Mean, Variance, Coefficient of Variation

advertisement

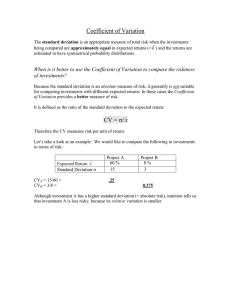

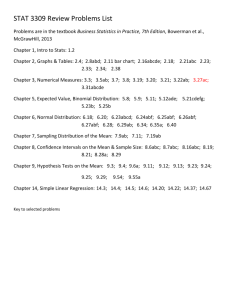

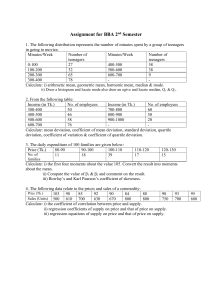

The Birth of Probability and Statistics The original idea of "statistics" was the collection of information about and for the "state." The word statistics derives directly, not from any classical Greek or Latin roots, but from the Italian word for state. Probability originated from “probing” meaning that is not too easy to find or prove. 1. The Expected Value (i.e., averages, mean): Expected Value = = (Xi Pi), the sum is over all i's. It is an important statistic, because, your customers want to know what to expect from your product/service OR as a purchaser of raw material for your product/service you need to know what you are buying, in other word what you expect to get: To read-off the meaning of the above formula, consider computation of the average of the following data 2, 3, 2, 2, 0, 3 The average is Summing up all the numbers and dividing by their counts: (2 + 3 + 2 + 2 + 0 + 3) / 6 This can be group and re-written as: [ 2(3) + 3(2) + 0(1)] / 6 = 2(3/6) + 3(2/6) + 0(1/6) = = (Xi Pi), which is the sum of each distinct observation times its probability. Right? 2. The Variance is: 2 = Var(X) = E[(X- )2] = [Xi2 Pi] - 2, the sum is over all i's. 3. Coefficient of Variation: Coefficient of Variation (CV) is the relative deviation with respect to size provided is not zero, expressed in percentage: CV =100 % An Application: Consider the performance of following two investment alternatives - Two Investments Investment I Payoff % Prob. Investment II Payoff % Prob. 1 0.25 3 0.33 7 0.50 5 0.33 12 0.25 8 0.34 Using the Multinomial (http://home.ubalt.edu/ntsbarsh/Business-stat/otherapplets/multinomial.htm) for calculation, we notice that the Investment I has mean = 6.75% and standard deviation = 3.9%, while the second investment has mean = 5.36% and standard deviation = 2.06%. First observe that under the usual mean-variance analysis, these two investments cannot be ranked. This is because the first investment has the greater mean; it also has the greater standard deviation; therefore, the Standard Dominance Approach is not a useful tool here. We have to resort to the coefficient of variation (C.V.) as a systematic basis of comparison. The C.V. for Investment I it is 57.74% and for Investment II is 38.43%. Therefore, Investment II has preference over the Investment I. Clearly this approach can be used to rank any number of alternative investments. Notice that less variation in return on investment implies less risk.