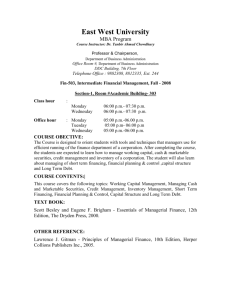

OAF 623 ADVANCED CORPORATE FINANCE

THE OPEN UNIVERSITY OF TANZANIA

FACULTY OF BUSINESS MANAGEMENT

MASTER OF BUSINESS ADMINISTRATION (MBA)

OAF 623: ADVANCED CORPORATE FINANCE

COURSE OUTLINE

P. M. K. NGATUNI, Ph.D

November 2010

1

THE OPEN UNIVERSITY OF TANZANIA

FACULTY OF BUSINESS MANAGEMENT

DEPARTMENT OF ACCOUNTING AND FINANCE

MASTER OF BUSINESS ADMINISTRATION (MBA)

OAF 623: Advanced Corporate Finance

Course Outline

1.0

Introduction

Corporate finance is becoming more dynamic and challenging both globally and in

Tanzania. The past few years have seen fundamental changes in financial markets and instruments as well as new developments in corporate financial theories and practices.

Firms are also operating in a more dynamic environment. Advanced Corporate

Finance is designed not only to take you to a higher level but also to introduce you to recent literature and developments in a number of areas in Financial Management.

The aim is to enable you master the selected topics that are significant and of contemporary nature and equip you with the ability to apply theoretical concepts in finance to problems in the area of corporate finance with all the complexities that the real world entails.

2.0

Course objectives and Learning Outcomes

This course extends and applies the principles of corporate finance learned before

(e.g. in OAF 612 and/or elsewhere) covering some of the main areas in corporate finance namely: the financing decision; financial system, markets and instruments; financing alternatives; dividend policy, leasing, corporate restructuring and mergers and acquisitions; and financial engineering and innovations. A key objective is to demonstrate the link between those various decisions and areas by, for example, exploring how the firm’s financing, investment and payout policies interact with each other and how those decisions have implications for corporate bankruptcy and takeovers.

At the end of the course you will be able to:

• acquire knowledge of broad financial concepts;

• enhance skills in obtaining information on current financial issues;

• apply knowledge to specific problems and cases;

2

• evaluate special areas, including sources of long term financing, corporate restructuring and reorganization, and financial engineering;

• become aware of some international issues in finance

At the end of this course you should be able to:

• have acquired a knowledge and understanding of the concepts and mainstream

•

•

• theories in corporate finance including recent developments in the area; be able to evaluate the strengths and limitations of up-to-date theories and practices in corporate finance; be able to derive, evaluate and apply some financial theories in corporate financial management and policy making have gained experience in writing an assessed essay, paper or report in advanced corporate finance

3.0 Course Evaluation and Grading

The course will be evaluated through a compulsory student progressive portfolio

(SPP), timed test (TT) and the final examination (FE).

3.1 Compulsory Student Progressive Portfolio (SPP)

When you register for the programme each year you will be given the SPP booklet in which you will open a page for this course. On this page you will reproduce the learning outcomes/objectives of this course. Then as you study for it, you document in the spaces provided what you have achieved, problem areas, the references you used, etc. This information will be the basis for your evaluative meeting with the course instructor during the face to face session. Upon satisfaction with this and with the interview, the instructor will endorse you to be given access to examination. This will be administered once, preferably in April (during the face to face session) at regional centre offices or at a venue arranged by the Director of Regional Centre.

There will be one test only covering the first half of the course and it will be administered only once in a given academic year. It requires prior registration. You should therefore consult your Regional Centre Staff for the procedures and timing.

The final examination will examine the whole course. Questions will be constructed to contain a fair balance of problems, short answers, and discussion questions (not multiple choices). The examination will be administered during the normal university examination session, i.e. in June. Note that you also need to register for it. If you fail

3

to take examination at this time (having officially notified the faculty of your extenuating circumstances) you will take the examination in February the following year, as special examination. If you score below the pass mark you will be given another chance to sit for a supplementary examination for it in February the following year; terms and conditions apply.

3.4 Weighting of the Course Assessment

The weighting of the assessment will be as follows:

The pass mark shall be 50%

4.0 COURSE COVERAGE AND STUDYING PLAN

4.1 INTRODUCTION TO ADVANCED CORPORATE FINANCE

♦ corporation and their key features

♦

Corporate financing

♦

Financial System and its role in corporate financing and development

♦

Taxonomy of Financial markets, Instruments, and their roles

♦

An overview of corporate financing alternatives

♦

Sources of finance for small, high-growth companies

♦

Venture capital financing and its role in corporate financing

♦

Target firms for venture capital financing

♦

The venture capital process

♦

Sources of funds for venture capital investments

♦

Attracting venture capital finance and choosing a venture capitalist

♦

Realities in venture capital financing

♦

Rules for successful venture capital investments

♦

When do venture capitalists cash out?

♦

Venture capital market in Tanzania.

Initial public offerings

♦

Introduction to IPOs

♦

Arranging a public offering

♦

Pricing an IPO

4

♦

Underwriters and their roles

♦

Costs of a public issue

♦

Underpricing: its reasons and effects

♦

Empirical evidence on IPOs

♦

Cross listing and its benefits

♦

Alternative issue methods

Seasoned equity offerings

♦

SEOs vs IPOs

♦

Issue procedures, alternatives and options

♦

Rights issues

♦

Terms of a rights issue and their determination

♦

Price setting in a rights issue

♦

Market price reaction: Reasons and empirical evidence

4.4 DEBT FINANCING - DEBENTURES

♦

Types of long term debt

♦

Main features of long term debt

♦

Designing a long term debt issue

♦

An overview of the debt market in Tanzania

♦

International debt financing

♦

Bond refunding analysis

4.5 DEBT FINANCING - COVERTIBLE DEBENTURES AND

WARRANTS

CONVERTIBLE DEBENTURES

♦

The workings of convertible securities

♦

Key features of convertible securities o Conversion value o Conversion ratio o Conversion premium o Investment value

♦

Valuation of convertible debt securities

♦

Why do companies issue convertible debt securities

WARRANTS

♦

Key Features of Warrants o Exercise price o Exercise ratio o Expiration date o Detachability o Rights

♦

Valuation of warrants

♦

Why do companies issue warrants

♦

Convertible debt securities vs. warrants

5

♦

The basics of leasing

♦

The types of leases

♦

Operating leases

♦

Financial leases

♦

Reasons for, and pros and cons of, leasing

♦

The cash flows from leasing arrangements

♦

Analysis of lease-buy decisions

4.7 DIVIDEND POLICY AND THEORIES

♦

Describe dividend payment procedures.

♦

The nature of dividends (How are they paid?)

♦

Determinants of dividend policy (How do companies decide on dividend payments?)

♦

Dividends, repurchases, and share price valuation

♦

The irrelevancy of dividend policy

♦

The influence of taxes.

♦

Dividend Theories

♦

Empirical literature on dividend policy

♦

Financial Distress

♦

Bankruptcy liquidation and reorganization

♦

Bankruptcy liquidation

♦

Bankruptcy Reorganization

♦

The choice between the two

♦

Predicting corporate bankruptcy

4.9 MERGERS AND ACQUISITIONS

♦

Acquisitions: basic forms and types

♦

Reasons for mergers

♦

Forms of business combinations

♦

Determining the synergy from acquisition

♦

Sources of the synergy

♦

Evaluating a merger candidate

♦

Value of the firm after acquisition

♦

The NPV analysis of mergers and acquisitions

♦

Merger defenses

♦

Empirical evidence on mergers and acquisitions

4.10 INTRODUCTION TO DERIVATIVE SECURITIES AND FINANCIAL

ENGINEERING

♦

An introduction to financial engineering and innovation

♦

Factors contributing to growth of financial engineering

♦

Financial Derivatives

6

-

Forward Contracts, Options, Futures and Swaps

♦

Options and Hedging Strategies

♦

Empirical evidence of the use of financial derivatives

5.0 Learning Resources References

There is no single text that is recommended for this course. Being an advanced comprehensive course in Business Finance, any good Corporate Finance/Financial

Management text book that covers advanced finance topics is very helpful.

Below are some useful books. You are strongly advised to make every effort to secure at least a copy of one of these texts. Latest editions are highly recommended but editions that are few years old may also be useful.

In addition, you are encouraged to search for specific cases and academic articles which are relevant to the topics covered. Reference No. 15 below is an example of sources of guidance on how to write an academic piece of work. If you cannot find these, there exist a number of equally good alternatives.

Arnold, G. (2005) Corporate financial management.

3 rd

edition. London: Pearson’s

International.

Bodie, Z., Kane, K. & and Marcus, J. (2003) Essentials of Investments 5 th

Edition,

McGraw Hill, New York, NY.

Brealey, R. A. & Myers, S. C. (2003) Principles of corporate finance. 7 th

edition .

Boston: McGraw-Hill, Irwin.

Brealey, R. A., Myers, S. C. & Allen, F.. (2011) Principles of corporate finance . 10 th edition. McGraw Hill Higher EducationBrealey, R. A., Myers, S. C. &

Marcus, A.J. (2006) Fundamentals of corporate finance . 6 th

edition.

Boston: McGraw-Hill, Irwin.

Damodaran, A. (2001) Corporate finance: Theory and practice . 2nd edition. New

York: John Wiley & Sons Inc.

Emery, D. R., Finnerty, J. D. & Stowe, J. D. (2007) Corporate financial management .

3rd edition. Prentice Hall

Fabozzi, F. J. & Modigliani, F. P (2009) Capital markets: Institutions and instruments . 4 th

edition. Upper Saddle River, New Jersey: Prentice Hall

Fabozzi, F. J., Modigliani, F. P. & Jones F. J. (2010) Foundations of financial markets and institutions . 4 th

edition. Upper Saddle River, New Jersey:

Prentice Hall.

7

Firer, C.; Ross, S. A.; Westerfield, R. W. & Jordan B. D. (2005) Fundamentals of

Corporate Finance. 3rd South African edition. Berkshire UK: McGraw-

Hill Companies.

Gitman, L. J. (2009) Principles of managerial finance . 12 th

edition. Addison-

Wesley/Prentice Hall

Joseph, G. C. (2002) Analysis of Factors affecting accessibility of small and medium enterprises to venture capital in Tanzania. Unpublished MBA dissertation,

University of Dar es Salaam

Kester, W. C.; Ruback, R. S. & Tufano, P. (2005) Cases and problems in finance. 12 th edition. New York: McGraw-Hill Kolb, R. W., (2000) Futures, Options and Swaps . 3 rd

Edition. Oxford: Blackwell Publishing Ltd .

Marshall, J. F. & Bansal, V. K. (2001) Financial engineering: A complete guide to financial innovation.

New Delhi: Prentice Hall of India

McMenamin, J. (1999) Financial management: An introduction . New York:

Routledge,

Mishkin, F. S. & Eakins, S. (2009) Financial markets and institutions . 6 th

edition.

Prentice Hall

Moyer, R. C., McGuigan, J. R., & Kretlow, W. J. (2008) Contemporary financial management . 11 th

edition. Cingage Learning.

Oberuc, R.

E. (2004) Dynamic portfolio theory and management: Using active asset

allocation to improve profits and reduce risk. McGraw-Hill

Pandey, I. M. (2006) Financial management . 9 th

edition. New Delhi: Vikas

Publishing House Pvt Ltd.

Rose, P. (1997) Money and capital markets: Financial institutions and instruments in a global market place. 6 th

edition. Chicago:, IRWIN/McGraw-Hill.

Rose, P., S., Kolari, J. W. & Fraser, D. R. (1993) Financial institutions:

Understanding and managing financial services. 4 th

edition. Chcago:

Richard IRWIN Inc.

Ross, S. A., Westerfield, R. W. & Jaffe, J. F. (2008) Corporate finance. International

8 th

edition. Boston: McGraw-Hill/Irwin.

Ross, S. A., Westerfield, R. W. and Jordan, B. D. (2006) Fundamentals of Corporate

Finance . 7 th

edition. Boston: McGraw-Hill - Irwin.

Saunders, M., Lewis, P., & Thornhill, A. (2009), Research methods for business students . 5 th

edition. Harlow: FT Prentice Hall Ashford Clour Press Ltd.

Van-Horne, J. (2002) Financial management and policy . 12 th

edition. Upper Saddle

River, New Jersey: Prentice-Hall

8

Winstone, D. (1995) Financial Derivatives: Hedging with Futures, Forwards,

Options, and Swaps. London : Chapman and Hall.

Many of these books are available at OUT HQ library, its regional centres, or appropriate sections in the Tanzania Library Services (TLS) branches. Some of them are available at bargain prices in bookshops, bookstalls in the city and other towns

(shop around). Other institutional libraries should have some of them (take the initiative). The list above is also not exhaustive. Many other books in finance cover the intended materials. Be curious but guided by this outline and explore them wherever you find them. You may also try your luck by visiting the following websites where you may find and download some of these or other equally relevant text books, including those of other subjects: www.4shared.com

, www.bookboon.com

, and www.scholar.google.com

. The following local websites are also extremely useful for this module: www.dse.co.tz

; www.bot-tz.org

; www.cmsatz.org

; www.tic.co.tz

.

5.2 Journal Articles and Other Periodicals

As mentioned earlier, you will need to read as many as relevant journal articles as you can. For each topic covered, several articles exist that you could read and gain a good insight on the empirical evidence reported on it. Depending on availability and relevance, you are encouraged to find and read more of such articles. Examples of useful journals include:

Journal of Finance

Business Management Review

Journal of Economics and Business

Journal of Financial and Quantitative Analysis

Journal of Financial Economics

Journal of Accounting and Economics

Journal of Accounting Review

Journal of African Economics

Journal of Business

Journal of Business Finance and Accounting

African Journal of Finance and Management

You can search for articles in these and many other journals in finance through the

OUT’s online journal database accessible via it library website http://www.out.ac.tz/current/Library/jounal1.html

. Some of the databases that are useful in finance include: Emerald, JSTOR, Blackwell Synergy, Oxford

University Press, and Taylor & Francis.

Example of articles drawn from these databases that are relevant to several topics are listed here

9

IPOs

Lee, I. Lochhead, S., Ritter, J. & Zhao, Q (1996) The cost of raising capital. Journal of Financial Research, 19(1) pp.59-74

Pagano, M., Panetta, F. & Zingales, L. (1998) Why do companies go public? An empirical analysis. Journal of Finance 53(1). Pp. 27-63.

Purnanandam, A. K. & Swaminathan (2004 ) Are IPOs really underpriced? The

Review of Financial Studies , 17(3). Pp. 811-848.

Ritter J.R., & Welch, I. (2002). A review of IPO activity, pricing and allocation.

Journal of Finance, 57(4), 1795-1829.

Ritter, J. (1991) The long run performance of initial public offerings. Journal of

Finance 46(1). Pp 3-27

SEOs, debt issuance

Asquith, P. and D. W. Mullins (1986) Equity issues and Offering Dilution, Journal of

Financial Economics 15 : 61-90

Loughran, T. and J. Ritter (1995) The new issues puzzle, Journal of Finance , 50: 23-

51

Masulis, R. W. ans A. N. Korwar (1986) Seasoned Equity Offerings: An Empirical

Investigation, Journal of Financial Economics 15 : 91-118.

Mikkelson, W. H. and M. M. Partch (1986) Valuation Effects of Security Offerings and the Issuance Process, Journal of Financial Economics 15 : 31-60.

Myers, S. C. and N. S. Majluf (1984) Corporate Financing and Investment Decisions when Firms have information that Investors do not have, Journal of

Financial Economics, 13 : 187-228

Ngatuni, P., J. Capstaff and A. Marshall (2007) Long-Term Performance Following

Rights Issues and Open Offers in the UK Journal of Business Finance &

Accounting , Volume 34, Numbers 1-2, January/March 2007 , pp. 33-

64(32)

With the revolution in distance learning brought about by the internet, students are encouraged to begin learning and using internet for search for information relevant to their subjects of study. You can also use the internet to set up your our discussion/study group. There are many downloadable learning resources available on the internet including sites, which publish working papers.

10