AD1101

Financial Accounting

_________________________________________________________________________

Course Description and Scope

This course aims to provide students with an understanding of how to use financial statement

information to make economic decisions from a user perspective such as investors and creditors. In

the process, students will learn how financial statements are prepared in accordance with the

Financial Reporting Standards.

The course examines the impact of various accounting choices on the financial statements and the

incentives that contracts based on accounting numbers can create for different stakeholders. These

help users to understand why managers choose certain accounting methods and avoid others.

Course Learning Objective

Students will be able to understand various items that are typically presented in a set of

consolidated financial statements and know how to analyze and interpret financial statement

information for decision making.

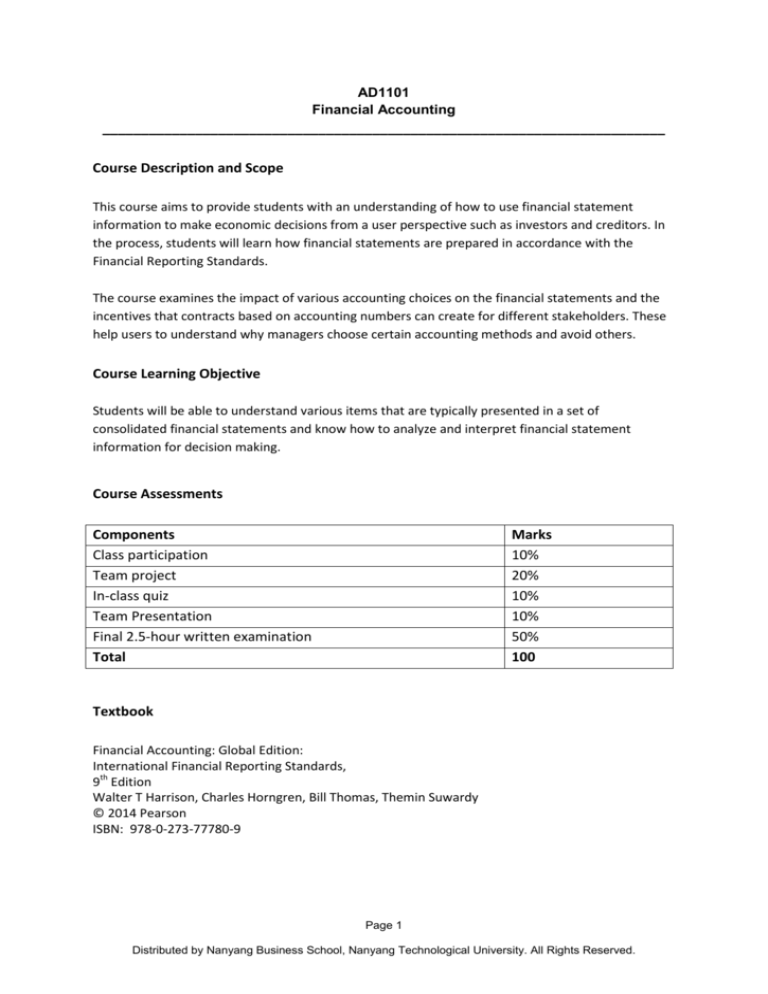

Course Assessments

Components

Class participation

Team project

In-class quiz

Team Presentation

Final 2.5-hour written examination

Total

Marks

10%

20%

10%

10%

50%

100

Textbook

Financial Accounting: Global Edition:

International Financial Reporting Standards,

9th Edition

Walter T Harrison, Charles Horngren, Bill Thomas, Themin Suwardy

© 2014 Pearson

ISBN: 978-0-273-77780-9

Page 1

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.

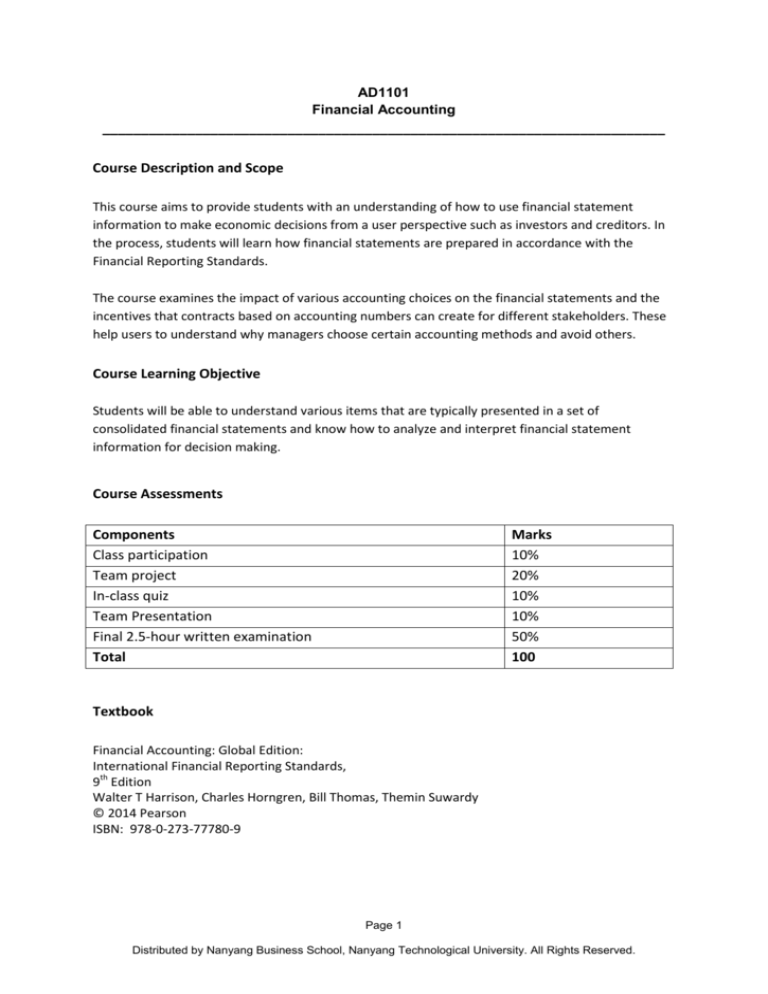

Proposed Weekly Schedule

Week

1&2

2

3

4&5

5&6

6

7&8

9

10 & 11

12

13

Topic

Introduction to Financial Accounting

Conceptual Framework

Double Entry System

Accounting Information System

Accrual Accounting; Adjusting Entries

Operating Activities - I

Inventories and Cost of Goods Sold

Operating Activities - II

Revenue Recognition

Valuation of Accounts Receivable

Foreign currency transactions

Investing Activities – I

Fixed Assets – Property, Plant and Equipment (PPE)

Intangible Assets

Investment Property

Investing Activities – II

Investments

Subsidiary and Associated Companies

Non-Controlling Interests

Financing Activities – I

Current and Long-term Liabilities

Contingent Liabilities

Lease Liabilities

Deferred Taxes

Financing Activities – II

Shareholder’s Equity

Dividends

Cash Flow Statements

Internal Control and Cash Management

Bank Reconciliation

Financial Statement Analysis

Course Revision

Page 2

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.