Rental Income Instructions (Schedule E)

advertisement

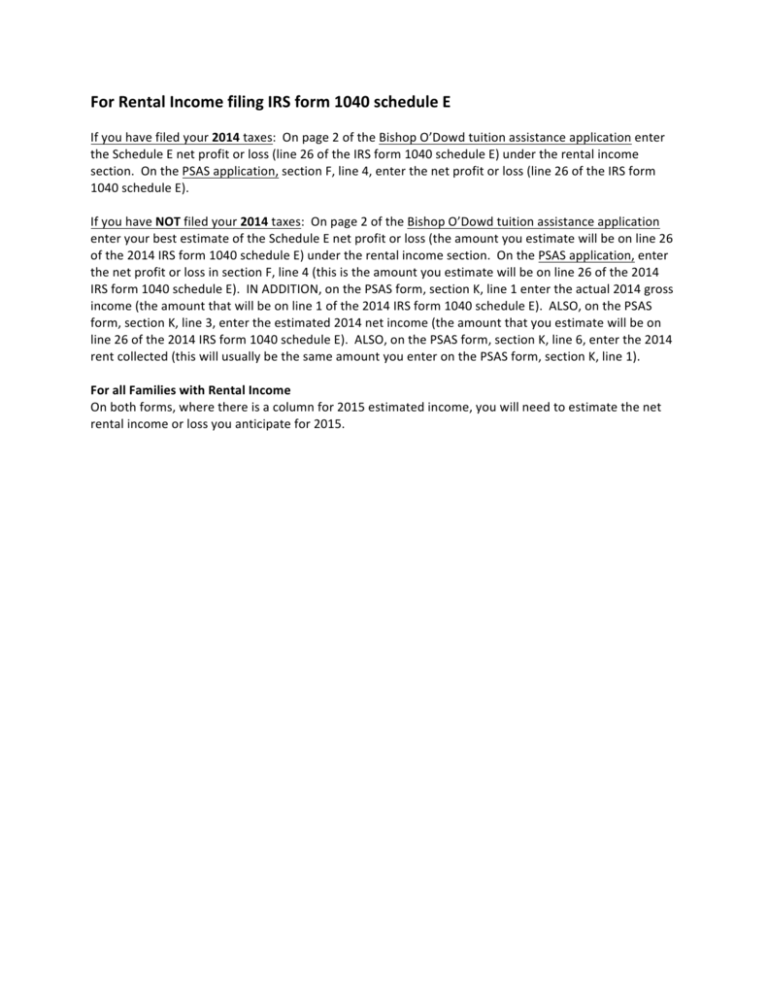

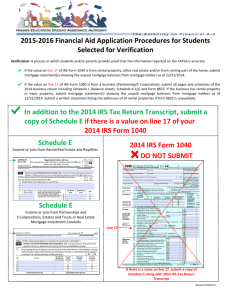

For Rental Income filing IRS form 1040 schedule E If you have filed your 2014 taxes: On page 2 of the Bishop O’Dowd tuition assistance application enter the Schedule E net profit or loss (line 26 of the IRS form 1040 schedule E) under the rental income section. On the PSAS application, section F, line 4, enter the net profit or loss (line 26 of the IRS form 1040 schedule E). If you have NOT filed your 2014 taxes: On page 2 of the Bishop O’Dowd tuition assistance application enter your best estimate of the Schedule E net profit or loss (the amount you estimate will be on line 26 of the 2014 IRS form 1040 schedule E) under the rental income section. On the PSAS application, enter the net profit or loss in section F, line 4 (this is the amount you estimate will be on line 26 of the 2014 IRS form 1040 schedule E). IN ADDITION, on the PSAS form, section K, line 1 enter the actual 2014 gross income (the amount that will be on line 1 of the 2014 IRS form 1040 schedule E). ALSO, on the PSAS form, section K, line 3, enter the estimated 2014 net income (the amount that you estimate will be on line 26 of the 2014 IRS form 1040 schedule E). ALSO, on the PSAS form, section K, line 6, enter the 2014 rent collected (this will usually be the same amount you enter on the PSAS form, section K, line 1). For all Families with Rental Income On both forms, where there is a column for 2015 estimated income, you will need to estimate the net rental income or loss you anticipate for 2015.

![-----Original Message----- From: Pitman Buck [ ]](http://s2.studylib.net/store/data/015588101_1-8341f4e78372efe89d0546692b0e70b5-300x300.png)