Responsibility center

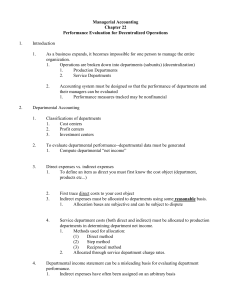

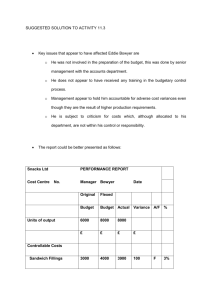

advertisement

Part Ten Responsibility Accounting Responsibility Accounting An accounting system that provides information . . . Relating to the responsibilities of individual managers. To evaluate managers on controllable items. Decentralization Decentralization often occurs as organizations continue to grow. Top Management Middle Management Supervisor Supervisor Middle Management Supervisor Supervisor Decision Making is Pushed Down Decentralization Promotes better decision making. Improves productivity. Improves performance evaluation. Develops lower­level managers. Advantages Allows upper­level management to concentrate on strategic decisions. Responsibility Reports Co s t Responsibility Reports Prepared for each individual who has control over revenue or expense items Responsibility Reports Œ Prepare budgets for • Measure performance of each responsibility center. each responsibility center. Ž Prepare timely performance reports comparing actual amounts with budgeted amounts. The Controllability Concept Successful implementation of responsibility Successful implementation of responsibility accounting depends on clear lines of authority accounting depends on clear lines of authority and clearly defined levels of responsibility. and clearly defined levels of responsibility. Board of Directors President Vice President of Finance Vice President of Operations Store Manager Department Manager Vice President of Marketing Management by Exception and the Degree of Summarization Amount of detail varies according to level in organization. Department manager receives detailed reports. Store manager receives summarized information from each department. Management by Exception and the Degree of Summarization Amount of detail varies according to level in organization. Management by exception Upper­level management does not receive operating detail unless problems arise. The vice president of operations receives summarized information from each store. Qualitative Reporting Features To be of maximum benefit, responsibility reports should . . . – Be timely. – Be issued regularly. – Be understandable. – Compare budgeted and actual amounts. THE CONCEPT OF RESPONSIBILITY ACCOUNTING Ø Involves accumulating and reporting costs on the basis of the manager who has the authority to make the day­to­day decisions about the items Ø Means a manager's performance is evaluated on the matters directly under the manager's control THE CONCEPT OF RESPONSIBILITY ACCOUNTING Ø Conditions for using responsibility accounting: ŒCosts and revenues can be directly associated with the specific level of management responsibility •The costs and revenues are controllable at the level of responsibility with which they are associated ŽBudget data can be developed for evaluating the manager's effectiveness in controlling the costs and revenues THE CONCEPT OF RESPONSIBILITY ACCOUNTING Levels of responsibility for controlling costs THE CONCEPT OF RESPONSIBILITY ACCOUNTING Ø Responsibility center ­ any individual who has control and is accountable Ø May extend from the lowest levels of management to the top strata of management Ø Responsibility accounting is especially valuable in a decentralized company § control of operations delegated to many managers throughout the organization THE CONCEPT OF RESPONSIBILITY ACCOUNTING Ø Two differences from budgeting in reporting costs and revenues: ŒDistinguishes between controllable and noncontrollable costs •Emphasizes or includes only items controllable by the individual manager in performance reports Ø Applies to both profit and not­for­profit entities § Profit entities: maximize net income § Not­for­profit: minimize cost of providing services CONTROLLABLE VS NONCONTROLLABLE REVENUES AND COSTS Ø Can control all costs and revenues at some level of responsibility within the company Ø Critical issue under responsibility accounting: Whether the cost or revenue is controllable at the level of responsibility with which it is associated CONTROLLABLE VS NONCONTROLLABLE REVENUES AND COSTS Ø All costs controllable by top management Ø Fewer costs controllable as one moves down to lower levels of management Ø Controllable costs ­ costs incurred directly by a level of responsibility that are controllable at that level Ø Noncontrollable costs – costs incurred indirectly which are allocated to a responsibility level RESPONSIBILITY REPORTING SYSTEM Ø Involves preparation of a report for each level of responsibility in the company's organization chart Ø Begins with the lowest level of responsibility and moves upward to higher levels Ø Permits management by exception at each level of responsibility RESPONSIBILITY REPORTING SYSTEM Ø Also permits comparative evaluations Ø Plant manager can rank the department manager’s effectiveness in controlling manufacturing costs Ø Comparative ranking provides incentive for a manager to control costs RESPONSIBILITY REPORTING SYSTEM Responsibility Centers • A responsibility center is the point in an organization where the control over revenue or expense is located, e.g. division,department or a single machine. • A responsibility center may be divided into three categories – cost – profit – investment TYPES OF RESPONSIBILITY CENTERS Ø Three basic types: § Cost centers § Profit centers § Investment centers Ø Indicates degree of responsibility that managers have for the performance of the center TYPES OF RESPONSIBILITY CENTERS Types of Responsibility Centers Co s t Cost Center A business segment that incurs expenses but does not generate revenue. Types of Responsibility Centers Profit Center A part of the business that has control over both revenues and expenses, but no control over investment funds. Revenues Sales Interest Other Expenses Manufacturing Commissions Salaries Other Types of Responsibility Centers Investment Center A profit center where management also makes capital investment decisions. Corporate Headquarters Measuring Managerial Performance Evaluation Measures Cost Center Cost control Quantity and quality of services Profit Center Profitability Investment Center Return on investment (ROI) Residual income (RI) RESPONSIBILITY ACCOUNTING FOR COST CENTERS Ø Based on a manager’s ability to meet budgeted goals for controllable costs Ø Results in responsibility reports which compare actual controllable costs with flexible budget data § Include only controllable costs in reports § No distinction between variable and fixed costs RESPONSIBILITY ACCOUNTING FOR PROFIT CENTERS Ø Based on detailed information about both controllable revenues and controllable costs Ø Manager controls operating revenues earned, such as sales, Ø Manager controls all variable costs (and expenses) incurred by the center because they vary with sales RESPONSIBILITY ACCOUNTING FOR PROFIT CENTERS Direct and Indirect Fixed Costs Ø May have both direct and indirect fixed costs Ø Direct fixed costs § Relate specifically to a responsibility center § Incurred for the sole benefit of the center § Most controllable by the profit center manager Ø Indirect fixed costs § Pertain to a company's overall operating activities § Incurred for the benefit of more than one profit center § Most not controllable by the profit center manager PROFIT CENTERS Responsibility Reports Ø Shows budgeted and actual controllable revenues and costs Ø Prepared using the cost­volume­profit income statement format: § Deduct controllable fixed costs from the contribution margin § Controllable margin ­ excess of contribution margin over controllable fixed costs – best measure of manager’s performance in controlling revenues and costs § Do not report noncontrollable fixed costs RESPONSIBILITY ACCOUNTING FOR INVESTMENT CENTERS Ø Controls or significantly influences investment funds available for use Ø ROI (return on investment) ­ primary basis for evaluating manager performance in an investment center Ø ROI shows the effectiveness of the manager in utilizing the assets at his or her disposal RESPONSIBILITY ACCOUNTING FOR INVESTMENT CENTERS ­ ROI Ø ROI is computed as follows: § Operating assets include current assets and plant assets used in operations by the center. • Exclude nonoperating assets such as idle plant assets and land held for future use § Base average operating assets on the beginning and ending cost or book values of the assets JUDGMENTAL FACTORS IN ROI ŒValuation of operating assets § May be valued at acquisition cost, book value, appraised value, or market value •Margin (income) measure § May be controllable margin, income from operations, or net income IMPROVING ROI Ø ROI can be improved by § Increasing controllable margin or § Reducing average operating assets Ø Assume the following data for Laser Division of Berra Manufacturing: IMPROVING ROI Increasing Controllable Margin Ø Increased by increasing sales or by reducing variable and controllable fixed costs ŒIncrease sales by 10% • Sales increase $200,000 and contribution margin increases $90,000 ($200,000 X 45%) • Thus, controllable margin increases to $690,000 ($600,000 + $90,000) • New ROI is 13.8% IMPROVING ROI Increasing Controllable Margin •Decrease variable and fixed costs 10% • Total costs decrease $140,000 [($1,100,000 + $300,000) X 10%] • Controllable margin becomes $740,000 ($600,000 + $140,000 ) • New ROI becomes 14.8% IMPROVING ROI Reducing Average Operating Assets Ø Reduce average operating assets by 10% or $500,000 § Average operating assets become $4,500,000 ($5,000,000 X 10%) § Controllable margin remains unchanged at $600,000 § New ROI becomes 13.3% Residual Income Earned Income – Investment charge = Residual income Investment × Desired ROI = Investment charge Investment center’s cost of acquiring investment capital Residual Income Residual income encourages managers to make profitable investments that would be rejected by managers using ROI. Transfer Pricing The amount charged when one division The amount charged when one division sells goods or services to another division. sells goods or services to another division. Batteries Battery Division Auto Division Transfer Pricing The transfer price affects the profit measure for both the selling division and the buying division. A higher transfer price for batteries means . . . Battery Division greater profits for the battery division. Auto Division lower profits for the auto division. Transfer Pricing The ideal transfer price allows The ideal transfer price allows each division manager to make each division manager to make decisions that maximize the decisions that maximize the company’s profit, while company’s profit, while attempting to maximize the attempting to maximize the division’s profit. division’s profit. Setting Transfer Prices Market­based transfer prices are Market­based transfer prices are preferred because they promote preferred because they promote efficiency and fairness. efficiency and fairness. When market prices are not available, companies may use . . . w Cost­based prices w Negotiated prices Negotiated Transfer Price A system where transfer prices are arrived A system where transfer prices are arrived at through negotiation between managers of at through negotiation between managers of buying and selling divisions. buying and selling divisions. Excessive management Excessive management time may be used in the time may be used in the negotiation process. negotiation process. May not be in the May not be in the best interest of best interest of the company. the company. Cost­Based Transfer Prices Cost­based transfer prices are the Cost­based transfer prices are the least desirable because the incentive least desirable because the incentive to control cost is diminished. to control cost is diminished. When used, cost­based transfer prices . . . When used, cost­based transfer prices . . . – Are either variable cost or full cost. – Are either variable cost or full cost. – Should use standard rather than actual costs. – Should use standard rather than actual costs. Setting Transfer Prices Conflicts may arise between the company’s interests and an individual manager’s interests when transfer­price­ based performance measures are used. PRINCIPLES OF PERFORMANCE EVALUATION Ø Management function that compares actual results with budget goals Ø At center of responsibility accounting Ø Includes both behavioral and reporting principles PRINCIPLES OF PERFORMANCE EVALUATION Behavioral Principles Ø Human factor – critical in performance evaluation Ø Behavioral principles: § Managers of responsibility centers should have direct input into the process of establishing budget goals for their area of responsibility § The evaluation of performance should be based entirely on matters that are controllable by the manager being evaluated § Top management should support the evaluation process § The evaluation process must allow managers to respond to their evaluations § The evaluation should identify both good and poor performance PRINCIPLES OF PERFORMANCE EVALUATION Reporting Principles Ø Reporting principles for performance reports include reports which § Contain only data that are controllable by the manager of the responsibility center § Provide accurate and reliable budget data to measure performance § Highlight significant differences between actual results and budget goals § Are tailor­made for the intended evaluation § Are prepared at reasonable intervals Thanks for Your Attention