a question of great importance to bankers, and to the mercantile

advertisement

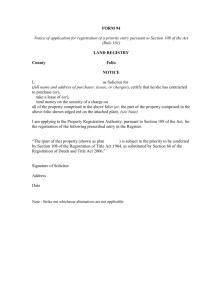

“A QUESTION OF GREAT IMPORTANCE TO BANKERS, AND TO THE MERCANTILE INTERESTS OF THE COUNTRY”1 A version of this article, written by Head of Banking & Finance, Jonathan Porteous & Associate, Laura Shackleton, first featured in Butterworths Journal of International Banking and Finance Law in July/August 2012. Key Points: The case of Hopkinson v Rolt established that in certain circumstances where advances are made by the prior chargee after a subsequent charge is entered into, the prior chargee is not entitled to “tack” further advances to his prior charge, unless he had no knowledge of the subsequent charge. Under statute, tacking is possible in limited circumstances. A prior chargee can put protections in place to prevent a situation arising in which he loses priority to amounts advanced by a subsequent chargee. TACKING OF FURTHER ADVANCES – THE PRINCIPLE The question Lord Campbell considered to be of such importance was whether a prior chargee’s future advances made after the debtor has granted a subsequent charge over the same property can be “tacked” to that prior chargee’s security in priority to amounts owing to the subsequent chargee secured by the subsequent charge. The point was considered in Gordon v Graham (2. Eq.Cas.Abr.598 pl16) which found in favour of a general right to “tack” unless there are special circumstances which mean the rule should not apply. THE RULE IN HOPKINSON V ROLT The later case of Hopkinson v Rolt established that, in circumstances in which: 1 there is a prior charge for present and future advances; Lord Campbell, Hopkinson v Rolt (1861) 11 E.R. 829 1 PERSONAL\6997882v1 25 February 2015 there is a subsequent charge for present and future advances; each party has notice of each other party’s charge; and advances are made by the prior chargee after the subsequent charge is entered into, the prior chargee is not entitled to priority for its further advances over advances already made by the subsequent chargee. The prior chargee is not, therefore, entitled to “tack” further advances to its prior charge, unless it did not have knowledge of the subsequent charge. Whilst the doctrine in Gordon v Graham was partly predicated on the basis that “it was the folly of the second mortgagee with notice to take such security”, Lord Campbell adopted the contrary position in reaching judgement in Hopkinson v Rolt, namely that where the prior chargee has knowledge of the subsequent charge, he cannot be injured by the subsequent charge as the prior charge secures past advances and there is no obligation to make further advances. If the prior chargee chooses to make further advances, he must ensure he has adequate security. THE STATUTORY POSITION Real Property The Law of Property Act 1925 (LPA), Land Registration Act 1925 and Land Registration Act 2002 (LRA) codified the rule in Hopkinson v Rolt and extended the ambit of the rule. Accordingly, the case of Hopkinson v Rolt does not apply to real property. Registered Land Section 49 of the LRA gives a prior chargee the right to tack further advances to its prior charge made after a subsequent charge is granted only in the following specific situations, or with the agreement of the subsequent chargee (best recorded in a deed of priority). However, as we explore further below, the prior chargee can alleviate any risks of losing priority in respect of amounts advanced by registering a restriction on 2 PERSONAL\6997882v1 25 February 2015 dispositions of the property on the title and only consenting to a subsequent charge if it is entered into contemporaneously with a deed of priority: Prior chargee can tack if he has no notice of subsequent charge (section 49(1)) The Land Registration Rules2 provide that the prior chargee will have the requisite notice if notice of the subsequent charge is served on the prior chargee at its address entered in the register (or another notified address) in accordance with those rules. The prior chargee should ensure the register is kept up to date with its service address details and that any notices served at that address will be attended to rapidly to ascertain whether it is anticipated further advances will be made. All further advances should be stopped until the prior chargee has adequate security and/or priority arrangements in place. The subsequent chargee should ensure notice of the subsequent charge is served on the prior chargee so that the subsequent chargee’s advances take priority over the prior chargee’s further advances. Prior chargee can tack if he has an obligation to make further advances and this is noted on the register (section 49(3)) If a facility includes any obligation to make further advances, for example in a development facility, this should be reflected in the legal charge by the inclusion of a clause such as: “The parties hereby apply to the Chief Land Registrar to enter a note on the register of Title Number [●] that the chargee is obliged to make further advances”. This can then be noted on the register. Prior chargee can tack if the parties to the prior charge have agreed a maximum amount for which the charge is security and this is noted on the register (section 49(4)) 2 Land Registration Rules 2003, rule 107 3 PERSONAL\6997882v1 25 February 2015 If a prior chargee envisages that he may need to make further advances to a debtor but does not have an obligation to do so, then to ensure priority over a subsequent charge the legal charge could include a clause reflecting a maximum amount (to include interest and costs) such as “The parties hereby apply to the Chief Land Registrar to enter a note on the register of Title Number [●] that they have a agreed a maximum amount of £[●] to be secured by the Charge.” This can then be noted on the register. Land Registry Form CH3 must be used to note a maximum amount on the relevant title. Unregistered property Section 94 of the LPA provides that a legal or equitable chargee of unregistered land may “tack” further advances to existing security, despite a subsequent chargee, if: the subsequent chargee has agreed; the prior charge includes an obligation to make further advances; or the prior chargee had no notice of the subsequent charge. For these purposes, the prior chargee will be deemed to have notice of the subsequent charge if it has been registered as a land charge, unless it was not protected by registration as a land charge at the time when the prior charge was created, or was not registered as a land charge at the time the subsequent chargee made a search of the Land Charges Register, whichever last happened. Other than tacking permitted by one of the above methods, section 94 goes on to provide that “save in regard to the making of further advances as aforesaid ….the right to tack is hereby abolished”. Other Property Whether or not section 94 of the LPA applies to personalty is in question. An argument may be made that it does not apply3, on the basis that section 94(4) of the LPA states that “this section applies to mortgages of land made before or after the commencement of this Act, but not to charges on registered land”, implying that 4 PERSONAL\6997882v1 25 February 2015 section 94 of the LPA does not purport to govern assets other than land. If that is the case the rule in Hopkinson v Rolt will continue to apply to personalty. Whilst that case addresses the situation in which the prior chargee does not have notice of the subsequent charge4, it does not expressly address the situation in which there is an obligation to make further advances5 nor, in our opinion, does it adequately address a situation where there is an agreed maximum amount of security. Applying the Hopkinson v Rolt line of case law, claims of a subsequent chargee will have priority over claims of a prior chargee in respect of any advances made by the prior chargee after he has notice of the subsequent charge, even if the prior charge has a contractual obligation to make further advances. Accordingly, a prior chargee will be presented with the choice of breaching his contract with the debtor or losing priority in respect of further amounts advanced6. This position is at odds with the basis for the conclusion in Hopkinson v Rolt that a prior chargee can protect himself by not advancing further funds after he has received notice of a subsequent charge. It is also surprising that it seems irrelevant that the subsequent chargee is on notice that the prior chargee has a contractual obligation to make further advances. In our view, on balance a court would be likely to extend the section 94 of the LPA rules to personalty, even if there is doubt that the draftsman intended this to be the case. The section is capable on its terms of being interpreted as applying to personalty, and it would be somewhat perverse to insist on a fine distinction between the treatment of land and personalty so as to reach a significantly different finding of priority depending on whether the charged asset was land or personalty in the case where the prior mortgagee was obliged to make further advances. It is worth mentioning another legal principle which is relevant to this topic. 3 See however Goode (Commercial Law 3rd Edition) – section 94 “apparently applies to personalty as well as realty” 4 The better view is that notice must be actual rather than constructive, see for example The Law of Personal Property Security (Beale, Bridge, Gullifer, Lomnicka) (2007) 5 See West v Williams [1899] 1 Ch 132 which applied the rule even where there was an obligation to make further advances 6 But see ibid, where it was observed that the entry into the subsequent charge released the prior chargee from its obligation to make further advances 5 PERSONAL\6997882v1 25 February 2015 CLAYTON’S CASE This is of course a very well known doctrine but with particular importance to priorities between chargees. Where a prior chargee has entered into an overdraft facility or revolving credit facility under which amounts will be drawn, repaid and redrawn, it also needs to be concerned about the “first in first out” rule in Clayton’s case (Devaynes v Noble (1814-1834) All ER Rep 1) namely that monies paid into an overdrawn account are deemed to repay the earliest debts first and any amounts redrawn are fresh drawings. Therefore, subject to the various exclusions detailed above, if: £10,000 is drawn down from the prior chargee under a secured revolving credit facility; a subsequent charge is granted with the knowledge of the prior chargee and £20,000 drawn down from the subsequent chargee; the £10,000 advanced under the revolving credit facility is repaid and £30,000 drawn, then the £30,000 owing to the prior chargee will rank behind the £20,000 owing to the subsequent chargee, as the prior charge secured amounts owing at the time the subsequent charge was granted but which were repaid prior to drawdown of the £30,000. This risk of loss of priority can be avoided by the prior chargee, on finding out that a subsequent charge has been granted, opening up a second account into which repayments should be paid leaving the initial advance owing and having priority over the advances of the subsequent chargee. However, in the absence of any arrangement between the chargees, advances already made by the subsequent chargee will have priority over any further advances of the prior chargee. The doctrine may be varied by contractual terms to the contrary. PROTECTIONS FOR THE PRIOR CHARGEE 6 PERSONAL\6997882v1 25 February 2015 A prior chargee can put protections in place to prevent a situation arising in which he loses priority to amounts advanced by a subsequent chargee. Deed of priority Multiple chargees can enter into a deed of priority, deed of subordination or intercreditor agreement to regulate the order in which amounts owing to them are paid and the order in which any proceeds of security of the same asset will be applied. The prior chargee should be aware that there are still potential risks of losing priority, even with such a contract in place, for example: A subsequent chargee might choose to assign its debt and security package, which it will most likely be entitled to do pursuant to the terms of those documents without the consent of the debtor. The assignee will only be bound by the deed of priorities if it has notice of it – which, unless it is registered at the Land Registry, is only likely to be the case if the assignor gives the assignee notice. Accordingly, it is important to include restrictions on assignment in the deed of priorities obliging the assignor to procure adherence by the assignee to the deed of priority. The deed of priorities may not have been executed correctly so may be ineffective against one or all parties. If the underlying facility and security documents are amended, the deed of priorities may be ineffective if the description of liabilities regulated is not sufficiently widely drafted. Negative pledge The prior chargee’s facility documents and security will probably include a negative pledge clause prohibiting the creation of further security. To improve the effectiveness of this clause (rather than simply relying on the debtor’s compliance), third parties should be put on notice of it, as follows: Charges registered against a company 7 PERSONAL\6997882v1 25 February 2015 On registration of the prior charge using Form MG01 the prior chargee should detail the terms of the negative pledge. A subsequent chargee who has carried out a search of the register will have actual knowledge of the negative pledge. However, whilst there has been no decision on the matter, it is widely considered to be the case that the inclusion of the negative pledge on the Form MG01 will not fix a subsequent chargee with constructive notice. Restriction on title In respect of registered land, in addition to the protections referred to above, a Land Registry standard form restriction in Form P should be included in the legal charge. With such restriction on the title, the Land Registry will not register the subsequent charge without the consent of the prior chargee. EXAMPLE The interplay of the rules set out above are best demonstrated with an example: 1 January: A borrower and a lender (Lender 1) enter into a £2,000,000 revolving credit facility (RCF). First ranking security is granted. £750,000 is advanced. 1 February: The borrower enters into a £3,000,000 term loan (Term Loan), with a second lender (Lender 2) to which it grants security over the same assets. The borrower draws down £1,000,000 under the Term Loan. 1 March: The borrower borrows £100,000 from another lender (Lender 3) to which it grants security over the same assets. 1 July: The £750,000 drawn down under the RCF is repaid and £2,000,000 is drawn down. 1 August: A further £2,000,000 is drawn down under the Term Loan. 1 September: The borrower is declared insolvent and security enforced with the following amounts owing: o Lender 1: £2,000,000 o Lender 2: £3,000,000 o Lender 3: £100,000 There is no deed of priority in place and Clayton’s case is not disapplied. 8 PERSONAL\6997882v1 25 February 2015 Asset Registered land Applicable law: section 49 LRA (1) Lender 1’s position – First drawdown of £750,000 Pursuant to the rule in Clayton’s Case, this amount has been repaid. (2) Lender 1’s position – Second drawdown of £2,000,000 The £2,000,000 will have priority over all amounts owing if: Lender 1 did not have notice of the charges in favour of Lender 2 or Lender 3; or Lender 1 had an obligation to make further advances which is noted on the register; or Lender 1’s security is for an agreed maximum amount of at least £2,000,000 noted on the register. (3) Lender 2’s position – First drawdown of £1,000,000 Unless Lender 1 has priority in the circumstances set out in Column (2), Lender 2 will have priority. (4) Lender 2’s position – Second drawdown of £2,000,000 (5) Lender 3’s position See Lender 1 column for analysis of ranking between Lender 1 and Lender 2. See Lender 1 and Lender 2 columns (1) to (4) for analysis of ranking. The £2,000,000 will have priority over Lender 3 if: Lender 2 did not have notice of the charge in favour of Lender 3; or Lender 2 had an obligation to make further advances which is noted on the register; or Lender 2’s security is for an agreed maximum amount of at least £3,000,000 noted on the register. Otherwise, the £2,000,000 will rank behind: £1,000,000 owing to Lender 2; To the extent the secured facility by Lender 2 included (i) an obligation to make further advances which was noted on the register, £2,000,000 owing to Lender 2; and (ii) an agreed maximum amount which was noted on the register, that agreed amount capped at £2,000,000 (plus interest and cots) owing to Lender 2; and Unregistered land Applicable law: section 94 LPA Pursuant to the rule in Clayton’s Case, this amount has been All amounts owing to Lender 3. The £2,000,000 will have priority over all amounts owing if: Lender 1 did not have notice of the charges in favour of Lender 2 or Lender 3; or 1 Unless Lender 1 has priority in the Otherwise, the £2,000,000 will rank behind all amounts owing to Lender 3. See Lender 1 column for analysis of ranking between Lender 1 and Lender 2. See Lender 1 and Lender 2 columns (1) to repaid. Lender 1 had an obligation to make such an advance under the secured facility. Otherwise, the £2,000,000 will rank behind: £1,000,000 owing to Lender 2; To the extent the secured facility by Lender 2 included an obligation to make the £2,000,000 further advance, the £2,000,000 owing to Lender 2; and Personalty Applicable law: either Hopkinson v Rolt or section 94 LPA Pursuant to the rule in Clayton’s Case, this amount has been repaid. All amounts owing to Lender 3. As above for unregistered land unless Hopkinson v Rolt applies in which case: The £2,000,000 will have priority if Lender 1 did not have notice of the charges in favour of Lender 2 or Lender 3. Otherwise, the £2,000,000 will rank behind the circumstances set out in Column (2), Lender 2 will have priority. £1,000,000 owing to Lender 2 but not the £2,000,000 owing to Lender 2 (as Lender 2’s £2,000,000 was advanced after Lender 1’s £2,000,000); and All amounts owing to Lender 3. 2 Unless Lender 1 has priority in the circumstances set out in Column (2), Lender 2 will have priority. The £2,000,000 will have priority over Lender 3 if: Lender 2 did not have notice of the charge in favour of Lender 3; or Lender 2 had an obligation to make such an advance under the secured facility. Otherwise, the £2,000,000 will rank behind all amounts owing to Lender 3. As above for unregistered land unless Hopkinson v Rolt applies in which case: The £2,000,000 will have priority over Lender 3 if Lender 2 did not have notice of the charge in favour of Lender 3. Otherwise, the £2,000,000 will rank behind all amounts owing to Lender 3. (4) analysis ranking. for of See Lender 1 and Lender 2 columns (1) to (4) for analysis of ranking. PRACTICAL STEPS The following practical steps should be observed by a lender looking to ensure that all amounts advanced by it have priority over amounts advanced by any subsequent chargee, regardless of when advances are made: Prior to any drawdown (or, if there is a maximum secured amount registered on the title, when that amount has been exceeded or the advance is pursuant to an obligation to make further advances which has been registered on the title), a chargee should check that no subsequent security has been granted by making enquiry of the debtor. For so long as the prior chargee does not have notice of subsequent charges, amounts it advances will have priority. As soon as a lender is aware subsequent security has been granted (whether in breach of a negative pledge or otherwise), no further advances (including any re-drawings under any overdraft or revolving facility) should be permitted until a deed of priority is in place (unless the prior chargee has accepted its further advances will rank behind the subsequent chargee). In the case of charges of registered land, a restriction should be noted on the title in respect of granting further security so that the prior chargee’s consent will be required before any subsequent security is registered. A lender should ensure its address for service registered on the title is correct and all notices received to that address will be dealt with. A negative pledge should be included in all relevant facility and security documentation and noted on Form MG01 on registration of charges at Companies House. If a subsequent chargee is aware that a prior charge contains a negative pledge, it should not accept the security from the debtor until the prior chargee’s consent has been received. Jonathan Porteous is Head of Banking & Finance team and Laura Shackleton is an Associate in the banking and finance team at Stevens & Bolton LLP. Jonathan can be contacted on jonathanon.porteous@stevens-bolton.com and Laura on laura.shackleton@stevens-bolton.com 3