Accounting Chapter 6 Lesson 6-1 • Money is referred to as cash in

advertisement

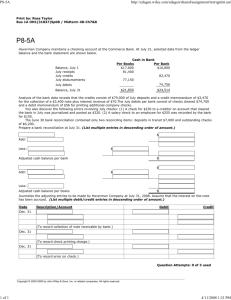

Accounting Chapter 6 Lesson 6-1 • • • • • • • • • • • • • • • • • Money is referred to as cash in accounting Check Checking account When open a checking account sign a signature card for all people who are allowed to sign checks Deposit slips are prepared when money put into an account All deposit slips have the same info o Checks listed according to the bank # on each check When deposit made get a receipt After deposit made, record it on check stub and a checkbook subtotal is calculated Cash receipts are journalized when cash received do no journal entry needed for deposits Ownership of a check can be transferred Name of the first owner is on the line after “Pay to the order of” Endorsement Endorsement should be signed exactly as name appears on front – if not correctly made out also need to sign with legal name Each endorser guarantees payment If bank doesn’t get payment from signer, each endorser is personally liable Blank endorsement = Rachel M. Nelson-Loupee o next owner is whoever possesses the check o Should be used only when ready to cash the check Special (full) endorsement = o only person whose name --------à is on back may cash • • • Pay to the order of Donna Nelson Rachel M. Nelson-Loupee Restrictive endorsement = For deposit only to Account # 123456 o Can NOT be cashed o Can only be used for stated purpose Rachel M. Nelson Loupee Check stubs are prepared before check written to prevent forgetting Preparing the check stub Write amt. of check after $ at the top Write date of check Write to whom the check is to be paid Record the purpose of the check Write amt. of check in the amount column at bottom Calculate the new checking account balance • Preparing the Check – ALL DONE IN INK Write the date Write to whom the check is to be paid Write amount in figures close the $ Write the amount in words and draw line to end Write purpose of check on line at bottom left Sign the bottom of the check • • • • • If amounts in figures and words to NOT match bank will often pay the words amount or refuse the check all together Postdated checks Banks can refuse to accept altered checks If make a mistake, VOID the check but keep for records Record a VOIDED check Record the date Write VOID in the account title column Write check # in Doc. No. column Place a checkmark in the Post. Ref. column Place a dash in both Debit and Credit columns Lesson 6-2 • • Bank Statement When banks receive checks it deducts the amount from the account • • • • Outstanding checks and deposits are those recorded by the depositor but not received by the bank as of printing time Account service charges are also on statements Statements should be checked for accuracy Reasons why might be a difference Service chard not recorded by depositor Outstanding deposits Outstanding checks Depositor math or recording error • • • For cancelled checks a check mark is made on the check stub to indicate it has cleared Bank statements are reconciled by verifying that the info on it matches the checkbook Reconciliation Steps Write date when prepared IN left amt. column, list balance brought forward on next unused check stub List any bank charges in space provided Write adjusted check stub balance at bottom left Write ending balance shown on bank statement in right amount column Write date and amt. of outstanding deposits and total it to the right amt. column Add the ending bank statement balance to total outstanding deposits and get subtotal List outstanding check numbers and amounts in correct space and carry total to the right amt. column Calculate adjusted bank balance Compare adjusted balances. Must be the same – if not an error has been made – must find and correct • Recording a bank service charge on stub Write service charge and amount under other Write amt. of the charge in the amt. column Calculate and record new subtotal • Service charges are not usually large or common so recorded as a miscellaneous expense o Debit miscellaneous expense and credit cash o Source Doc. is a memo Lesson 6-3 • • Dishonored Check Reasons checks are dishonored Checks appear to be altered Signatures do not match Amounts in words and figures do not match Check is postdated Check writer has stopped payment Check writer has insufficient funds • • • • • Issuing checks with insufficient funds or altering or forging a check is illegal Dishonored checks can impact credit rating Dishonored checks are a business expense because banks charge the depositing business a fee for handling the dishonored check The business will then try to collect this amount (the bank fee) plus the amount of the check from the check writer Recording dishonored checks on a check stub Write Dishonored check and amount under other (check amount + fee) Write total of dishonored check in amount column Calculate and record new subtotal • • A memo is prepared to deal with crediting cash for the service fee and amount of dishonored check Journalizing a dishonored check Date Write account and amount debited (A/R) Credit Cash for total amount Write source doc. of the transaction • • • • Electronic Funds Transfer Use EFTs to send payments from business EFTs use memos as source doc. Journalizing an EFT Date Debit (A/P) Credit (cash) Source Doc. (memo) • • • • • • EFTs are recorded on check stub under Other Debit Card Debit card transaction need to be recorded under other on check stub EFTs are on bank statement under checks Debit cards show up as purchases To Journalize a debit card transaction – cash is credited and a memo is created Lesson 6-4 • • • • Petty Cash Dollar amount to be held differs by business Petty cash is an asset account with a normal debit balance Establish a petty cash fund Date Debit Petty Cash Credit Cash Source doc. is a check • • • • Petty Cash slip: #, date, to whom paid, reason, amount paid, account to be recorded, signature approval No entries made to journal until pretty cash dry or end of month Must prove petty cash fund Replenishing petty cash does not affect the petty cash account o Credit cash and debit whatever expenses were paid all in one transaction with a new check as the source document.