Asset Class Review

advertisement

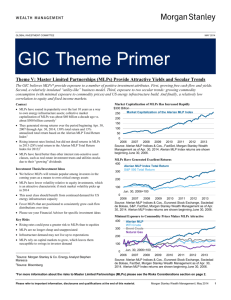

APR. 24, 2013 INVESTOR EDUCATION GLOBAL INVESTMENT COMMITTEE Asset Class Review OVERVIEW AUTHOR Master Limited Partnerships DAVID M . DARST , CFA DESCRIPTION. Master limited partnerships (MLPs) operate physical assets such as pipelines, tank facilities, and other equipment for oil, natural gas, natural gas liquids, and refined products processing, fractionation, transportation, and storage services. MLPs are partnerships (or LLCs(1)) listed on public exchanges. MLPs trade in the form of units and unitholders receive quarterly cash distributions. Structured as pass-through entities, MLPs pay no entity-level tax; instead, taxes are paid by unitholders on distributions, based on the unitholder’s specific tax rate with a portion of the taxes paid on a deferred basis. The first MLP was launched in 1981, as the Apache Oil Company. As of early 2013, total MLP market capitalization exceeded $480 billion. In 1987, as MLP structures began to proliferate through a variety of industries (including sports teams such as the Boston Celtics), the US Congress created Section 7704 of the Internal Revenue Service Tax Code to limit partnership tax treatment to MLPs earning at least 90% of their income from qualified sources. Qualified sources include interest, dividends, capital gains, natural resources activities, and rental income; capital gains from real estate; income from commodity investments; and capital gains from the sale of assets used to generate such income. Qualifying natural resources include oil, gas, and petroleum products; coal and other minerals; timber; any other resource that is depletable under section 613 of the US Tax Code; and since 2008, industrial carbon dioxide, ethanol, biodiesel, and other alternative fuels. The most common structure for an MLP consists of a general partner (GP) and limited partners (LP). The GP manages the daily operations of the partnerships, generally has a ~2% ownership stake, and may have incentive distribution rights (IDRs). As unitholders, the LPs have no role in the partnerships’ operations or management. CHOICES. Master limited partnerships are available in several formats. Investors can directly invest in MLPs by purchasing units on a major securities exchange. Other options include: (i) closed-end MLP mutual funds; (ii) open-end MLP mutual funds; (iii) exchange traded notes; (iv) exchange traded funds; and (v) i-shares. Ishares are shares of a publicly traded management company whose only assets are the underlying MLPs and whose distributions are in the form of additional i-shares instead of cash. Certain MLP-dedicated open-end and closed-end mutual funds and exchange traded funds may offer exposure to MLP investments without incurring unrelated business taxable income (UBTI) and without the need to file state filings and/or a federal IRS K-1 partnership return. Chief Investment Strategist 212-296-6224 David.Darst@ms.com Master Limited Partnerships Advantages Disadvantages 1. Due to their relatively predictable pattern of income generation and quarterly distributions, several segments of the MLP asset class tend to possess important defensive characteristics within a portfolio context. 1. MLPs are usually dependent on access to debt and equity capital markets to fund growth in assets, and thus growth in distributions. Financial market developments that might restrict such access could negatively affect distribution growth. MLPs offer portfolio diversification benefits through generally low returns correlations with equities, underlying commodity prices, and 10-year US Treasury securities. When directly investing in MLPs, investors receive a schedule K-1 instead of a form 1099-DIV. Additionally, investing in MLPs through tax-exempt vehicles can be problematic since MLPs tend to generate unrelated business taxable income (UBTI). Limited Partners (unitholders) usually have very little or no control over the management and operation of an MLP. Investing in MLPs differs from investments in common stock, with risks related to cash flow, dilution and voting rights. 3. The potential for MLP quarterly distributions to increase over time may represent a growth opportunity and a partial hedge against inflation. From 1995 through 2011, MLP total returns have outperformed those of the S&P 500. Past investment performance is no guarantee of future investment results. 3. Incentive distribution rights (IDRs) may be structured into many MLPs to incentivize the general partner (GP) to increase the amount of the quarterly distributions; however, the nature of the incentive may motivate the general partner to increase distributions as quickly as possible as opposed to increasing the distributions at a rate which maximizes the value of the MLP for limited partners as well as the general partner. MLPs may offer tax advantages through the partnership structure as well as due to the partially deferred taxes (generally around 80%) applicable to the quarterly cash distributions received by unitholders, both of which serve to enhance investor total return. Correlations of returns for MLPs with the returns on other asset classes may: (i) vary over time; and (ii) change in an adverse way during periods of financial market turbulence. Energy infrastructure companies are subject to risks specific to the industry such as fluctuations in commodity prices, reduced volumes of natural gas or other energy commodities, changes in the economy or the regulatory environment, or extreme weather. Some MLPs may trade less frequently than larger companies due to their smaller capitalizations which may result in erratic price movement or difficulty in buying or selling. 5. MLPs may offer estate-planning benefits as the cost basis of MLP units is stepped up to fair market value when, upon the demise of the owner, units are transferred to beneficiaries. In general, this tends to negate the accumulated tax deferred liability from past distributions. 5. While MLPs have been granted partnership taxation treatment in order to foster investment in the US energy infrastructure, MLPs’ tax status may be subject to revision by Congress. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment, including the risk that an MLP could lose its tax status as a partnership, which could reduce the value and income produced from the MLP. 2. 4. 2. 4. Source: National Association of Publicly Traded Partnerships (naptp.org); Morgan Stanley Wealth Management Global Investment Committee; Morgan Stanley & Co. Research “Midstream Energy MLPs Primer 3.0, April 18, 2013,” (67 pages), by Stephen J. Maresca, Robert S. Kad, Shaan Sheikh, and Brian Lasky. 2 MORGAN STANLEY WEALTH MANAGEMENT | APR. 24, 2013 Please refer to important information, disclosures and qualifications at the end of this material. Alerian MLP Index – Price Performance Price Performance From Inception on December 29, 1995 to 2013 YTD (Price in US Dollars) (1) 500 450 400 350 300 250 200 150 100 50 0 (1) 1995 1996 1997 1998 200 2001 200 200 200 200 200 200 200 200 2010 2011 2012 2013 Note: (1) Data are as of Apr. 19, 2013. Source: Bloomberg. Alerian MLP Index – Sector Composition As of Year-End 2012 Exploration & Production 6.7% Other 5.4% Petroleum Transportation 36.8% Natural Gas Transportation 33.6% Propane 2.2% Gathering and Processing 15.3% Source: Alerian Capital Management, Dallas Texas. 3 MORGAN STANLEY WEALTH MANAGEMENT | APR. 24, 2013 Please refer to important information, disclosures and qualifications at the end of this material. Alerian MLP Index – Monthly and Annual Total Returns (% in US Dollars) (1) From Inception in December29, 1995 to 2013YTD YEAR JAN FEB MAR APR MAY JUN JUL 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 12.62 1.94 3.02 0.63 15.25 -0.59 4.98 5.54 5.06 -1.35 4.47 -0.74 9.97 10.75 4.34 3.87 5.28 5.06 0.88 4.16 3. 49 4.56 -4.16 -0.53 2.78 -0.87 0.89 1.11 1.21 -7.93 2.30 -2.50 -4.69 1.00 0.97 -0.22 5.38 -3.99 -0.61 2.88 0.67 -6.29 4.72 1.14 -3.83 2.91 1.27 7.27 2.62 -0.64 -0.50 -1.18 -2.36 -0.20 2.24 3.31 3.38 11.02 7.34 6.26 1.66 3.07 -8.26 8.10 2.33 10.90 2.74 7.57 1.79 -0.61 0.67 -7.42 -4.95 -5.41 9.32 1.02 -0.24 1.18 0.91 -0.48 3.28 -2.80 1.34 1.11 -2.45 -0.64 2.95 -1.49 3.31 1.09 5.60 -1.69 -4.90 0.86 -1.53 4.08 2.28 3.63 -7.52 -1.65 5.49 1.64 -1.97 3.07 0.29 5.07 -1.89 7.53 12.45 -1.72 -1.06 4.36 5.18 3.95 1.94 1.15 5.59 4.37 2.75 0.89 8.21 3.42 AUG 1.59 -1.08 -2.55 -3.24 1.69 -5.82 2.47 -2.41 3.15 0.58 6.44 4.35 3.05 1.53 -9.14 2.42 3.70 SEP OCT NOV DEC FULL (1) YEAR 1.99 -4.14 6.13 4.80 -17.17 -3.03 -1.37 1.25 5.32 1.60 -4.22 -2.94 9.05 -4.66 7.33 1.22 1.00 0.50 10.26 5.39 2.86 -0.12 6.87 5.17 -1.73 0.11 2.43 0.23 5.96 -3.78 -1.79 3.68 3.31 1.11 -0.81 -0.24 1.92 6.36 -17.10 -4.12 4.28 -3.75 5.13 3.92 0.33 -2.70 -1.29 -7.82 -2.95 0.58 2.04 -3.12 5.76 1.74 6.61 -3.70 0.79 1.68 -1.98 2.41 5.22 3.34 2.16 11.25 -2.99 -4.68 -1.11 0.29 4.81 13.93 35.85 76.41 -36.91 12.72 26.07 6.32 16.67 44.54 -3.36 43.73 45.71 -7.82 -2.99 26.20 16.60 Notes: (1) Data are as of Mar. 29, 2013. Source: Bloomberg. The indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees, or sales charges, which would lower performance. Past performance is no guarantee of future results. The Alerian MLP Index is a float-adjusted, capitalization-weighted index of the 50 most prominent energy master limited partnerships.. 4 MORGAN STANLEY WEALTH MANAGEMENT | APR. 24, 2013 Please refer to important information, disclosures and qualifications at the end of this material. Morgan Stanley Wealth Management Global Investment Committee – Asset Class Reviews 1. Publicly Traded Real Estate Shares and REITs 2/27/12 2. High Yield Fixed Income 3/26/12 3. US Investment Grade Fixed Income 4/23/12 4. Inflation-Indexed Securities 5/21/12 5. Emerging Markets Fixed Income 6/25/12 6. Hedge Funds 7/30/12 7. Emerging Markets Equity 8/27/12 8. Commodities 9/24/12 9. Non-US Equity 10/22/12 10. Non-US Fixed Income 11/26/12 11. Gold 12/10/12 12. Managed Futures 13. US Equity 2/19/13 14. US Cash and Cash Equivalents 3/25/13 15. Master Limited Partnerships 4/22/13 5 MORGAN STANLEY WEALTH MANAGEMENT | APR. 24, 2013 1/28/13 Please refer to important information, disclosures and qualifications at the end of this material. Risk Considerations Master Limited Partnerships (MLPs) are limited partnerships or limited liability companies that are taxed as partnerships and whose interests (limited partnership units or limited liability company units) are traded on securities exchanges like shares of common stock. Currently, most MLPs operate in the energy, natural resources or real estate sectors. Investments in MLP interests are subject to the risks generally applicable to companies in the energy and natural resources sectors, including commodity pricing risk, supply and demand risk, depletion risk and exploration risk. MLP Risks Individual MLPs are publicly traded partnerships that have unique risks related to their structure. These include, but are not limited to, their reliance on the capital markets to fund growth, adverse ruling on the current tax treatment of distributions (typically mostly tax deferred), and commodity volume risk. For tax purposes, MLP ETFs are taxed as C corporations and will be obligated to pay federal and state corporate income taxes on their taxable income, unlike traditional ETFs, which are structured as registered investment companies. These ETFs are likely to exhibit tracking error relative to their index as a result of accounting for deferred tax assets or liabilities (see funds’ prospectuses). The potential tax benefits from investing in MLPs depend on their being treated as partnerships for federal income tax purposes and, if the MLP is deemed to be a corporation, then its income would be subject to federal taxation at the entity level, reducing the amount of cash available for distribution to the fund which could result in a reduction of the fund’s value. MLP funds accrue deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax-deferred return of capital and for any net operating gains as well as capital appreciation of its investments; this deferred tax liability is reflected in the daily NAV; and, as a result, the MLP fund’s after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked. For additional risks, please see the Disclosures section beginning on page 7 of this report. 6 MORGAN STANLEY WEALTH MANAGEMENT | APR. 24, 2013 Please refer to important information, disclosures and qualifications at the end of this material. Disclosures Morgan Stanley Wealth Management (“Morgan Stanley Wealth Management”) is the trade name of Morgan Stanley Smith Barney LLC, a registered brokerdealer in the United States. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security or other financial instrument or to participate in any trading strategy. Past performance is not necessarily a guide to future performance The author(s) (if any authors are noted) principally responsible for the preparation of this material receive compensation based upon various factors, including quality and accuracy of their work, firm revenues (including trading and capital markets revenues), client feedback and competitive factors. Morgan Stanley Wealth Management is involved in many businesses that may relate to companies, securities or instruments mentioned in this material. This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/instrument, or to participate in any trading strategy. Any such offer would be made only after a prospective investor had completed its own independent investigation of the securities, instruments or transactions, and received all information it required to make its own investment decision, including, where applicable, a review of any offering circular or memorandum describing such security or instrument. That information would contain material information not contained herein and to which prospective participants are referred. This material is based on public information as of the specified date, and may be stale thereafter. We have no obligation to tell you when information herein may change. We make no representation or warranty with respect to the accuracy or completeness of this material. Morgan Stanley Wealth Management has no obligation to provide updated information on the securities/instruments mentioned herein. The securities/instruments discussed in this material may not be suitable for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives. Morgan Stanley Wealth Management recommends that investors independently evaluate specific investments and strategies, and encourages investors to seek the advice of a financial advisor. The value of and income from investments may vary because of changes in interest rates, foreign exchange rates, default rates, prepayment rates, securities/instruments prices, market indexes, operational or financial conditions of companies and other issuers or other factors. Estimates of future performance are based on assumptions that may not be realized. Actual events may differ from those assumed and changes to any assumptions may have a material impact on any projections or estimates. Other events not taken into account may occur and may significantly affect the projections or estimates. Certain assumptions may have been made for modeling purposes only to simplify the presentation and/or calculation of any projections or estimates, and Morgan Stanley Wealth Management does not represent that any such assumptions will reflect actual future events. Accordingly, there can be no assurance that estimated returns or projections will be realized or that actual returns or performance results will not materially differ from those estimated herein. This material should not be viewed as advice or recommendations with respect to asset allocation or any particular investment. This information is not intended to, and should not, form a primary basis for any investment decisions that you may make. Morgan Stanley Wealth Management is not acting as a fiduciary under either the Employee Retirement Income Security Act of 1974, as amended or under section 4975 of the Internal Revenue Code of 1986 as amended in providing this material. Morgan Stanley Wealth Management and its affiliates do not render advice on tax and tax accounting matters to clients. This material was not intended or written to be used, and it cannot be used or relied upon by any recipient, for any purpose, including the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. federal tax laws. Each client should consult his/her personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation. Asset allocation and diversification do not assure a profit or protect against loss in declining financial markets. The indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment. Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies. This material is disseminated in Australia to “retail clients” within the meaning of the Australian Corporations Act by Morgan Stanley Wealth Management Australia Pty Ltd (A.B.N. 19 009 145 555, holder of Australian financial services license No. 240813). Morgan Stanley Wealth Management is not incorporated under the People's Republic of China ("PRC") law and the research in relation to this report is conducted outside the PRC. This report will be distributed only upon request of a specific recipient. This report does not constitute an offer to sell or the solicitation of an offer to buy any securities in the PRC. PRC investors must have the relevant qualifications to invest in such securities and must be responsible for obtaining all relevant approvals, licenses, verifications and or registrations from PRC's relevant governmental authorities. Morgan Stanley Private Wealth Management Ltd, which is authorized and regulated by the Financial Services Authority, approves for the purpose of section 21 of the Financial Services and Markets Act 2000, content for distribution in the United Kingdom. Morgan Stanley Wealth Management is not acting as a municipal advisor and the opinions or views contained herein are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. This material is disseminated in the United States of America by Morgan Stanley Smith Barney LLC. Third-party data providers make no warranties or representations of any kind relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages of any kind relating to such data. Morgan Stanley Wealth Management research, or any portion thereof, may not be reprinted, sold or redistributed without the written consent of Morgan Stanley Smith Barney LLC. © 2013 Morgan Stanley Smith Barney LLC. Member SIPC. 7 MORGAN STANLEY WEALTH MANAGEMENT | APR. 24, 2013 Please refer to important information, disclosures and qualifications at the end of this material.