Chapter Review

advertisement

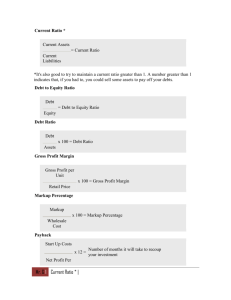

CHAPTER 21 Performance Management and Evaluation REVIEWING THE CHAPTER Objective 1: Describe how the balanced scorecard aligns performance with organizational goals. 1. The balanced scorecard is a framework that links the perspectives of an organization’s four basic stakeholder groups with the organization’s mission and vision, performance measures, strategic and tactical plans, and resources. The four groups are investors, employees, internal business processes, and customers. To add value for these groups, an organization determines each group’s objectives and translates them into performance measures that have specific, quantifiable targets. 2. During the planning phase of the management process, managers use the balanced scorecard to translate their organization’s vision and strategy into operational objectives that will benefit all stakeholder groups. Once they have established these objectives, they set performance targets and select performance measures. In the performing phase, managers use the organization’s operational objectives as the basis for decision making within their individual areas of responsibility. Managers evaluate the effectiveness of their strategies in meeting performance targets set during the planning stage and compare planned performance with actual results. Managers prepare a variety of performance reports to communicate results to stakeholder groups. Objective 2: Discuss performance measurement, and identify the issues that affect management’s ability to measure performance. 3. A performance management and evaluation system is a set of procedures that account for and report on both financial and nonfinancial performance. Such a system enables a company to identify how well it is doing, the direction it is taking, and what improvements will make it more profitable. 4. Performance measurement is the use of quantitative tools to gauge an organization’s performance in relation to a specific goal or an expected outcome. Each organization must develop a unique set of performance measures appropriate to its specific situation that will help managers distinguish between what is being measured and the actual measures used to monitor performance. Objective 3: Define responsibility accounting, and describe the role that responsibility centers play in performance management and evaluation. 5. Responsibility accounting is an information system that classifies data according to areas of responsibility and reports each area’s activities by including only the revenue, cost, and resource categories that the assigned manager can control. 6. A responsibility center is an organizational unit whose manager has been assigned the responsibility of managing a portion of the organization’s resources. The five types of responsibility centers are as follows: 7. a. A cost center is a responsibility center whose manager is accountable only for controllable costs that have well-defined relationships between the center’s resources and products or services. b. A discretionary cost center is a responsibility center whose manager is accountable only for costs in which the relationship between resources and products or services produced is not well defined. These centers, like cost centers, have approved budgets that set spending limits. c. A revenue center is a responsibility center whose manager is accountable primarily for revenue and whose success is based on its ability to generate revenue. d. A profit center is a responsibility center whose manager is accountable for both revenue and costs and for the resulting operating income. e. An investment center is a responsibility center whose manager is accountable for profit generation; the manager can also make significant decisions about the resources the center uses. The manager can control revenues, costs, and the investments of assets to achieve the organization’s goals. An organization chart is a visual representation of an organization’s hierarchy of responsibility for the purposes of management control. A responsibility accounting system establishes a communications network within an organization that is ideal for gathering and reporting information about the operations of each of these areas of responsibility. The system is used to prepare budgets by responsibility area and to report on the actual performance of each responsibility center. The performance report for a responsibility center should contain only controllable costs and revenues—that is, the costs, revenues, and resources that the manager of the center can control. Objective 4: Prepare performance reports for cost centers using flexible budgets and for profit centers using variable costing. 8. Performance reports allow comparisons between actual performance and budget expectations. Such comparisons enable management to evaluate an individual’s performance with respect to responsibility center objectives and companywide objectives and to recommend changes. The content and format of a performance report depend on the nature of the responsibility center. 9. The performance of a cost center can be evaluated by comparing its actual costs with the corresponding amounts in the flexible and master budgets. A flexible budget (also called a variable budget) is a summary of expected costs for a range of activity levels. A flexible budget is derived by multiplying actual unit output by predetermined unit costs for each cost item in the report. The flexible budget is used primarily as a cost control tool evaluating performance at the end of a period. 10. A profit center’s performance is usually evaluated by comparing its actual income statement with its budgeted income statement. When variable costing is used, the profit center manager’s controllable costs are classified as variable or fixed. The variable cost of goods sold and the variable selling and administrative expenses are subtracted from sales to arrive at the center’s contribution margin; all controllable fixed costs are subtracted from the contribution margin to determine operating income. The variable costing income statement takes the form of a contribution income statement rather than a traditional income statement. A traditional income statement (also called a full costing or absorption costing income statement) assigns all manufacturing costs to cost of goods sold. A variable costing income statement uses only direct materials, direct labor, and variable overhead to compute variable cost of goods sold. Fixed overhead is considered a cost of the current accounting period and is listed with fixed selling expenses. Objective 5: Prepare performance reports for investment centers using the traditional measures of return on investment and residual income and the newer measure of economic value added. 11. Return on investment (ROI) is a performance measure that takes into account both operating income and the assets invested to earn that income. It is computed as follows: Operating Income Assets Invested In this formula, assets invested are the average of the beginning and ending asset balances for the period. Return on investment can also be examined in terms of profit margin and asset turnover. Profit margin is the ratio of operating income to sales; it represents the percentage of each sales dollar that results in profit. Asset turnover is the ratio of sales to average assets invested; it indicates the productivity of assets, or the number of sales dollars generated by each dollar invested in assets. Return on investment is equal to profit margin multiplied by asset turnover: Return on Investment (ROI) = ROI = Profit Margin × Asset Turnover or Operating Income Sales Operating Income × = Sales Assets Invested Assets Invested 12. Residual income (RI) is the operating income that an investment center earns above a minimum desired return on invested assets. The formula for computing residual income is ROI = Residual Income = Operating Income – (Desired ROI × Assets Invested) 13. Economic value added (EVA) is an indicator of performance that measures the shareholder wealth created by an investment center. A manager can improve the economic value of an investment center by increasing sales, decreasing costs, decreasing assets, or lowering the cost of capital. The cost of capital is the minimum desired rate of return on an investment. The formula for computing economic value added is as follows: EVA = After-Tax Operating Income – Cost of Capital in Dollars EVA = After-Tax Operating Income – [Cost of Capital × (Total Assets – Current Liabilities)] or Objective 6: Explain how properly linked performance incentives and measures add value for all stakeholders in performance management and evaluation. 14. The effectiveness of a performance management and evaluation system depends on how well it coordinates the goals of responsibility centers, managers, and the entire company. Performance can be optimized by linking goals to measurable objectives and targets and by tying appropriate compensation incentives to the achievement of those targets through performance-based pay. Cash bonuses, awards, profit-sharing plans, and stock option programs are common types of incentive compensation. Each organization’s unique circumstances will determine its correct mix of performance measures and compensation incentives. If management values the perspectives of all stakeholder groups, its performance management and evaluation system will balance and benefit all interests.