Express Opportunities In China Packaging a Strategy For the

advertisement

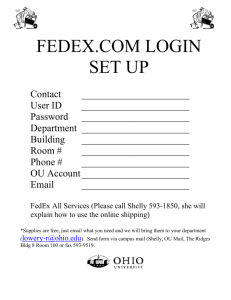

Perspective Alexander Niehues Edward Tse Justin Zubrod Express Opportunities In China Packaging a Strategy For the International And Domestic Express Delivery Market Booz & Company is a leading global management consulting firm, helping the world’s top businesses, governments, and organizations. Our founder, Edwin Booz, defined the profession when he established the first management consulting firm in 1914. Today, with more than 3,300 people in 58 offices around the world, we bring foresight and knowledge, deep functional expertise, and a practical approach to building capabilities and delivering real impact. We work closely with our clients to create and deliver essential advantage. For our management magazine strategy+business, visit www.strategy-business.com. Visit www.booz.com/cn to learn more about Booz & Company in Greater China. CONTACT INFORMATION Hong Kong/Shanghai McLean Stuttgart Partner edward.tse@booz.com Partner justin.zubrod@booz.com Partner alexander.niehues@booz.com Edward Tse Justin Zubrod Alexander Niehues Originally published as: Express Opportunities in China: Packaging a Strategy for the International and Domestic Express Delivery Market, by Ed Tse, Justin Zubrod, Alexander Niehues, Simon Gillies, and Paolo Pigorini, Booz Allen Hamilton, 2007. 1 Express Opportunities in China Packaging a Strategy for the International and Domestic Express Delivery Market Introduction As China strives to further improve the quality of its manufactured products and reliability of delivery, the share of high-value goods as part of the Chinese trade flows will rise further— increasing the need for express delivery service providers, both domestically and internationally. China is on its way to becoming a global trade powerhouse—with an economy that is expected to reach a gross domestic product of USD 4.5 trillion within the next decade. Its huge availability of cheap labor has already made China a global manufacturing center, which will continue to strongly drive import and export transportation needs over the coming years. Because most of China’s trade flows are focused on the United States, Europe, and the Asia Pacific region, global integrators are well-positioned to capture growing express demand in their worldwide networks. Exhibit 1 China Foreign Trade Flows (in USD Billions) Netherlands $13 (3%) Germany $17 (5%) $18 (4%) Japan $53 (14%) $43 (10%) China China Imports Imports 14% 4% 3% 3% 3% 9% 64% South Korea $42 (11%) $20 (5%) Russia $9 (2%) • Computers & Electronic Equipment, Parts • Crude Oil • Machinery & Motor Vehicles, Parts • Plastics in Primary Form • Steel & Aluminum Products • Iron Ore Other US $29 (8%) $91 (21%) Taiwan Hong Kong $41 (11%) $5 (1%) $68 (16%) China China Exports Exports Malaysia $10 (3%) • Apparel & Textiles 12% 9% 2% 2% 6% Legend: Legend: Imports Imports in in $USbn $USbn Exports Exports in in $USbn $USbn % % value value denotes denotes share share of of total total imports imports or or exports exports respectively respectively Source: Statistic Department of Customs General Administration of China (for the first half of 2006) • Computers • Electronic Equipment, Parts • Steel Products • Furniture 68% Other 2 With China increasingly becoming an integrated part of the worldwide manufacturing processes, express delivery services will grow in importance to cover the demand for time-sensitive shipments in global supply chains. Therefore, it is not surprising that China is the strongest developing market in the Asia-Pacific express and parcels delivery sector—showing continuous growth close to 30 percent on average per year. At about USD 4.4 billion in 2006, the Chinese express market has already become a major strategic target for global players. about +40% per year. Tremendous growth in foreign trade and direct investments, strong domestic economic development, and state support in massive infrastructure investments create a market environment that offers tremendous opportunities for both domestic and international express companies. However, despite the investment enthusiasm surrounding exponential growth rates, there are still huge chal­lenges in doing business in China: Overregulation, fragmentation, a weak transport network, and congestion are holding back the industry. There are many risks for western companies attempting to Exhibit 2 China Express Delivery Market (2004-2008) in USD Billions and Major Drivers of Growth Foreign Foreign Trade Trade International Express Domestic Express Domestic Domestic Economic Economic Development Development 8-10% GDP growth in recent years Expect 10% average growth of air cargo traffic next 20 years (Boeing) 2,8 0,9 3,5 1,1 +28% 4,4 1,4 1,9 2,5 3,1 2004 2005 2006 Market Market Opening Opening and and State State Support Support 2001-06 CAGR +30% Import/export volume exceeding $1400 bn p.a. 7,4 5,8 2,6 Foreign Foreign Direct Direct Investment Investment 1,9 3,8 2007E 4,8 2008E FDI exceeding $60 bn p.a. Outward FDI by Chinese Enterprises over $7 bn in 2006, growing at 26% WTO agreements Closer Economic Partnership Arrangement (CEPA) Source: Market Research, Booz Allen Hamilton Estimate When China joined the World Trade Organization (WTO), the country experienced a rapid market liberalization and modernization as well as rising domestic consumption. As a result, the Chinese express market continues to offer huge growth prospects for local and foreign players alike – since growth of time-definite deliveries are running at enter the market, although these did not prevent the major global integrators such as UPS, TNT, DHL, and FedEx from establishing a local presence two decades ago. Despite the large business opportunities, the market is one of the most difficult in which to operate. As it develops further, both domestic and international 3 market, and China’s eventual accession to the WTO were still far removed from reality. However, the major global integrators such as TNT, UPS, DHL, and FedEx recognized that China presented an opportunity not to be missed. With ever more foreign companies entering China, and the country’s growing awareness for the international exchange of goods and documents, these “big four” integrators made sure their services were available. players need to revisit their strategies to create and maintain sustainable positions that enable them to tap into future expected growth. In light of China’s explosive growth and the full liberalization of the transport sector, the pressure is now on the express delivery providers to understand new strategic imperatives. They need to anticipate the challenges and obstacles that must be overcome to achieve and secure sustainable, profitable growth in the Chinese international and domestic express market. All international companies who arrived in the ‘80s and ‘90s were only able to enter the Chinese market by means of local joint venture partners—forcing international express companies to adopt identical market strategies in the region. All four players chose as their first joint venture partner the state-owned Sinotrans Group, which was the largest player in logistics in China at that time. But in subsequent years, they followed different paths in developing their businesses. A. China’s International Express Market The Growth Story The beginnings of the market for express delivery services in China date back to the early 1980s, when the Chinese Postal Administration introduced Express Mail Service (EMS) for international deliveries. At that time, the prospects of the Chinese economy opening up to become something resembling a free Exhibit 3 Major Events and Growth Periods in China Express 1980 to 2006 Initiation (1980 – 1988) Expansion (since 2001) Market Establishment after first Express Mail Service offered by China Post Rapid Market Growth following China’s WTO Accession cancels Sinotrans JV form JVs with Sinotrans 1986 enters via agencies 1981 enters via agencies Domestic EMS launched 1984 1980 China Post launches EMS Source: Literature Search, Company Web Pages switches JV from Sinotrans to EAS 1995 enters via agencies enters via Sinotrans JV 1988 forms JV with Sinotrans operates first direct flight of int’l cargo airline into China 1996 switches JV from EAS to DTW 1999 first crossborder flight to Japan 2003 renews Sinotrans JV until 2052 2002 opens retail stores starts Hoau acquisition offers direct buys out flights to China DTW 2005 launches domestic service 2006 buys out JV Offers next-day and nextmorning svc 2004 12 / 2001 China joins WTO starts domestic air service launches domestic service 12 / 2005 Market opened to WOFEs Cooperates with Okay Airways 2007 4 Market Strategies of the Big Four As the first foreign express company in China, DHL signed an agency agreement with Sinotrans in 1981. In 1986, both companies formed the first Chinese international express joint venture (JV), which prevails to this day. In 2003, DHL underlined its strong partnership by purchasing an equity stake of 5 percent in Sinotrans Ltd. Due to its first-in advantage, the DHL/Sinotrans JV now holds the lead position in Chinese international express delivery with about one third of the market. In 2004, DHL was the first of the international integrators to offer a domestic parcel service in China, again via the Sinotrans JV. In 1988, UPS followed the same approach as DHL and FedEx and used Sinotrans as a delivery agent to gain access to the Chinese express market. This was followed by a joint venture agreement in 1996 and equity investments in Sinotrans in 2003. Because of competitive conflicts with the DHL-Sinotrans JV, UPS exited the cooperative agreement in 2004. It effectively bought out the existing customer contacts and 23 stations in major cities for USD 100 million in an agreement phased until the end of 2005. Thus, UPS has established its own network in China, which currently serves about 19 percent of the international express market. FedEx started express operations in China in 1984 on an agency basis and in 1986 entered a JV with Sinotrans, shortly after DHL. After termination of the Sinotrans JV in 1995, FedEx partnered first with smaller EAS International Transportation (now Kerry EAS), and in 1999 switched to the then little known Tianjin Datian W. Group Co., Ltd. (DTW Group). Following these moves to eversmaller JV partners, at the beginning of 2006, FedEx announced a USD 400 million takeover of DTW Group’s express business, including domestic express assets in 89 locations, thus converting its Chinese operations into a wholly owned foreign enterprise (WOFE). FedEx holds an approximately 20 percent market share of the international express delivery market. TNT Express also entered the Chinese market in 1988, by means of a JV with Sinotrans that lasted until 2003. Subsequently, TNT took over about 90 percent of the employees and entered into a new JV with a very small partner, Machplus (founded in 1999 and with 800 staff at the time). The company built a network of 25 owned and 50 franchised locations serving about 600 cities across the country. Since 2005, this company also offers domestic services. TNT is currently the smallest player of the big four with about a 7 to 8 percent market share of the Chinese international express market. 5 Exhibit 4 China International Express Market Shares (1995 vs. 2006) 100% Other 2% 90% 6% 7-8% 80% 18-20% 70% 60% 19-21% 50% 97% 19-21% 40% 30% 20% 30-34% 10% 0% 1% 1995 2006 Source: DHL, Morgan Stanley, Press search, China Economic Review June, 2006; Press Search; BAH analysis Over time, the ‘big four global integrators’ have captured between about 80 percent of China’s international express market, absorbing the largest part of the immense market growth into their networks. The incumbent state-owned EMS of China Post, which held 97 percent of the market in 1995, comparatively stagnated at low single-digit growth rates. One reason is that the early presence of all large integrators ensured they were in place when their existing multi-national corporation customers (MNC) entered China. The key factor, however, is the non-competitive international product offering of EMS. China Post got a late start, in 2003, in operating its first few international flights. It largely relies on the Universal Postal Union network of national post operators for international delivery. Delivery times in its existing network are dependent on the individual postal operator’s handling capabilities and are far removed from the next-day time-definite guarantees the large integrators offer for an increasing number of destinations. Competitive Landscape As the former incumbent, EMS is working hard to catch up with time-definite delivery services. In May 2004, EMS set up a service with Singapore Post and Japan Post that guarantees time-definite express delivery between China, Singapore, and Japan. EMS also partnered with the TNT Group in offering a “China Express” international delivery product that serves international destinations via the TNT network, providing express delivery to major European centers. In addition, China Post launched a speeded up “All Night Flight” delivery program, which guarantees that mail reaches recipients in China’s biggest cities by 10 a.m. the following day. Competition in the China express industry remains intense, with operators snapping up opportunities in an effort to stay ahead of the competition. For example, FedEx invested USD 150 million into a new hub at the Guangzhou Baiyun International Airport in Southern China, the largest air cargo hub in Asia Pacific. In 2007, UPS will establish an international air hub at Pudong International Airport and plans to open more than 20 new facilities in major Chinese cities during the next two years. TNT has put two new B747-400ERF 100-ton cargo planes into operation that will go into daily service between Europe and China, massively increasing uplift capacity. 6 Overall, the big four international players are well established in the China international express market and have divided up the market among themselves. Each one offers comprehensive service levels at competitive prices and has partially complementary competencies in serving the European and U.S. markets. None of these players have a major competitive advantage nor does EMS have any options for breaking out of its primarily regional role. The key for any further market developments, therefore, is the way in which companies operate within China and if and how they set up their domestic delivery networks. New Strategic Opportunities With China’s announcement that it would open up the ground transportation market to WOFEs, new strategic opportunities arose. DHL remains the only international express integrator that is still operating in a strong JV relationship with Sinotrans—presumably locked in by mutual longterm commitments and management’s belief that the close governmental ties offered by Sinotrans provide a competitive edge. Despite inherent though smaller conflicts of interest between Sinotrans’ Freight Forwarding and 3PL Business with DHL Exel Supply Chain Solutions—acting as competitors in some segments—DHL Express sticks to the joint venture. Annual growth figures of up to 45 percent for express volume and revenue seem to prove that DHL’s strategy is the right one. The other integrators follow the route of higher independence in the Chinese express market, to be quicker in their decision making, gain more control over their operations, and avoid internal cultural conflicts. FedEx and TNT have followed similar approaches after deciding the Sinotrans JV did not fulfill their strategic purposes; both companies chose much smaller JV partners. FedEx cooperated with smaller partners, EAS and DTW, They both offered significant benefit to FedEx’s operations at the time of JV formation but were small enough to avoid dependence. FedEx’s final move was the complete takeover of DTW’s express division in 2006. TNT joined with Machplus, a company so small that TNT had great control over the Chinese assets from the beginning. Since 2003, TNT has effectively operated independently. UPS remained with the Sinotrans JV until December 2004, when it signed a USD 100 million agreement to take direct control of Sinotrans’ operations in 23 Chinese cities. Exhibit 5 China International Express Market Shares (1995 vs. 2005) 100% 3% 90% 80% 70% 60% 50% 97% 40% 30% 40% 20% 10% 0% 1995 Source: “China Economic Review” June, 2006; Lit Search; Booz Allen Estimates 2006 7 With the final opening of the express market in 2005, China Post’s remaining “safe” income stream is the state-guaranteed monopoly on delivery of personal mail letters, since now all operators are allowed to deliver business letters. China Post is trying to lobby for new regulation, for example, to ban all express companies in China (other than EMS) from delivering goods that weigh less than 350 grams, but these efforts face pressure from competitors as well as the State Council. The three integrators now operating independently have taken a big step. Although they have gained significant knowledge of the local market and culture through their long phase of cooperation, they are faced with challenges such as more limited network coverage. This has opened a new competitive battlefield— the Chinese domestic express delivery market. B. China’s Domestic Express Market Over the last years, with the rapid growth of China express, many new operators came into play in the domestic market. Among the thousands of small to medium-sized companies, the vast majority are local truckers who operate at very low prices and varying (mostly low standard) service levels in the fragmented geographical and regulatory landscape of Chinese Similar to the international express market, China Post used to be the monopoly in the domestic express delivery market a decade ago, but has been losing significant market share since then. Although China Post is still the strongest player, it continuously loses ground to fast growing domestic competitors. Exhibit 6 State-owned and Private Players in the China Domestic Express Segment Type China Rail Express China Air Express ZJS Express Express Services Network Domestic express 736 service hubs in 275 Chinese cities State-owned Infrastructure International transportation and logistics State-owned Infrastructure Domestic express 8/12/24/36/48-hr. service 287 cities Domestic express 12/24/48-hr. – 3/4/5-day service >2000 cities and districts, 40 branches Nation-wide Express Value added services Internat’l express TTK Express Nation-wide Express Domestic express 24/48-hr. service Internat’l express “Door-to-door” service network covers more than 380 Chinese cities 900 domestic air routes between 129 airports 1200 vehicles, 14 rented airplanes .000 employees 500 cities 11,000 employees Notes Largest competitor of EMS, more than USD 150 million revenue Expanding air and road network Founded 1996 by Civil Aviation Authority under participation of all major domestic airlines Largest private express company in China, founded 1994 in Beijing ~USD 100 million revenue in 2005, rapidly growing Founded 1994, with headquarters in Shanghai Handles ~200.000 parcels/day Regional Road Express Domestic express in Zheijang and Jiangsu > 400 delivery points Founded in Shanghai > 2,000 vehicles Handles ~200.000 parcels/day Regional Road Express Domestic express in Guangdong, plus Hong Kong > 100 cities Domestic 12/24/36/48/72-hr. service and internat’l express > 1,100 cities, 100 branches Kerry EAS International Logistics Group, 3PL EAS is a former JV partner of FedEx, taken over by international Kerry Group in 2005 1000 service points CNEX/Jiaji Integrated Logistics, 3PL More than USD 100 million revenue; generally 3PL but references to large share of Express STO Express SF Express Express delivery 10,000 employees > 3.000 trucks, of which 1.200 are long-haul 10.000 employees DTW Group Hoau Group Source: Literature Search, Company Web Pages Integrated Logistics, 3PL Freight + Package Road Transport Domestic express International express in FedEx JV Package delivery Founded 1993 in Guangdong 20 provinces 144 stations in JV with FedEx 89 domestic locations previously not in JV 1.100 depots 56 hubs 3.000 trucks 12,000 employees Former FedEx JV partner, all express business (even nonJV domestic) bought out by FedEx early 2006 Largest private road network in China In negotiation with TNT for takeover to be completed by mid 2007 (for 135 Mio. USD) 8 logistics operations. The strong protectionism of local authorities, especially with regard to road transport, put up significant barriers to large expansion strategies. Some local operators, however, have found ways to expand profitably in the last decade’s doubledigit growth environment. Nonetheless, none of the new emerging local operators captured more than 10 percent of the market, leaving all the players except China Post in very fragmented positions. Market Strategies of Selected Domestic Players Established in 1993, the China Railway Express (CRE) rapidly expanded its service to more than 300 cities in China. In 2003, CRE invested in its own trucks and increased the number of sorting and logistics facilities by an additional 12 cities from the original single one in Beijing. In 2004, CRE gained access to more than 60 domestic air routes through airline partnerships, and thus is able to provide faster service across the country. Currently, CRE is serving more than 380 cities. With an express revenue of more than 150 million USD and a domestic market share of approximately 5 to 10 percent, CRE is the second largest provider of domestic express services in China after EMS. Despite having some limited flexibility in pricing and market approach because of direct control by the Chinese Ministry of Railroads (MOR), CRE has established itself as a premium provider and is investing heavily in infrastructure and IT to ensure growth and reliable delivery. China Air Express is another stateowned provider of express services. It was founded in 1996 under direct control of the Civil Aviation Administration of China and has access to the majority of Chinese airlines and airports. It was one of the first companies in China to offer time-definite delivery via its network of more than 900 domestic air routes between 129 airports. The company is covering about 280 cities and starting to expand local road transport distribution centers. Of the private companies, the largest pure-breed express operator is ZJS Zhai Ji Song (ZJS) Express. Founded in 1994 in Beijing, ZJS offers a number of flexible express services with delivery times between 12 hours and 5 days. Its overall network covers 2.000 districts and cities and around 40 branch companies. ZJS is also offering a number of value-added services such as insurance, payment collection, and packing and storage service. From a backbone of airline-connected major centers, the network has been developed down to smaller municipalities covering more than 1,000 cities. Revenue has reached about USD 100 million in 2005, with year-on-year growth peaking at about 70 percent in 2003/2004. According to the ambitious company leader, Chen Ping, “We aim to enter into the stock market, name our own flights, board on the Top 500 companies list, and become the most famous domestic express company in China.” The second private express company that operates across China is Tian Tian Kuai (TTK) Express. Based in Shanghai, its network covers about 500 cities and reaches remote areas such as Inner Mongolia or Tibet, but the main focus is on the Zhujiang River Delta, the Yangtse River Delta, and offshore Bohai Gulf regions. In 2004, TTK’s revenue was about 10 percent lower than that of ZJS. Like ZJS, TTK also offers an option for international express delivery. It is interesting to note that these two companies have the most professional and complete English-language web presence of all Chinese operators reviewed in this paper. Of the more regionally road-based express companies, examples of sizable players are SF Express and STO Express. They offer a very dense transportation network in their region at competitive prices, without having the far-reaching aviation interface that allows them to offer nationwide services. Their competitive advantage is based on their local connections. These companies are quite sizable; STO Express, for example, delivers 200,000 pieces per day, which is on the same order of magnitude as TTK. However, as their network is exclusively road based, expanding to much larger regions would require changing the mode of operation; thus in their current form, these 9 enterprises are limited to the growth of their regional markets. In addition to exclusive express delivery providers, there are numerous integrated logistics firms that also provide domestic time-definite services. The most prominent of these are shown in Exhibit 6. They mostly focus on 3PL services and are generally not considered as core competitors in the Chinese express market. Of special interest are the DTW Group and the Hoau Group, which are being bought by FedEx and TNT, respectively, to further strengthen their footprint in the Chinese transport market. Building the Domestic Express Business in China At the beginning of 2006, immediately after China has opened the market following WTO accession requirements, all four large international integrators are poised to expand in the Chinese domestic market with full steam. Every one of them has announced that they plan to actively participate in the massive growth that is expected for years to come. They have set up legal structures and built or bought a beachhead into the market, but none of them has any sizable market share yet. The players that have so successfully dominated China’s international express market with their product offerings, have chosen quite different ways to approach the domestic market. DHL, building on the long-standing joint venture relationship with Sinotrans and thus not waiting for the market opening for WOFEs, was the first international integrator to enter into the domestic express market in 2004 - offering some 70 domestic destinations, reaching already about 95% of the domestic population. This move enabled DHL to fully leverage its existing China network to better use the “less-than-truckload” (LTL) pick-up and delivery fleets and increased its participation in domestic trade. Nonetheless, some hurdles remain: DHL’s prices are currently about 25 percent higher than those of China Post. With its acquisition of 17 domestic airfreight licences in 2007 (e.g. operating out of major cities such as Shanghai, Beijing, Dalian and Tianjin), DHL is now the only one of the ‘big four’ that offers a domestic airfreight express services in China. Going forward, DHL plans to invest about $215 million in express centers, new branches, express logistics centers and strategic spare-parts centers. Exhibit 7 Overview of the Big Four International Express Players’ Strategic Footprint in China Network coverage 318 cities, 56 outlets, 163 stations, > 220 cities, to increase by 330 cities, covered by 75 100 in the next 5 years facilities >600 cities, 25 owned + 50 franchise facilities Year of market entry 1981, JV with Sinotrans in 1986 1984, JV with Sinotrans in 1986 1988, JV with Sinotrans in 1996 1988 via JV with Sinotrans Type of presence Sinotrans JV since 1986 WOFE since Jan. 2006 WOFE since Jan. 2006 Effectively WOFE since 2003 Staff ~ 9,200 > 6,000 Expansion of Air Freight business with 17 domestic destinations In Jan, 2006, FedEx bought out DTW for USD 400m Strategic announcements May move its AP express Moved its China HQ from hub from the Philippines to Hong Kong to Shanghai in Guangzhou in Southern July 2003 China Outlets to increase from 50 Departed Sinotrans JV for to over 70 USD 100 million DHL has the longest history in China and continues to build its success on the proven Sinotrans joint venture. Investing USD 500m into new hub at Shanghai’s Pudong airport China is the only country for which FedEx has established a separate headquarter, showing its importance as a market. > 3,000 (Feb 2007) Has set up an effective Opened first two express franchising system since retail centers in September 2003 2006 Raising stake in Air Hong Kong to 40%, Cathay Pacific holding 60% USD 200m+ infrastructure investments, expanding Pudong, Guangzhou and Hong Kong hubs Key Fact > 3,500 by the end of 2006 6,500 in APAC total “Brown Initiative” aims to have only direct operations; no JV or agents in the future to ensure 100% UPS brand. Source: Bear Stearns, Reuters, FT, Morgan Stanley, Company Web Pages, Booz Allen Estimate (based as of end 2006) Expansion of cooperation with China Southern Airlines Hoau Acquisition underway, freight/parcel company serving over 1,100 locations China is the focus for TNT Express at the moment: “We aim to establish our second home market in China.” 10 FedEx is in the process of fully acquiring the express operations of its present joint venture partner DTW. This process will be concluded in the first half of 2007. In addition to its current JV operations, FedEx will have full control of DTW’s domestic express network in 89 cities, which DTW started to build in 2002. FedEx plans to open up another 32 branch offices in China – reaching a total of 58 establishments that covers a network of 300 cities and provinces by end of 2007. UPS was the first western company to announce the change to wholly owned operations. The buy-out of the Sinotrans JV in early 2005 gave UPS full control over its operations in China, but did not include any domestic business. In July 2005, the company announced it would offer domestic next-day service between 23 metropolitan areas, which according to UPS generate about 80 percent of China’s international trade. In August 2006, the company opened two retail stores in Shanghai’s business district, in a move to position its product offerings with professional services industries. Currently, UPS has 4.000 employees in China. Being the express & logistics sponsor for the Bejing Organizing Committee for the Olympic Games is expected further bolster brand identity in the region. TNT is the most ambitious in setting targets for China, with its CEO, Peter Bakker, stating in 2005 that TNT’s aim was “becoming market leader in the Chinese domestic express market.” To this end, TNT has, in addition to its owned stations, opened a franchising system to quickly expand its branch network. TNT claims its 25 owned and 50 franchised facilities cover more than 600 cities, which is a higher number than quoted by any other foreign operator. TNT’s second strategic move is the takeover of Hoau Group, which is assumed to operate the largest private road transportation network in China. If the negotiations succeed, TNT will control a massive infrastructure of 3,000 trucks and almost 1,200 depots across China and plans to differentiate itself from the other competitors by operating a comprehensive road transportation network across Southeast Asia. In the long-term, TNT expects to build up 1.100 depots in China. Different Routes to Capture Domestic Growth Of the big four integrators’ strategies, the most obvious differentiating factor is the way they expand their business: n n Acquisitions (FedEx and TNT) Organic growth (DHL’s Sinotrans JV and UPS, partially) For companies entering a foreign market, acquisitions are often a natural route for quickly gaining market share. In China, however, mergers and acquisitions ( M&A) have little history, because Chinese culture values “blood authentic” relationships in business— only organically grown branches are considered as really belonging to a company. In the case of the FedEx and TNT takeovers, the dangers seem manageable because both companies have already established a strong presence and local management in China. The FedEx acquisition of DTW’s express business can be seen as a natural expansion of the previously existing joint venture, and FedEx has taken care of building up its local workforce: More than 80 percent of the FedEx-DTW JV managers are Chinese citizens, and FedEx was ranked by Hewitt Associates in 2005 as among the Top Ten “Best Companies To Work For” in China. TNT’s acquisition plans follow a different strategy than that of FedEx. Hoau is not a direct competitor in the express market because it is mainly a trucking company and has no previous immediate relationship to its new owner. Thus, TNT will focus on maintaining the key performance indicators (KPI) of the infrastructure and transportation service Hoau can provide its express business. China’s administrative structure could present an obstacle: as local protectionism still prevails in many administrations, a foreign-owned company could suddenly face difficulties such as excessively long handling times for crossing districts. Because this is fundamentally the same issue facing a company from a different city or province, Hoau, with its existing nationwide network will have developed strategies and contacts to operate in this environment. In general, an acquisition strategy in China will be challenging. Because of the high market 11 fragmentation there are few known targets and limited data available to conduct a detailed due diligence. Thus, only small acquisitions by service and/or geography are possible, which result in incremental growth instead of a large leap forward. Rolling up and integrating regional express players into an existing network and organization will be very difficult. Political interference is another hurdle to overcome because the Chinese government will protect state-owned enterprises and intellectual property. When considering growth via acquisitions, an international player needs to consider six major evaluation criteria relevant to a successful integration: Critical Success Factors in China Domestic Express A. Geographical Concentration The three costal regions, Bo Hai Bay, the Yangtze River Delta, and the Pearl River Delta, have 30 percent of the total population and represent about half of China’s gross domestic product (GDP). These areas attract 75 percent of foreign direct investment and 84 percent of all international trade volumes. These are also the areas where the big four have focused their operations, generating the majority of their express revenue along the coastal regions. Over the next years, the demand in the costal regions for express delivery of high-value products will continue to outgrow other areas in China. Since transportation networks are well established already, economies of scale will drive down operating costs and offer competitive prices that are necessary to be successful in the domestic express market and provide a strong footprint to expand to the (less developed) western regions of China. 1. Potential to fully acquire the target or at least obtain a majority stake 2. Brand reputation and awareness in China 3. Geographic attractiveness (domestic versus international) 4. Financial attractiveness/soundness of operations and customer base 5. Product/service mix, vertical industry coverage 6. Target relationship with local government officials B. Price-Service Competitiveness What will be the right strategy for success in this highly competitive and fragmented environment? The success of a domestically grown company like ZJS shows it is possible to build a competitive nationwide infrastructure. But the ZJS example also shows the Exhibit 8 Hurdles to Achieve Growth in China Via Acquisitions Political Interference Government protects state-owned companies Limited Resources Understanding of regional conditions only by locals Unfulfilled staffing needs Intellectual Property Protection Risk of know-how leakage Need to retain local employees Limited Players Information Limited reliable data Unique accounting methods in China Fragmented Market All potential companies <5% market share Only regional coverage 12 difficulties of surviving the competition in China. The company generally handles consignments in the range of 5 to 100 kg, with a typical size of 30 kg. A price comparison shows that CRE is offering 24-hour service for 5 kg and 40 kg for a lower price than ZJS’s 48-hour product. In mid-2005, the vice president of ZJS, Xiong Xingming, said that in the face of rising fuel prices, increasing logistics costs, and “cutthroat competition,” margins had dropped down to 5 percent from the previous 10 percent. Although FedEx and UPS currently do not offer domestic express services between Beijing and Shanghai, DHL’s domestic delivery prices seem to be significantly higher than other players’ express services. The only way to justify higher prices is service and quality levels. The Chinese logistics market can be characterized with “three Ls”: Low Skills, Low Levels, and Low Prices. This is typically true of operations across most of the more than two million small local trucking companies in China, where about 80 percent of trucks have no solid body but nylon covered beds. Overloading is common practice, and trucking and warehousing workers often carelessly handle packages, leading to high damage ratios. In a 2005 survey among 3PLs in China, “Quality of service,” “Data tracking,” and “Cargo security” were among the most frequently named challenges (topped only by “Government regulations”). For the express business, timeliness of delivery is of similar importance to physical integrity of shipments.. In this area, the market leader EMS is behind many of its private competitors, having pushed the on-time delivery of domestic EMS mail items to more than 90 percent. The Chinese market participants have recognized the importance of offering high-quality services. In addition to verbal commitments and money-back guarantees, many companies heavily invest in IT infrastructure to ensure the smooth flow of goods. For example, CRE is featured by Intel as a showcase customer for wireless mobile applications in tracking shipments. In this area, the international players certainly have some expertise to bring into the market, but the large Chinese companies are already quite advanced in optimizing their process flows. Exhibit 9 Geographical Areas of Growth for High-Value Express Delivery Services Bo Bo Hai Hai Bay Bay Population Population 12% 12% GDP GDP 18% 18% Foreign Foreign Investment Investment 21% 21% Int‘l Int‘l Trade Trade 19% 19% Yangtze Yangtze River River Delta Delta Population Population 11% 11% GDP GDP 20% 20% Foreign Foreign Investment Investment 35% 35% Int‘l Int‘l Trade Trade 30% 30% Pearl Pearl River River Delta Delta Source: Bear China Statistical Year Book; Booz Allen Hamilton Analysis Population Population 6% 6% GDP GDP 10% 10% Foreign Foreign Investment Investment 21% 21% Int‘l Int‘l Trade Trade 35% 35% 13 C. Staff Resources and Expertise Another key factor for high service quality is attracting and maintaining a skilled and loyal labor force. This is even more important in China than in other countries, because the market is growing more rapidly than education can provide skilled professionals: China will lack about one million logistics professionals by 2010 and growth targets of the big four require about a ten-fold addition of new resources over the next two to three years. Consequently, numerous companies follow a strategy of “up-skilling” and retaining staff. For example, FedEx is offering each employee up to USD 2,500 in tuition reimbursements for training and is following a strategy of promoting internally—more than 90 percent of management positions in Asia are filled by people who began their careers in non-management positions. TNT has built a “TNT China University” in cooperation with a Shanghai management school and is one of very few foreign enterprises offering a comprehensive internship program. In TNT’s franchising system, the members are enrolled into a specific internal training program to build their skill base. This type of a globalbackground education cannot be matched by the much smaller Chinese companies. It may indeed be a key attraction for employees in a country where, according to a recent survey, more than half of the students leave university with the feeling of never having learned “anything practical.” D. Local Network and Licenses High complexity for the players in the Chinese parcel delivery market arises from the complicated and often inefficient legal procedures, which are strongly driven by local administrations. For road transport, which is crucial for the domestic business, legislation exists at the national, provincial, and local level; local protectionism often leads to difficulties for non-local vehicles and ranges from high tolls and lengthy registration procedures for entering a city to close supervision and heavy-handed fining for minor breaches of regulation. Some downtown areas are closed for trucks between 7 a.m. and 7 p.m. Another critical success factor to ensure future growth is to obtain the relevant operating licenses to be able to offer international and domestic express services. In addition to legal difficulties, the security situation in some areas of the country mandates escorting trucks to avoid loss of goods and vehicles, which Exhibit 10 Examples of Domestic Inter-city Express Delivery Prices of Major Players in China Price for a single package from Beijing to Shanghai (USD; Exchange Rate of Sep 07, 2006) DHL 0.5 kg 2kg up (14.40) 24 hrs Delivery 5 kg 27 40 kg 170 0.5 kg 40 FedEx currently no Domestic service UPS currently no Domestic service TNT 5,30 11,70 EMS 6,30 11,30 55 CRE Cargo, min 5kg 11,30 25 48 hrs Delivery 5 kg 40 8,80 8,80 2,50 9,30 40 kg 78 62 No Service (only 3 days) CAE 45 54 161 4,40 13 ZJS 18 18 43 14 14 35 TTK 10 19 98 1,30 5,30 41 STO 101 No Service (min 3 days) SF No Service 2,50 7,60 52 KEAS 28 39 121 3,10 14 35 DTW 4,10 10 58 4,10 10 58 Source: Booz Allen Hamilton Market Research; based on Full-Rate Card Quotes 14 Exhibit 11 Required Enterprise Licenses and Certificates for International and Domestic Air Express Enterprise Licenses and Certificates International Domestic Enterprise Establishment License X X Enterprise Legal Person Business License X X Int. Freight Forwarding Enterprise Certificate of Approval X Postal Entrustment X Class 1 Cargo Sales Agent X Air Express Permit X X Customs Declaration Agent Certificate X Customs Bonded Warehouse Certificate X Customs Supervised Export Warehouse Certificate X Import Export Quarantine Agent X Import/Export Express Operator X Quarantine Inspection Declaration of Import/Export Express Operator X Source: Booz Allen Hamilton Market Research drives up costs, especially for high-value express delivery. In this type of environment, it is essential to have a deep understanding of the various factors and a broad network of local connections. DHL enjoy a certain advantage in this area, with its strong JV partner Sinotrans and 18,000 employees. If TNT does a good job of managing the Hoau integration, that company’s wide-spread road transport network may prove to be a valuable asset in the same respect. E. Vertical Industry Focus To achieve profitable growth in the China market, express delivery players need to concentrate their efforts on sizable industry verticals that offer a good economic delivery model in terms of both pick-up and delivery costs, which are influenced by delivery times and consignment weight. Whereas front-door, lowweight parcels offer a high degree of automation (e.g., electronics, computing, and retail industry) and thus keep operations costs to a minimum, there might also be opportunities in the more heavy-weight, back-door business (e.g., automotive, machinery, and equipment industry) because delivery density tends to be higher due to consolidated consignment shipments. Looking at the growth figures across some selected industries that require time-definite express deliveries, most sectors in China show above GDP growth, especially the electronics and computing and the automotive and transportation industries. These fast growing industry verticals offer an attractive segment to further expand local operations as customers require nationwide, expedited transportation services at high quality, but also rely on international coverage (e.g., for overseas on-time deliveries). Players with additional supply chain logistics service—like the big four—should be able to differentiate themselves and move out of the low-cost priced market by focusing on time sensitive verticals that explicitly ask for value added services such as after-market logistics capabilities, inventory management, and other 3PL solutions. Conclusion Looking at the development of China’s GDP and its foreign and domestic trade volumes, it is clear that the country currently offers the major growth market for express delivery services worldwide. Such growth will probably only be matched by a similar evolution in India. This has been clearly recognized by the big four global players in the industry, namely DHL, FedEx, UPS, and TNT. Consequently, all of them are pursuing aggressive growth strategies in the region. 15 In the international market, the global players have been quite successful in using their existing networks and multinational customer bases to divide the market mostly among themselves. The only significant Chinese competitor is China Post’s EMS service. Similar to postal operators in other countries, EMS offers a product that cannot directly compete with the comprehensive services of the integrators, and therefore is viewed as filling a limited market niche in China’s international express segment. Looking forward, we do not expect any major shifts driven by developments within the market; changes will primarily result from global strategies or from the domestic business the integrators build—a strong domestic market position may lead to synergies for their customers, but overall the links between international and domestic express operations are rather small. The key success factors in the domestic express market are price competitiveness, service quality, staff expertise, and local connections. Along those dimensions, it should be noted that a number of strategic initiatives may in the end decide ultimate market success. Provided below are some examples of these initiatives: In the domestic market, the rapid growth (which has eroded the previous postal monopoly) has so far been captured by a multitude of fragmented small players, some of which have shown the potential to build decent market positions. The global integrators have entered this market recently and are now in a similar position to many of the much smaller local players. n Brand Marketing: UPS is currently showing the most consistent approach. Following the so-called “Brown Initiative,” the company is committed to operating only on fully owned assets, explicitly excluding any joint venture or agent operations to ensure a clear corporate identity is carried in each customer contact. At the same time, UPS is carrying its brand to the public in its newly opened retail stores and via sponsorship of the 2008 Beijing Olympics, for which UPS is the designated logistics partner n Service Differentiation: Targeting very specific customer segments is one way to maintain profit margins in the low-price Chinese market. An example for this is TNT’s “Clinical Express” product for the clinical trial diagnostics market. Even though there are many labs in China, for special examinations valuable specimens often have to be transported to diagnostic centers or even overseas to such places Exhibit 12 Comparison of Economic Express Delivery Models Across Different Industry Verticals 10% later Wholesale Chemical Pharma / Healthcare Delivery Time 1) Retail Metal Products 5% Building & Construction Automotive Food, Beverages & Tobacco 0% Textile earlier Other Services Paper, Publishing & Printing Machinery & Equipment Financial Services -10% -30% -20% lower -10% 0% 10% Average Weight per Consignment 1) Difference in % vs. weighted average across all industries Source: Booz Allen Hamilton Market Research Electronics & Computing Public Sector Professional Services -5% Transport 20% 30% 40% higher 16 Exhibit 13 Estimated Growth of Selected Industry Verticals in China Electronics & Computing 13 -14% Automotive & Transport Textiles & Apparel Consumer Products 12 -13% 9 -10% 8 -9% Ø China GDP Source: WTO, Global Insight, China Statistics Yearbook; Booz Allen Hamilton Estimates as the United Kingdom. This kind of transport was often carried out by lab staff personally carrying the samples on passenger flights. With “Clinical Express,” TNT takes care of properly handling the sample, which can be quite lucrative —a package to Europe that would normally have a USD 400 value could end up costing USD 2000! n n Cooperation: Many cooperation models have been tried in the Chinese market. In 1999, for example, FedEx partnered with Kodak photo stores to serve as pickup and delivery points. These stores form a nationwide network of more than 8,000 locations across China,. TNT has a strategic partnership with EMS, employing the nationwide network of postmen to deliver its parcels, as well as a code sharing agreement with China Southern airlines. Very little information about these agreements is available after the initial announcements, leading to the assumption that they were not successful. The reasons for this are unclear because cooperation, especially between a local player with a strong lastmile transportation infrastructure and a global player with the international network, seems to be quite natural, although it is possible that the cooperation model is simply overshadowed by the next option. Selected Acquisitions: All private players in the Chinese logistics market are very small compared to the global integrators. Instead of cooperating to deliver a service, it is an even more straightforward choice to directly buy the smaller partner, as UPS and FedEx did when they acquired their JV partners or TNT did in its takeover of Hoau group, which as a local infrastructure provider ideally offers the “last mile” component to TNT’s express product. While some of the acquisitions may not add significant operational assets and capabilities, they can help build the customer base and add volume into the acquisitions network. At the moment, no single operator has shown a significant competitive advantage that puts the company at the top of the pack. Success is and will be defined by a multitude of key success factors that are required to tap into the growing domestic express market. It might be possible that some local players like CRE and ZJS, with their greater experience in Chinese operations, will grow their positions to be dominant in the market. On the other hand, the foreign international integrators with their global reach and financial power may still decide the race in their favor. The opportunity is there—now it needs to be captured! BOOZ & COMPANY WORLDWIDE OFFICES Asia Europe Middle East South America Beijing Hong Kong Mumbai Seoul Shanghai Taipei Tokyo Amsterdam Berlin Copenhagen Dublin Düsseldorf Frankfurt Helsinki London Madrid Milan Moscow Munich Oslo Paris Rome Stockholm Stuttgart Vienna Warsaw Zurich Abu Dhabi Beirut Cairo Dubai Riyadh Buenos Aires Rio de Janeiro Santiago São Paulo Australia, New Zealand, and Southeast Asia Adelaide Auckland Bangkok Brisbane Canberra Jakarta Kuala Lumpur Melbourne Sydney North America Atlanta Chicago Cleveland Dallas Detroit Florham Park Houston Los Angeles McLean Mexico City New York City Parsippany San Francisco The most recent list of our office addresses and telephone numbers can be found on our Greater China Web site, www.booz.com/cn. 08/08 Printed in Greater China ©2007 Booz & Company Inc.