Aggregate and Entity Approach in Partnership Taxation

advertisement

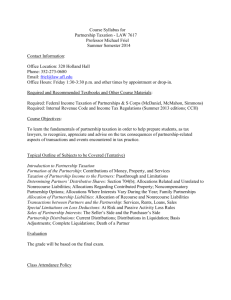

476 조세연구|제10—2집 Aggregate and Entity Approach in Partnership Taxation 1)Lee, Kang [LLM(Taxation), UW School of Law, Expected June 2011. US. CPA(WA)] Abstract Taxing regimes of the United States are divided into three categories, that is, taxation for corporation, partnership and individual. Because S corporation and limited liability company (LLC) are basically taxed through partnership taxation, a lot of taxable entities are regulated under this taxation. It is difficult to apply because the Internal Revenue Code(I.R.C.) has only 36 sections about that, but related regulations are provided over about 250 pages. Partnership taxation is supported by two theories, that is, aggregate theory and entity theory. Aggregate theory is a kind of theory that states that partnership is only equal to the aggregate of partners. According to this theory, each partner is finally responsible for tax liability. In contrary, entity theory is a kind of theory that states that partnership exists separately regardless of its partners. Partnership taxation is basically based on aggregate theory. However, because it is not easy to establish a taxation system only with aggregate approach, both theories * 투고일:2010.7.15., 심사개시일:2010.7.29., 수정일:2010.8.23., 게재확정일:2010.8.25. Aggregate and Entity Approach in Partnership Taxation 477 are included in a lot of provisions. So, to summarize key points of partnership taxation from the standpoint of aggregate and entity approach is helpful to understand. This is also helpful when we need to revise the provisions. Especially, because partnership taxation was enacted as a title of “Special Taxation for Partnership Firms” and has been effective since 2009 in South Korea, it is a task of great significance at this time to review the partnership taxation horizontally according to both theories. In this article, I would like to review and compare the legal attitude of U.S. law with Korean’s with respect to aggregate theory and entity theory in partnership taxation. Key Words: Partnership taxation, Entity theory, Aggregate theory Ⅰ. Introduction There have been a lot of studies about partnership taxation in South Korea. As a result of studies and changes of business environment, partnership taxation was enacted under the name of “Special Taxation for Partnership Firms” and has been in the process of enforcement since 2009. However, because current sections only provide basic structure, it is expected that there will be a lot of confusion in the process of real enforcement. Partnership taxation is known for the most complicated taxation. Although the Internal Revenue Code(I.R.C.) has only 36 sections, regulation provides a lot of specific rules and examples over about 250 pages. Taxation of the United States is divided into three categories, that 478 조세연구|제10—2집 1) is, taxation for individuals, for corporations 2) and for partnerships. 3) However, as S corporation and Limited Liability Company (LLC) are basically taxed through partnership taxation, partnership taxation has applied to a lot of business entities. 4) Partnership taxation is supported by aggregate and entity theory. Aggregate approach is defined as if the entity is considered as an aggregation of individuals. In contrary, entity approach is defined as if the entity is separate from individuals. Basically, partnership is not a taxable entity. This means that partnership needs not to pay tax liability. All income and loss items are finally passed through to partners, and partners will be responsible for paying tax liability. The Code allows a freedom and flexibility to partnership. However, it is also an element that makes 1) Although there are a lot of differences between the corporate taxation and the partnership taxation, major difference is that the corporate taxation reflects entity theory. See the following for the detailed explanation. Boris I. Bittker and James S. Eustice, Federal Income Taxation of Corporations and Shareholders, WG & L, 2009, ¶1.07. 2) S corporation is a pass-through entity. S corporation itself is not subject to tax liability. In 1997, tax return by S corporation exceeds more than 50% of the corporate tax return for the first time. In 2003, tax return by S corporation occupies 61.9% of the total corporate tax return. See the following for the details. Stephen A. Lind et al., Fundamentals of Partnership Taxation, Foundation Press, 2008, pp.27~28. 3) Id. at 28. Limited liability company (LLC) appeared in the 1980’s and has become the best alternatives for a closely held business. The number of LLCs was 118,559 in 1995. However, it increased up to 1,465,223 in 2005. 4) In fact, the combination of both theories started from enactment of the original Uniform Partnership Act (UPA) in 1914, prior to tax aspect. See following article for detail. Daniel S. Kleinberger, The Closely held business through the entityaggregate prism, 40 WFLR 827, at 827. Aggregate and Entity Approach in Partnership Taxation 479 it complicated. Because all items are taxed under the individual level, it is a key point to understand how the basis changes, especially outside basis. These structures reflect aggregate theory. It is helpful to understand both approaches and catch up with them over partnership taxation. Although there are a lot of articles only to explain partially current position in each section as results of prior research, there are a few articles to analyze both theories specifically and insist on a specific theory. A recent article, “Aggregate-Plus Theory of Partnership Taxation” (2009) by Professor Borden at Washburn University School of Law shows how both theories are realized into partnership taxation. It is a very useful article for understanding basic positions although Professor Borden also does not insist on choosing a specific theory. In this article, I would like to review and compare the legal attitude of I.R.C. with Korean’s current act with respect to aggregate theory and entity theory in partnership taxation. Ⅱ. Formation 1. The legal attitude in I.R.C. (1) Non-recognition and basis. When it comes to partnership formation, any gain or loss on the transfer of property to a partnership is not recognized for the contributing 5) 6) partner and partnership although there is an exception. It is a natural 5) I.R.C. §721(a). 6) I.R.C. §351(a). and Reg. §1.351-1(c)(1)(ⅱ). §351(e) prevents an investment com- 480 조세연구|제10—2집 outcome because partnership is not a taxable entity according to aggregate approach. It is mere conversion from the partner’s prior property to the partner’s interest. Although there is no section setting forth what is a property for §721, The Court held that the term ‘property’ for §351 is 7) analogous to the term ‘property’ for §721. The Court also held that services are not included in the term ‘property’ here. So, contribution of services is a taxable event, and the partner has to recognize gain, if any 8) gain. Unlike formation of C corporation, §721 doesn’t require to control of the partnership immediately after formation. Through the formation, a contributing partner transfers his original 9) basis to the partnership. So, a partner’s basis in partnership interest is equal to the sum of any cash contributed and the adjusted basis of the contributed property. It is generally referred as “outside basis”, and outside basis reflects the aggregate theory. The partner is allowed to tack the prior holding period to the holding period of partnership interest. In contrary, through the formation, partnership gets to have its own basis. It is generally referred as “inside basis”, and inside basis reflects the entity theory. Partnership is also allowed to tack the partner’s holding 10) period. pany from converting investment items without recognition of gain. 7) Stafford v. United States, 611 F.2d 990 (5th Cir. 1980). 8) I.R.C. §36(c). In case of the formation of C corporation, the Code requires to control of the corporation. To meet the control requirement, one or more shareholder must own at least 80 percents of the total voting power of all classes of stock entitled to vote and at least 80 percent of the total number of shares of all other classes of stock of the corporation. 9) I.R.C. §722. 10) I.R.C. §1223(2). Aggregate and Entity Approach in Partnership Taxation 481 Section §702(b) provides the character of items constituting distributive share. The character of any items of income, gain, loss, deduction, or credit included in a partner’s distributive share under separately stated item provision 11) is determined as if such items were realized directly by the partnership, or incurred in the same manner as incurred by the partnership. This reflects entity theory. However, Code requires special characterization rules to prevent partner from converting ordinary income into capital gain or capital loss into ordinary loss according to aggregate 12) theory. Unrealized receivables, inventory items and capital loss property are included in this special rule. First, when a partner contributes an 13) unrealized receivable, any gain or loss that is recognized by the partnership on the disposition of the unrealized receivable is treated as ordinary items. The holding period of a partnership does not matter. 14) Second, when a partner contributes inventory items, any gain or loss recognized by the partnership during the 5 year period is treated as ordinary items. It is different from the unrealized receivable from the point that it doesn’t have period limitation. Third, when a partner contri- 11) See footnote 53 for detail. 12) I.R.C. §724. 13) I.R.C. §751(c). The term “unrealized receivables” includes any rights to payment for (1) goods delivered, or (2) services rendered, or to be rendered. 14) I.R.C. §751(d). The term “inventory items” means (1) property of the partnership of the kind described in §1221(a)(1), (2) any other property of the partnership which would be considered property other than a capital asset and other than property described in §1231, and (3) any other property held by the partnership which would be considered property of the type described above. 482 조세연구|제10—2집 butes built-in loss property, any loss recognized by the partnership from the disposition of that property within 5 year after contribution is treated as a capital loss. (2) Liability 15) Sometimes, partners borrow money as the partnership’s liabilities forming a partnership. The partnership has to allocate liabilities among the 16) partners according to aggregate theory. The increase of a partner’s share of liabilities is considered as a contribution of money according to aggregate theory. In contrary, the decrease of a partner’s share of liabilities is considered as a distribution of money. So each partner has to increase or decrease the outside basis up to the extent of the increase or 17) decrease of the partner’s share of liabilities. However, how and what amount a partner can increase or decrease 15) Reg. §1.752-1(a)(4). Liabilities are divided into “§1.752-1 liability” and “§1.752-7 liability”. §1.752-1 liability is defined as a liability that (1) creates or increases the basis of any of the obligor’s assets, (2) gives rise to an immediate deduction to the obligor ;or (3) gives rise to an expense that is not deductible in computing the obligor’s taxable income and is not properly chargeable to capital. Recourse liability and nonrecourse liability are included in this category. §1.752-7 liability is defined as any fixed or contingent obligation to make payment without regard to whether the obligation is otherwise taken into account for purposes of the Internal Revenue Code. This liability includes debt obligations, environmental obligations, tort obligations, contract obligations, pension obligations, obligations under a short sale, and obligations under derivative financial instruments such as options, forward contracts, futures contracts, and swaps. §1.752-7 liability is treated as built-in loss property. 16) I.R.C. §752. 17) It is a major difference from S corporation. In case of S corporation, each shareholder doesn’t need to increase outside basis. See I.R.C. §1367 for detail. Aggregate and Entity Approach in Partnership Taxation 483 outside basis depends on the character of liabilities. In case of “recourse liabilities”, partnership has to allocate those liabilities to the partner who bears the “economic risk of loss”. Whether any partner bears the economic risk of loss or not is determined by who would be required to pay 18) ultimately. In determining who bears the economic risk of loss, 19) regulation introduces a “constructive liquidation”. Partnership can deter- mine who bears the economic risk of loss according to this method liquidation. To illustrate, consider following simple example. Example #1: AB is a partnership of which A and B are general partners. A and B contribute cash in the amounts of $700 and $300. After forming a partnership, the partnership purchases an office building for $5,000 by paying $1,000 cash and assuming $4,000 mortgage. This mortgage is fully recourse. A and B agreed to share all profit and loss according to contribution rate (7:3). AB’s original balance sheet is as follows: Asset Office building Liabilities $5,000 Mortgage $4,000 Capital Account A B $700 $300 $1,000 18) Reg. §1.752-2(a). 19) Reg. §1.752-2(b)(1). Under the constructive liquidation, all of the following events are deemed to occur simultaneously;(1) All of the partnership’s liabilities become payable in full;(2) all of the partnership’s asset, including cash, have a value of zero;(3) the partnership disposes of all of its property in a fully taxable transaction for no consideration;(4) all items of income, gain, loss, or deduction are allocated among the partners;and (5) the partnership liquidates. 484 조세연구|제10—2집 According to constructive liquidation, five events are deemed to occur as follows: (a) All of the mortgages become payable in full; (b) Office building has a value of zero; (c) Partnership disposes of the office building without consideration. This results in a $5,000 loss; (d) The $5,000 loss is allocated among A and B according to their agreement, that is, $3,500 to A and $1,500 to B. This reduces their capital accounts to ($2,800) and ($1,200). (e) The partnership liquidates. 20) 2,800 and $1,200 stand for each partner’s share of liability. A’s outside basis increases from $700 to $3,500 and B’s outside basis increases from $300 to $1,500. It is a little different in the case of nonrecourse liabilities. A partner doesn’t need to bear nonrecourse liabilities. So, constructive liquidation is useless here. Instead, the partner’s share of nonrecourse liabilities is 21) computed to sum three items: 22) (a) Share of partnership minimum gain(PMG); 20) A’s portion of liability is $2,800($4,000 × 70%) and B’s portion is $1,200 ($4,000 × 30%). These amounts are added to A and B’s interest each. 21) Reg. §1.752-3(a). 22) Reg. §1.704-2(g)(1). A partner’s share of partnership minimum gain equals (1) the sum of nonrecourse deductions allocated to that partner up to that time and the distributions made to that partner up to that time of proceeds of a nonrecourse liability allocable to an increase in partnership minimum gain;minus (2) the sum of that partner’s aggregate share of the net decreases in partnership minimum gain plus their aggregate share of decreases resulting from revaluations of partnership property subject to one or more partnership nonrecourse liabilities. Aggregate and Entity Approach in Partnership Taxation 485 (b) The amount of any taxable gain that would be allocated to the partner 23) under §704(c) and the regulations; 24) (c) Share of the excess nonrecourse liabilities(excess NRL). To illustrate, consider following simple example. Example #2: A, B and C formed ABC partnership. A contributed $200. B and C contributed $400 each. ABC borrowed $9,000 to purchase an office building for $10,000. The useful life of the office building is 5 years, and this building is depreciated on a straight-line basis. Borrowed money was secured by the building. The partners share all items in accordance with their capital contribution rate. Determine the partner’s outside basis one year after forming a partnership. In this case, the amount of first year depreciation is $2,000 and the book value of the office building at the end of the first year is $8,000. The amount of debt ($9,000) exceeds the inside basis of property($8,000). So, there is $1,000 partnership minimum gain. Second, there is no §704(c) gain because this building is not contributed property. The remaining $8,000 is an excess nonrecourse liability. Because all items are allocated by capital contribution, outside basis is as follows: 23) Reg. §1.752-3(a)(2). This gain is the amount allocated to the partner under §704(c) if the partnership disposed of all partnership property subject to one or more nonrecourse liabilities of the partnership in full satisfaction of the liabilities and for no other consideration. 24) Reg. §1.752-3(a)(3). Excess nonrecourse liabilities are the remaining balance of nonrecourse liabilities after prior allocation has been completed. 486 조세연구|제10—2집 Amount A $200 B $400 C PMG $1,000 $400 §704(c) Gain - - - - Excess NRL $8,000 $1,600 $3,200 $3,200 Share of liability $9,000 $1,800 $3,600 $3,600 Initial OB $1,000 $200 $400 $400 Final OB $10,000 $2,000 $4,000 $4,000 ※ ∙ PMG:Partnership Minimum Gain ∙ NRL:Non-Recourse Liabilities ∙ OB:Outside Basis 2. The legal attitude in South Korea Restriction of Special Taxation Act does not provide any specific provision for partnership formation. The current act only provides the provision that listed firms which are established by other acts are eligible 25) for partnership taxation. For example, a partnership under the Civil Act or an undisclosed association under the Commercial Act is eligible. So, it is ambiguous as to which kind of positions the current act takes. This ambiguity gives the current an act easy way to avoid considering the contribution problem. The contribution under formation is one of the most difficult parts in partnership taxation and it affects the whole process. Furthermore, the contribution of property to company are taxed at the time of contribution. This makes a lot of tax problems easier, but it also creates obstacles to the vitalization of partnership taxation. The contribution of property basically means the change of the character of investment, not amount of 25) Restriction of Special Taxation Act. §100-15. Aggregate and Entity Approach in Partnership Taxation 487 property. Although it is somewhat reasonable that the contribution of property is taxed in the corporate tax law in the aspect that the corporate tax act presumes the substance of corporation, it is not logically correct in partnership taxation. It is reasonable that carryover provisions of realized income through contribution of property, because all income and loss except income and loss distributed are reflected into a partner’s interest, and they are taxed in the final stages. This carryover provision also triggers other problems when the partnership distributes contributed property to a partner, or sells the property to a third party. However, those problems may be solved according to the above examples of the U.S. system. Another major part with respect to the formation is about liability. However, it is also ambiguous as to which kind of positions the current act takes because the current act does not provide any specific provision for dealing with liabilities when partnerships borrow money. The liability problem relates to a partner’s interest. A general partner is generally responsible for those liabilities. So, those liabilities are added to the 26) partner’s interest. The adjustment of a partner’s interest is one of the major issues in partnership taxation. It is because of the adjustment of a partner’s interest, that the partner’s interest affects the amount taxed at the time of selling interest or liquidation. However, the current act only provides for three cases, that is, (1) when partners contribute property, or the partnership distributes property, (2) when partners purchase or sell the interests of the partnership (including inheritances and gifts) and (3) when the 26) The current act uses the term, the adjustment of value of equity shares instead of adjustment of partner’s interest. Restriction of Special Taxation Act. §100-17. 488 조세연구|제10—2집 partnership allocates income or deficit. The provision for dealing with liabilities is required because liabilities also affect the partner’s personal interest and all income and loss are taxed at the ends through the partner’s interest. In conclusion for the formation, current act of South Korea is deficient in most important provisions, that is, contribution and liabilities. Ⅲ. Operation 1. The legal attitude in I.R.C. (1) Income allocation Partnership is not a basically taxable entity. So, all items, both separately stated items and ordinary income or loss items are passed to partners according to aggregate theory. Unless otherwise provided in the Code, the distributive share of these items is determined by the partnership agreement. This means that Code permits lots of flexibility to partners and the partnership. This also means that through agreement between partners, partners may distort tax results. So, if there are no directions about the distributive share on the partnership agreement or the allocation doesn’t meet the “substantial economic effects”, the distributive 27) share is determined by interest rate of the partnership. In conclusion, if an allocation from the partnership to each partner has substantial economic effects, it will be respected. If not, the original 27) I.R.C. §704(b). Aggregate and Entity Approach in Partnership Taxation 489 allocation will not be respected, and there needs to be reallocated in accordance with the partner’s interest. Substantial economic effects analysis is divided into two separate tests, that is, “economic effects test” and “substantiality test”. First, we need to determine if the allocation has economic effects. For economic effect, a partner has to receive economic benefit or economic burden 28) through allocation. If the partnership agreement meets the following 29) requirement, an allocation is deemed to have economic effects. (a) Maintenance of the partners’ capital account in accordance with the Regulation rules. (b) Liquidating distributions are required in all cases to be made in accordance with the positive capital account balance. (c) If such partner has a deficit balance following the liquidation, that partner is unconditionally obligated to restore the amount of such deficit balance to the partnership. Unlike general partnership, limited partnership can’t meet the above third requirement because the limited partner doesn’t have an obligation to restore the deficit. Regulation provides for “alternate test for economic 30) effects”. If the limited partnership agreement meets the following requirements, an allocation is deemed to have economic effects. (a) Above first and second requirements are satisfied. (b) The partnership agreement contains a “qualified income offset”. (c) The allocation does not cause or increase a deficit balance in such partner’s capital account. The second test is about substantiality to meet “substantial economic 28) Reg. §1.704-1(b)(2)(ⅱ)(a). 29) Reg. §1.704-1(b)(2)(ⅱ)(b). 30) Reg. §1.704-1(b)(2)(ⅱ)(d). 490 조세연구|제10—2집 effects”. So, economic effects must be substantial. The economic effects of an allocation are substantial if there is a reasonable possibility that the allocation will affect substantially the dollar amounts to be received by 31) the partners. However, Code and regulation don’t give any specific words about what cases are substantial. Instead, it provides two situations that are not substantial, that is, “shifting tax consequences” and “transitory 32) allocations”. If at the time the allocations are the parts of the partnership agreement, there is a strong likelihood that (a) the net increases and decreases of a partner’s respective capital accounts will not differ substantially from the net increases and decreases if the allocation were not contained in the partnership agreement, and (b) the allocation will 33) reduce the total tax liability of the partnership, it is considered as case of shifting tax consequences. To illustrate, consider following simple example. Example #3: A and B are general partners of AB partnership. The partnership invested in municipal bonds, and received $500 of taxexempt interest from that bond. The partnership also received $500 in cash from doing ordinary business. A is individually in the 35% tax bracket, and B is in the 15% tax bracket. If there is no special allocation, the partnership allocates $250 of 31) Reg. §1.704-1(b)(2)(ⅲ)(a). 32) Reg. §1.704-1(b)(2)(ⅲ)(c). The transitory allocation is similar to “shifting tax consequence” method. Major difference is that the transitory allocation is applied to taxable year between two and five. If there is no offsetting allocation within 5 years, the allocation will be respected. 33) Reg. §1.704-1(b)(2)(ⅲ)(b). Aggregate and Entity Approach in Partnership Taxation 491 tax-exempt interest and $250 of ordinary income to A and B each. 34) As a result of this allocation, A has $412.5 of after-tax income, and B has 35) $462.5 of after-tax income. So, total after-tax income is $875. If the partnership allocates all tax-exempt interest to A, and all ordinary income to B, then A has $500 of after-tax income, and B has $425 of after-tax income. So, they have $925 of total after-tax income. This means that through the special allocation, they receive an additional $50 benefit. Therefore, the partnership has to reallocate these items. (2) Allocation with respect to contributed property Income, gain, loss and deduction with respect to contributed property is shared by partners to take into account the variation between the basis of contributed property and the fair market value at the time of 36) contribution. It is natural from the point of the aggregate approach because only the partners are responsible for all items. If the tax basis of contributed property is equal to the fair market value at the time of contribution, it doesn’t matter. However, if both amounts are different from each other, the partnership must allocate built-in gain or built-in loss to the partners in specific two cases. First case is when the partnership sells or exchanges contributed property. Second case is when there is a depreciation or 34) It is because they are general partners and the allocation rate between A and B is 50:50 if there is no special agreement. $250 of the tax-exempt interest and $150 of cash is allocated to A and B each. 35) A’s after-tax income is calculated like this:$250(tax-exempt interest) + $250 (ordinary income) × (100 - 35)% = $412.5. B’s after-tax income is calculated like this:$250(tax-exempt interest) + $ 250(ordinary income) × (100 - 15)% = $462.5. 36) I.R.C. §704(c)(1)(A). 492 조세연구|제10—2집 depletion of contributed property. Here, regulation provides three possible 37) methods;traditional method, 38) traditional method with curative allocation 39) and remedial allocation method. The purpose of the traditional method with curative allocation and the remedial method is to get rid of distortion 40) from the ceiling rule. To illustrate, consider following simple example. Example #4: A and B form AB partnership. A and B agree that all profits and losses are allocated equally. A contributes a machine for business with fair market value of $1,200 and the basis of $400. B contributes land with fair market value of $1,200 and the basis of $200. B has held this land for 5 years. Situation 1: suppose that the partnership sells the land immediately after formation for only $600. What happens if the traditional method is used? 37) Reg. §1.704-3(b)(1). The traditional method requires that when a partnership has income, gain, loss or deduction attributable to section 704(c) property, the partnership must make appropriate allocations to its partners to avoid shifting the tax consequences of the built-in gain or built-in loss. 38) Reg. §1.704-3(c)(1). The curative allocation is an allocation of income, gain, loss or deduction for tax purposes that differ from the partnership’s allocation of the corresponding book item. 39) Reg. §1.704-3(d)(1). The remedial allocation method requires to eliminate the distortions by creating remedial items and allocating those items to its partners. 40) Reg. §1.704-3(b)(1). According to the ceiling rule, all items allocated to its partners can’t exceed the total partnership income, gain, loss or deduction. Aggregate and Entity Approach in Partnership Taxation 493 The initial balance sheet after formation is as follows: Asset Tax Book Capital Acc’t Tax Book Machine $400 $1,200 A $400 $1,200 Land $200 $1,200 B $200 $1,200 $600 $2,400 $600 $2,400 Because there is a tax gain of $400($600-$200) and a book loss of $600($600-$1,200), a $400 tax gain has to be allocated to B 41) according to §704(c), and the book loss has to be allocated equally. Basically, A should be allocated a $300 tax loss due to book loss. However, because of the ceiling rule, that is, there is no tax loss in this sale of land, A can’t be allocated a $300 tax loss. Balance sheet after the sale of land is as follows: Asset Tax Book Capital Acc’t Tax Book Machine $400 $1,200 A $400 $900 Cash $600 $600 B $600 $900 $1,000 $1,800 $1,000 $1,800 Situation 2: suppose that the basic information is same as Situation 1, and the partnership also has $1,000 of capital gain resulting from business operation at the end of the first year. What happens if the traditional method with curative allocation is used? $1,000 of capital gain is allocated equally. Because there is a $600 of capital loss in situation 1, the book value will finally be $1,400. However, for tax purposes, A must not get a $300 tax loss resulting 41) §704(c) requires that the built-in gain related to §704(c) property must be allocated to the contributing partner. 494 조세연구|제10—2집 from the sale of land because of the ceiling rule. So, A’s share is reduced to $200 from $500. Balance sheet in this situation 2 is as follows: Asset Machine Cash Tax Book Capital Acc’t $400 $1,200 A $600 Tax $1,400 Book $1,600 $1,600 B $1,400 $1,400 $2,000 $2,800 $2,000 $2,800 Situation 3: suppose the same with case. What happens if the remedial allocation method is used? In the remedial allocation method, if the allocation of tax gain or loss is prohibited from following book items for noncontributing partners, then, the partnership creates remedial tax items for the noncontributing partner and offset tax items for the contributing partner at the same time. In this case, because of the ceiling rule, A can’t receive the allocation of $300 tax loss. So, the partnership creates $300 capital loss for A, and at the same time, creates $300 capital gain for B. Balance sheet in this situation 3 is as follows: Book Capital Acc’t Tax Book Machine Asset $400 Tax $1,200 A $100 $900 Cash $600 $600 B $900 $900 $1,000 $1,800 $1,000 $1,800 These allocations become more complicated if there is depreciation from the property. However, basic logic is equal to the above. (3) Transaction between partnership and partner A partner may receive a compensation for the service. If we adopt the aggregate approach, it doesn’t make sense. How can the partner be Aggregate and Entity Approach in Partnership Taxation 495 employed by that partner? If the partner sells or buys property, how can we explain that situation according to the aggregate approach? The Code has split this compensation issue into three categories. First, if the partner provides service at arm’s length, that partner is not considered as a partner. So, this compensation is treated as if it were a 42) transaction with strangers. This reflects entity theory. Second, if the partner acts in the partnership’s capacity, this compensation is treated as a part of the distributive share. So, it is taxed under §704(b) and general rules of partnership taxation. This reflects aggregate approach. Third, if 43) the partner receives a guaranteed payment, approach. the Code adopts a hybrid 44) Sale or exchange of property between a partnership and apartner is considered as if it were the transaction between a partnership and 45) strangers. However, for the purpose of preventing tax avoidance, the Code provides that no deduction is allowed with respect to losses from sale or exchange of property between a partnership and a partner owning directly or indirectly more than 50% of the capital interest, or the profit 46) interest. The Code also provides that any gain from the sale or exchange 42) I.R.C. §707(a). 43) Reg. §1.707-1(c). The guaranteed payment is a fixed payment for services when apartner provides services as a partner or for the use of capital. 44) I.R.C. §707(c). The hybrid approach means that it treats partnership as an entity for some purposes, and as an aggregate for others. In this section, for the purpose of §§61(a), 162(a) and 263, that the payment is treated as if it were a transaction with strangers according to the entity approach. For other purposes, it is treated as a distributive share according to the aggregate approach. 45) I.R.C. §707(a)(1). 46) I.R.C. §707(b)(1). 496 조세연구|제10—2집 between a partnership and a partner owing more than 50% of the interest 47) is considered as ordinary income. (4) The sale of a partnership interest Theoretically, entity theory treats the sale of a partnership interest as a corporate stock. Therefore, any gain or loss from that sale is treated as a capital gain or loss. Under entity theory, there is no effect on the partner’s basis. In contrary, aggregate theory treats that sale as the sale of an undivided interest in each asset. It has affected the character of gain or loss. This means that gain or loss may become ordinary income or loss. Furthermore, the buyer receives assets at a cost basis. The position of the Code is not easy to understand at a first sight. The Code ostensibly looks like adopting the entity theory because gain or loss from that sale is characterized as capital gain or loss, 49) doesn’t affect the inside basis of those assets. 48) and that sale This position also provides 50) “administrative convenience” with the IRS. However, §751 restricts application of §741 in specific case. So, the amount of any money from the sale or exchange of unrealized receivables or inventory items is considered as ordinary items. Additionally, if a partnership makes a §754 election, the basis of partnership property is adjusted in the case of a distributed property and a transfer of interest in 51) the manner provided in §743. So, the aggregate approach is also 47) I.R.C. §707(b)(2). 48) I.R.C. §741. 49) I.R.C. §743(a). 50) Bradley T. Borden, Aggregate-plus theory of partnership taxation, 43 GALR 717, 766. 51) These adjustments are for reducing the disparities between buyer’s outside basis Aggregate and Entity Approach in Partnership Taxation 497 reflected strongly in this subject. 2. The legal attitude in South Korea Basic concepts about income and loss allocation in the current act are similar to I.R.C. So, all incomes are taxed in a partner’s level according to 52) aggregate theory. The income and loss are allocated in proportion to the allocation rate at the end of each taxable year. Unlikely to I.R.C., the current act divides the partner concept into two categories, that is, general partner 53) and passive partner. No deficit is allocated to the passive partner. 54) current act provides that the allocation rate of income and loss The applies to the submitted allocation rate first, and then to the contribution rate. However, there is no provision governing the special situation of when the partner changes the allocation rate for the purpose of reducing 55) taxable income. So, there needs to be a special provision for preventing the reduction of taxable income by changing the allocation rate. As we saw in the above U.S. cases of partners changing their allocation rate, partners have a chance to avoid or reduce potential income tax through and share of inside basis. 52) Restriction of Special Taxation Act. §100-18. 53) A passive partner is a partner who has not participated in its management and two restrictions have to be kept by the Presidential Decree. Firsts, his name should not be used as a partnership name. Second, this kind of partner should not bear on unlimited liabilities. Restriction of Special Taxation Act. Presidential Decree §100-18. 54) The current act uses deficit instead of loss. Restriction of Special Taxation Act. §100-17. 55) Restriction of Special Taxation Act, Presidential Decree. §100-17. Presidential Decree only provides for general provision to prevent an unfair practice. 498 조세연구|제10—2집 the change of their allocation rate. It is ambiguous as how to the extent of those situations are respected when partners periodically change the allocation rate. Although those situations can be finally resolved by suit, it will be desirable to provide some specific guidelines to eliminate or reduce disputes previously in the process of enforcement. With respect to transactions between partnership and partner, the current act provides that partnership and its partner each should include income or loss in calculating tax liabilities if a partner makes a transaction 56) with the partnership as a third party. This position reflects entity theory. Unlikely to I.R.C., the current act does not divide transactions specifically. Instead, if a partnership or a partner understates the income dishonestly, this transaction may be cancelled. If a partner transfers partnership interest to the other person, income 57) from this transfer is treated as income from general stock transfer. This position comes from entity theory. When we calculate income from an interest transfer, the interest amount at the date of transfer becomes the basis. Ⅳ. Distribution 1. The legal attitude in I.R.C Theoretically, because a partnership is not taxable entity, all assets of the partnership are owned by each partner. This means that a partner 56) Restriction of Special Taxation Act. §100-19. 57) Restriction of Special Taxation Act. §100-22. Aggregate and Entity Approach in Partnership Taxation 499 doesn’t need to realize gain or loss even if the partnership distributes its assets to the partners. The Code basically adopts this logic. In the case of distribution, each partner related to distribution basically doesn’t need to 58) recognize gain or loss. However, there are some exceptions. First, if the amount of money received from distribution exceeds the partner’s outside basis, then that partner has to recognize gain. Furthermore, because distribution reduces the partner’s share of interest, constructive cash distribution also has to be recognized as gain. For example, distribution of marketable securities is 59) treated as cash distribution. Second, if the partner’s interest is changed by distribution of unrealized receivables and inventory items, the distribute 60) partneralso has to recognize gain or loss. Third, if any contributed property is distributed directly or indirectly within 7 years of being 61) contributed, the distributed partner also has to recognize gain or loss. To illustrate, consider following simple example. Example #5: A and B form a general partnership. A and B agree that all items are shared equally. After formation, the initial balance sheet is as follows: Asset Book FMV Cash $300 $300 Inventory $50 Land $150 $500 $800 58) I.R.C. §731(a). 59) I.R.C. §731(c). 60) I.R.C. §751(b). 61) I.R.C. §704(c)(1)(B). Capital Acc’t Book FMV $200 A $250 $400 $300 B $250 $400 $500 $800 500 조세연구|제10—2집 Situation 1: what happens if the partnership distributes all cash equally to each partner? No gain is recognized by each partner because the amount of cash distribution ($150) doesn’t exceed the partner’s outside basis ($250). There is also no effect on partnership. Due to cash distribution, the partner’s outside basis will be reduced to $100 each. Situation 2: What happens if the partnership distributes all cash of $300 to A and land to B? A has to recognize $50 gain because the amount of cash distribution ($300) exceeds A’s outside basis ($250). A’s outside basis is reduced to zero. B doesn’t need to recognize gain from the distribution of land because any gain is recognized only by cash distribution. B’s outside basis is reduced to $100. 2. The legal attitude in South Korea When a partnership distributes some assets to a partner, the current act provides that excess amount to be treated as a dividend if the market value of the asset exceeds the value of the partnership interest. This position is very similar to I.R.C. and it is a natural provision from the basic concept prospective of partnership taxation. However, the current act restricts the loss situation. The current act only allows two cases as a loss when the market value of the asset does not exceed the value of partnership interest. The first is when a partnership is liquidated by winding-up, merger or consolidation. The second is when a partner withdraws from the partnership. If a loss is permitted, this loss is treated Aggregate and Entity Approach in Partnership Taxation 501 as a loss from stock transfer. However, these restrictions are not fair provisions in comparison with gain situations. In case of a gain, all of the gain from all situations has to be included in computing taxable income. In contrast, loss from just two cases is acceptable. This provision is extremely favorable for tax administration. The current act is very easy in comparison with I.R.C. because the property contributed is tax at the time of contribution, and basis is move to the value of the time which is taxed. Maintaining original basis makes distribution process difficult. However, contribution should not be taxed at the time of contribution as I mentioned above. If we changed the current act, a lot of complicate problems would appear and similar provision like I.R.C. would be required. Ⅴ. Accounting Matters 1. The legal attitude in I.R.C. (1) Computing taxable income In this chapter, we also confirm that aggregate and entity theory are harmonious with each other. §701 is natural when we consider the essence of partnership taxation. It explains tax results between a partnership and its partners according to aggregate theory Partners not partnership shall be liable for income tax. However, when we specifically compute taxable income, Code adopts entity theory. Code provides that the taxable income of a partnership shall be computed in the same manner as in the case of 502 조세연구|제10—2집 62) an individual. This means that it needs to compute taxable income in a partnership level. There are a lot of tax items to affect all partners the same way. Ordinary income items and ordinary deduction items are mainly included in this category. These items generally produce ordinary income or ordinary loss. So, these items are recorded on page 1 of Form 1065 first, and then are passed through to partners according to allocation rate. However, there are some tax items to be considered in the partner’s 63) level. These items are referred as “separately stated items”. When we consider separately stated items, we get to know that aggregate and entity theory are combined together here. Each partner has each tax profile. Each partner has his own ordinary income or capital gain. Each partner has a different maximum tax rate. This is a basic characteristic of partnership taxation. Separately stated items are items that bring different results depending on the tax profile of each partner. So, those items are recorded first on Schedule K, and then recorded on Schedule K-1 according to the allocation rate of the partners. 62) I.R.C. §703(a). 63) I.R.C. §702(a). Separately stated items are as follows:(1) gains and losses from sales or exchanges of capital assets held for not more than 1 year(it means short term capital gain), (2) gains and losses from sales or exchanges of capital assets held for more than 1 year(it means long term capital gain), (3) gains and losses from sales or exchanges of property described in section 1231, (4) charitable contributions, (5) dividends with respect to section of “Dividends Received Deduction” and section constituting net capital gain, (6) taxes, described in section 901, paid or accrued to foreign countries and to possessions of the United States, (7) other items of income, gain, loss, deduction, or credit, to the extent provided by regulations prescribed by the Secretary, and (8) taxable income or loss, exclusive of items requiring separate computation under other paragraphs of this subsection. Aggregate and Entity Approach in Partnership Taxation 503 There is a specific item that belongs to both ordinary items and separately stated items. It is “guaranteed payment”. Guaranteed payment is the amount that a partnership pays to a partner for the service and the use 64) of capital without respect to the partnership’s income. Because this item belongs to both categories, it is recorded on page 1 of Form 1065 as if the partnership pays to someone who is not a partner, and then recorded on Schedule K and Schedule K-1 as ordinary income. This means that it is regarded as expense on the partnership’s level and ordinary income as on the partner’s level. Each partner who receives guaranteed payments reports these payments on Schedule E(Form 1040) as ordinary income. (2) Taxable year This section about taxable year of partnership reflects entity theory. The taxable year of a partnership is determined as though the partnership 65) were a taxpayer. A partnership has to follow the required taxable year 66) except when the partnership establishes an acceptable business purpose, 67) and it makes an §444 election. First, the partnership has to adopt “Majority interest taxable year”. Majority interest taxable year means the same taxable year used by that partner or partners when one or more partner has an aggregate interest in 64) I.R.C. §707(c). 65) I.R.C. §706(b)(1)(A). 66) I.R.C. §706(b)(1)(C). This business purpose is required for approval of the Secretary. 67) I.R.C. §444(b). A partnership may elect under §444 to use different taxable year from required taxable year only if the deferral period of the taxable year elected is not longer than 3 months. 504 조세연구|제10—2집 68) partnership profits and capital of more than 50 percent. If there is no majority interest taxable year, the partnership has to adopt the same taxable year of all principal partners if all principal partners share the 69) same taxable year. The principal partner is a partner owning an interest of 5 percent or more in partnership profits or capital. If there is no majority interest taxable year and principal partner’s taxable year, the partnership has to adopt taxable year which results in the “least aggregate 70) deferral of income”. To compute least aggregate deferral of income, Regulation requires testing each taxable year of all partners. After testing, the taxable year that results in the least aggregate deferral of income becomes the taxable year of the partnership. To illustrate, consider following simple example. Example #6: ABC is a partnership of which A, B and C are partners. Taxable year and profit allocation rate of A, B and C as follows: Partner Profits rate Year end A B C 40% 40% 20% 5/31 8/31 10/31 First, because no partner holds more than 50% and no combination of partners share the same year, there is no majority interest taxable year. Second, because A, B and C hold more than 5%, all are the principal partner. However, the partnership can’t adopt the principal partner’s taxable year because no partners share the taxable year. Third, to see the least aggregate deferral of income, we need to test each taxable year of 68) I.R.C. §706(b)(4). 69) I.R.C. §706(b)(1)(B)(ⅱ). 70) Reg. §1.706-1(b)(3) Aggregate and Entity Approach in Partnership Taxation 505 each partner. Assuming the adoption A’s 5/31 fiscal year Partner Year end Profits rate Months of deferral Rate × Deferral A B C 5/31 8/31 10/31 40% 40% 20% 0 3 5 0 1.2 1.0 71) Total 2.2 Assuming the adoption B’s 8/31 fiscal year Partner Year end Profits rate Months of deferral Rate × Deferral A B C 5/31 8/31 10/31 40% 40% 20% 9 0 2 3.6 0 0.4 72) Total 4.0 Assuming the adoption C’s 10/31 fiscal year Partner Year end Profits rate Months of deferral Rate × Deferral A B C 5/31 8/31 10/31 40% 40% 20% 7 10 0 2.8 4.0 0 73) Total 6.8 As we can see above, because adoption of 5/31 fiscal year results in the least aggregate deferral of income (2.2), the partnership has to adopt that taxable year ending 5/31. 71) This amount is calculated like this;(40% × 0) + (40% × 3) + (20% × 5) = 2.2 72) This amount is calculated like this;(40% × 9) + (40% × 0) + (20% × 2) = 4.0 73) This amount is calculated like this;(40% × 7) + (40% × 10) + (20% × 0) = 6.8 506 조세연구|제10—2집 2. The legal attitude in South Korea The current act also reflects entity theory when we compute a partnership’s income and aggregate theory when these incomes are allocated to its partners. It is a basic concept of partnership taxation. In case a partnership is not a type of corporation, this partnership is treated 74) as a single domestic corporation in many cases. It includes the taxable year, tax payment place, business registration, tax credits, abatement and exemption of tax amount, tax withholding, additional tax and transfer income of land. So, all accounting matters with a partnership are handled through the entity theory. It is acceptable to take this position for easy process for taxation. However, it is necessary to provide a special provision to prevent avoiding tax liabilities. For example, the current act, mutatis mutandis, uses a taxable year provision of the corporate tax act. It means the partnership may freely change the taxable year according to the corporate tax act. At the end, income or deficit is allocated to the partner according to the allocation rate at the end of year 75) in which the taxable year of the partnership firm ends. It gives partners opportunities to avoid or reduce income tax using a different income tax rate. So, there needs to be some provisions similar to a disapproval provision of an unfair practice. The current act also has those provisions partially, that is, under transactions between the partner ship and its partners 76) or under the provision that non-resident or foreign 74) Restriction of Special Taxation Act. §100-26. 75) Restriction of Special Taxation Act. §100-18. 76) Restriction of Special Taxation Act. §100-19. Aggregate and Entity Approach in Partnership Taxation 507 77) corporation partners receive a dividend. However, those provisions can’t be applied to all unfair practices. Although it is perfectly acceptable to enact specific provisions to prevent avoiding and reducing tax, it is an alternative to maintain that provision for a while because it will be specific and supplemented on the process of enforcement. Ⅵ. Conclusion I have reviewed basic sections and related regulations in four chapters formation, operation, distribution and accounting matters. Aggregate and entity theory are related to each other like a spider web. It is too much 78) to say that almost all sections are related to both theories. Throughout history, there was a time that the aggregate approach was the focus, or the entity approach was the focus. However, it is no more or no less for computing appropriate taxable income and loss. As I write above, partnership taxation was enacted and has been effective since 2009 in South Korea. However, because it doesn’t have enough provisions in Presidential Decree, It is expected that there will be in a lot of confusions in the enforcement. There will also be a need to revise current provisions in the near future. However, we don’t need to stick to a specific approach. As we review the four points above, focusing on entity or aggregate theory is not the important issue. The substance of partnership taxation is to give a taxpayer more discretion. So, Enactment 77) Restriction of Special Taxation Act. §100-24. 78) Bradley, supra n. 46, at 784. 508 조세연구|제10—2집 of any new provision should be done according to the direction that appreciates the substance of this system well, not focusing on either aggregate or entity approaches. Finally, I hope that the National Tax Service (NTS) will have a positive position in the new tax system. Partnership taxation may provide good alternatives to choose taxable entity with taxpayers. NTS needs to keep in mind that after decision of Internal Revenue Service(IRS) that LLC is taxed under partnership taxation, LLC has become a common type of taxable entity. Aggregate and Entity Approach in Partnership Taxation 509 |bibliography| Bittker, Boris I. & Eustice, James S., Federal Income Taxation of Corporations and Shareholders, WG & L. 2009. Borden, Bradley T., Aggregate-plus theory of partnership taxation, 43 GALR 717, 2009. Cunningham, Laura E. & Cunningham, Noel B., The Logic of Subchapter K., Thomson/west, 2006. Donaldson, Samuel A., Federal Income Taxation of Individual, Thomson/west. 2007. Gunn, Alan, & Repetti, James R., Partnership Income Taxation, Foundation Press. 2005. Kleinberger, Daniel S., Closely Held Business Through The Entity-Aggregate Prism, 40 WFLR 827, 2005. Lam, Edward W., The Treasury’s panacea against abusive partnership, 9 DPLBLJ 65, 1996. Lind, Stephen A., et al. Fundamentals of Business Enterprise Taxation, Foundation Press, 2008. _______________, et al. Fundamentals of Corporate Taxation, Foundation Press, 2008. _______________, et al. Fundamentals of Partnership Taxation. Foundation Press, 2008. Staffaroni, Robert J., Partnership:Aggrgate vs. Entity and U.S. International Taxation, 49 TAXL 55, 1995. White, Matthew K., New tension between entity and aggregate theories of partnership taxation, 3 No. 3 BUSNET 14, 2001. 510 조세연구|제10—2집 국문요약 조합과세제도에서의 집합론과 단체론 미국의 과세제도는 크게 C corporation에 대한 과세, partnership에 대한 과세, 그리고 개인에 대한 과세로 나누어볼 수 있다. S corporation과 최근에 유행하고 있는 LLC도 약간의 차이는 있지만 기본적으로 파트너십 과세제도를 이용하고 있 기 때문에 널리 이용되고 있다. 파트너십 과세제도는 비록 조항 수는 36개 조밖에 되지 않지만, Regulation은 250여 페이지에 달하기 때문에, 적용시에 많은 어려움 이 있는 제도이다. 파트너십 과세제도는 크게 두 가지 이론, 즉 집합론과 단체론에 의해서 구성된 다. 집합론은 파트너십이 파트너들의 합일체에 불과하다는 이론으로서 결국적으 로 파트너 개인이 종국적인 납부 책임을 지게 된다. 이에 반해 단체론은 파트너십 이 파트너와는 별개의 단체로서 존재한다는 이론이다. 파트너십 과세제도는 개념 적으로 집합론에 근거한 과제제도라고 할 수 있다. 그러나 집합론 자체만으로는 적절한 과세체계를 확립하기가 어렵기 때문에 현실적으로 단체론에 근거한 규정 들이 상당수 혼재되어 있다. 따라서 이러한 집합론과 단체론의 관점에서 파트너십 과세제도를 바라보는 것은 그 자체로도 파트너십 과세제도를 이해하는 데 도움이 될 뿐만 아니라, 개별 사항에 대해 이를 입법적으로 어떻게 규율할 것인지를 판단 하는 데에도 많은 도움이 된다. 특히 우리나라의 경우 조세특례제한법에서 “동일기업에 대한 과세특례”라는 제 목하에 파트너십 과세제도를 도입하여 2009년부터 시행하고 있다. 따라서 집합론 과 단체론의 관점에서 파트너십 과세제도를 횡적으로 고찰해 보는 것도 이 시점에 서 의미있는 일이라 생각된다. 따라서 본 논문에서는 미국과 한국의 파트너십 과세제도를 설립, 운영 및 분배 와 회계문제로 나누어서, 각 부문에서 집합론과 단체론이 어떻게 영향을 미치고 있는지 살펴보고자 한다. 주제어: 파트너십 과세제도, 조합과세제도, 집합론, 단체론, 동일기업