Factors Affecting Retail Coffee Prices, a study on the U.S Coffee

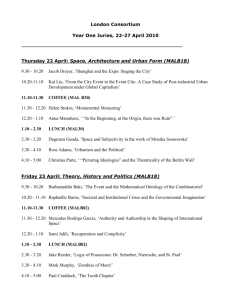

advertisement

Factors Affecting Retail Coffee Prices, a study on the U.S Coffee Retail Market Ashutosh Tiwari and Pratibha Bisht Authors are 1Graduate Student, Morrison School of Agribusiness and Resource Management, Arizona State University, Mesa, AZ. and 2Manager Projects at Premium Farm Fresh Produce Ltd. India Contact author: Tiwari email:atiwari7@asu.edu, Ph.480-359-8357. Keywords: Coffee Prices, International Coffee Agreement, Volatility, Factors, Panel Data Abstract: External and Internal factors which affect coffee retail prices in the United States are studied. The study uses ordinary least squares regression and panel data analysis to analyze factors from United States and four major coffee exporting countries (Brazil, Mexico, Guatemala and Columbia). Soda consumption in the U.S has a positive impact on coffee retail prices unlike tea, which has a negative correlation. The study uses a time series data from 1990 to 2010. Income share of poorest 20 percent of the population has a negative correlation with retail coffee prices in the U.S. Economic performance of both exporting and the U.S fuels coffee retail prices. International Coffee Agreement and NYBOT coffee prices/spot prices are the two most important factors that impact retail prices of coffee in the United States. Introduction Crude oil, coffee and gas are the three most traded commodities in international markets. No other agriculture commodity can compete with the trade volumes of crude oil and gas than coffee. Coffee is the queen of all agriculture commodities when it comes to the volume of international trade. Unlike tea, coffee is mostly consumed by developed nations such as the United States and European countries but produced by developing countries such as Brazil, Columbia, Indonesia and Vietnam. The coffee demand-supply web makes coffee truly an international commodity. Two main coffee varieties are traded internationally viz. Arabica (Coffea Arabica) and Robusta (Coffea. canephora var. robusta). Arabica coffee is more favored by consumers in general than Robusta. Arabica coffee is native to Ethiopia and it represents around seventy percent of world coffee production. On the world market, Arabica coffee brings the highest prices. Arabica is more climate sensitive than Robusta and needs mild temperatures for optimum quality produce while Robusta is comparatively climate resistant and needs less agronomic attention. Robusta coffee contains about 50 to 60 percent more caffeine and has a unique taste compared to Arabica. Robusta coffee is mainly used for making instant coffee and for blending purposes. The United States consumes 21,435,967 bags (one coffee bag contains 60 Kilograms of coffee) of coffee in a year and is the world’s number one coffee consumer in terms of volume. Coffee is a popular drink in the U.S. It is consumed both at home and away from home but more consumers drink coffee in their homes rather than away from home (National Coffee Association, 2011). Coffee comes in various ready to make and ready to drink forms, and is readily available to U.S residents. The caffeine in coffee works as a stimulant and provides a refreshing experience to consumer. Per capita consumption of coffee in the U.S is 4.2 Kg per year compared to average world consumption per capita which is 1.3 Kg per capita per year (International Coffee Organization, 2007). Forty percent of 18-24 year olds drink coffee daily and fifty four percent of adults age 25-39, said they drink coffee daily (National Coffee Association, 2011). Involvement of a number of countries as consumers and suppliers in the international coffee trade makes coffee difficult to predict. Various climatic, economic, political and demographic factors affect retail coffee prices. Prices of agricultural commodities such as coffee directly affect consumers and producers. If the retail price is higher than normal, it hurts consumers and forces them to make alternate choices and if the retail price is too low compared to normal levels, it affects the wellbeing of the producer. Coffee producers are generally poor farmers with small landholdings who live in developing nations. Price fluctuations create disturbances and uncertainty in the international coffee trade, which eventually makes coffee trade riskier for all stakeholders. Coffee producers generally are poor and their livelihood is directly linked to coffee prices. Coffee prices fluctuate at all levels viz. farm, spot and retail but for coffee consumers retail prices are most important among all prices at different levels. The retail coffee price is the final price of the coffee, which the consumer pays in order to buy a single unit of coffee. Wheeler (1998) concluded that sixty percent of the coffee retail price is comprised of value addition in the importing country and forty percent of the coffee retail price is due to the produce and value addition in the exporting country (i.e. the origin country of the coffee produce). This study analyzes the factors responsible for coffee retail price fluctuation in the United States by evaluating both internal factors and external factors by using a time series data from 1990 to 2011 for major coffee exporters. Internal factors include factors present inside the importing country (United States in this case). External factors are the factors which are associated with the exporting countries (Brazil, Columbia, Mexico and Guatemala in this case). Before coffee reaches to the consumer it goes through various stages of value addition. The coffee value chain and the number of intermediaries can vary from case to case but in general this study is adapted from the coffee value chain model suggested by Fitter and Kaplinsky (2001). They suggested a detailed value chain with seven different price levels, however this study takes only three levels and three prices into consideration. Farmers receive a farm gate price for their coffee produce and export the produce to the traders in the United States. Then the traders/roasters pass the produce at the wholesale price to the retailers. Finally, retailers charge retail price directly to the final coffee consumers. In order to study the value addition effect on the coffee retail price the study considers the overall performance of the major companies such as major coffee roasters and retailers in the U.S. The study considers three packaged coffee producing companies Proctor and Gamble, Krafts and Sara Lee and the largest retail coffee house in the United States Starbucks. The study also finds the relationship between retail coffee prices and consumption levels of other popular supplementary drinks such as tea and carbonated drinks. The next section of this text is a review of existing literature on coffee trade and related aspects. Third section presents the research methodology while the fourth, fifth and sixth sections discuss data, results and summarize key findings respectively. Review of Literature Hopp and Foote (1955) studied the factors responsible the variability in coffee prices by running a regression. They found that world coffee stocks, Brazilian exportable production and the consumer demand for coffee were the most important factors that impacted the coffee prices. They concluded that coffee prices depict a cyclic pattern. They also mentioned that buyers’ expectations about the supply also affect coffee prices but this is increasingly becoming less relevant because of improvements in supply forecasting techniques. Mundlak and Larson (1992) used a panel data for 58 countries for 60 commodities/products using a time series panel data for different qualities of coffee. They concluded that producing countries’ commodity policies affect the levels of prices of the commodities but these policies do not prevent the movement of domestic prices with the international prices of those commodities. Coffee is a globally traded commodity; hence producing countries’ coffee policies should affect domestic and international coffee prices. Time series data can be used to estimate coffee price fluctuations in the U.S retail market and coffee exporting countries. Ghoshray (2010) discussed that the prices for different types of coffee are correlated and concluded that the coffee market is linked internationally. He used time series data to figure out that the international coffee market is one big market which constitutes small national level units. He estimated that the major reasons for price volatility are supply deficiencies and the unavailability of close substitutes. Gilbert (2005) concluded in his research that ICA regulations and Brazilian production trends affect coffee prices. He predicted that the coffee prices would fall after 2005 as he suggested that prices were 30 percent higher than the normal and theorized that prices would come down in the near future because there was no parallel consumption increase so markets would readjust. However after 2004 prices actually increased continuously, possibly because of the changing dynamics in the coffee industry. Gilbert (2007) found that the previous monopoly in the US market for coffee has been transformed into a highly competitive environment and that the US coffee market is the largest roasted coffee market which influences the whole coffee trade. UK and US markets are quite different as US is highly competitive compared to the U.K coffee market. Absence of concentration of roasters supported the coffee consumption and boosted the price levels. Mehta (2008) studied coffee prices at three levels, farm prices in Brazil and wholesale and retail prices in the United States. He studied the effect of the ICA (International Coffee Agreement) on coffee prices at different times and pointed out the downward movement of coffee prices when quota regulations were in place. He found that Brazilian farm prices did not move with international coffee prices in the short run. He also found that retail prices are more sensitive to wholesale price increases than wholesale price decreases. He finally concluded that ICA interventions disrupted the natural supply and price cycle for coffee and cautioned against the use of predictions using time series data. Gilbert (2008) by using the GVC (Global Value Chain) analysis mentioned that only half of retail coffee costs can be attributed to the price of unprocessed or green coffee. Hence it can be inferred that there is a considerable amount of added value taking place beyond green coffee. He mentioned that the coffee buyers refer to the major terminal markets (New York and London) for price quotes while purchasing green coffee and do not consider production cost as a major factor affecting coffee prices. Similarly the sellers also refer to New York and London commodity markets for coffee price determination. Hence coffee price at New York Board of Trade (NYBOT) and London (LIFFE) market can be used as a proxy for the commodity price at a given point of time. Fitting and Kaplingsky (2001) were convinced that coffee can be branded because of its vast variety at the retail level and that coffee stands next to wine with respect to variety at retail level. They talk about the transformation from trading as a commodity to so much variety at the retail level and provide evidence that there is a large value- added component before the coffee reaches the consumers. It is also evident that factors other than the commodity coffee prices are important in determining the retail prices of coffee. Mohan (2007) concluded that liberalization in the coffee trade has transferred the risk to coffee producers from other stakeholders. This trade risk is caused by the price fluctuation of coffee but terminal markets (NYBOT/LIFFE) reduce that risk. He further recommends that these terminal markets should open their branches that could be accessed by the producers directly. He highlighted the importance of these terminal markets in price discovery and minimizing the producers’ risk. Kolk (2005) found that retailers in the U.S pay high prices for quality and certified coffee. Also retailers differentiate and are willing to pay more for Fair Trade coffee. Still coffee producers are facing problems and are not able to realize the benefits of such a strong market. He further argues that coffee consumption has to increase in order to improve the livelihood of the coffee farmers in developing countries. Ponte (2002) stated the importance of coffee quality rather than the quantity with respect to the producers of coffee. He argued that producers should keep in mind, the final consumers’ preferences and the characteristics of the coffee for which consumers would be willing to pay more. Quality coffee provides more revenue to producers and it is a better strategy to earn more revenue for same quantity of coffee compared to low quality coffee. Rotaris and Danielis(2011) found that Italian coffee consumers are willing to pay a premium price for fair trade coffee over conventional coffee but this characteristic can vary with other demographic factors such as age, income, gender etc. Housewives, retired consumers and less educated and young consumers tend to buy cheaper coffee brands. Basu and Hicks (2008) found that U.S customers are more sensitive towards fair trade coffee compared to German customers. They also found that a coffee brand can be priced higher in the western countries if it is a fair trade coffee brand compared to a conventional coffee brand. Bohman and Jarvis (1999) found out that ICA uses the export quotas to restrict coffee trade in order to increase and stabilize the international price but the use of quota decreased the price realization by the farmers in most of the coffee producer countries. In this paper I will study the affect of ICA on the coffee retail prices in the United States. Lee and Gómez1 (2011) that United States retail coffee prices are the most receptive to the international coffee prices as compared to the France and Germany. That means changes in the international coffee prices affect coffee retail prices in the United States more than they do in Germany and France. Methodology The empirical analysis has two parts. The first part uses a panel data set consisting of four countries, Brazil, Columbia, Mexico and Guatemala. These four countries are the major coffee exporters to the U.S coffee market (Economic Research Service, USDA). In the data set country specific external variables that affect the US retail coffee prices will be included. In order to control individual country variation I will use the fixed effect model for all the four coffee exporting countries over time. The second part of the empirical analysis will estimate an ordinary least square regression (OLS) for U.S retail coffee prices. Regressors in the second OLS regression will include the internal variables that affect U.S Retail coffee prices. 1. Panel data analysis for external factors The U.S coffee market is dominated by the four coffee exporting nations, Brazil, Columbia, Mexico and Guatemala. All these countries are developing economies where agriculture plays an important role in the national growth but each country has different coffee production levels, agricultural policies, climatic conditions and trade policies. This section will analyze country specific factors that affect retail prices of coffee in the United States. The panel regressions estimate the effect of individual countries on the U.S coffee retail prices from 1990 to 2010. U.S market trades in two types of coffee, Arabica and Robusta. Arabica coffee is generally favored by the U.S consumers (Goddard and Akiyama, 1988). In general economic indicators such as GDP represents a country’s economic wellbeing but due to the difference in the sizes of the coffee exporting economies GDP per capita for individual countries is considered as a factor for present study. Retail coffee prices are highly seasonal (Barsky and Miron, 1989). To avoid the consequences of using monthly or quarterly data, yearly data is taken for empirical estimation. Instead of using the yearly total coffee production of individual exporting countries, only exportable yearly coffee production is used in the empirical analysis. According to Akiyama and Varangis (1990) ICA (International Coffee Agreement) affected the coffee retail prices in the past, so to analyze the ICA affect on U.S retail coffee prices a dummy variable is taken in this research paper. I use the yearly retail coffee price in U.S dollars as a function of domestic consumption of coffee measured in thousand bags (x1), GDP (Gross Domestic Product) per capita for each of the four coffee exporting countries (x2), yearly exportable coffee production for each exporting country (x3), Income share held by the poorest 20 percent of the population (x4) and income share held by the richest 20 percent of the population (x5). Apart from the above mentioned variables a dummy variable is also included in the regression. The dummy variable is to consider the ICA (International Coffee Agreement) effect (x6), (Eq.(1)). Pit = αi +∑ βk Xkit + µit (1) Where: Pit is the retail price of coffee in a particular year in United States measured in US dollars. αi is the unknown intercept, which represents the individual effect of each of the four coffee exporting countries. Xkit represents the ‘kth‘independent variable for the ‘ith’ country and the ‘tth’ year. Βk is the coefficients corresponding to different dependent variables in equation (1). µit is the error term for the ith country and tth year. ‘I (1 to 4)’ represents the four coffee exporting countries. ‘t (1 to 21)’represents the years from 1990 to 2010. ‘k (1 to 6 )’ represents the number of independent variable. 2. Ordinary least square regression for the internal factors This part uses an ordinary least square regression for the internal factors affecting the retail coffee price in United States. Internal factors include consumption data for tea, cocoa and carbonated soft drink consumption data (i.e. yearly consumption of tea (m1), yearly cocoa consumption (m2) and yearly consumption of soda/carbonated soft drinks (m3)). Gilbert (2008) mentioned that roasters take terminal market prices to determine the spot prices for coffee. In order to analyze the effect of spot prices on retail coffee prices NYBOT annual average coffee prices (m4) are taken as a representation of spot prices. GDP per capita in U.S (m5) on a yearly basis is taken as an indicator of U.S economic wellbeing. There are three major coffee roasters in United States viz. Procter & Gamble (P&G) which produces coffee brand Folgers, Kraft which produces coffee brands Maxwell House and Yuban, and Sara Lee which produces coffee brands Hills Bros., Chock Full O’ Nuts, MJB, and Chase & Sanborn (Leibtag et.al, 2007). Yearly average share prices for three major roasters P & G, Kraft and Sara Lee (m6, m7 and m8) and yearly share prices for the major coffee house in the United States, Starbucks (m9) are also taken as regressors in equation (2) Pt= ρt + ∑ δk mkt +εt (2) Where: Pt is the retail coffee price in the U.S in the year t. δk is the coefficient of variable mk in equation (2) where k=(1 to 9) as there are 8 independent variables in equation (2) εt is the error term in equation (2) ρt is the intercept of the coffee retail price function. ‘t (1 to 21)’represents the years from 1990 to 2010. ‘k (1 to 9)’ represents the nine regressors in equation (2) Data In this paper, I use two separate datasets. The first dataset is arranged as a panel for the four coffee exporting countries viz. Brazil, Columbia, Guatemala and Mexico. This data set includes the external factors prevailing outside the United States. I took yearly timeseries data (from 1990 to 2010) to avoid any kind of seasonality in the analysis. External variables in the first dataset are grouped in two subgroups. First subgroup consists of the individual exporting country specific data for each of the four coffee exporting countries. The first subgroup of external variables includes domestic consumption of coffee measured in number of sixty kilograms coffee bags, yearly GDP per capita, exportable production of coffee for all four exporting countries and the income share held by lowest 20 percent people in each of the four countries. Other than GDP per capita and income share held by the poorest/richest 20 percent population (that come from World Bank data) all the other data in this subgroup is from International Coffee Organization. The second subgroup of external variables includes common variables for all the coffee exporting countries. A dummy variable that considers the affect of International Coffee Agreement and NYBOT prices for Arabica coffee are taken in the second group of external variables. The second dataset contains internal variables that prevail inside the United States. The second dataset is also arranged as a time series from 1990 to 2010. This dataset has GDP per capita of United States, NYBOT coffee Arabica yearly average prices. The second dataset also includes consumption data for other common drinks such as cocoa, carbonated drinks and tea. I included yearly coffee inventory in the second data set as inventory levels and imports combined represents the total coffee availability in the country. Average yearly stock prices of three major coffee roasters Kraft foods, Proctor and Gamble (P&G) and Sara Lee are included in the second data set to analyze the relationship between coffee roasters’ performance coffee retail prices. Similarly, to analyze the relationship between retail coffee prices and performance of coffee houses, I choose the largest coffee retail chain (Starbucks yearly average stock price). Empirical Analysis This section is divided into two parts, panel data analysis for the external factors prevailing in exporting countries and Ordinary Least Square (OLS) regression for internal factors prevailing in the United States. 1. Panel data analysis for external factors The panel data analysis includes four major coffee exporting countries in the United States i.e. Brazil, Columbia, Guatemala and Mexico. I start with a fixed effect panel data analysis (Panel Analysis 1) for coffee retail prices (unit taken cents per pound) in the U.S with independent variables, domestic consumption (measured in thousand, 60 kilograms coffee bags), Income share percentage by the lowest 20 percent income group, GDP per capita, ICA dummy variable, exportable production (measured in thousand, 60 kilograms coffee bags) for all the four coffee exporting countries (See Table-1). In this first model, the overall model ‘F’ value is 0.0192, which indicates this model is a good acceptable model. Variables Domestic consumption, Income share held by the lowest 20 percent population in the exporting countries, GDP per capita of the exporting countries, the effect of ICA are all significant at 95 percent confidence level. I added a new variable, income-share held by the highest 20 percent population in the exporting countries to the original Model-1 but Table-1 Panel data analysis for external factors (Brazil, Columbia, Guatemala and Mexico) as a function of coffee retail prices in the United States Regressors/ Parameters Model F Statistics Model 1 Coefficient (t-value) 0.0192* Model 2 Coefficient (t-value) 0.0025* Model 3 Coefficient (t-value) 0.0013* R squared (within) 0.3679 0.4642 0.4513 Rho 0.9054 0.9526 0.9563 Domestic Consumption (000’ Bags) 0.017 (2.60)* -87.77 (-3.13)* - 0.021 (3.39)* - 0.020 (3.32)* - 21.07 (4.08)* 0.018 (3.26)* -42.80 (-2.85)* -0.0011 (-0.82) -1059.48 (-3.15)* 21.77 (4.29)* 0.019 (3.53)* -42.51 (-2.84)* - Income-share held lowest 20 % Income-share held highest 20 % GDP per capita (Exporting Countries) ICA (Dummy) Exportable Production (000’ Bags) Const. 0.016 (2.70)* -36.31 (-2.26)* -0.0015 (-1.06) 506.29 (7.20)* -1114.91 (-3.41)* *significant at 95% confidence level due to co-linearity between income-share held by the highest 20 percent population in the exporting countries and income share held by the lowest 20 percent population in the exporting countries this degraded the original model. To overcome multicolinearity I added income-share held by the highest 20 percent population in the exporting countries and removed income-share held by the lowest 20 percent population in the exporting countries in Model-2. Model-2 turned out to be better than Model-1 with overall ‘F’ value 0.0025, which is better than F value for Model-1 (Refer Table-1). Exportable production for the exporting countries is insignificant in both Model-1 and Model-2 so I removed this variable in Model-3. ‘F’ value of Model-3 (0.0013) is the best F value among all the three panel data models. I also modified the Model -3 by adding other variables such as NYBOT prices of coffee for Arabica and Robusta coffee beans but it made the model unstable. To ensure the suitability of the fixed effects panel analysis I performed a ‘Hausman Test’ (Hausman, 1978).The Hausman test indicates whether fixed or random effects model suits the data. The chi square value from the Hausman is 0.0025, which is less than 0.05, the tabulated value, (see Appendix-1). So the result of the Hausman test indicates that the fixed effects model suits Model-3. In Model-3 all the four variables in the regression are significant at 95 percent confidence level. The ‘within R squared value’ (R-squared from the mean-deviated regression) for Model-3 indicates that the four independent variables in the model explains 45.13 percent variability in coffee retail prices. In Model-3 the Rho value (intra-class correlation, 0.9563) explains that 95.63 percent variance is due to differences across exporting country panels. Domestic consumption of coffee in the exporting countries affects the coffee prices in the United States in general. The coefficient associated with domestic consumption is 0.020 which implies, ceteris paribus that if all the four exporting countries will consume 100,000 more bags per year of coffee, the U.S retail coffee price increases two cents per pound in general. Total exportable production of the exporting countries do not have significant impact on coffee retail prices but the domestic consumption of coffee has a large impact on retail coffee prices. GDP per capita of the coffee exporting countries has a positive coefficient (0.019) in Model-3 this means that with every ten unit increase in GDP per capita there is a 0.19 cent per pound increase in coffee retail prices. If the share of income for the richest 20 percent people in exporting countries increases with respect to the rest of the population retail coffee prices in the U.S are likely to increase. With every one percent increase of the income share by the richest 20 percent population in exporting countries the coffee retail prices in the United States can be expected to rise by 0.019 cents per pound. ICA (International Coffee Agreement) has a very strong impact on retail coffee prices in the United States. The ICA dummy variable is a qualitative variable and it is complicated to measure its affect but it strongly affects the coffee retail prices in United States as the coefficient of ICA dummy variable is very large (-42.51). This finding complements the finding of Bohman and Jarvis (1999) that ICA has a significant impact on coffee prices. They argue that ICA quotas work as a tax for both the consumers and the producers They mentioned in their research that “the effect of quotas on producer prices can depend on government policy preferences. Producer prices can increase or decrease when quotas are imposed, but a negative impact is found to be more likely under the range of government preferences considered”. Akiyama and Varangis (1990) also found out that ICA has a major impact on coffee prices and they say that ICA regulation helps in risk mitigation in the international coffee trade but small farmers lose their revenues due to ICA quota regulation. Strong influence of ICA in determining retail coffee prices is good news because this indicates that the ICA policies can be designed to safeguard consumers’ and farmers’ benefits. 2. O.L.S regression for internal factors The second part of empirical analysis is an Ordinary Least Square (OLS) regression for the internal factors that prevail inside the United States. First OLS regressions analyses the relationship among coffee retail prices, consumption of other common drinks e.g. tea, soft drinks, cocoa and the United States GDP per capita. In this regression coefficients for tea, soft drink consumption and GDP per capita are significant. The model is acceptable with F value 0.0013. This model explains 88.71 percent variability in the retail coffee prices in the United States. Coefficients for tea consumption (-3.581) and soft drink consumption (0.126) are also significant at 95 percent confidence level. This result shows that tea is not a substitute for coffee in the United States but soft drinks is a substitute for coffee. It is an interesting finding as coffee was generally consumed as a hot beverage and soda is a cold beverage. One of the possible explanations could be the increasing popularity of cold coffee and ready to drink coffee beverages. GDP per capita in the U.S is also related to coffee retail prices. When the ratio of GDP and population is high the coffee retail prices can be expected to be higher than the counter situation as GDP per capita coefficient is 0.010 (See Table-2). Cocoa consumption is not significant in regression-1. I found multicolinearity in regression-1 as cocoa consumption shows high correlation with coffee consumption. To make the model better when I removed coffee consumption from regression-1 but it further degrades the model. Table-2 OLS regressions1, 2 and 3 for internal factors that affect retail coffee prices Regressors/ Parameters Model F Statistics Regression 1 Coefficient (t-value) 0.0013 Regression 2 Coefficient (t-value) 0.0001 Regression 3 Coefficient (t-value) 0.0005 R squared 0.8871 0.9453 0.9128 Tea Consumption in the U.S -3.581 (-6.17)* 0.126 (5.13)* -0.002 (-0.02) 0.010 (3.60)* - -3.419 (-9.04)* 0.120 (6.98)* - -3.137 (-5.65)* 0.119 (5.40)* 0.011 (5.57)* 1.179 (2.92)* 0.009 (3.14)* - Soft Drink Consumption in the U.S Cocoa Consumption in the U.S GDP per Capita (U.S) Stock Prices ‘Sara Lee’ Stock Prices ‘P&G’ 0.441 (1.53) *significant at 95% confidence level The second regression (regression-2) is for the coffee roasters’ (Sara Lee, Kraft and P&G) and coffee retailer’s (Starbucks) stock prices. I used yearly average stock prices for Starbucks, Sara Lee, Kraft and P&G along with coffee consumption, tea consumption, and U.S GDP per capita as regressors in regression-2 but the model suffers from multicolinearity problem as stock prices for the coffee companies are highly correlated. To resolve this problem, I use Sara Lee stock prices with coffee consumption, tea consumption, and U.S GDP per capita as independent variables for regression-2 against dependent variable coffee retail price in United States. I used Sara Lee yearly average stock prices and P&G yearly average stock prices in two separate models (regression-2 and regression-3) over other coffee roasters’ stock prices and Starbucks’ yearly stock prices. The logic behind not using the stock prices of Starbucks and Kraft is, Kraft operated as a public company from 2001 and Starbucks from 1992 whereas with Sara Lee and P&G this problem is nonexistent. In regression-3 P&G stock prices were insignificant at 95 percent confidence level. To conclude regression-2 is the best model among first three regressions (regression-1, 2 and 3). Among regressions 1, 2 and 3, regression-2 is the best model. All the independent variables in regression-3 are significant at 95 percent confidence level. The coffee retail prices rise when the ratio of GDP and population in the United States increases. Coffee roaster Sara Lee has a significant effect on coffee retail prices and as the company’s stock performance improves by one unit coffee retail price increases by 1.179 cents per pound. This is a significant change and can be explained the fact that there are only four major coffee roasters in the United States and the value added by roasting the coffee contributes a significant portion of the total retail price of the coffee. Exhibit-1, Consumption of coffee vs. consumption of other common drinks in the U.S In order to determine the relationship between spot prices of coffee (NYBOT coffee prices in this study) and retail coffee prices in the United States I estimate regression-4 and regression-5 (See Table-3). Regression-4 has two independent variables NYBOT coffee prices (considered as coffee Spot prices in this study) carbonated soft drinks yearly consumption in the United States while regression-5 has coffee inventory in United States as an independent variable other than NYBOT coffee prices. Both regressions 4 and 5 have high and significant coefficients (1.157 and 0.701 respectively) for NYBOT Arabica coffee prices. This implies that coffee retail prices move with the spot prices (See Exhibit-2) but the retail prices decrease with increasing coffee inventory Table-3 OLS regressions 4 and 5 for internal factors that affect retail coffee prices Regressors/ Parameters Regression 4 Regression 5 Coefficient Coefficient (t-value) (t-value) 0.000 0.000 Model F Statistics R squared 0.860 0.8597 NYBOT Arabica Coffee Prices /Spot Prices Soft Drink Consumption in the U.S 1.157 (7.98)* 0.026 (3.02)* - 0.701 (5.25)* - U.S Coffee Inventory Const. *significant at 95% confidence level -124.483 (-1.10)* -0.009 (-3.52)* 294.968 (11.94)* Coffee Retail Prices vs NYBOT Prices 450 400 U.S Retail Price Price (₵/Lb) 350 300 250 200 NYBOT Arabica, 150 100 50 NYBOT Robusta 0 Exhibit-2, Coffee retail price vs. Spot/NYBOT coffee prices levels in the United States (coefficient -0.009) and increase with increasing carbonated soft drink consumption (coefficient 0.026, See Table-3). This can be explained by the general practice followed by the traders dealing with coffee. Traders, in order to maximize profit generally hold the coffee stock if the prices of coffee are low and sell that coffee when again the price gets higher. Conclusion This paper examines the factors that affect coffee retail prices in the United States. The paper categorizes these factors in two categories, internal factors and external factors. This research finds significant factors under both internal and external factors categories that affect coffee retail prices in the United States. In the external factors category, domestic coffee consumption in the exporting countries, income share held by richest/poorest 20 percent of the population, GDP per capita of the exporting countries and changes in International Coffee Agreement (ICA) significantly affect the retail coffee prices in the United States. Income share held by the richest 20 percent population has a positive correlation with the retail coffee prices in the United States but income share held by the poorest 20 percent population decreases as coffee prices go up. That implies when the poor population in the exporting countries increases earning, the coffee prices decrease. Poor population in the coffee exporting countries majorly consists of coffee farmers and agricultural laborers. Income share held by rich population and income share held by the poor population are negatively correlated. To sum it can be inferred that increased coffee prices in the United States helps to increase income share of rich people rather than income share of poor population in the coffee producing countries. ICA is one of the most important factors that impact the coffee retail prices in the United States. Carefully designed ICA policies can safeguard the poor farmers’ and the U.S coffee consumers’ interests in the future. Both economic performance (measured with GDP per capita) of the coffee exporting countries and economic performance of the United States have positive correlation with the coffee retail prices in the Unites States. Improvement in economic performance of either exporting or the importing country increases the retail coffee prices. Among the internal factors tea and carbonated soft drink consumption affect the coffee retail prices. GDP per capita in United States, stock performance of coffee roaster Sara Lee, coffee inventory in the U.S and NYBOT coffee Arabica prices are also significant factors that affect retail coffee prices. When the prices of coffee increase soda consumption increases hence soda is a substitute for coffee. Interestingly tea is not a substitute for coffee in the United States. Value addition affect captured by Sara Lee stock prices confirm that value addition by the roasters significantly and very strongly affect the retail prices of coffee in the United States. NYBOT coffee Arabica prices (also considered spot prices in the study) have major impact on coffee retail prices as the NYBOT coffee prices reflect the overall effect of all other factors before wholesale trading, roasting and other kinds of value addition before coffee comes on the retail shelves. Although this article focuses upon the importance of various factors (both internal and external) that affect coffee retail prices, it will be interesting to carry out a policy evaluation study for ICA. Secondly a price transmission and a consumer behavior study, which could help in identifying the critical stakeholders and their role in the coffee value chain, will be a significant contribution to the coffee research. Modifications in the ICA are critical, so a study that could examine the optimum quota regulation levels for minimizing the price fluctuation is required. References 1. Basu A. and Hicks, Volume 32, Issue 5, pages 470–478, September (2008), “Label performance and the willingness to pay for Fair Trade coffee: a cross-national perspective”, International Journal of Consumer Studies 2. Bohman and Jarvis (1999), “The International Coffee Agreement: a tax on coffee producers and consumers?” Agriculture and Resource Economics Working Papers, Department of Agricultural and Resource Economics, UCD, UC Davis 3. Fitter R. and Kaplinsky, , Vol. 32, No. 3, (2001) “Who Gains From Product Rents as The Coffee Market Becomes More Differentiated? A Value Chain Analysis”, IDS Bulletin Special Issue on “The Value of Value Chains” 4. Ghoshray, A. Volume 62, Issue 1, pages 97–107, (Jan., 2010) “The Extent of the World Coffee Market” Bulletin of Economic Research 5. Gilbert C.L, Discussion Paper No. 25 (2007) “Have we been mugged? Market Power in the World Coffee Industry” Group of Research and Analysis on Development 6. Gilbert C.L, (2005) “The Long Run Impact of the Ending of Coffee Control” (University of Trento, Italy and Commodity Risk Management Group (ARD), World Bank, Washington D.C.) Paper presented at the Second World Coffee Conference, Salvador (Bahia), Brazil on 24 September 7. Gilbert C.L, , Page 5-34, (2008) “Value Chain Analysis and Market Power in Commodity Processing with Application to the Cocoa and Coffee Sectors”, Commodity Market Review, Food and Agriculture Organization of the United Nations Rome 8. Hopp, H. and Richard J. Foote, Vol. 37, No. 3 pp. 429-438 (Aug., 1955), “A Statistical Analysis of Factors That Affect Prices of Coffee”, Journal of Farm Economics 9. Kolk A., Volume 23, Issue 2, Pages 228-236, April (2005) “Corporate Social Responsibility in the Coffee Sector: The Dynamics of MNC Responses and Code Development” European Management Journal 10. Lee and Gómez1 (2011), “Impacts of the End of the Coffee Export Quota System on International-to-Retail Price Transmission”, Working Paper, Dyson School of Applied Economics and Management Cornell University, Ithaca, New York, USA 11. Mehta J.P and Chavas, Vol. 85, No. 1-2, (2008) “Understanding the Coffee Crisis: What can We Learn from Price Dynamics?” Journal of Development Economics, 12. Mohan S. , Volume 25, Issue 3, pages 333–354, May (2007) “Market-based Price-risk Management for Coffee Producers” Development Policy Review 13. Mundlak, Y and Donald F. Larson, Vol. 6, No. 3: 399-422 Sept., (1992) “On the Transmission of World Agricultural Prices” The World Bank Economic Review 14. Ponte S. , Volume 30, Issue 7, Pages 1099-1122, July (2002) “The `Latte Revolution'? Regulation, Markets and Consumption in the Global Coffee Chain” World Development 15. Rotaris L. and Danielis, Vol. 9 / Issue 1 (2011) “Willingness to Pay for Fair Trade Coffee: A Conjoint Analysis Experiment with Italian Consumers” Journal of Agricultural & Food Industrial Organization

![저기요[jeo-gi-yo] - WordPress.com](http://s2.studylib.net/store/data/005572742_1-676dcc06fe6d6aaa8f3ba5da35df9fe7-300x300.png)