Gold Future Production Sales Contract

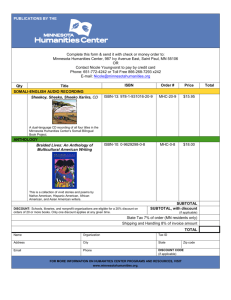

advertisement

Series C.1.a Gold Future Production Sales Contract V 9.2 Offer Validity only by Nov 2014 IMC Business Plan Introduction The GoldFund Trust is sponsored by Investors Member's Club, Corp. USA -IMC- with the purpose of marketing physical gold from Peru, Colombia and Chile and offering also its custody by issuing a Gold Investment Certificate - GIC, besides other investment opportunities. The affiliate companies, IMC Panamá and IMC Perú, are responsible for the production and delivery respectively. www.investorsmembersclub.com Offer Validity only by Nov 2014 Estimated Benefit The benefit offered by GoldFund Trust allows the investor to estimate a return between an annual over 17% and 32% during the first thirty months which could be even higher or lower. Additional Benefits 1) The investment buyer has the option, through a well structured portfolio of securities and handled by management portfolio company as Merrill Lynch/ Morgan Stanley which during the last three years has had an annual performance between a 5% and 8% and over as part of the return previously indicated. In this case, Morgan Stanley/ Merrill Lynch grants financing to GoldFund Trust for the investment up to 80% of the market value of the GoldFund Securities Portfolio. 2) Warrants with conversion rights of its investment in Units of the GoldFund Trust, on its Value of Net Cash Flow Projected. 3) Right to the resulting performance of the LBMA old price during the time of delivery and after. Telf. 51-1 632 8635 / 36 The Offer GoldFund Trust offers gold related gold investors and buyers Gold Future Production Sales Contracts - GFPSC to be delivered as from the fifth month of the term of the contract which could be at 12, 18, 24 or 30 months, with discounts between 10% and 28% over the LBMA date of the agreed day or the signature depending of the delivery term and amount of gold stated in the contract. Participation GoldFund Trust The GoldFund Trust has a participation in the net cash flow of IMC / FunValPeru in the Mineral Processing and Metal Production Plants to obtain gold and other metals, at present in development process. This participation increases the Net Flow Cash Value of the GoldFund Trust. This Income is part of the resources for the participation and payment of the offered benefits, cover the Gold Future Production Sales Contract and the value of the Units over the GoldFund Trust Net Cash Value of it Cash Flow to which the investor has a conversion right up to its invested amount. info@investorsmembersclub.com Investment Escrow Account The investment resources of the investors in the Gold Future Production Sale Contracts of the GoldFund Trust, as well as the income from the gold exportation sales and from the GIC, are handled in a Investment Escrow Account in an International Bank as Merrill Lynch/ Morgan Stanley. Master Contracts Term Sheet GFPSC C.1-a www.investorsmembersclub.com Offer Validity only by Nov 2014 Purpose: Information on the Gold Future Production Sales Contract . Target Market: Accredited Buyers as Industrials, Jewelers and Sophisticated Investors. Contents of Series C.1-a: Up to 632 Contracts of 10Kg of physical gold each one, equivalent to 321.51 Oz, for a total of up to 203,192.72 Ounces equivalent to 6,320.00 Kg. for the Series C.1.a, with a Purity of 999/1.000 or better. Issues Telf. 51-1 632 8635 / 36 Distribution: Among gold related investors and businessmen in the United States or oversea. First Issue -AMinimum Amount: Master Contract : 50,798.18 Oz Conformed by up to158 Contracts of 10 Kg .of gold each one equivalent to 321.51 Oz. Alternatively, could be offered by up to 790 Contracts of 2 Kg., equivalent to 64.30 Oz each one. Reference Price: 1.250 US$ by Ounce minus up to 16% of discount (*)on the Second Fix of the day of the contract´s execution. Broker Fees: Achieving and Placing: From 2% to 5,00% on the net amount of the investment. (*) Fee final percent affect the Discount on Gold Price. info@investorsmembersclub.com Deliveries of the Contract: 8 consecutive deliveries of the same kind during 12 months as from the fifth month from the signature of the Contract. Master Contracts Term Sheet GFPSC C.1-a www.investorsmembersclub.com Offer Validity only by Nov 2014 Second Issue -BMinimum Amount: Master Contract : 50,798.18 Oz Conformed by up to158 Contracts of 10 Kg .of gold each one equivalent to 321.51 Oz. Alternatively, could be offered by up to 790 Contracts of 2 Kg., equivalent to 64.30 Oz each one. Reference Price: 1.250 US$ by Ounce minus up to 18% of discount (*)on the Second Fix of the day of the contract´s execution. Broker Fees: Achieving and Placing: From 2% to 5,00% on the net amount of the investment. (*) Fee final percent affect the Discount on Gold Price. Telf. 51-1 632 8635 / 36 Deliveries of the Contract: 14 consecutive deliveries of the same kind during 18 months as from the fifth month from the signature of the Contract. Third Issue -CMinimum Amount: Master Contract : 50,798.18 Oz Conformed by up to158 Contracts of 10 Kg .of gold each one equivalent to 321.51 Oz. Alternatively, could be offered by up to 790 Contracts of 2 Kg., equivalent to 64.30 Oz each one. Reference Price: 1.250 US$ by Ounce minus up to 24% of discount (*)on the Second Fix of the day of the contract´s execution. Broker Fees: Achieving and Placing: From 2% to 5,00% on the net amount of the investment. (*) Fee final percent affect the Discount on Gold Price. info@investorsmembersclub.com Deliveries of the Contract: 20 consecutive deliveries of the same kind during 24 months as from the fifth month from the signature of the Contract. Master Contracts Term Sheet GFPSC C.1-a www.investorsmembersclub.com Offer Validity only by Nov 2014 Fourth Issue -DMinimum Amount: Master Contract : 50,798.18 Oz Conformed by up to158 Contracts of 10 Kg .of gold each one equivalent to 321.51 Oz. Alternatively, could be offered by up to 790 Contracts of 2 Kg., equivalent to 64.30 Oz each one. Reference Price: 1.250 US$ by Ounce minus up to 28% of discount(*)on the Second Fix of the day of the contract´s execution. Broker Fees: Achieving and Placing: From 2% to 5,00% on the net amount of the investment. (*) Fee final percent affect the Discount on Gold Price. Telf. 51-1 632 8635 / 36 Deliveries of the Contract: 26 consecutive deliveries of the same kind during 30 months as from the fifth month from the signature of the Contract. info@investorsmembersclub.com Purchase must be confirmed before 5 pm of validity offer day and bank o brokerage house notification should be confirmed by 10 am next working day www.investorsmembersclub.com Terms Sheet GFPSC C.1-a Summary Series C.1.a.i- Contract Quantity A. Total Oz Discount Up to 158.00 0 50,798.18 16% B. 158.00 0 50,798.18 18% C. 158.00 0 50,798.18 22% D. 158.00 50,798.18 28% 0 632.00 203,192.72 Series C.1.a.ii- Contract Quantity Total Oz Discount Up to A. 790.00 0 50,798.18 16% B. 790.00 0 50,798.18 18% C. 790.00 0 50,798.18 22% D. 790.00 50,798.18 28% OR COMBINED WITH: 0 3,160.00 203,192.72 For not reason, the total amount of ounces to be placed between both type of contracts will be more of 203,192.72 Telf. 51-1 632 8635 / 36 Master Contracts info@investorsmembersclub.com Offer Validity only by Nov 2014 Master Contracts Terms Sheet GFPSC C.1-a www.investorsmembersclub.com Offer Validity only by Nov 2014 Participants Gold Supplier Investors Member´s Club, Corp. -IMC- Trader Goldfund Trust / Investor Members Club, Corp. www.investorsmembersclub.com Trust Account & Custodian Agent: Investment Bank as Morgan Stanley www.morganstanley.com Development, Production and Dispatching Agent: www.amicorp.com GTP Natural Resource Group www.gptnaturalresourcegroup.com Legal Advisers: Gala- Galindo Arias Lopez / VanEps Kunneman Van Dorne http://gala.com.pa www.ekvandoorne.com Weight and Quality Certifird: Alex Stewart www.alexstewartperu.com Distribution and Placing Agent: __________ Local Agent ___________ Right to Sell: Once the physical gold is delivered to buyer, the investor buyer of the Gold Next Future Production may request the selling of its gold to be paid in cash at the market price or request the delivery of its physical gold or exchange same for Gold Investment Certificates kept in custody by a international custodian bank. The terms and conditions are included in the Placing Memorandum. Contracts as Nominal, Transferable and Assignable, prior the registration and expressed authorization of GoldFund Trust. During the term of the contract investors can sale it contract gold rights to third party, previous GoldFund Trust approval in writing. info@investorsmembersclub.com GoldFund Trust’ Administrator Agent: Amicorp Telf. 51-1 632 8635 / 36 or Merrill Lynch www.ml.com or Similar Company www.investorsmembersclub.com Offer Validity only by Nov 2014 Master Contracts Term Sheet GSCFP C.1-a Recommendations and Warnings: The present specifications do not represent an offer of securities or investment proposal. The Issuing and Placing Memorandum under the terms and conditions, as well as the information of the IMC business Plan, are available at the expressed request of the accredited investor. GoldFund Trust Nov 2014 – V9.2 NOTE: The Local Agent. acting as broker/agent for the placement of Gold Sale Contract of Future Production -GSCFP- of processed gold (AU) will be 99.995% pure and 24 caret, issued by Investors Member´s Club,/ GoldFund, scheduled to start placement on or before November 15th 2014 until December 15th 2014. This placement must be only to Accreditor Investors. Telf. 51-1 632 8635 / 36 It is recommended to the reader or interested parties to consult a trusted qualified agent before carrying out a purchase of a Gold Future Production Sales Contract. The Gold Sale Contract of Future Production -GSCFP- may be offered by the Local Agent. to its clients up to 203,192,72 Ounces of processed gold (AU) at LBMA Second Fix per ounce minus the agreed discount, as two (2) modality of GSCFP- and could be combined offers to prospective purchasers as: 1) Represented up to 632 purchase contracts Series B.1.a of 321.50 ounces or 10 Kg. each contract of processed gold (AU). The face value per Purchasing Agreement will be US$ 401,884.00 before discount. The face value per Purchasing Agreement will be US$ 80,376.87 before discount. Minimum initial deposit should be represented by not less than US$ 1.000.000. Regular next minimum deposit should be represented be not less than US$ 321.000. The Local Agent will receive from IMC from 2% up to 5% as broker fee from Net Value after discount (discounted price). info@investorsmembersclub.com 2) Represented up to 3,160 purchase contracts Series B.1.a of 64.30 ounces or 2 Kg. each contract of processed gold (AU).