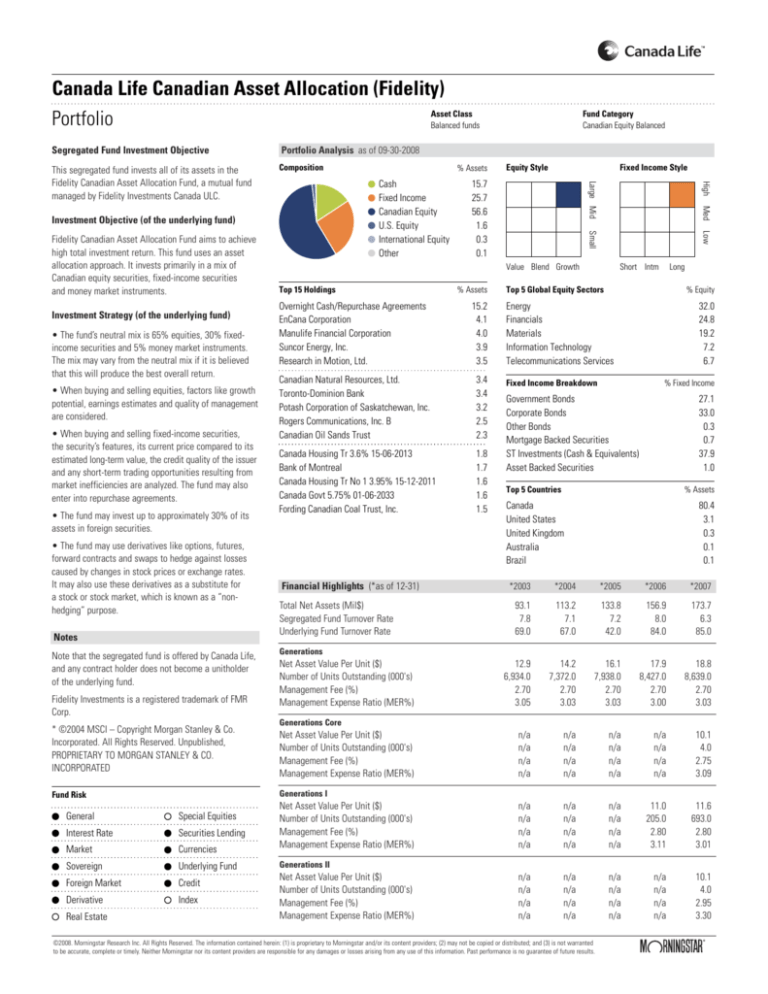

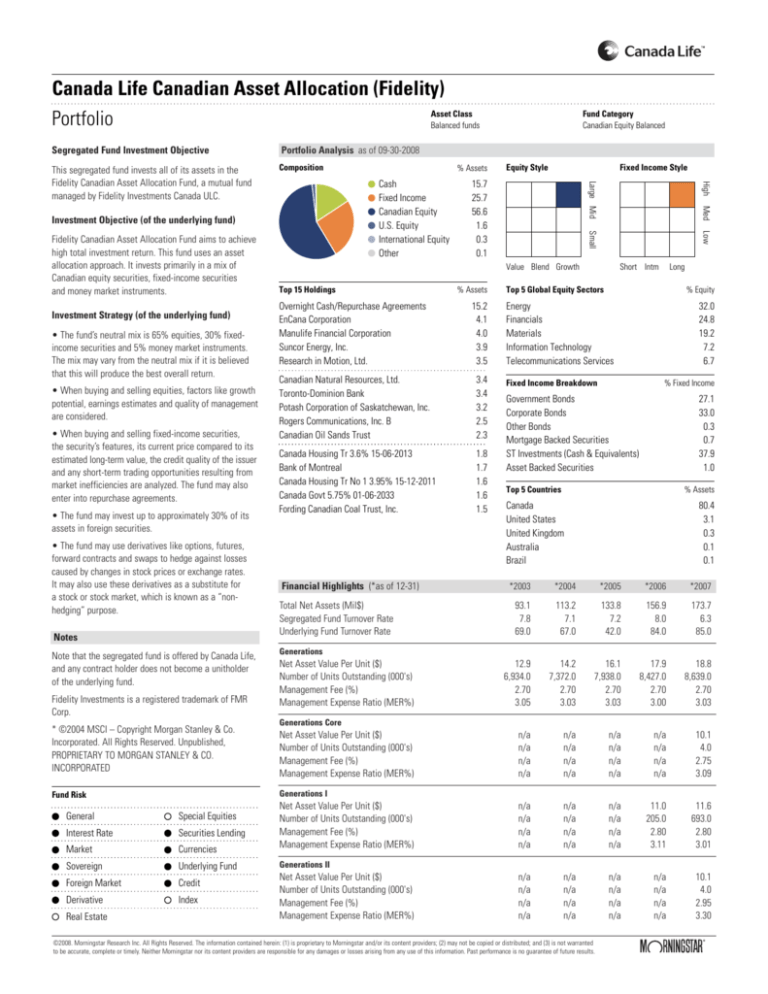

Canada Life Canadian Asset Allocation (Fidelity)

Asset Class

Portfolio

Balanced funds

This segregated fund invests all of its assets in the

Fidelity Canadian Asset Allocation Fund, a mutual fund

managed by Fidelity Investments Canada ULC.

Composition

• When buying and selling equities, factors like growth

potential, earnings estimates and quality of management

are considered.

• When buying and selling fixed-income securities,

the security’s features, its current price compared to its

estimated long-term value, the credit quality of the issuer

and any short-term trading opportunities resulting from

market inefficiencies are analyzed. The fund may also

enter into repurchase agreements.

• The fund may invest up to approximately 30% of its

assets in foreign securities.

• The fund may use derivatives like options, futures,

forward contracts and swaps to hedge against losses

caused by changes in stock prices or exchange rates.

It may also use these derivatives as a substitute for

a stock or stock market, which is known as a “nonhedging” purpose.

Notes

Note that the segregated fund is offered by Canada Life,

and any contract holder does not become a unitholder

of the underlying fund.

Fidelity Investments is a registered trademark of FMR

Corp.

* ©2004 MSCI – Copyright Morgan Stanley & Co.

Incorporated. All Rights Reserved. Unpublished,

PROPRIETARY TO MORGAN STANLEY & CO.

INCORPORATED

Value Blend Growth

Top 15 Holdings

% Assets

Overnight Cash/Repurchase Agreements

EnCana Corporation

Manulife Financial Corporation

Suncor Energy, Inc.

Research in Motion, Ltd.

15.2

4.1

4.0

3.9

3.5

Canadian Natural Resources, Ltd.

Toronto-Dominion Bank

Potash Corporation of Saskatchewan, Inc.

Rogers Communications, Inc. B

Canadian Oil Sands Trust

3.4

3.4

3.2

2.5

2.3

Canada Housing Tr 3.6% 15-06-2013

Bank of Montreal

Canada Housing Tr No 1 3.95% 15-12-2011

Canada Govt 5.75% 01-06-2033

Fording Canadian Coal Trust, Inc.

1.8

1.7

1.6

1.6

1.5

Financial Highlights (*as of 12-31)

Total Net Assets (Mil$)

Segregated Fund Turnover Rate

Underlying Fund Turnover Rate

Short Intm

Long

Top 5 Global Equity Sectors

% Equity

Energy

Financials

Materials

Information Technology

Telecommunications Services

Fixed Income Breakdown

32.0

24.8

19.2

7.2

6.7

% Fixed Income

Government Bonds

Corporate Bonds

Other Bonds

Mortgage Backed Securities

ST Investments (Cash & Equivalents)

Asset Backed Securities

27.1

33.0

0.3

0.7

37.9

1.0

Top 5 Countries

% Assets

Canada

United States

United Kingdom

Australia

Brazil

80.4

3.1

0.3

0.1

0.1

*2003

*2004

*2005

*2006

*2007

93.1

7.8

69.0

113.2

7.1

67.0

133.8

7.2

42.0

156.9

8.0

84.0

173.7

6.3

85.0

12.9

6,934.0

2.70

3.05

14.2

7,372.0

2.70

3.03

16.1

7,938.0

2.70

3.03

17.9

8,427.0

2.70

3.00

18.8

8,639.0

2.70

3.03

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

10.1

4.0

2.75

3.09

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

11.0

205.0

2.80

3.11

11.6

693.0

2.80

3.01

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

n/a

10.1

4.0

2.95

3.30

Generations

Net Asset Value Per Unit ($)

Number of Units Outstanding (000's)

Management Fee (%)

Management Expense Ratio (MER%)

Generations Core

Net Asset Value Per Unit ($)

Number of Units Outstanding (000's)

Management Fee (%)

Management Expense Ratio (MER%)

Generations I

Fund Risk

General

Special Equities

Interest Rate

Securities Lending

Market

Currencies

Sovereign

Underlying Fund

Foreign Market

Credit

Derivative

Index

Real Estate

Low

• The fund’s neutral mix is 65% equities, 30% fixedincome securities and 5% money market instruments.

The mix may vary from the neutral mix if it is believed

that this will produce the best overall return.

Fixed Income Style

Small

Investment Strategy (of the underlying fund)

Equity Style

15.7

25.7

56.6

1.6

0.3

0.1

Med

Investment Objective (of the underlying fund)

Fidelity Canadian Asset Allocation Fund aims to achieve

high total investment return. This fund uses an asset

allocation approach. It invests primarily in a mix of

Canadian equity securities, fixed-income securities

and money market instruments.

% Assets

Cash

Fixed Income

Canadian Equity

U.S. Equity

International Equity

Other

High

Portfolio Analysis as of 09-30-2008

Large Mid

Segregated Fund Investment Objective

Fund Category

Canadian Equity Balanced

Net Asset Value Per Unit ($)

Number of Units Outstanding (000's)

Management Fee (%)

Management Expense Ratio (MER%)

Generations II

Net Asset Value Per Unit ($)

Number of Units Outstanding (000's)

Management Fee (%)

Management Expense Ratio (MER%)

©2008. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted

to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Canada Life Canadian Asset Allocation (Fidelity)

Asset Class

Performance

Balanced funds

Category Description

Fund Category

Canadian Equity Balanced

Performance as of 09-30-2008

Category: Canadian Equity Balanced

22

Funds in the Canadian Equity Balanced category must

invest at least 70% of total assets in a combination of

equity securities domiciled in Canada and Canadian

dollar-denominated fixed income securities and between

61% and 90% of their total assets in equity securities.

19

16

13

10

7

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

Volatility Analysis

16

8

Investment (within category)

Low

Moderate

0

High

-8

Category

Best 1 Year Return

Worst 1 Year Return

25.3%

08-31-1999 to 08-31-2000

-10.1%

09-30-2000 to 09-30-2001

Operations

Series

Description

Fund Code

Gens

Gens

Gens Core

Gens Core

Gens I

Gens I

Gens II

Gens II

Deferred Sales Charge

No Sales or Redemption Charge

Deferred Sales Charge

No Sales or Redemption Charge

Deferred Sales Charge

No Sales or Redemption Charge

Deferred Sales Charge

No Sales or Redemption Charge

CLA191

CLA1191

CLAA191

CLAB191

CLA2191

CLA3191

CLAC191

CLAD191

Telephone

Web Site

Annualized Returns

as of 09-30

Gens

Gens I

Benchmark

-16

It is important to note how a fund's price fluctuates over

time. More volatile investments are those that

experience more exaggerated price increases or

decreases. Generally speaking investors with a shorter

time horizon should avoid higher volatility investments.

However, it is worth noting that some of the risk

associated with highly volatile investments can be offset

through proper portfolio construction.

Gens Inception

Gens Core Inception

Gens I Inception

Gens II Inception

Management Company

Growth of $10,000

Gens

Gens I

Benchmark

11-27-1998

12-03-2007

06-05-2006

12-03-2007

Canada Life Assurance

Company

888 252 1847

www.canadalife.com

YTD

1 Year

3 Year

5 Year

-8.6

-8.6

-7.8

-9.1

-9.2

-9.2

-7.6

-10.6

2.8

2.8

2.8

0.1

7.1

7.1

6.6

5.2

10 Year

Since Fund Inception History

—

—

5.8

4.3

5.7

2.4

5.1

—

Generations

Generations I

Benchmark

Category

24

12

0

-12

Calendar Year Rtns

as of 12-31

Gens

Gens I

Benchmark

-24

1998

1999

2000

2001

2002

2003

2004

2005

2006

—

—

11.9

4.5

15.1

—

13.3

11.4

4.6

—

4.3

6.2

-1.6

—

-3.1

-4.5

-6.1

—

-5.6

-8.4

13.2

—

13.3

12.3

10.1

—

9.1

9.8

13.4

—

11.5

11.1

11.1

—

12.2

8.6

2007

5.2

5.2

3.0

1.3

History

Generations

Generations I

Benchmark

Category

Benchmark Description

30% S&P/TSX Composite Total Return Index:

Measures the market activity of a broad range of senior equities listed on the Toronto Stock Exchange.

25% Morgan Stanley Capital International (MSCI) World Index*:

Includes stocks of companies in all the developed markets around the world.

40% DEX Universe Bond Index:

Comprised of Canadian investment-grade bonds which mature in more than one year.

5% DEX 91-Day Treasury Bill Index:

Comprised of 91-day treasury bills issued by the Canadian government.

Performance Disclaimer

The returns or performance information shown assume that all income and/or realized net gains are retained by the segregated fund in

the periods shown. This results in higher unit values of the segregated fund. Return or performance information does not take into

account any sales, redemption, distribution or other optional charges. Nor does it take into account any income taxes payable that would

have reduced returns or performance.

How a segregated fund has performed in the past does not necessarily reflect how it will perform in the future.

The Generations Core and Generations II series for this segregated fund became available in December 2007. The above performance

data reflects the performance of the Generations series of this segregated fund. The management fee for the Generations Core series of

this segregated fund is equal to or greater than the management fee for the Generations segregated fund, and the actual performance

of the Generations Core series for this period would have been equal to or less than the returns shown above. The management fee for

the Generations II series of this segregated fund is equal to or less than the management fee for the Generations series, and the actual

performance of the Generations II series for this period would have been equal to or greater than the returns shown above.

©2008. Morningstar Research Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted

to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Segregated fund outlines and financial highlights

Explanation of terms used in the fund outlines

This section provides you with an explanation of some of the terms and assumptions that apply to the information provided about the Funds

on the following pages. You should refer back to this section when reading the Segregated Fund Outlines and Financial Highlights to make

sure you have complete information about a Fund.

Investment Objective

Performance data

This section describes the fundamental investment objective of the

Fund and where applicable, the Underlying Fund.

The past performance of the Fund is shown under the year-by year

returns, overall past performance and annual compound returns

headings.

Investment Strategy

This section describes how the Fund, the Underlying Fund (where

applicable), attempts to achieve its investment objective.

Growth of $10,000

The risks of a Fund and the Underlying Fund (where applicable), are

listed in this section. See Fund Risks section for more information.

The graph shows the growth of a hypothetical $10,000 investment

in the Fund, as compared to a hypothetical $10,000 investment in a

specified index or indices. The benchmark shown in the graph

represents Canada Life’s benchmark index or indices as indicated

on the Fund page.

Financial highlights

Annualized returns

This table shows selected key financial information about the Fund

as at December 31 of the indicated year and are intended to help

you understand the Fund’s financial performance for the years

shown. This information is derived from the Fund’s audited financial

statements. The information shown is for each series of the Fund

and is as follows:

The table shows the historical annual compound total return of the

Fund for the periods indicated, as compared to the performance of

the specified index or indices. A description of the indices used can

be found on each Fund page.

Fund Risks

• the total net assets

• segregated fund turnover rate

• underlying fund turnover rate

• net asset value per unit

• the number of units outstanding

• management fee

• the management expense ratio (MER) (annualized for

units in existence for less than one financial year)

Management Fee

Management Fee refers to the fee that Canada Life charges for the

management and administration of each Fund and the Policy.

Management expense ratio (MER)

MER refers to the total of the Management Fee and operating

expenses (expressed as an annual percentage) paid by the Fund.

Please remember that past performance of the funds is not an

accurate prediction of future returns.

Annual compound returns and overall past performance have been

compared to a relevant broad-based securities index for each Fund.

Each index is provided for comparison purposes only.

Calendar Year returns

The bar chart shows the annual performance of the Fund.

Performance is shown for each of the identified years and

illustrates how the fund’s performance has changed or fluctuated

from year to year. The bar chart shows, in percentage terms, how

much an investment made on January 1 of each year would have

grown or decreased by December 31 of that year, assuming the

investment remained in that Fund for the full year and no additional

transactions occurred.

We are not permitted by regulation to show performance history for

funds less than one year old.

Volatility Analysis

Turnover rate

The Fund’s portfolio turnover rate generally indicates how actively

the portfolio advisor manages the investments. A portfolio turnover

rate of 100% is equivalent to the Fund buying and selling each

security once in the course of the year.

This depicts the percentile rank for the 3 yr standard deviation

within the Morningstar Category compared to the category average

along with a text description of why volatility is important to

consider.

THE CANADA LIFE ASSURANCE COMPANY

Canada Life GenerationsTM

Segregated fund outlines and financial highlights

For the period ending Sept. 30, 2008

The indicated rates of return for 1, 3, 5, 10 years and From Inception

are annual compounded returns for the period ending Sept. 30, 2008,

including changes in unit value and reinvestment of all distributions.

The segregated fund management fee has been deducted. Please note

that unit values and investment returns will fluctuate and past performance

is not necessarily indicative of future performance.

A description of the key features of Canada Life’s individual variable

insurance contract is contained in the information folder, available from

your advisor*.

For more information about Canada Life and its products visit

www.canadalife.com or talk to your advisor.

ANY AMOUNT THAT IS ALLOCATED TO A SEGREGATED FUND IS INVESTED AT THE

RISK OF THE POLICYHOLDER AND MAY INCREASE OR DECREASE IN VALUE.

Helping people achieve moreTM

TM

Canada Life and design, “Helping people achieve more” and Canada Life Generations are trademarks of The Canada Life Assurance Company.

*In Quebec, advisor refers to a financial security advisor for individual insurance and segregated fund policies: and to an advisor in group

insurance/annuity plans for group products.