CITY OF NORFOLK, NEBRASKA ANNUAL BUDGET FISCAL YEAR

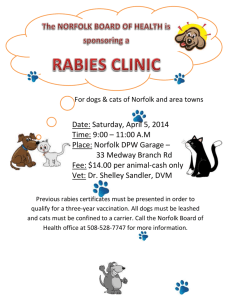

advertisement