2015 “Update on the U.S. M&A Market Activity”

Adhesives and Sealants Council Spring Convention, April 2014 “M&A in Adhesives & Sealants:

Private Equity vs Strategic Buyers”

American Coatings Association, October 2013 “M&A in Specialty Chemicals & Coatings:

Innovation, Consolidation, and Playing Well with Others”

Adhesives and Sealants Council Leadership Conference, June 2013 “Value Creation in Specialty

Chemical Mergers and Acquisitions”

6

Global Reach

Global Capabilities

Multinational Client Base and Relationships

Nearly all of our sell-side processes include potential non-U.S. buyers

Strong relationships with key global chemical and materials companies

We cultivate direct ties to senior management around the world, who respect

us for our industry expertise and deal flow. They also often hire us for their

divestitures.

Recent multinational clients include the following:

GM principals visit European clients on a regular basis (typically monthly)

Approximately 70% of our deals in the last three years involved significant

interaction with global, non-U.S. strategic buyers

Approximately one-third of our deals in the last three years were cross-border

7

Grace Matthews Chemicals Team

John Beagle | Co-founder, Managing Director

Doug Mitman | Co-founder, Managing Director

Kevin Yttre | Managing Director

Chemical Team Lead

Former Trader for Fidelity Investments and Market Maker

at the American Stock Exchange in New York

Formerly with ICI’s Uniqema specialty chemicals business

in U.S. and The Netherlands

MBA from Cornell University and BA from Dartmouth

College

MBA from Harvard, B.S. in Chemical Engineering from

University of Wisconsin-Madison

25+ years relevant experience

10+ years relevant experience

Former research engineer at Digital Equipment Corporation

MBA from Cornell University, B.S. in Materials Science from

Cornell University

25+ years relevant experience

Ben Scharff | Managing Director

Thomas Osborne | Senior Advisor

Trent Myers | Vice President

Advises clients in chemicals, paints and coatings, construction

products and services, and general manufacturing sectors

Former CEO of both The Tnemec Company and ICI Paints

North America / The Glidden Company

Served as monthly columnist for Adhesives Age and

Modern Paint and Coatings

BS from University of Wisconsin-Madison and previously

served in the United States Marine Corps

BS from Youngstown State University, and has completed

the Advanced Management Program at Harvard Business

School

MBA from University of Wisconsin, MA from the University

of Virginia, BA from the University of Georgia

20+ years relevant experience

25+ years relevant experience

30+ years relevant experience

Andy Hinz | Vice President

Andrew Cardona | Associate

Patrick Maag | Analyst

Former Equity Research Analyst at Robert W. Baird & Co.

Former Investment Associate at Prudential Capital

Group, working in both the international group and the

restructuring group

Supports clients in a variety of chemical and materials

industries

MBA from Northwestern University and BBA from

University of Wisconsin-Eau Claire; holds the CFA

designation

BBA from the University of Wisconsin-Madison

10+ years relevant experience

6 years relevant experience

George Yang Liu | Analyst

Sarah Toledano| Analyst

Supports clients in a variety of chemical and materials

industries

Supports clients in a variety of chemical and materials

industries

BA in Economics from Northwestern University

BS in Chemistry from Massachusetts Institute of

Technology (MIT)

Joined Grace Matthews in 2014

BS in Finance from Marquette University

2 years relevant experience

Joined Grace Matthews in 2015

8

Grace Matthews: Chemical Team Leaders

Douglas Mitman

John Beagle

John Beagle, Managing Director, is a co-founder of Grace Matthews and has

advised clients on mergers and acquisitions since 1991. John has been the

lead investment banker on over 100 engagements in a variety of industries

including chemicals, coatings and basic materials, as well as in other

manufacturing and service industries.

Prior to his investment banking career, John was a research engineer at

Digital Equipment Corporation, where he was part of the team that

developed the patented Alpha chip technology – at the time, the fastest

commercial microprocessor ever engineered. John has a B.S. in Materials

Science from Cornell University, and an M.B.A. from the Johnson Graduate

School of Management, Cornell University.

Kevin Yttre

Douglas Mitman, Managing Director, is a co-founder of Grace Matthews

and has worked in mergers, acquisitions, and capital fundraising since 1993.

Doug has completed over 50 transactions ranging in value from $5 million

to $500 million, and has sat on the board of several privately-held

companies.

Prior to forming Grace Matthews, Doug ran an investment banking office in

Prague, Czech Republic, and worked as a Trader for Fidelity Investments in

Boston and as a Market Maker at the American Stock Exchange in New

York. Doug has a B.A. in Economics from Dartmouth College and his M.B.A.,

with Highest Distinction, from the Johnson School of Management at

Cornell University.

Benjamin Scharff

Kevin Yttre, Managing Director, has worked with clients in a variety of

industries including specialty chemicals, commodity chemicals, coatings, and

materials. A chemical engineer, Kevin held a number of engineering and

management positions with ICI’s Uniqema specialty chemicals business in the

U.S. and The Netherlands.

Benjamin Scharff, Managing Director, focuses on mergers and acquisitions,

leveraged transactions and recapitalizations. Over the course of his

investment banking career, Ben has advised clients in a broad range of

industries, including chemicals, paints and coatings, construction products

and services, and general manufacturing.

Kevin holds a M.B.A. from Harvard Business School and a B.S. degree, with

Highest Distinction, in Chemical Engineering from the University of Wisconsin

– Madison. At the University of Wisconsin, Kevin was awarded the Kurt F.

Wendt Memorial Scholarship for outstanding academic performance and the

Kowalke-Harr Teamwork Award, and was also named a Dalhke Scholar and

Colbeck Scholar.

Ben graduated from the University of Wisconsin with a B.S. degree in

Economics. Ben is a member of the Association for Corporate Growth

(Wisconsin Chapter) and previously served in the United States Marine Corps.

9

Grace Matthews Chemicals Team

Thomas Osborne

Andrew Hinz

Thomas Osborne focuses on new business development and strategic

planning for Grace Matthews. Prior to joining Grace Matthews, Tom held a

variety of senior leadership positions in the global chemical industry, including

CEO of both The Tnemec Company and ICI Paints North America / The

Glidden Company.

Tom served as Board Chairman of the National Paint and Coatings Association

from 2003 to 2005 and received the Association’s highest honor, the George

Baugh Heckel award. Tom holds a B.S. from Youngstown State University, and

has completed the Advanced Management Program at Harvard Business

School.

Trent Myers

Andrew Hinz, Director, joined Grace Matthews in 2007 and specializes in

buy- and sell-side transactions and leveraged finance. Andy has experience

in a variety of industries including chemicals, basic materials, coatings and

adhesives, printing, and industrial equipment and services. Prior to joining

Grace Matthews, Andy was an Equity Research Analyst with Robert W. Baird

& Co. in Milwaukee, Wisconsin. At Baird, Andy provided investment

recommendations to support institutional equity investors.

Andy holds the Chartered Financial Analyst (CFA) designation and received a

B.B.A. from the University of Wisconsin - Eau Claire with an emphasis in

Accounting and Finance and an M.B.A. from the Kellogg School of

Management at Northwestern University.

Andrew Cardona

Trent Myers, Vice President, has over 20 years experience working in

mergers, acquisitions, and leveraged transactions. Trent has been involved

in over 100 transactions throughout his career, involving such industries as

chemicals, coatings and adhesives, basic materials, and a variety of other

manufacturing and service industries.

Trent has served as a monthly columnist on economic and M&A issues for

Adhesives Age and Modern Paint and Coatings magazines. Trent holds an

M.B.A. degree, with an emphasis in Finance, from the University of

Wisconsin, an M.A. from the University of Virginia, and a B.A. from the

University of Georgia.

Andrew Cardona, Associate, joined Grace Matthews in 2013, and assists in

buy-side and sell-side transactions, supporting clients in a variety of industries

including chemicals, food ingredients, retail, energy, and automotive.

Previously, Andrew was an Investment Associate at Prudential Capital Group

in Chicago. During his time at Prudential, Andrew worked in both the

international group, investing in companies based in Mediterranean Europe,

Latin America and Australia, as well as the restructuring group, managing

troubled investments and investing in distressed securities.

Andrew received a B.B.A. from the University of Wisconsin-Madison, with an

emphasis in finance and investment banking. At Madison, Andrew received

the UW Student-Athlete Academic Excellence Award and the Arthur Ashe Jr.

Award, a National Academic Award for Scholar Athletes.

10

Grace Matthews Chemicals Team

Patrick Maag

George Yang Liu

Patrick Maag, Analyst, joined Grace Matthews in 2013. Patrick supports

clients in a variety of chemical and materials industries. Patrick holds a BS in

Finance from Marquette University where he was a member of the Applied

Investment Management Fund, which teaches fundamental analysis through

direct investment of university funds.

George Yang Liu, Analyst, joined Grace Matthews in 2014. George

supports clients in a variety of chemical and materials industries. George

holds a BA in Economics from Northwestern University. George also

studied Chinese Political and Economic Development at Peking University

in Beijing, China.

Sarah Toledano

Sarah Toledano, Analyst, joined Grace Matthews in 2015. Sarah supports

clients in a variety of chemical and materials industries. Sarah holds a B.S. in

Chemistry from the Massachusetts Institute of Technology (MIT), with

extensive coursework in finance and accounting through the Sloan School of

Management. Sarah also participated in the Ruhr Fellowship in NordrheinWestfalen, Germany, with a focus on global fuels technology.

11

Grace Matthews Recent

Chemical Industry Transactions

Select Chemical Industry Transactions

has been recapitalized by

has been acquired by

has acquired select assets of

the Capcure® business from

has been acquired by

has sold certain assets to

has been recapitalized

by a confidential

private equity group

Grace Matthews, Inc. advised

W.F. Taylor Co.

Grace Matthews, Inc. advised

Compass Chemical International

Grace Matthews, Inc. advised

Jones-Blair Company

Grace Matthews, Inc. advised

Polytex Environmental Inks

Grace Matthews, Inc. advised

Gabriel Performance Products

Grace Matthews, Inc. advised

Spraylat Corporation

has sold its portfolio company

a wholly owned subsidiary of

has acquired

has been acquired by

to Management and

Syrgis Performance

Products, LLC

has sold its portfolio company

has acquired the assets of

has been acquired by

Grace Matthews, Inc. advised

Eastman Chemical Company

Grace Matthews, Inc. advised

Silbond Holdings, LLC

Grace Matthews, Inc. advised

Superior Capital Partners and

Edge Adhesives

Grace Matthews, Inc. advised

Syrgis Performance Products

to

Grace Matthews, Inc. advised

Equa-Chlor, Inc.

Grace Matthews, Inc. advised

Audax Group

13

Select Chemical Industry Transactions

a wholly owned subsidiary of

Syrgis Performance Products

has been acquired by

American Sugar Refining Inc.

has acquired

has acquired the

Specialty Sweetener Division

assets of

has sold its

Resilient Floor Coatings

Business to

has sold its portfolio company

has acquired

to

from

Grace Matthews, Inc. advised

Syrgis Performance Products

Grace Matthews, Inc. advised Chr. Hansen

Grace Matthews, Inc. advised

Landec Corporation

Grace Matthews, Inc. advised

LORD Corporation

Grace Matthews, Inc. advised

NorthStar Chemicals, Inc.

a wholly owned subsidiary of

has been recapitalized by

has acquired

Grace Matthews, Inc. advised

Prairie Capital Management, LLC

has acquired

has acquired the assets of

Syrgis Performance Products

has merged with

has been acquired by

Management of Lycus, Ltd.

The Flood Company

Grace Matthews, Inc. advised

Columbia Paint & Coatings

Grace Matthews, Inc. advised

Fasse Paint Company

Grace Matthews, Inc. advised

Syrgis Performance Products

Grace Matthews, Inc. advised

ColorMatrix Corporation.

Grace Matthews, Inc. advised

AkzoNobel

Grace Matthews, Inc. advised

Northwest Coatings, LLC

14

Select Chemical Industry Transactions

has sold its specialty

chemical subsidiary

has sold its portfolio company

to

to

Grace Matthews, Inc. advised

Chr Hansen, Inc.

Grace Matthews, Inc. advised

Landec Corporation

Grace Matthews, Inc. advised

Brockway Moran

has been acquired by

has been acquired by

has sold its U.S. fine chemicals

subsidiary to

Grace Matthews, Inc. advised

the shareholders of CERAC, Inc.

Grace Matthews, Inc. advised

Raabe Corporation

Grace Matthews, Inc. advised

Borregaard Synthesis, Inc.

has acquired the

Excipients Division of

has acquired

has acquired a majority

interest in

has acquired the assets of

Grace Matthews, Inc. advised

AkzoNobel

Grace Matthews, Inc. advised

Vesta, Inc.

Grace Matthews, Inc. advised

Pacific Epoxy Polymers, Inc.

has licensed exclusive fields of

Intelimer technology from

Grace Matthews, Inc. advised

Landec Corporation

Beckers Industrial Coatings

has acquired the stock of

has sold the assets of

Lubrizol Performance Systems

to

Grace Matthews, Inc. advised

Specialty Coatings Company, Inc.

Grace Matthews, Inc. advised

Lubrizol Corporation

15

Recent Transactions Case Studies

Dominus Capital’s Recapitalization of W.F. Taylor Co., Inc.

Overview

Results

W.F. Taylor Co., Inc. (“Taylor” or the “Company”) is a leading North American

manufacturer and marketer of flooring adhesives and related products. The Company

has a reputation for developing high quality, technologically-advanced adhesives and

providing superior customer service. Taylor is a leader in product innovation and

offers a broad range of environmentally-friendly products that are free from

isocyanates, solvents, and other potentially hazardous chemicals.

The process was highly competitive and generated a significant amount of interest

from both strategic and financial buyers. Grace Matthews led discussions with a

variety of potential buyers with interest in formulated chemicals and the flooring

market.

Taylor has been family-owned and operated since John Raidy, Sr. acquired the

business in 1989. Since that time, Taylor has grown into an industry leader with a

reputation for providing high quality and innovative adhesives to installers of floor

coverings throughout the U.S. The Company was owned by six members of the Raidy

family, including Jack Raidy, Jr. and Mike Raidy, the second generation of Raidys to

own and manage the business.

Ultimately, the shareholders elected to partner with Dominus Capital, a New Yorkbased private equity fund that had developed an expertise in the flooring market

through several prior acquisitions. In Taylor, Dominus recognized another opportunity

to leverage its market knowledge and industry contacts with a business that had a

reputation for high quality, technologically-advanced and environmentally-friendly

products. The transaction provided an opportunity for shareholder liquidity while

allowing management, including Jack and Mike Raidy, to retain ownership in the

business. The shareholders also viewed Dominus Capital’s broad network of industry

resources as an asset to support continued growth.

After successfully developing the Taylor brand and expanding into multiple

distribution channels throughout North America, the shareholders decided to seek

partial liquidity for estate planning purposes. The shareholders engaged Grace

Matthews to explore the Company’s options.

Process

Taylor’s niche market position and strong historical growth made the Company an

attractive target for a broad range of both strategic and financial buyers. Given their

extensive historical focus on developing a strong brand presence and creating a

positive corporate culture, the Raidy family was committed to identifying a partner that

would build upon the company’s success and maintain continuity for the operations

and employees.

has been recapitalized by

Grace Matthews, Inc. advised

W.F. Taylor Co., Inc.

17

Jones-Blair’s Sale to Hempel A/S

Overview

Results

Jones-Blair Company (“Jones-Blair” or the “Company”) is a niche market leader in the

development, manufacture, and marketing of industrial (predominantly oil & gas) and

construction coatings (marketed under the NEOGARD brand name). Jones-Blair is well

known in the coatings industry for its technologically-advanced, user-friendly products

and its industry-leading customer service.

The process was highly competitive and generated a significant amount of interest

from strategic buyers. Per Grace Matthews’ recommendation, the shareholders

allowed extensive further diligence, including QoE reports, management meetings and

site visits to multiple interested parties prior to final offers. Albeit time-consuming,

this process allowed the company to choose from a few well-diligenced final offers each with a high probability to close.

Jones-Blair was founded in 1928 and was privately-held by three families who were

not active in the day-to-day operations of the business. The Company was operated

by outside, professional managers that shaped it into two distinct, niche business

units. After realigning the Company and making significant investments in technology

and product development, the managers oversaw a period of strong top- and bottomline growth for Jones-Blair.

Recently, Jones-Blair was approached by several strategic buyers, and the

shareholders engaged Grace Matthews to explore potential strategic options for the

Company.

Ultimately, the shareholders elected to sell the business to Hempel A/S, a Copenhagen,

Denmark-based world-class manufacturer of high performance coatings. Hempel

recognized in Jones-Blair a near perfect strategic fit with its complementary products

and technologies, targeted geographies and key personnel additions. Hempel paid a

full-value for the business, and it provided a positive outcome on all of the ‘softer’

issues that were important to the stakeholders of Jones-Blair. The final outcome

demonstrated that transaction value does not need to be compromised to achieve a

win-win for all parties involved.

Process

Jones-Blair had often received inquiries from both strategic and financial buyers, but

the shareholders had not previously explored a formal sale process. Based on the

shareholders’ desire to maintain continuity for Jones-Blair’s operations and to preserve

confidentiality, Grace Matthews held informal conversations with senior management

of a small group of strategic buyers to describe the opportunity and gauge initial

interest.

One of the challenges of the process was to find a buyer that would place premium

values on both the industrial and the construction coatings operations. Also, as is

common, Jones-Blair had a few unique characteristics that a buyer needed to fully

understand early in the process, to avoid late stage contract issues.

has been acquired by

Grace Matthews, Inc. advised

Jones-Blair Company

18

One Rock Capital Partners’ Acquisition of

Compass Chemical International

Overview

Results

Compass Chemical International LLC (“Compass”) is a leading independent producer of

specialty and standard phosphonates and other specialty chemicals and a major

importer and distributor of phosphorus acid. With operations in Smyrna, Georgia and

Huntsville, Texas, Compass serves a diverse base of oilfield, industrial water and

recreational water customers. Cooperative product development with customers is a

major competitive differentiator for Compass, and has helped the Company build a

robust customer base consisting of industry leading blue-chips as well as small to midsize industrial firms.

Ultimately, the shareholders of BMMC selected One Rock Capital as Compass’

new partner. One Rock recognized that Compass’ market position, strong

management, and industry reputation represented a strong base for future

growth, and was selected based on One Rock partners’ industry knowledge and

relationships, as well as the cultural fit between the parties. The transaction

offered continuity for the existing management team and allowed them to go

forward with an experienced partner committed to executing the Company’s

growth strategy.

Compass was owned by BMMC Holdings, whose shareholders had overseen Compass’

development into an industry leader in phosphonate-based scale and corrosion

inhibitors for oilfield and industrial water applications. Because Compass was one of

few remaining independent mid-sized North American manufacturers focused on these

fast-growing markets, the shareholders of BMMC determined in mid-2014 that the

Company was at an inflection point, and that it was an opportune time to consider

bringing in new investors that could support the company’s future growth prospects.

has made an equity investment in

Process

BMMC’s shareholders engaged Grace Matthews to explore the Company’s options.

Grace Matthews believed that Compass would attract considerable interest from the

investment community. In choosing a potential partner, BMMC shareholders and

Grace Matthews considered several variables, including opportunities for Compass’

talented management team and potential for continued growth.

Grace Matthews, Inc. advised the shareholders of

Compass Chemical International

19

Evonik Industries’ Acquisition of Silbond Corporation

Overview

Results

Silbond Corporation, or “Silbond”, is a leading manufacturer and supplier of tetraethyl

orthosilicate (TEOS), a specialty silicate material. With a history of growth, high

margins, and strong cash flow complemented by a unique, low-cost, highly efficient

manufacturing process, Silbond has established itself as a leader in TEOS-related

products for the consumer electronics and semiconductors, investment casting,

protective paints and coatings, and chemical processing and catalyst industries.

Silbond produces TEOS in a unique and inherently clean direct reaction process that

allows the company to consistently meet the highest requirements for purity. Having

invested significantly in production capabilities and product development over the

past five years, Silbond possessed a number of tangible, material growth

opportunities that positioned the company well for continued success.

Over the course of its long-term engagement with O2 Investment Partners, Grace

Matthews worked to navigate ownership through a series of challenging discussions

with multiple interested parties. With significant expected synergies and

complementary geographic locations and product lines, Evonik Industries successfully

acquired Silbond Corporation in February 2014.

O2 Investment Partners, supported by Centerfield Capital Partners, acquired the

Company along with Silbond’s management team in 2010. After initial meetings in

2012, Silbond Holdings engaged Grace Matthews in a long-term advisory role to help

prepare the company for an eventual sale.

has been acquired by

Process

A number of interested acquirers approached Silbond prior to ownership’s decision to

formally declare the company for sale. As one party emerged as a serious potential

buyer, the shareholders made the decision to ask Grace Matthews to market the

company to an limited group of other strategic and high-potential private equity

acquirers.

Grace Matthews, Inc. advised

Silbond Holdings, LLC on this transaction

20

The Gladstone Companies’ and Akoya Capital’s Acquisition of

Edge Adhesives from Superior Capital Partners

*Winner of the M&A Advisor’s Divestiture of the Year Award for 2014

Overview

Results

Edge Adhesives, or “Edge”, is a developer and manufacturer of adhesives, sealants,

tapes, gaskets, and related materials for the construction, transportation, electrical,

HVAC, and other markets. By combining significant formulation and production

expertise across multiple facilities and technology platforms with the ability to

formulate, compound, extrude, coat, and convert products, Edge developed and

commercialized a number of products that are currently recognized as leaders in their

respective market niches.

The result was a timely, efficient sales process that was quite competitive, and

included numerous interested strategic and private equity groups.

After acquiring the initial platform company in 2010, Superior Capital Partners, the

majority owner of Edge, and Edge’s CEO had successfully integrated a number of

acquisitions and achieved substantial cost savings and organic growth. In the summer

of 2013, ownership began considering potential exit options and ultimately engaged

Grace Matthews to run a sale process targeted at a select group of strategic and

private equity buyers.

In partnership with Akoya Capital, the Gladstone Companies acquired Edge Adhesives

in February 2014. Gladstone and Akoya brought in several key industry executives

early in the process that were able to help them understand the value proposition and

growth opportunities, which allowed them to get comfortable with the ultimate

valuation.

The final value of the transaction matched the high expectations of the sellers, and the

management team of Edge (which included a significant roll from the CEO into Newco)

was very pleased with its new equity partner. This all-around positive outcome

underscores the need for a well-managed and executed sale process.

Process

After working with ownership to position and prepare the company for sale, Grace

Matthews was tasked with finding a group of buyers that would value the business off

of significant, yet defensible, increased future performance. As such, Grace Matthews

leveraged industry relationships to contact the best potential strategic acquirers that

could benefit from Edge’s manufacturing footprint, technology and diverse product

portfolio. Grace Matthews also contacted a number of targeted private equity groups,

interested and familiar with the space, who could acquire the company and deploy

additional capital and management resources to continue building upon an already

rapid growth trajectory.

has sold its portfolio company

to Management and

Grace Matthews, Inc. advised

Superior Capital Partners and Edge Adhesives

21

Gabriel Performance Products’ Acquisition of

BASF’s Capcure® Business

Overview

Results

Gabriel Performance Products, a portfolio company of Edgewater Capital Partners, is a

manufacturer of proprietary, high-performance chemicals and also provides custom

synthesis services to the chemical industry. Gabriel is headquartered in Ashtabula,

Ohio.

Grace Matthews’ process resulted in a highly synergistic transaction that allowed

Gabriel to become a market leader in mercaptan-based epoxy curing agents.

Due to the chemical similarities between Gabriel and Capcure’s products,

integration of Capcure into Gabriel’s operations was seamless. The Capcure

products were manufactured using existing equipment without adding any new

fixed costs or overhead. No customers were lost through the integration

process and today all incremental gross margin generated from sales of Capcure

products directly increases Gabriel’s EBITDA.

Gabriel management believed that bolstering its presence in the specialty epoxy curing

agents market could provide significant revenue and profit opportunities, and was

aware that BASF had an attractive product line of curing agents sold under the

Capcure® brand name. Gabriel believed the business to be non-core for BASF, which

had acquired the product line through the acquisition of Cognis Corporation in 2010.

In early 2012, Edgewater Capital Partners sought out Grace Matthews for assistance in

pursuing the acquisition.

Process

Grace Matthews leveraged prior relationships with senior BASF management at BASF’s

Ludwigshafen, Germany Headquarters in order to access key decision makers, and

ultimately led negotiations between Gabriel and BASF.

A challenging component of the transaction was handling the transfer of customer

relationships and inventory from BASF to Gabriel, without revealing confidential

information or disrupting customers’ order patterns. Grace Matthews negotiated a

transitional agreement that allowed BASF to service customers and reduce inventory for

a period of time post-close, while Gabriel finalized production specifications, scheduling,

and logistics for distribution of Capcure products from its Ashtabula facility.

has acquired select assets of the

Capcure® business from

Grace Matthews, Inc. advised

Gabriel Performance Products

22

Weatherford International’s Acquisition of Syrgis Performance Chemicals

Client

Results

Syrgis Performance Chemicals, or “PChem”, is a manufacturer of specialty

oilfield chemicals. PChem primarily services the oil and gas industry with

products that are used in a variety of end markets, including drilling and

stimulation, production, pipeline transportation and refining.

The buyer that emerged from this rigorous process was Clearwater

International, a subsidiary of Weatherford International, a worldwide

provider of equipment and services used in all phases of oil and natural gas

production. PChem’s future growth is expected to accelerate under the

new owner, as PChem’s custom formulation capabilities will greatly benefit

from Weatherford’s global reach and exceptional marketing resources.

The timing of the sale was excellent, as PChem was posting record sales and

earnings as the oil and gas industry in North America was experiencing rapid

growth due to the discovery and development of shale oil deposits in the

U.S. and Canada. PChem, which provides custom-formulated products to

match the unique characteristics of oil and natural gas deposits in specific

geographic areas, was well positioned to capitalize on growing oil and gas

production in North America, as well as continue expanding its overseas

footprint with sales in Russia and Central and South America.

a wholly owned subsidiary of

Syrgis Performance Products, LLC

Process

Grace Matthews contacted both strategic and private equity buyers for

PChem. Management presentations were conducted for a limited group of

buyers that expressed a strong interest in acquiring PChem. A smaller subset

of potential buyers was allowed to conduct more detailed due diligence.

has been acquired by

Grace Matthews, Inc. advised

Syrgis Performance Products

23

PPG Industries’ Acquisition of Spraylat Corporation

Overview

Results

Spraylat Corporation is a global manufacturer of industrial powder and liquid

coatings and is one of the largest privately held coatings companies in North

America. Spraylat, known for its technology and customer service, is a leader in

many of the niche markets it serves, including automotive wheel and tire

coatings, electronic conductive coatings, mirror coatings and solutions, and

architectural powder coatings. The company operates manufacturing facilities in

North America, Europe, and Asia and has customers in over fifty countries.

Grace Matthews’ process resulted in the successful sale of Spraylat

Corporation to PPG Industries at a value that exceeded the shareholders’

goals. The cultural, strategic, and product fits between the organizations

were a clear driver of value in the transaction. The acquisition strengthened

PPG’s capabilities in industrial coatings while simultaneously providing

access to Spraylat’s strong, worldwide customer base.

Prior to engaging Grace Matthews, the owners of Spraylat had been approached

by a strategic buyer that could realize significant synergies in a transaction. With

no readily apparent succession plan in place, the owners sought advice from

Grace Matthews on possible sale options.

Process

has sold certain assets to

Spraylat’s owners ultimately engaged Grace Matthews to run a timely sale process

targeted at strategic buyers that potentially had the most to gain in a synergistic

transaction. Grace Matthews identified a small group of global coatings companies

that could reasonably be expected to achieve the value goals of the shareholders.

After approaching these targets to gauge their interest, Grace Matthews met with

each potential buyer to discuss Spraylat and the synergy opportunities that an

acquisition could provide. GM then guided the sellers and potential buyers through

what became a highly competitive sale process.

Grace Matthews, Inc. advised

Spraylat Corporation

24

PolyOne Corporation’s Acquisition of ColorMatrix Group

Client

Results

Audax Group, a Boston-based private equity firm, engaged Grace Matthews

(along with a co-advisor) to develop and execute a strategy to maximize value

to a strategic buyer during the sale of ColorMatrix, a portfolio company of

Audax Group and a world leader in colorants and additives for plastics.

PolyOne Corporation successfully bid over 11x EBITDA for ColorMatrix,

whose global sales and EBITDA for June 30, 2011, were $196.8 million and

$43.6 million, respectively.

Having advised on ColorMatrix’s founder’s $175-million sale of the company

to Audax Group in 2006, Grace Matthews was very familiar with ColorMatrix

and the company’s ability to provide technical solutions for beverage

packaging, industrial extrusion, performance molding, and fiber end

markets.

The acquisition of ColorMatrix is a significant milestone in PolyOne’s

publicly stated commitment to focus more on specialty chemicals.

Process

The marketing process for ColorMatrix involved a broad auction that included

over 100 prospective private equity and strategic buyers. Grace Matthews,

based on our expertise in chemicals, plastics, and additives, focused solely on

high potential strategic buyers within the specialty chemicals industry.

After extensive research of market participation, product portfolios,

geographic footprints, and potential synergies, Grace Matthews proceeded

to handpick certain buyers, including PolyOne, for introductory meetings.

These “fireside chats” informally introduced the ColorMatrix story,

highlighted business fit, and generated strong interest from a number of

strategic bidders.

has sold its portfolio company

to

Grace Matthews, Inc. advised Audax Group

25

Landec Corporation’s Acquisition of Lifecore Biomedical

Client

Results

Landec Corporation (Nasdaq: LNDC), based in Menlo Park, CA, is a materials

science company that develops and markets patented polymer products for

food, agriculture, personal care and drug delivery applications. Grace

Matthews has a strong, long-standing relationship with Landec, having

advised the company on a number of transactions including its acquisition of

Dock Resins and a joint venture with Air Products and Chemicals.

Warburg Pincus set a minimum price target for Lifecore based on its return

of investment objectives. To meet the targeted value, Grace Matthews

negotiated closing consideration of $44.0 million, including $40.0 million in

cash and $4.0 million in assumed debt. Additional contingent payments of

up to $10.0 million based on Lifecore’s 2011 and 2012 performance were

structured by Grace Matthews to help Landec mitigate risk while

simultaneously achieving Warburg Pincus’ minimum sale price.

Process

Landec engaged Grace Matthews to perform an acquisition search that

would expand Landec’s capabilities in advanced materials. Working together,

Grace Matthews and Landec developed three criteria that acquisition

candidates had to possess: growth potential in areas beyond Landec’s core

food technology, biomaterial products that had synergies with the company’s

Intelimer® polymers, and a level of profitability that would be meaningfully

accretive to near-term financial performance.

During the process, Grace Matthews identified and qualified a number of

acquisition candidates, including Lifecore Biomedical (Chaska, MN), a

developer and manufacturer of biopolymers used in a wide range of

therapeutic treatments and medical research initiatives and a portfolio

holding of Warburg Pincus, a $30 billion New York based private equity firm.

Lifecore represents an important investment for Landec’s future in the area

of biomaterials. The acquisition significantly advances Landec’s commitment

to advanced materials in new, growing markets and achieves all the stated

objectives of the company’s acquisition strategy.

has acquired

from

Grace Matthews, Inc. advised

Landec Corporation

26

Columbia Paint Company’s Merger with Sherwin-Williams

Client

Results

Columbia Paint Company, based in Spokane, Washington, is a leading

manufacturer and retailer of architectural coatings in the Pacific Northwest.

The Company services the professional painting contractor, builder and do-ityourself markets through 43 company-owned stores.

The process generated three strong, competitive bids for Columbia. Grace

Matthews successfully negotiated and structured a merger with Sherwin

Williams that achieved the shareholders’ goals at an attractive valuation.

Because of its strong regional brands, favorable demographics, and proven

growth strategy, Columbia enjoyed sales and profit growth far in excess of

industry averages.

The final transaction was structured as a cash merger – which provided

shareholders with an extremely advantageous tax position for the

transaction.

Process

The shareholders of Columbia engaged Grace Matthews to market the

company to select buyers. In agreement with Columbia’s Board and

shareholders, Grace Matthews identified a group of the six best strategic

buyers that could reasonably be expected to achieve the Board’s objectives

relating to valuation, corporate culture and management succession.

Grace Matthews approached each of these six ideal buyers with a detailed

Offering Memorandum and customized analyses for each that took into

account the strategic fit and the buyer’s likely post-acquisition plans for

Columbia.

has merged with

Grace Matthews, Inc. advised

Columbia Paint & Coatings

27

Ceradyne’s Acquisition of Minco

Client

Results

The Philadelphia-based private equity group Argosy Capital engaged Grace

Matthews to sell their portfolio company, Minco, the world’s leading

producer of premium-grade fused silica, a key raw material used in hightemperature precision investment casting.

Grace Matthews prepared all of the documentation required for a full,

broad-based sale process, including an Offering Memorandum,

management presentation, a secure on-line due diligence data room, a

summary of synergies in China, and a detailed Letter of Intent: all of which

supported a full valuation for the business that would be required for a preemptive offer to be successful.

A key consideration was finding a potential buyer that would support Minco's

excellent growth prospects - the company had established strategic alliances

with major industry partners, and was in the process of setting up a joint

venture to enter the rapidly growing markets in China.

The process resulted in a very successful vertical integration of two

businesses at a purchase price that provided the client with a high return on

the initial investment.

Process

After a thorough business analysis and evaluation, including detailed financial

modeling to determine the expected values from both private equity and

strategic buyer perspectives, we determined that there was a small group of

strategic buyers that would be significantly affected by the sale of Minco,

including the Los Angeles-based Ceradyne (NASDAQ: CRDN). Minco was a

long-time supplier to Ceradyne’s Thermo Materials division, which stood to

gain significant cost savings from the vertical integration of Minco into its

operations.

Ceradyne showed strong interest in the acquisition, and requested the

chance to make a pre-emptive bid for Minco.

has acquired

Grace Matthews, Inc. advised Minco, Inc.

28

Akzo-Nobel’s Acquisition of Chemcraft

Client

Results

Grace Matthews has a long-standing client relationship with Amsterdam’s

Akzo-Nobel, the world’s largest coatings manufacturer. Over the last 10+

years, Grace Matthews principals have advised Akzo on numerous buy- and

sell-side transactions.

Because of our regular interaction with the debt and equity markets, we

were able to quickly and accurately determine the value that an aggressive

private equity group would put on Chemcraft.

With revenues in excess of $16 billion, Akzo had a strong interest in acquiring

Chemcraft, a highly profitable North American manufacturer of wood

finishes with annual sales exceeding $150 million.

This analysis provided our client, Akzo, with a baseline on which to build an

attractive package for both the shareholders and management, which was

ultimately accepted by Chemcraft.

This creative approach allowed Akzo to participate in and win a competitive

sale process while the other interested strategic buyers remained

bystanders.

Process

Despite the exodus of U.S. furniture manufacturing to China, both Akzo and

Chemcraft had managed to grow their wood coatings businesses in North

America based on product innovation and excellent customer service. The

two businesses were a natural strategic fit.

Chemcraft’s management initially pursued a private equity-backed

management buy-out, and didn’t believe a sale to Akzo or any other strategic

buyer would achieve their objectives.

has acquired

Grace Matthews recognized that only an approach that countered

management's objections to strategic buyers would allow Akzo into the

process.

Grace Matthews, Inc. advised Akzo Nobel

29

RoundTable’s Acquisition of Vesta

Client

Results

Vesta is North America’s leading manufacturer of silicone-based, single-use

medical devices. Vesta’s branded and private label products are sold to global

leaders in heath care including Abbott Labs, Baxter and Bristol-Myers Squibb.

Because of its growth prospects, high margins, and experienced

management team, Vesta generated a great deal of interest from the

private equity community with about 25 bids in the initial phase of a twostage auction process.

As one of the fastest growing businesses in its industry, Vesta had

been regularly contacted by both strategic and financial buyers

interested in acquiring the business.

Of the eight finalists, management partnered with RoundTable Healthcare

Partners, a Chicago private equity firm specializing in healthcare.

Process

The value of the recapitalization was about three times the amount of an

offer received just two years earlier, demonstrating the power of a wellexecuted, competitive sale process.

Vesta’s founding shareholders wanted to capture some of the value they had

created within the Company, but also had an interest in seeing the Company

continue as an independent firm with the resources it needed to maintain its

strong record of growth. The shareholders were supported by a young

management team that had helped build the business and the owners felt a

great deal of appreciation and loyalty to them, as well as to the rank-and-file

employees.

Despite the anticipation of a high level of interest from strategic, synergistic

buyers, the shareholders requested that Grace Matthews limit the sale

process to leading private equity firms that would provide existing

management with the opportunity for a meaningful equity position in the

business.

has acquired a majority interest in

Grace Matthews, Inc. advised Vesta, Inc.

30

Audax Group’s Recapitalization of ColorMatrix

Client

Results

In 2006, the shareholders of privately-held ColorMatrix (Cleveland) engaged

Grace Matthews to advise them on the sale of the company.

The first phase of the auction process resulted in 41 bids with a wide range

of values.

ColorMatrix is the world’s leader in liquid colorants for plastics, with

operations in the U.S., the U.K., The Netherlands, Brazil and China. Over half

of ColorMatrix’s revenues are outside the U.S.

Concurrently with the second round of bidding from the eight final parties,

we secured a “staple-on” debt package from GE Capital, which was well

equipped to underwrite a complex, multi-currency global entity like

ColorMatrix.

Process

Three strong, well-respected private equity groups bid aggressively in the

second round, resulting in a successful bid at the high end of the range. The

Shareholders and management ultimately chose the Audax Group based on

a combination of price, culture and shared values.

The company’s founders had grown the business to over $100 million in

revenue, and were seeking liquidity through a recapitalization or sale of the

business.

Grace Matthews assisted the owners with careful planning and positioning

the company for a sale, based on its strong management team, loyal

customers and solid international growth prospects.

has been recapitalized by

Based on these fundamentals, as well as a history of high margins and

double-digit growth, Grace Matthews recommended a broad two-stage

auction that would involve both strategic and financial buyers.

Grace Matthews, Inc. advised

ColorMatrix Corporation

31

219 North Milwaukee Street, 7th Floor

Milwaukee, WI 53202

414.278.1120

www.gracematthews.com

© 2015 Grace Matthews, Inc. All rights reserved. Securities are offered through GM Securities, LLC, under common control with Grace Matthews, Inc., and a registered broker dealer and member of the Financial Industry Regulatory Authority.