Guide to Standard Deviation and Beta

advertisement

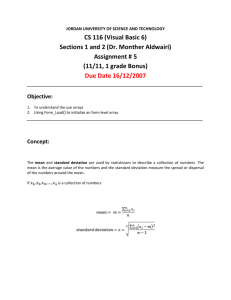

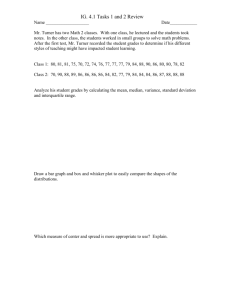

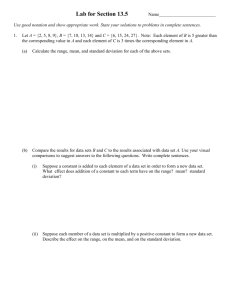

Franklin Templeton Investments STRATEGY INSIGHT GUIDE TO STANDARD DEVIATION AND BETA As prudent asset managers, Franklin Templeton Investments uses a variety of ways to manage risk. Two long-established metrics that measure risk are beta and standard deviation. This Flash is a quick guide to those risk tools, and how they are used in analyzing returns of a stock, bond or fund. Both standard deviation and beta are important measures in understanding the potential returns of an instrument. Neither metric offers full information in isolation; the beta of one stock or fund should be measured against its peer group or the market. The same is true for the standard deviation. Looking deeper, the standard deviation of returns can demonstrate the variability of the returns of any fund—Franklin Templeton’s or a competitor’s — compared with the market or peer group. Standard Deviation Standard deviation is the average distance from the mean of a sample. More specifically, the standard deviation represents a dispersion of returns from the mean. This dispersion gives an idea of the volatility of a stock, bond, fund, or other instrument based on the spread of returns over a given time period. Historically, the higher the investment’s standard deviation, the greater the volatility, and the more risky the investment. According to U.S. fund-ranking company Morningstar, standard deviation is “probably used more than any other measure to gauge a fund’s risk.” Essentially, standard deviation measures the variability of returns. But a standard deviation for a fund’s (or a stock’s, or bond’s) return cannot be seen in isolation. From 1970 to October 2006, MSCI EAFE (Total Return) Index has had an average return of 11.4% with a dispersion of approximately +/-16.5% around that number. This means, according to a normal distribution, that there is a 68% chance (one standard deviation) each year’s return was between 27.9% and -5.1%. Following this calculation, there is a 95% chance (two standard deviations) that the return would fall between 44.4% and -21.6%. FRANKLIN T TEMPLETON TON INVESTMENTS TS Stock market standard deviations tend to be higher than those of bonds. The Citigroup World Government Bond Index (WGBI) has returned 7.6% since 1986 (the first year data is available) through 2006. The standard deviation, however, is only 6.6%. During that same period, the MSCI EAFE’s mean return was 8.7% with a standard deviation of 16.6%. The relative comparison shows that the bond market (as represented by the WGBI) has been historically less volatile than the stock market, as represented by the EAFE index. Franklin Templeton Investments . STRATEGY INSIGHT 1 Using standard deviation can be helpful in comparing the volatility of two funds, as seen below. 13% RETURN, 22% STANDARD DEVIATION 13% RETURN, 11% STANDARD DEVIATION SCENARIO A: Higher Return/Higher Risk Fund for 20 Years SCENARIO B: Lower Risk/Lower Return Fund for 20 Years +3 79% +3 46% +2 57% +2 35% +1 35% +1 13% 68% 95% 24% 13% 99.99966% -1 -9% -1 2% -2 -31% -2 -9% -3 -53% -3 -20% 68% 95% 99.99966% Source: Franklin Templeton Investments A 22% standard deviation in Fund A means that, given a 20-year history, the fund was more volatile, and had a 68% chance of returning between 35% and -9%. An 11% standard deviation in Fund B means that, given a 20-year history, the fund was less volatile, and had a 68% chance of returning between 24% and 2%. Volatility is only one indicator of risk affecting a security; a stable past performance of a fund does not guarantee future stability. Behind the numbers In the mid-1730s, French mathematician Abraham de Moivre first calculated standard deviation while examining distributions from the mean. Using calculus and the binomial theorem, he created a way to assess the probability that a set of observations is statistically significant. De Moivre showed that the largest number of observations in a set tended to cluster around the mean. He calculated that in a normal distribution, 68% of the observations will fall within one standard deviation of the mean and 95% of observations will fall between two standard deviations of the mean. Calculating standard deviation is straightforward. Technically, it is the square root of the variance, which measures the average of the square of the distance from the mean for each value. The formula is as follows: Where: s = standard deviation Xi = individual observation X= mean of the observations N = number of observations Beta While standard deviation measures absolute volatility, beta measures the relationship of a security or a fund's performance versus the movements of the entire market. Beta is defined as the sensitivity of a security or a portfolio of securities to the market as a whole. This sensitivity is depicted by the relationship of an instrument, say a stock, compared to the market. In the case of a stock, beta is derived by measuring stock returns compared to those of a market proxy such as the S&P 500, the FTSE 100, or an index. The beta of the market proxy is always 1. Another way of describing beta is a statistical calculation of a security’s returns compared to an index’s returns. Beta is calculated by a regression analysis of historical prices compared to the desired benchmark. Beta is always a relative measure; it does not represent the unique behavior of a security. Theoretically, beta describes how a stock performs based on how the market performs. A beta close to 1 indicates that the security will perform roughly in line with the market. A beta lower than 1 means Franklin Templeton Investments . STRATEGY INSIGHT 2 the security has historically moved less than the benchmark; such stocks are usually considered defensive. A beta higher than 1 means the security has historically moved further from the benchmark, and is considered aggressive. For example, as of December 2006, German energy conglomerate E.ON’s beta was .86, which means, that on average, when the market went up 10%, E.ON rose 8.6%, and if the market dropped 10%, E.ON declined 8.6%. Conversely, German electronics conglomerate Siemens’ beta is 1.10, which means if the market went up 10%, Siemens rose 11.0%, and declined by that same amount if the market dropped by 10%. Bonds also have betas. As with stocks, it is important to ensure that the benchmark is appropriate, such as the Citigroup World Government Bond Index, or the JP Morgan Emerging Bond Index Global. A fund’s beta is a measure of a fund's sensitivity to an appropriate index. For example, the beta of FTIF Templeton Growth Euro Fund is .87 (three years as of end-November), which is measured against the fund’s benchmark, the MSCI World Index. Beta on its own is somewhat deceptive. It is an historical statistic, and a stock, bond or fund is not always going to behave like its beta predicts. It is useful to pair it with R2, which indicates the proportion of a security’s total variance related to the market, and which illustrates the reliability of the beta. This is computed by comparing the market’s variance with the security’s variance. A higher R2 represents a greater confidence in the beta’s information. A low R2 may mean that the instrument’s return is more affected by events other than market-related risk. The R2 of Siemens was .58, meaning that 58% of the stock’s performance was due to overall market movement, while 42% was unique to the stock’s characteristics. The R2 of E.ON was 40%, meaning that 40% of the stock’s performance was due to overall market movement. Franklin Templeton equity fund betas are listed on SICAV fact sheets. Below are betas from representative SICAV funds. 3 YEAR R2 VS. BENCHMARK 3 YEAR STANDARD DEVIATION OF RETURNS 1.15 0.89 7.04 0.92 .76 0.73 6.41 A(dis) 0.85 .93 0.87 10.72 FTIF Templeton Emerging Markets Fund A(dis) 0.86 .97 0.97 15.19 FTIF Franklin Mutual Beacon Fund A(acc) 0.74 1.17 0.73 6.27 FUNDS CLASS 3 YEAR BETA VS. BENCHMARK FTIF Templeton Growth (Euro) Fund A(acc) 0.87 FTIF Templeton Global Bond Fund A(dis) FTIF Templeton Global Smaller Companies Fund PEER GROUP AVERAGE BETA Data As Of 30 November 2006 A portfolio beta defined More formally, the Franklin Templeton risk management team defines historical beta of a portfolio as a “standardized measure of systematic risk, (i.e., market risk) derived by taking the covariance of the portfolio to the benchmark portfolio and dividing by the variance of the market portfolio.” Covariance measures the degree to which two assets move in tandem and the variance is the measure of the spread from the mean. The square root of the variance is the standard deviation. This guide does not constitute or form part of an offer for shares or an invitation to apply for shares of the Franklin Templeton Investment Funds (“FTIF”). Subscriptions for shares of FTIF can only be made on the basis of FTIF current Prospectus and accompanied by a copy of the latest available audited annual report and, if subsequently published, the latest unaudited semi-annual report. The prices of shares and income from them can go down as well as up, and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Currency fluctuation may affect the value of overseas investments. An investment in FTIF entails risks which are described in the Prospectus. No shares of FTIF may be directly or indirectly offered or sold to nationals or residents of the United States of America. In emerging markets, the risks can be greater than in developed markets. Please consult your financial advisor before deciding to invest. Any research and analysis contained in this guide has been procured by Franklin Templeton Investments for its own purposes and is provided to you only incidentally. Any views expressed are the views of the investment manager and do not constitute or form part of legal or tax advice or an offer for shares or an invitation to apply for shares of FTIF. Shares of FTIF are not available for distribution in all jurisdictions and prospective investors should confirm availability with their local Franklin Templeton Investments representative before making any plans to invest. A copy of the FTIF Prospectus and/or the latest financial reports can be obtained from Franklin Templeton International Services S.A., 26 Boulevard Royal L-2449 Luxembourg – Tel: (+352) 46 66 67 212 – Fax: (+352) 46 66 76. Franklin Templeton Investments . STRATEGY INSIGHT 3