Hire Purchase: Meaning, Features & Legal Aspects

advertisement

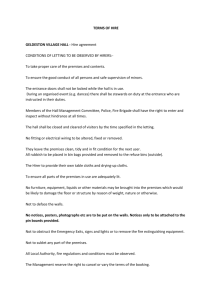

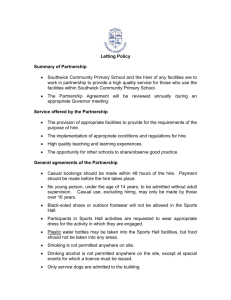

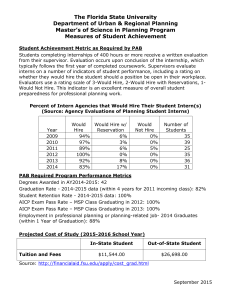

Hire Purchase 1. 2. 3. 4. 5. 6. 7. 8. 9. Meaning Features of H.P. Legal Position Terms of Agreement Contents of H.P. Agreement H.P. Vs Credit & Installment Sale H.P.& Leasing Origin & Development Banks & H.P. Business Meaning Hire purchase is new method of selling. In this the ownership of goods is remains with the creditors until the last installment is paid but the possession is passes immediately to hirer. The one who purchases property is known as hirer & the one who sells it is called creditor. Features of Hire Purchase ¾ Buyer takes possession of goods immediately & agrees to pay the total hire purchase price in installment. ¾ The each installment is treated as hire charges. ¾ The ownership of goods passes from seller to buyer on the payment of last installment. ¾ In case of default, seller has right to repossess the goods & forfeit the amount already received. ¾ Hirer has also right to terminate the agreement any time before the property passes. Legal Position The Hire Purchase Act 1972, defines a hire purchase agreement, an agreement under which goods are let on hire & under which hirer has an option to purchase them in accordance with the terms of agreement. Terms of Agreement ¾ Payment to be made in installment. ¾ Possession is delivered to the purchaser at the time of entering into contract. ¾ The ownership passes to the purchaser at the time of last installment paid. ¾ In case of default is made in payment of any one installment, the seller is entitled to take away the goods. ¾ The hirer/purchaser is free to return the goods without being required to pay any further installments falling due after the return. Contents of H.P. Agreement Must be in writing & signed by both the parties Description of goods Price of Hire Purchase The date of commencement of agreement The number of installment, amount & due date H.P. Vs Credit Sale Point Hire Purchase Credit Sale Title of Property Ownership with seller, possession with hirer Both Ownership & possession with buyer Case of Default Seller can take back goods Seller can charge interest for O/s amount H.P. Vs Installment Sale Point Hire Purchase Installment Sale Title of Property Ownership with seller, possession with hirer Both Ownership & possession with buyer Case of Default Seller can take back goods Seller can sue the buyer Hire Purchase & Leasing POINTS HIRE PURCHASE LEASING Ownership With Seller With Lessor Method of Business Assets & Financing Consumer articles Only Business Assets Claim of Hirer can claim Depreciation Lessee cant claim Hire Purchase & Leasing POINTS HIRE PURCHASE Tax Benefit Only interest part is installment Tax deductible LEASING The entire lease is Tax deductible Salvage Value Hirer enjoys the Salvage value Lessee cant enjoy the same Deposit Normally 20% deposit required No deposit required Hire Purchase & Leasing POINTS HIRE PURCHASE LEASING Extent of finance 70 to 75% finance is made 100% finance is made Maintenance Born by hirer himself Reporting Shown in the Balance Sheet of Hirer Lessee is responsible Shown as Foot note only Origin & Development Origin can be traced to 1807 in U.S.A. when Cowperwet & Sons, a furniture dealer introduced the system. In U.K. it was after industrial development by Henry Moore a piano maker in 1846. All early Hire Purchases were financed by manufacturer or dealer. In India the growth is visible after second World War though it was started after 1st World War. It increase in it’s activities during fifties & sixties. Origin & Development In 1987-88 the total of hire purchase business in India is Rs.635 crores. Now it is estimated around Rs.3000 crores. Now not only automobile but also consumer goods are sold on hire purchase system, with a growing Indian middle class 100 to 150 million & their willingness to mortgage the future for today’s enjoyment have led spectacular growth in this business. Bank & H.P. Business Through recent notification issued on 7-9-1990 of Banking Regulation Act 1949, Government of India permitted banks to engage in hire purchase business with taking into account the guidelines from R.B.I. No banks at present can undertake directly the Hire purchase business The banks which are already engage in merchant banking or equipment leasing can undertake this business but only after prior approval from R.B.I. The investment of bank in the shares of subsidiary set up for hire purchase business shall not in the aggregate exceed 10% of paid up & reserve