SIMPLIFYING

DAILY BANKING

YOUR BUSINESS IS TURNING WASTE INTO WATTS.

OURS IS GENERATING THE FUNDS.

Shanks Group plc specialises in innovative waste management. We issued a £57,5m

guarantee that is helping them realise a new waste-to-energy project in the UK.

That’s how we’re supporting sustainable business.

www.ingcb.com

USOF_97396_TMI_November_ING_CB.indd 1

10/21/13 11:37 AM

TMI221 ING RP P1 Contents_Contents_Germany 05.qxp 09/12/2013 09:13 Page 1

SIMPLIFYING

DAILY BANKING

SIMPLIFYING

DAILY BANKING

Published by

Contents

Treasury Management International Ltd

Waney Edge Barn, Foxhill Lane, Playhatch,

Reading RG4 9QF, UK

Tel: +44 (0)118 947 8057

Fax: +44 (0)118 947 8062

2

e-mail: tmi@treasury-management.com

Internet: www.treasury-management.com

Helen Sanders

Editor

Commissioning Editor

Copy Editor

Caroline Karwowska

Robin Page

Publisher’s Assistant

Sam Clarke

Design & Production

Glen Orford

Head of Digital Development

Webmaster

Robin Page, Chief Executive, TMI

3

Elizabeth Hennessy

CEO & Publisher

A True Partner Bank

ING’s success in Central and Eastern

Europe

Andre Rijs, Global Head of Sales Transaction Services US, CEE, UK,

ING

5

Harry Edwards

Fluor Corporation Optimises Cash

Management in Europe

Martin Blom, Finance Director, and Arno van Slooten, Manager

Accounts Payable, Fluor B.V.

Richard Benwell

Printed in England by Micropress Printers

© 2013 P4 Publishing Ltd

Registered in England and Wales No. 05838515

TMI-TREASURY MANAGEMENT INTERNATIONAL, ISSN 0967-523X,

is published monthly (except July and December) by P4 Publishing

Ltd, Waney Edge Barn, Foxhill Lane, Playhatch, Reading RG4 9QF,

UK. The 2013 US annual subscription price is $400.00. Airfreight

and mailing in the USA by agent named Air Business Ltd, c/o

Worldnet Shipping Inc., 156-15, 146th Avenue, 2nd Floor, Jamaica,

NY 11434, USA. Periodicals postage paid at Jamaica NY 11431. US

Postmaster: Send address changes to TMI-TREASURY MANAGEMENT INTERNATIONAL, Air Business Ltd, c/o Worldnet Shipping

Inc., 156-15, 146th Avenue, 2nd Floor, Jamaica, NY 11434, USA.

Subscription records are maintained at Waney Edge Barn, Foxhill

Lane, Playhatch, Reading RG4 9QF, UK. Air Business Ltd is acting as

our mailing agent. While all reasonable care has been taken to

ensure the accuracy of the publication, the publishers cannot

accept responsibility for any errors or omissions.

All rights reserved. No paragraph or other part of this publication

may be reproduced or transmitted in any form by any means,

including photocopying and recording, without the written permission of P4 Publishing Ltd or in accordance with the provisions

of the Copyright Act 1988 (as amended). Such written permission

must also be obtained before any paragraph or other part of this

publication is stored in a retrieval system of any kind.

Subscription enquiries

Sam Clarke, TMI

Telephone: +44 (0)118 947 8057

Fax: +44 (0)118 947 8062

sclarke@treasury-management.com

TMI

|

www.treasury-management.com

8

Leveraging Innovation to Support a

Fast-growing Organisation

John Colleemallay, Senior Director, Group Treasury & Financing,

Dassault Systèmes

12

Innovation and Precision in Managing

International Project Risks

Bert van der Donk, Treasury & Risk Manager, NEM Energy B.V.

15

Addressing Cash Management Complexity

in Turkey through a One Bank Strategy

Jennifer Tan Sue Een, Treasury Manager, Europe & Africa and Mario

Del Natale, Director Treasury Operations, Systems & Applications,

Johnson Controls

1

TMI221 ING RP Intro_Layout 1 09/12/2013 09:19 Page 2

insight

A True Partner Bank

by Robin Page, Chief Executive, TMI

W

e are delighted to produce this

booklet in partnership with ING,

with whom TMI has a longstanding and valued relationship. With its

extensive footprint across 28 countries in

Europe plus a global network, ING combines

local expertise with integrated pan-European

capabilities to deliver a range of solutions

required by companies as they expand

internationally. One key aspect of its work is

Robin Page

its emphasis on the simplicity of banking

business – it recognises that commercial

business is complex and challenging but believes strongly

that ING should provide consistent solutions, reporting

capabilities and banking channels for its clients. It is also

streamlining its implementation approach and simplifying

documentation.

A key aspect

of ING’s

approach is

its emphasis

on the

simplicity of

banking

business.

2

All this points to a culture of partnership hardwired into the

bank, and this booklet provides some interesting examples of

partnership in practice. The article by Martin Blom and Arno van

Slooten describes how their company, the leading global

engineering and construction company Fluor enjoys a successful

relationship with ING and close co-operation with ING’s

subsidiary Bank Mendes Gans (BMG). Together they have put in

place a notional cash pool and implemented a payments hub

which channels payment files through SWIFT. Rick van

Doggenaar of ING’s Transaction Services notes how the bank has

supported Fluor throughout the past seven years.

Also headquartered in the Netherlands is NEM Energy, a global

leader in heat recovery steam generators and associated

equipment, whose Treasury and Risk Manager Bert van der Donk

discusses how the company uses trade instruments in

combination with other approaches to help manage collections

risk that derives from both individual consumer credit risk and

wider political risk. Outlining the firm’s partnership with its bank,

ING’s Jean Bonnet says that the two have enjoyed a relationship

extending for more than a decade, and points out that an

important part of ING’s service offering is to “offer solutions

that meet the individual cash and risk management needs of

each of our customers and the projects in which they are

engaged, fulfilling the role of a true partner bank”.

The impact on the company of its recent geographic expansion

and financial process optimisation, including establishing

regional shared service centres, is the subject of the article by

Jennifer Tan Sue Een and Mario del Natale of Johnson Controls.

Their company works with ING and BMG in

Turkey as well as many other countries in EMEA,

where the bank provides domestic as well as

international cash and treasury management

services: Rick van Doggenaar of ING points out

that the strength of the relationship between

Johnson Controls and ING is “largely based on

the close alignment between the two parties at

both a local and regional (treasury) and HQ

level, and effective communication”.

John Colleemallay of Dassault Systémes, a

world leader in 3D design software, describes

how his firm has experienced enormous growth since the

company was founded in 1991, with a “culture of dynamism and

innovation inherent across the entire business, not least in

treasury”. He itemises some of the most recent innovations,

including rationalising cash management, implementing global

multi-currency cash pooling and process and technology

harmonisation. These have all been achieved in partnership with

Bank Mendes Gans, whose Managing Director Cash Management,

Saskia van Nes, adds that centralising cash has become a priority

for organisations of all sizes, whether or not their objectives are

to reduce the need for external funding or optimise the return

on cash, with the result that a growing number of companies,

like Dassault Systémes, are approaching BMG to implement a

multi-currency cash pooling solution.

This bank-wide emphasis on partnership has, unsurprisingly,

resulted in ING being chosen for one of TMI’s 2013 Awards for

Innovation and Excellence, in this case for Best Cash

Management in Eastern Europe (for the second consecutive

year). Andre Rijs, Global Head of Sales for ING’s Transaction

Services in CEE, UK and US, gives a bird’s eye view of the

financial and economic conditions in Central and Eastern Europe,

which as he points out has weathered the financial and

economic crisis better than Western Europe, with significantly

lower levels of government debt. Rijs expresses the particular

pleasure taken by ING in this award ”as we know our clients

have given us this accolade”. The bank’s knowledge and

understanding of local market conditions and developments

allow it to take a proactive approach to the challenges facing its

clients, and he details the significant changes made in July 2013

to the way it provides transaction services; “instead of individual

product teams, we now adopt a holistic approach to our clients’

needs through transaction banking consultants who can deal

with multiple product areas and find the most appropriate

solution”. ■

TMI

|

www.treasury-management.com

TMI221 ING_Layout 1 09/12/2013 09:20 Page 3

insight

3

ING’s Success in Central

and Eastern Europe

by Andre Rijs, Global Head of Sales Transaction Services US, UK, C&EE,

ING Commercial Banking

M

ultinational companies often divide the world into

distinct regions for payments and cash management

in order to maximise efficiency and minimise costs.

These regions are determined not only by geography but also,

to a certain extent, by shared characteristics. As a result

Central and Eastern Europe (CEE) is often treated as a separate

region in Europe. The irony is that CEE is an incredibly diverse

region. And that makes it so interesting.

TMI

|

www.treasury-management.com

Since 2008 CEE has weathered the financial and economic crisis

better than Western Europe, with significantly lower levels of

government debt. Weak growth in much of the developed world

is prompting multinationals to seek new growth opportunities

and markets with increasing demand and high margins. Many

countries in CEE – most notably Turkey with its rapid growth rate

and strong demographics – fit that description perfectly.

Conditions continue to improve in the region from a payments

3

TMI221 ING_Layout 1 09/12/2013 09:20 Page 4

insight

and cash management perspective. Some

countries, such as Poland, have reached a

stage in their development where they

are largely indistinguishable from

Western European countries in terms of

their financial market infrastructure and

operating environment. Nevertheless the

markets in the region remain challenging.

Broadly speaking the further east one

travels the more complex payments and

cash management becomes. In Ukraine,

for example, interest rates are extremely

volatile and the country’s regulatory

environment is closed. Consequently

multinational companies seeking to

operate in CEE must be flexible in the

way they approach this diverse region

that spans open, euro-denominated

economies as well as closed economies

with currency controls. For corporates

that operate in multiple CEE markets it is

therefore essential to work with a bank

that has on-the-ground knowledge and

expertise of relevant market and

regulatory conditions.

We are therefore delighted to receive

the TMI award for Best Bank Cash

Management Eastern Europe for the

second consecutive year, particularly as

we know that our clients have given us

this accolade. We also see it as

recognition of ING’s history of expertise

in this market and our commitment to

the region. We are proud to say that we

have been an integral part of the banking

industry in CEE since the late 1980s with

our presence in the nine most important

markets in this growing region. This

presence extends beyond payments and

cash management to a full-service

commercial banking operation. In Poland,

for example, ING operates a full network

4

with 300 branches. Our knowledge and

understanding of local market conditions

and developments enable us to take a

proactive approach to the challenges

facing our clients. An example of this is

Hungary, where ING informed its clients

in a timely manner about the

implications of the introduction of

transaction tax.

We have invested heavily in solutions

including electronic cash vaults that

allow cash collections to be posted to

company accounts on the day of

collection (i.e., before physical delivery to

the bank) by installing deposit machines

on the clients’ premises. ING has also

introduced virtual accounts that allow

companies such as utilities to create

virtual accounts for their customers so

that payments are easy to reconcile.

In every market we operate ING

behaves and acts as both a local and

international bank, combining the

benefits of flexibility and standardisation.

That means that ING can provide all local

products and services, such as domestic

payment instruments. However, we also

offer all our products and services with

standard international terms and

conditions, making it easy for our clients

to manage their relationship with us

while providing service and customer

support in an internationally consistent

way to give our clients the control and

visibility they need across multiple

countries. And we can also connect the

solutions we provide in CEE to any global

solution in Asia, the US or anywhere else

where our international clients do

business.

In July 2013 we changed the way we

provide transaction services to better

reflect how our clients operate. Instead

of individual product teams, we now

adopt a holistic approach to clients’

needs through transaction banking

consultants who can deal with multiple

product areas and find the most

appropriate solution. The integration of

payments and cash management with

working capital solutions and trade

finance services (including supply chain

finance, traditional trade finance

products such as letters of credit, and

the ability to access independent trade

finance platforms) is not only aligned

with how corporate treasuries are

organised but also ensures that solutions

are structured to optimise efficiency,

maximise benefits, reduce risks and

lower costs. ■

www.ingcb.com

André Rijs

Global Head of Sales

Transaction Services C&EE

USA and UK, ING

André has over 15 years’ experience

in banking, having joined ING in

1997. After working for Nissan

Europe for four years he started at ING Bank

International Securities Lending and moved via

Bank Mendes Gans to ING Central & Eastern Europe as a

senior product manager. Subsequently he joined

Payments & Cash Management Product Sales in

Amsterdam and is currently responsible as Global Head

of Sales Transaction Services, for Central and Eastern

Europe, the USA and the UK.

TMI

|

www.treasury-management.com

TMI221 ING RP Art2_Layout 1 09/12/2013 09:21 Page 5

insight

Fluor Corporation

Optimises Cash

Management

in Europe

by Martin Blom, Finance Director, and Arno van Slooten,

Manager Accounts Payable, Fluor B.V.

A

s a leading global engineering and construction

company, Fluor has had a long-standing presence in

Europe. The Netherlands office was established in

1946 and acquired by Fluor in 1959. Managing cash and risk

is a key treasury responsibility. In cooperation with its US

headquarters, the Netherlands treasury group is responsible

for over 20 legal entities and branches across mainland

Europe. This article outlines Fluor’s successful relationship

with partner bank ING, which has resulted in considerable

financial and operational efficiencies through a series of

transformational initiatives including notional cash pooling

and a SWIFT based payments hub.

A partner in business

At ING, we

have been a

proud

partner for

Fluor for the

past seven

years.

TMI

|

According to Martin Blom: “We have a large multi-currency

credit facility in the United States and typically, we try and offer

our ancillary banking business to the banks that participate in

this facility wherever possible. As a result of our financing

relationship, we evaluated ING’s cash management services in

Europe to understand synergies between the organisations. We

were very satisfied with the solutions and services that ING

offered, and appointed the bank in 2006 for European cash

management services. This relationship has progressed very

successfully both in terms of day-to-day banking and

transformation initiatives that we have undertaken together.

“Our treasury centre in the Netherlands has responsibility for

cash and treasury management activities in mainland Europe.

We have set up entities in each country in which we operate,

each of which needs its own bank account for supplier and

employee payments. We use SAP for cash management and

accounting and produce batch payments files which are

www.treasury-management.com

“At ING, we have been a proud partner for Fluor both in

Europe and globally for the past seven years. ING

recognise the importance of delivering solutions that

meet Fluor’s needs precisely, a disciplined project approach

and a commitment to offering added value in all aspects

of our relationship. Consequently, we have been able to

support Fluor’s day to day payment and cash management

needs, but also its transformation projects in areas such as

innovative notional cash pooling and centralised

payments processing, therefore enabling both its

operational and financial efficiency objectives.”

Rick van Doggenaar, Regional Manager

– Corporate Sales US, Transaction Services, ING

5

TMI221 ING RP Art2_Layout 1 09/12/2013 09:21 Page 6

We first

implemented

the cash pool

in the

Netherlands

and have

rolled it out

to over 40

legal entities

and

branches.

Fluor Corporation

Fluor Corporation is one of the world’s largest publicly traded engineering, procurement, construction management (EPCM)

companies. Over the past century, Fluor has become a trusted global business leader by providing exceptional services and

technical knowledge across every phase of a project. Fluor design, build, and maintain many of the world’s most complex

and challenging capital projects, working with governments and multinational companies across a wide variety of

traditional and evolving industries worldwide, including chemicals and petrochemicals; commercial and institutional;

government services; health-care; life sciences; manufacturing; microelectronics; mining; oil and gas; power; renewable

energy; telecommunications; and transportation infrastructure.

Fluor has 41,000 employees across a network of offices in more than 30 countries across six continents. In 2012, Fluor

generated revenues of $27.6bn, with a five-year annual revenue growth rate of more than 10.5%.

forwarded to ING. We have a local multiused facility with ING in the Netherlands

to allow occasional overdrafts, but

primarily to allow ING to provide bank

guarantees. Typically we give guarantees

to customers for advance payments or

performance

guarantees.

Smaller

guarantees (e.g., under €2m) are issued

within this facility, although specific

credit lines are set up for larger ones,

supported with a parent company

guarantee.”

6

Cash pooling and

intercompany netting

In addition to our daily banking and

guarantee requirements, our close cooperation with ING also includes its

subsidiary bank, Bank Mendes Gans (BMG).

By working with BMG, we were able to

implement a global notional cash pool to

improve liquidity and risk management

monitoring. We first implemented the cash

pool in the Netherlands and have

TMI

|

subsequently rolled it out to more than 40

legal entities and branches across the

world, while the number of participants is

still growing. As we had hoped, this has

proved a very effective liquidity

management tool. A challenge that we

had always experienced in the past is that

profits are generated and maintained

within each entity. We only centralise this

cash to issue dividends when it is costeffective to do so, which may be every six

to seven years, and cash remains with the

www.treasury-management.com

TMI221 ING RP Art2_Layout 1 09/12/2013 09:21 Page 7

insight

local entities in the meantime. Before

implementing the BMG notional cash pool,

this cash was effectively ‘trapped’ in each

country, offering no value to the wider

enterprise. We have implemented cash

concentration in some cases too, so the

combination of physical and notional

pooling enables us to manage both our

liquidity

and

risk

management

requirements effectively.

Having put in place the BMG notional

cash pool, we have also been able to

introduce an intercompany netting solution

to settle intercompany invoices costeffectively and automate the production of

the resulting account postings. It is

important to settle intercompany invoices

regularly to avoid these amounts being

treated as loans for tax purposes.

Payment factory and SWIFT

Although we need to make payments to

suppliers, government authorities and

employees in each country in which we do

business, we recognised the importance of

consistent processes, controls and bank

communication. We therefore decided to

implement a payments system that would

continue to enable local payments

execution whilst i) harmonising formats

based on ISO 20022 standards, and ii)

channeling payment files through a single

bank-neutral channel, for which we selected

SWIFT.

We piloted the project with ING initially

and have subsequently approached our local

banks to roll out the payments hub. Our

banking partners have been very supportive

of our harmonisation and standardisation

objectives and are willing to accept the ISO

20022 format. Implementing a payments

hub will deliver a number of efficiencies

including:

●

●

●

Our cost and maintenance efforts will be

reduced as a result of replacing local

banking systems with SWIFT;

Similarly, we no longer need to maintain

interfaces of each local banking system

and instead, we have a single interface to

SWIFT which is managed by our service

bureau;

As SWIFT is a bank-neutral

communication channel, we can add or

change our payment banks without

changing our payments or connectivity

infrastructure.

In addition to cost and efficiency

advantages, we will achieve more consistent

controls as separate user rights and profiles

no longer need to be set up in each banking

system. With a more streamlined

environment, and with the support of a

specialised service bureau, it is also easier to

concentrate expertise and to pinpoint and

resolve problems.

We were already using SWIFT AllianceLite,

but we now have a full implementation

underway with our service bureau partner.

We expect to have completed our payments

hub and SWIFT project by the end of 2013.

rationalise our bank accounts. We currently

have more than 900 accounts across

multiple banks globally which leads to

considerable challenges in managing

permissions, and establishing consistent

controls over account opening and closing.

Once we have reviewed and rationalised

our account structure, we will be able to

consider more efficient means of bank

account management.

We expect to

have

completed

our

payments

hub and

A positive partnership

We were early adopters of electronic

banking solutions, having implemented

first generation electronic banking tools in

the Netherlands in the early 1990s. The

implementation of SWIFT as a key element

of our payments hub is an important new

step in this journey to achieving highly

efficient, automated payments and cash

management and industry best practices.

Working with ING has facilitated this

progression whilst also enabling our wider

cash and treasury management objectives

with efficient day-to-day banking and

cash pooling structures that meet our cash,

liquidity and risk management needs. ■

SWIFT

project by

the end of

2013.

Arno van Slooten

Future developments

In the long term, we may develop our

payments hub further by centralising

payments execution as part of a wider

Fluor strategy to expand the range of

functions currently supported through our

Global execution centres in India, Poland

and Philippines.

We are also embarking on a project to

Manager Accounts Payable,

Fluor B.V.

Arno joined Fluor in 1976 and is

based in Fluor’s Haarlem office.

Arno has a long career across a wide

range of finance activities. He has

been a pioneer of integrated solutions between Fluor

and bank systems ever since the early 1990s. Before his

current appointment, his role as SAP country

implementation manager involved projects in Poland,

the Czech Republic, several locations in Russia,

Kazakhstan, Belgium and Spain.

Rick van Doggenaar

Regional Manager Corporate Sales US,

Transaction Services, ING

Martin Blom

Finance Director, Fluor B.V.

Rick started his career as account manager for ING’s

corporate clients in The Netherlands in 2008. In February

2012, he decided to join the Payment and Cash

Management US Team. In this role, he is the single point

of contact for US corporates and responsible for addressing their payments

and cash management-related challenges across the entire ING network.

Rick has a vast knowledge of the European corporate banking

environments. Over the years, he created an extensive network within ING

to ensure excellent service and perfect execution for his clients.

TMI

|

www.treasury-management.com

Martin started his career in

management reporting at Ford Motor

Company and General Mills before

joining Fluor in 1983. He is based in

Fluor’s Haarlem office and

responsible for the Dutch finance operations including

treasury for over 20 entities and branches throughout

mainland Europe.

7

TMI221 ING RP Art3_Layout 1 09/12/2013 09:22 Page 8

Courtesy of ISD Valenciennes

Leveraging Innovation

to Support a Fastgrowing Organisation

by John Colleemallay, Senior Director, Group Treasury & Financing, Dassault Systèmes

D

8

assault Systèmes (DS) is a fast-growing innovator, and

has experienced a doubling in revenues to over €2bn

in the six years between 2006-2012. Treasury has had

a major role in DS’ achievements so far, and is critical to

delivering on its strategic vision of the future. DS’ financial

position differs from many organisations in that it has zero

TMI

|

www.treasury-management.com

TMI221 ING RP Art3_Layout 1 09/12/2013 09:22 Page 9

insight

net debt. However, centralising cash

balances and enhancing the efficiency

and automation of processes across the

business is no less important. By

optimising the use of cash, funding

working capital requirements without

the need for external borrowing and

reducing costs, treasury is helping DS to

invest in new technologies and

innovation that will drive growth and

further increase customer satisfaction.

This article outlines some of the recent

initiatives on which treasury has

embarked and how these contribute to

DS’ strategic vision.

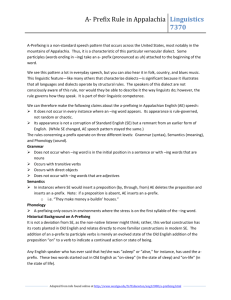

Figure 1 - Multicurrency global cash pooling with BMG

TREASURY

REA

ASU

BMG Pooling Structure

●

●

●

●

●

●

Treasury is organised regionally, with

common processes, policies and

systems;

We have reviewed our bank

relationships and connectivity globally

to ensure rapid, secure access to our

cash assets;

We have an active risk management

programme with constant monitoring

of our market and credit risks;

We have reviewed our corporate legal

structure with a view to promoting

simplification and transparency;

We have centralised and harmonised

core processes such as payments on a

global basis;

We have been early adopters and

champions of technology such as XML,

SWIFT and 3SKey to promote and

enhance standardisation and security

across our treasury processes globally.

On DS Japan account

at BMG (notional case)

USD

Local USD Pooling:

Surplus USD locally

DS USA

Account

EUR

JPY

On DS SA account

at BMG (ZBA case)

Treasury at Dassault

Systèmes

We have experienced enormous growth

at DS since the company was founded in

1981, to become the world’s leading 3D

software design company. This culture of

dynamism and innovation is inherent

across the entire business, not least in

treasury. We have a small but highly

focused team that aims to embrace and

pioneer the latest developments in cash,

treasury and risk management, and

leverage integrated, secure technology to

enhance performance and efficiency.

These objectives influence not only the

way in which we have organised the

department, but also in the projects on

which we embark. For example,

Investment

Funding

Daily Conversion

at ECB Fixing rate

BMG

Account

DS US Bank

DS Japan

Account

BMG

Account

Local JPY Pooling :

JPY funding from

BMG

DS Japan Bank

Source: Dassault Systèmes

has been a significant contributor to the

successful integration of a number of

major acquisitions realised over the last

six years, allowing us to double our

revenue and position the business for

future growth.

Phase 1: Rationalising cash

management banks

In such a fast-growing global

organisation, managing cash efficiently is

a major priority for DS. We therefore

sought to improve the visibility of our

cash, ensure rapid, secure access, and

maximise the value of cash assets

globally. The first phase of this project

was to rationalise our bank relationships.

One of the results of such rapid

international

growth

was

the

proliferation of banks and accounts, with

at least 83 bank relationships in place

across our three core regions: Europe,

North America and Asia. We made the

decision to reduce this number to four

banks.

We issued a request for proposal (RFP)

to a number of respected international

banks with the solutions, credit quality

and geographic reach that we were

seeking. A key criterion for our decision

was bank communication. When

rationalising our banking partners, we

wanted to implement a single, bankneutral connectivity channel that is

integrated

with

our

treasury

management system (SWIFT integrated

with Kyriba) as opposed to installing

multiple proprietary systems. This would

permit greater efficiency and more

We have an

active risk

management

programme

with

constant

monitoring

of

our market

and credit

risks.

Dassault Systèmes

Founded in 1981, Dassault Systèmes (DS), is the world leader in 3D design

software. 11,000 employees serve more than 170,000 customers across 140

countries and 12 industries worldwide, ranging from Transportation &

Mobility, Aerospace & Defense to Natural Resources.

Dassault Systèmes’ pioneering technology, the 3DExperience platform,

enables customers to be faster and more innovative in their development,

and to do business on the Cloud. The Cloud is more than an infrastructure

or a delivery mechanism: it is a new way of working. It is where consumers

voice their needs, ideas and feedback. It is where innovation takes place.

With the 3DExperience platform, DS reveals and delivers that potential.

As a result of these initiatives, treasury

TMI

|

www.treasury-management.com

9

TMI221 ING RP Art3_Layout 1 09/12/2013 09:22 Page 10

with balances denominated in foreign

currencies translated at the European

Central Bank daily fixing rate. The

balance on this header account is then

itself swept to our central Euro account

in Paris on a daily basis, where all our

cash investments are done. Each foreign

currency is then revalued the following

day and any adjustments made.

Figure 2 - Treasury technology infrastructure

Phase 3: Process and

technology harmonisation

Source: Dassault Systèmes

We had

Kyriba

already in

place

as our TMS,

which we

integrated

with

SWIFT to

replace the

various

proprietary

bank systems

that we had

consistent security in the short term, and

greater independence in our choice of

banks in the future; however, not all

banks could satisfy this requirement.

This project took around two years,

but these four banks now cover 99% of

our cash flows, with the remaining 1%

handled through local banks for

regulatory reasons. As a result of

rationalising our banking relationships

and reduced the number of accounts, we

were in a better position to centralise our

cash balances. Using the example of

Europe, each entity has an account in

each relevant country. These are zerobalanced into a non-resident euro

account per country held by Dassault

Systèmes S.A. These balances are in turn

transferred to an account in France. We

now have cash pools in USD, EUR and

JPY, our three major currencies, with

header accounts in each relevant region.

used in the

past.

Phase 2: Global multicurrency cash pooling

While this arrangement successfully

addressed the challenge of centralising

cash for each currency, within each bank,

we wanted to extend our cash pooling

concept further to centralise cash held

with each of our banks and in all

currencies that could then be managed

by our headquarters in Paris. This would

enable us to reduce FX risk, leverage our

10

cash assets more effectively and optimise

cash investment. We reviewed a number

of alternatives but ultimately decided to

appoint Bank Mendes Gans (BMG), part

of the ING Group, to implement a multicurrency, multi-bank cash pool. BMG was

the only bank that was able to offer daily

pooling across all currencies, which was

more cost-effective and efficient than

members of our treasury team

transacting multiple FX swaps with the

banks to reduce our FX exposure (figure

1). The header account, denominated in

euro, is based in Amsterdam, Netherlands,

The third project phase has been to

standardise and optimise our treasury

processes. We had Kyriba already in place

as our TMS, which we integrated with

SWIFT to replace the various proprietary

bank systems that we had used in the

past. In addition, a global ERP

(Peoplesoft) rollout was taking place in

parallel with our treasury project, which

we also integrated into our treasury

technology infrastructure to streamline

transaction and information flows,

therefore creating a complete ‘no touch’

straight-through process.

There were two important elements to

this phase of the project in addition to

SWIFT:

Firstly, while SWIFT enabled us to

communicate with our banks through a

single channel, we also wanted to use a

single format. We implemented XML ISO

20022 to achieve this. As we were an

early adopter of this format, which is also

the format used for SEPA payment

instruments, we were one of the first

“Centralising cash has become a priority for organisations of all sizes, whether or

not their objectives are to reduce the need for external funding or optimise the

return on cash. For global corporations in particular, this can be very challenging

given the range of currencies and banking relationships involved and diverse

regulatory environments. Consequently, a growing number of companies are

approaching Bank Mendes Gans (BMG) an independently operating subsidiary of

ING, to implement a multi-currency multi-bank overlay global cash pooling

solution.

ING Commercial Banking together with Bank Mendes Gans (BMG) create robust

liquidity management structures, both globally and locally, that are designed and

implemented according to each customer’s needs. Having developed and delivered

its unique global cash pooling solutions, netting and cash visibility solutions over

many years, BMG has the experience, technology, and local, regional and global

expertise to enable customers to reduce their FX risks and maximise visibility and

control over their cash worldwide.”

Saskia van Nes, Managing Director, Cash Management, Bank Mendes Gans

TMI

|

www.treasury-management.com

TMI221 ING RP Art3_Layout 1 09/12/2013 09:22 Page 11

insight

corporations to comply with SEPA,

significantly ahead of the February 2014

end date.

Secondly, in the past, each electronic

banking system had its own security

protocols and devices which was

inconvenient bearing in mind the large

number of systems involved. While

implementing SWIFT enabled us to

rationalise the number of systems, we

also wanted to add personal digital

signatures to financial messages as we

had done previously, but using a single

device. We recognised that SWIFT’s 3SKey

solution, which is supported by our

banks, would facilitate this requirement

(figure 2).

A far-reaching impact

The benefits of this new infrastructure

have been substantial and far-reaching.

Not only have we rationalised our

technology infrastructure, standardised

and secured processes, but we have also

been in a position to implement a

payments

factory.

DS’

Finance

department has established shared

service centres (SSCs) in United States

(for North America) and 3 SSCs in Europe

(France, Germany and UK) with payment

factories located in each one. In each

case, all payments for the relevant region

are now channeled through the SSC and

therefore through our new technology

infrastructure. 3SKey has been an

essential element in achieving this by

increasing trust across the business and

enabling a consistent approach to bestpractice transaction security.

We have also enhanced our technology

infrastructure with ancillary services such

as Misys for confirmation matching and

360T for online transaction execution,

further enriching the degree of

automation and efficiency that we have

achieved. Looking forward, it is our

intention to extend our infrastructure to

include eBAM (electronic bank account

management) with 3SKey. Currently,

banks are able to offer bank account

management services through their

proprietary systems, but not yet through

SWIFT and/ or with 3SKey.

Project outcomes

Our project has been a remarkable

success. Not only has treasury

contributed significantly to growth in

recent years but we have also helped

position the company for future success.

One of our core business assets for DS is

cash, 97% of which is now centralised

and invested securely. Our cash

management infrastructure is robust,

Saskia van Nes

Managing Director, Cash Management,

Bank Mendes Gans

Saskia van Nes, managing director Central Western

Europe, has been working for BMG for more than 15

years. Since 2005 she has been responsible for the

French, Italian and Spanish markets.

Before joining BMG, Saskia was employed in ING’s dealing room. She

has a legal background and has lived and worked internationally; she is

now based in France.

John Colleemallay

Senior Director, Group Treasury & Financing,

Dassault Systèmes

John Colleemallay joined DS six years ago. Previously he

was Group Treasurer for the leading French publishing

group, Editis, and before that he was Treasurer of the

Remy Cointreau group, a leading company in the

beverages sector.

TMI

|

www.treasury-management.com

transparent and meets our current and

future need for optimal cash and liquidity

management. Similarly, by implementing

best-in-class

treasury

technology,

supported with industry-preferred

standards and security, we been able to

enhance efficiency, control and costeffectiveness both within treasury and

for centralised payments processing by

our SSCs. This allows both greater process

automation and control but also enables

better visibility and control over working

capital.

Delivering success

The success of a project of this scale,

complexity and diversity of stakeholders

is by no means guaranteed and requires

considerable effort, commitment,

project discipline and a shared global

vision, not only within DS but also

amongst our external partners, such as

banks and vendors. We selected these

partners carefully and worked closely

together to share experiences and

insights and develop common objectives.

Inevitably, however, there were some

challenges to overcome. In particular, it

was important to work with business

units to articulate and convince them of

the benefits of rationalising bank

relationships and centralising cash, both

at a local and headquarters level. It was

challenging, for example, to explain that

cash would still ‘belong’ to them, but

that the cost of borrowing would be

reduced, and return on investment

increased.

We achieved this by visiting business

units and spending time with local

finance executives to understand their

concerns and explain the concept in

detail. By rolling out a single, global

technology infrastructure, each business

unit had access to their own

intercompany account, ensuring that

they maintained visibility and control

over cash information, supported by a

very high quality of service. This process

of education, trust and transparency was

essential to the success of the project as

business

units

were

naturally

apprehensive about a potential loss of

control. Today, however, we have

common platforms, an efficient means of

centralising cash and a successful

outcome across the organisation as a

whole. ■

Not only has

treasury

contributed

significantly

to growth in

recent years

but

we have also

helped

position the

company

for future

success.

11

TMI221 ING RP Art4_Layout 1 09/12/2013 09:23 Page 12

Innovation and Precision

in Managing International

Project Risks

by Bert van der Donk, Treasury & Risk Manager, NEM Energy B.V.

A

s a global engineering firm operating in many of the

world’s most dynamic but also some of the most volatile

regions of the world, NEM Energy B.V., part of the

Siemens Group, has to apply its combination of innovation and

precision that characterises its product suite and approach to

project delivery to its treasury management activities. Managing

risk is a particular challenge, which has to be assessed and

managed at an individual project level. In this article, Bert van

der Donk, Treasury & Risk Manager discusses how NEM uses

trade instruments in combination with other approaches to help

manage collections risk that derives from both individual

customer credit risk and wider political risks.

Treasury background

NEM is a global business, and although the number of customers

with which we work is limited due the specialist nature of our

activities, these are located in all parts of the world. Similarly, we

work with suppliers and subcontractors globally. Like most

engineering companies, the majority of our treasury activities relate

NEM Energy B.V.

Established in 1929, NEM Energy B.V. (‘NEM’) is a global

leader in heat recovery steam generators (HRSGs),

industrial and utility steam generators and related

equipment. Since 2011, NEM has been a fully owned

subsidiary of Siemens AG, operating on a stand-alone

basis. The company is headquartered in Leiden, the

Netherlands, and employs around 550 professionals

across 25 agencies and 7 offices globally, with HRSGs

installed in 6 continents.

Like most

engineering

companies,

the majority

of our

treasury

activities

relate to

individual

projects.

12

TMI

|

www.treasury-management.com

TMI221 ING RP Art4_Layout 1 09/12/2013 09:23 Page 13

insight

cash position can typically be financed

through surpluses in other projects. In

addition, as part of the Siemens group,

liquidity is centralised on a group basis,

which enables further access to internal

financing if required. As a result, cash

management is relatively straightforward.

Banking partnerships

to individual projects. We manage each one

independently, which includes financing,

risk management and cash management.

Each project has its own cash flow profile,

with different timings of cash inflows and

outflows according to the project, but each

project should be cash-neutral when

considered on an aggregate basis. In

general, projects do not need to be financed

externally, as projects that have a negative

We have three core banks with which we

have a close relationship. A major aspect

of this relationship is the bank’s ability to

provide guarantee facilities, and support

in a correct and precise drafting of the

wording of the trade instruments applied

next to efficient execution. For example,

it is a common requirement that we

provide performance and warranty bonds

to customers. In addition, we work with

an insurance partner to provide

guarantees. With a project-based

approach to treasury, however, managing

credit risk is a major activity. Not only do

we focus on managing our risk to each

individual counterparty, but political risk

is becoming a more significant issue than

in the past. Emerging markets and the

Middle East are particularly challenging

where credit reference information may

not be readily available and where the

political situation may be opaque and

fast-changing. The use of trade finance

instruments is therefore an essential

aspect of our risk management approach.

We rely on our banks heavily for the

issue of letters of credit (LCs), standby LCs

and dealing with incoming guarantees and

standby LCs. We work with banks that can

confirm (standby) LCs in particular. With

the growing importance of political risk,

and the cost of insuring this risk

increasing, we need our banking partners

to share some of this risk. This enables us

to adhere to our internally set credit risk

management policy.

We prefer standby LCs over bank

guarantees for three key reasons:

Firstly, if we need to issue a guarantee to

a customer, the use of standby LCs is

transparent as it is always conducted

according to recognised universal practices.

Secondly, a LC always has an end date.

As such you are not dependent on any

release-action of the beneficiary. In case

the latter abstains from such action, the

facilities remain blocked while the

underlying contract is already duly

performed. Therefore the fixed end date is

particularly important to us.

Thirdly, a standby LC offers better

security on incoming payments, as if a

customer pays late, we can make a

demand for payment under the standby LC

by simply sending the overdue invoice and

statement to the bank. This assists with

cash flow forecasting by improving the

predictability of collections.

With a

project-based

approach to

treasury

managing

credit risk is

a major

activity.

Partnership with ING

“ING and NEM have enjoyed a relationship that extends for more than a decade with a

particular emphasis on trade finance instruments encompassing LCs and Bank

guarantees. In addition, the bank has a comprehensive banking relationship with the

wider Siemens Group, particularly focused on servicing the Group’s European

operations.

As a complex, global engineering business solution provider, NEM requires trade

finance solutions that are specifically designed to meet NEM’s credit , political risks and

- to a lesser extent – cash management guidelines associated with each project

including standby LCs. The latter instruments are commonly used in the United States

and Latin America, and at a global level in the oil and gas sectors in particular. In

Europe and Middle East, bank guarantees are typically used. However2, NEM has taken

a less conventional approach and preferred to select trade instruments according to

each individual scenario. It is an important part of our service offering at ING to be

able to offer solutions that meet the individual cash and risk management needs of

each of our customers, and the projects in which they are engaged, fulfilling the role of

a true partner bank.”

Jean Bonnet, Senior Consultant Trade Finance Services at ING

TMI

|

www.treasury-management.com

13

TMI221 ING RP Art4_Layout 1 09/12/2013 09:23 Page 14

insight

Proactive risk management

As every

project is

unique, so

too is each

LC.

We review the commercial and risk

conditions of each project regularly and

evaluate the instruments that are in place

to protect our risk. This includes both

guarantees that we issue, and those that

we receive from our suppliers, including

suspension of force majeure clauses and

clear delivery statuses. If we determine

that our political risk is high, we liaise

with sales teams to manage processes

such as warehousing carefully to

minimise trapped cash that may be

vulnerable. We also clearly specify

payment conditions in the customer

contract, e.g. what would happen to the

contract in the event of the country

becoming subject to an embargo. These

same terms are included in the LC which

should mirror the contract. To ensure that

this is the case, we draft the LC at the

same time as contract negotiations.

Precision and flexibility

We typically work on a relatively small

number of high-value projects, so we do

not need to deal with a large volume of

transactions. As every project is unique,

so too is each LC. This makes the use of

templates and automated processes more

difficult than in a more standardised

environment, so each LC is managed

individually. Not all customers are willing

to issue a LC, in which case we transact

business under open account, but this

Bert van der Donk

Treasury Manager NEM

Energy B.V.

Bert van der Donk is Treasury Manager

of NEM Energy B.V. in the Netherlands.

He joined NEM Energy in 1998 as

Project Controller. After two years Bert

moved into treasury responsible for setting up a Treasury

Department which supports the international export

contracts and global sourcing practices of the company.

Bert is in charge of bank relation management, cash

management and market risk hedging. His function also

includes documentary trade finance, ECA-covered financing,

credit and political risk insurance and guarantees.

Before joining NEM Energy, Bert held the position of

Finance Manager with the engineering company Articon BV

and before that he worked for some 22 years with the Dutch

Construction Company Ballast Nedam, where he held

positions in the Netherlands and for10 years as expatriate in

Bahrain, Saudi Arabia and Qatar.

14

applies in only a few cases where we

already have a trusted, proven business

relationship for which internal credit

limits are put in place. Even in these

cases, we still need to mitigate political

risk through credit insurance or a

combination of insurance and export

credit agency financing. In some cases,

such as in the case of a recent project in

Iran, it was not possible either to insure

our risk or obtain an LC. In this instance,

we constructed the payment schedule

carefully so that we always received

more cash from the customer than the

costs we had incurred, including future

supplier commitments.

Tailor-made solutions/ or

using the right instrument

in each situation

Based on our experience of managing risk

in emerging and/ or politically volatile

markets, it is important to consider the

full range of instruments that are

available, and leverage the right

instrument in each situation. This is not

limited to bank or insurance solutions: as

an exporter of capital goods, we have

worked with the Dutch ECA very

successfully. The basis of a trade

instrument should always be the

customer contract which sets the

conditions for delivery, payment etc. The

greatest difficulty in this respect is the

final payment which may be assumed to

be due after a certain period as opposed

to being linked to a specific project

deliverable. LCs have proved particularly

valuable for our business, not least as

that a customer’s ability to an LC

demonstrates its financial viability and

good banking relationship. In instances

where using an LC or standby LC is not

feasible, political or credit risk insurance

should be considered.

Risk is not limited to customer

payment performance: supplier risk is

also a major consideration, both

individually and from a wider political

risk perspective. To manage this, we visit

our suppliers and subcontractors

regularly and assess their financial and

operating conditions. There are insurance

products

available,

such

as

subcontractor’s default insurance, and

construction wrap-up insurance in the

US, but these allow the pass through of

risk, as opposed to mitigating risk, and

currently we do not use these products,

although we may consider doing so in

the future.

Maintaining effective communication

between NEM and our banks is essential

in order to ensure that trade instruments

meet our needs exactly and are drafted

correctly. These banks also add value by

sharing their expertise derived from

working with a variety of companies with

comparable risk management needs.

Similarly, we work closely with internal

sales, procurement and logistics teams to

understand and mitigate our risk. This

internal and external dialogue, based on

common objectives is essential to

manage risk and transform credit and

political risk to performance risk. Project

delivery is more closely in our control and

an area in which NEM excels, so we are

leveraging our strengths, whilst

minimising potential areas of weakness in

which we have less control. ■

Jean Bonnet

Senior Consultant Trade Finance Services

at ING

Jean Bonnet, Senior Consultant Trade Finance Services at ING,

started his banking career as management trainee after which

he subsequently fullfilled roles as Treasury & cash

management consultant, relationhip manager Trade &

Commodity Finance, head of commercial risk trading, global head loan syndication

(emerging markets & TCF focus) as part of Debt Capital Markets, regional head

MidCorporates, relationship manager Corporate Clients and since 2010 in it’s present

role focusing on large/ global clients with a Dutch footprint.

Jean graduated from University Nijmegen law school with further

postgraduate and management education followed at a.o. Free University of

Amsterdam (incl. commercial finance) and Insead.

TMI

|

www.treasury-management.com

TMI221 ING RP Art5_Layout 1 09/12/2013 09:28 Page 15

insight

Addressing Cash

Management Complexity

in Turkey through a

One Bank Strategy

by Jennifer Tan Sue Een, Treasury Manager, Europe &

Africa and Mario Del Natale, Director Treasury Operations,

Systems & Applications, Johnson Controls

A

t Johnson Controls,

Inc. we have been

through a period of

geographic expansion and

financial process optimisation,

including establishing regional

shared service centres (SSCs). As

part of this strategy, we made the

decision to appoint one bank per country

for cash management, whilst aiming to reduce

our total number of banking partners overall. We use a variety

of criteria when choosing a bank according to our requirements

in each country, but they should be part of our lending

syndicate (i.e., a relationship bank) and we will review each

bank relationship in depth every five years. Our EMEA treasury

department in Belgium is responsible for 47 countries across

Europe, Middle East and Africa (EMEA). In some cases, we need

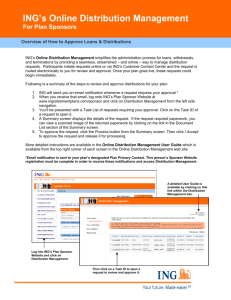

“The strength of the relationship between JCI and ING is largely based on the close

alignment between the two parties at both a local and regional (treasury) and HQ

level, and effective communication. The project has benefited significantly from a

long-standing relationship in a number of countries and ING’s experience and

expertise derived from working with large multinationals with comparable

requirements to JCI, such as SWIFT connectivity.”

Rick van Doggenaar, Payments & Cash Management US,

Ayşe Özgür, Corporate Clients ING Turkey,

ING Commercial Banking

TMI

|

www.treasury-management.com

to work with a local bank for domestic cash management

purposes but ideally we try to work with our relationship banks

wherever possible.

Optimising bank communications

While a one bank per country strategy met our relationship banking

and cash management requirements, there was a risk of

fragmentation and replication of banking technology. Consequently,

we made the decision in 2008 to migrate to SWIFT, leveraging XML

to standardise communication formats at a global level. We have

now implemented SWIFT in most countries of operation, enabling us

to achieve our banking strategy whilst maintaining a high degree of

efficiency, control and standardisation in our bank connectivity.

Relationship banking with ING

We work with ING in multiple countries in EMEA. In each case,

ING provides domestic as well as international cash and treasury

management services, which include FX, commodities (e.g., base

metals), derivatives, cash management and notional pooling

through Bank Mendes Gans (BMG), a subsidiary of ING. ING is a

15

TMI221 ING RP Art5_Layout 1 09/12/2013 09:28 Page 16

insight

strong SWIFT partner, so we have

implemented SWIFT and XML formats in

each country, most recently Turkey.

Supporting business growth in

Turkey

Turkey has been an important growth

region for JCI in recent years. Before 2011,

we had an existing business through two

fully-owned subsidiaries and a joint

venture. Since then, these have continued

to grow, fuelled by a series of mergers &

acquisitions. In addition, we have set up a

new plant in Turkey that we expect to fuel

further growth. Cash management in

Turkey can be complex and in the past, we

had multiple local banking partnerships. In

2011, however, we decided to implement

our one bank strategy in Turkey, so we

launched a request for proposal (RFP).

Based on a rigorous analysis of a shortlist

of banks, we made the decision to appoint

ING as our partner bank in Turkey. There

were a variety of factors that contributed

to this decision. We were impressed by

ING’s depth of presence and range of

services that the bank provides locally at a

competitive price, including local

financing. In addition, we were confident

in the bank’s professionalism and

experience based on our relationship in

other countries, including the bank’s

support and expertise in SWIFT

connectivity.

A local and regional banking

partnership

Although we launched our RFP late in 2011,

we were not able to migrate our banking

relationships immediately due to changes in

the local funding situation which we

needed to address first. However, we are

now

actively

engaged

in

the

implementation with ING. We maintain our

relationship with ING at both a treasury and

local level: activities such as account

opening and setting up credit facilities take

place locally while treasury ensures that the

JCI’s overall financial and efficiency

objectives continue to be achieved. This

combined regional and local approach

enables us to maintain operational

efficiency, control and policy compliance

whilst ensuring that we have the local

presence and expertise to optimise our local

cash and treasury requirements.

Turkey is one of the last countries to be

connected to SWIFT. ING has an existing

SWIFT hub in Belgium to which JCI is

connected, and Turkey will be part of this

infrastructure in the same way as every

other country in which JCI works with ING.

This includes a variety of different payment

types.

Jennifer Tan Sue Een

Treasury Manager, EMEA,

Johnson Controls

Jennifer Tan Sue Een, ACMA, CGMA, works as Treasury

Manager in Regional Corporate Treasury EMEA department of

Johnson Controls based in Brussels, Belgium. To-date, she has

been working in Regional Corporate Treasury EMEA for over

five years. She started with responsibility for the Middle Office

for all derivatives and commodity trading, later taking over the

main responsibility for Bank Relationship Management and

Cash Pool Restructuring for 41 countries in Europe and Africa.

Until recently, she had moved on to her new role as the main

Treasury Business Unit Support for Power Solution Division

EMEA.

Jennifer started in Johnson Controls as an International

Internal Auditor in the Regional Corporate Internal Audit EMEA

department based in Brussels, Belgium prior to joining Regional

Corporate Treasury EMEA department.

Looking ahead

Over the next year, we will complete the

migration of cash and treasury

management in Turkey to ING. This requires

a flexible approach as our business activities

in the country continue to expand. More

generally, we are also reviewing bank

relationships in a limited number of

countries where it has proved difficult to

work with a relationship bank in the past.

We are working with all of our relationship

banks to clarify our exposure to country risk

in each country. This is becoming more

important as the economic situation both

regionally and globally continues to be

Johnson Controls, Inc.

Johnson Controls, Inc. (JCI) is a global diversified technology and industrial leader

serving customers in more than 1,300 locations worldwide (150 countries).The

company has 170,000 employees who create quality products, services and solutions

to optimise energy and operational efficiencies of buildings, lead-acid automotive

batteries, Absorbent Glass Matt (AGM) Start Stop Batteries and advanced batteries

for hybrid and electric vehicles and interior systems for automobiles. Founded in

1885 with the invention of the first electric room thermostat, JCI has a

demonstrable commitment to sustainability. In 2012, Corporate Responsibility

Magazine recognised JCI as the #5 company in its annual 100 Best Corporate

Citizens’ list. JCI is headquartered in Milwaukee, United States and is traded on the

New York Stock Exchange (NYSE: JCI). The company is positioned at no. 67 on the

US Fortune 500 and no. 267 on the Global Fortune 500.

16

fragile and our business increases in

emerging markets where risk exposures may

be more difficult to quantify. In addition, we

continue to standardise fee structures across

our banking partners to make it easier to

compare and reconcile bank charges. ■

Mario Del Natale

Director Treasury,

Johnson Controls

Mario works for Johnson Controls, a global

diversified technology and industrial leader

serving customers in more than 150

countries headquartered in Milwaukee, US.

He is based in Brussels where is responsible for treasury

operations (cash management EMEA, global back- and middleoffice for all derivatives trading) as well as for providing longterm strategic recommendations on global treasury IT

applications and solutions to VP & Treasurer and treasury’s

leadership team.

Rick van Doggenaar

Payments & Cash Management

US, ING Commercial Banking

In 2008 Rick started his career at ING

Corporate Clients The Netherlands as

account manager and developed good skills

in relationship management. In February

2012 he decided to join the Payment and Cash Management US

Team. In this role he is the single point of contact for US

corporates and responsible for managing all their payments and

cash management related questions and queries throughout the

entire ING network.

Rick has a vast knowledge of the European corporate banking

environments. Over the years he has created an extensive

network within ING to ensure excellent service and perfect

execution for his clients.

TMI

|

www.treasury-management.com

Download the ING CB app

for iPad in the App Store

and watch this ad in 3D

See how we provided Randstad with payments & cash management

services in Italy so they can concentrate on their core business

www.ingcb.com

236.00.277 ING Randstad_210x297.indd 1

7/23/13Week:30 9:25 AM