Central Bank's Regulatory Role Over Non

advertisement

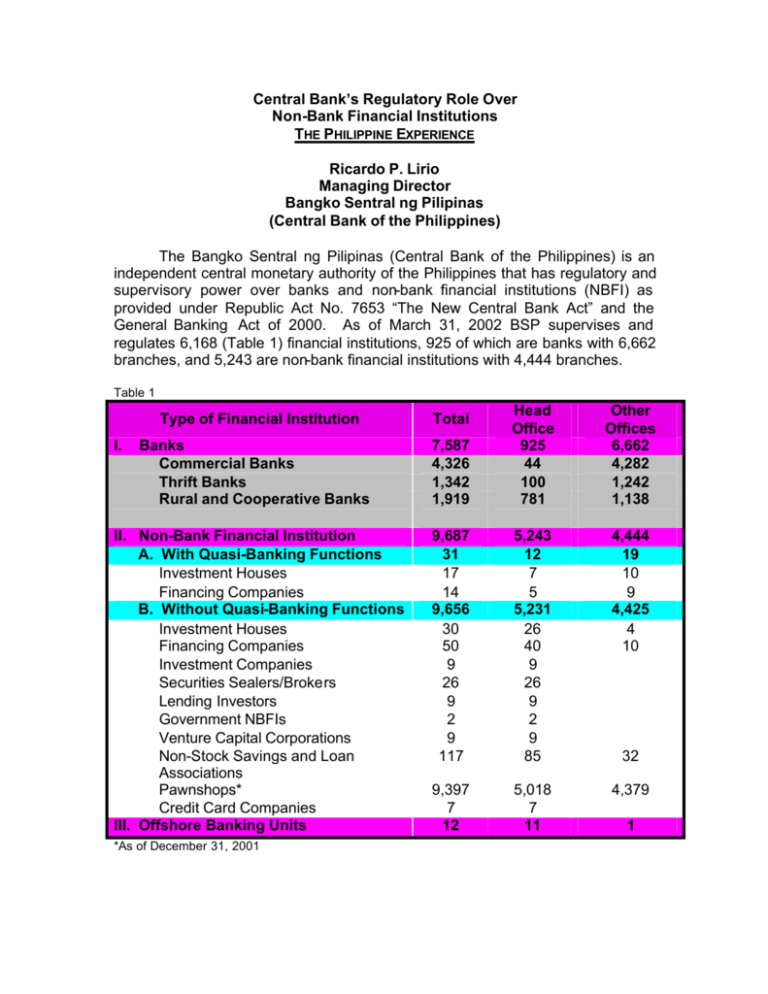

Central Bank’s Regulatory Role Over Non-Bank Financial Institutions THE PHILIPPINE EXPERIENCE Ricardo P. Lirio Managing Director Bangko Sentral ng Pilipinas (Central Bank of the Philippines) The Bangko Sentral ng Pilipinas (Central Bank of the Philippines) is an independent central monetary authority of the Philippines that has regulatory and supervisory power over banks and non-bank financial institutions (NBFI) as provided under Republic Act No. 7653 “The New Central Bank Act” and the General Banking Act of 2000. As of March 31, 2002 BSP supervises and regulates 6,168 (Table 1) financial institutions, 925 of which are banks with 6,662 branches, and 5,243 are non-bank financial institutions with 4,444 branches. Table 1 Type of Financial Institution I. Banks Commercial Banks Thrift Banks Rural and Cooperative Banks II. Non-Bank Financial Institution A. With Quasi-Banking Functions Investment Houses Financing Companies B. Without Quasi-Banking Functions Investment Houses Financing Companies Investment Companies Securities Sealers/Brokers Lending Investors Government NBFIs Venture Capital Corporations Non-Stock Savings and Loan Associations Pawnshops* Credit Card Companies III. Offshore Banking Units *As of December 31, 2001 7,587 4,326 1,342 1,919 Head Office 925 44 100 781 Other Offices 6,662 4,282 1,242 1,138 9,687 31 17 14 9,656 30 50 9 26 9 2 9 117 5,243 12 7 5 5,231 26 40 9 26 9 2 9 85 4,444 19 10 9 4,425 4 10 9,397 7 12 5,018 7 11 4,379 Total 32 1 Banks and NBFIs in the Philippine Financial System have interrelated activities. NBFIs are either subsidiaries or affiliates of banks and other NBFIs by means of equity investment, management interlock, common stockholders, management contracts or permanent/proxy voting stock. Some NBFIs were established to complement the products and services offered by the banking institutions. As a case in point, five of the biggest universal banks in the Philippines, have five or more NBFI subsidiaries and affiliates as shown in Table 2. Table 2 with QB Name of Bank without QB Invest. Financing Invest. Financing SecuritiesD House Company House Company ealers Bank of the Philippine Islands 1 2 2 Metrobank 2 1 2 1 2 1 Equitable- PCI Bank Philippine National Bank RCBC 1 1 3 Credit Card Venture Invest. Capital Company 2 1 1 1 2 1 1 1 1 1 1 1 1 Banks and NBFIs differ in the type of instruments they issue. Only banks are allowed to use deposit instruments such as demand deposits/checking accounts, savings deposits (passbooks) and certificates of time deposits. While NBFIs primarily use deposit-substitute instruments like promissory notes, repurchase agreements and certificates of participation/assignment. There are several types of NBFIs offering varying services such as investment houses, financing companies, investment companies, securities dealers/brokers, lending investors, government NBFIs, venture capital corporations, non-stock savings and loan associations, pawnshops and credit card companies. NBFIs are generally classified into two major groups: (1) NBFIs with Quasi-Banking Function, and (2) NBFIs without Quasi-Banking Function. Quasi-banking is the issuance of deposit substitutes or borrowing instruments to twenty or more persons or entities. Borrowing from the said number of persons/entities is considered as borrowing from the public and would require the prior approval and authority from the Bangko Sentral ng Pilipinas. The development of the NBFIs started in the 1970s. They provided alternative funding source for the public and other intermediary services. The growing demand for their products and services began to pose considerable pressure on the deposits and lending market, which called the attention of the Central Bank of the Philippines. CBP, in partnership with the International 1 Monetary Fund (IMF), created a survey commission tasked to assess the adequacy of laws and regulations governing the entire financial system including NBFIs. The decrees prepared by the commission was signed into law in 1972 in pursuant to their conclusion that NBFIs should be under the authority of the CBP for effective credit administration. From 1972 to 1974 NBFIs were required to register at the Central Bank of the Philippines. In 1973, Presidential Decree Nos. 114 “Pawnshop Regulation Act “ and 129 “Investment Houses Law” were passed into law. PD 114 placed pawnshops under the regulatory authority of the CBP. Prior to this decree, there was no uniform law on pawnshops and their activities. They were governed principally by the ordinances of their respective cities/municipalities. On the other hand, PD 129 granted exclusive authority to all investment houses to underwrite securities, which reinforced their distinct function in the financial system. The changes that took place in the financial system in the 1980s called for strengthening the regulatory powers of CBP over NBFIs. The decade was marked by intensified competition among the different financial institutions and the increased availability of long term funds through direct and indirect financing to increase stability of the financial system. CBP responded by consolidating the rules governing operations of NBFIs in Book IV of the Manual of Regulations. 1990s marked a new era in the Philippine financial system as it opened its doors to the international financial markets. The approval of the Foreign Investments Act in 1991 providing greater leeway and fewer restrictions to foreign investors served as the turning point for all industries. It was succeeded by the full liberalization of foreign exchange and the unification of the two stock exchanges in 1992. A revolutionary event that followed was the entry of foreign banks and insurance firms in 1993. This prompted the NBFI industry to strengthen its anchor in the highly competitive environment. One of the measures to keep pace with the changes is the approval of the Republic Act 8366 in 1997, which increased foreign equity participation and the minimum capitalization for Investment Houses. The capital requirements for certain NBFIs were increased to strengthen and protect the financial system from economic downturns. It aids in ensuring strong solvency positions of NBFIs and automatically weeds out the weak players in the industry that could only trigger systemic risk. Year 200 called for a different regulatory approach to NBFIs as we strive to protect the financial system from the flow of illegal funds. The passage into law of the Anti-Money Laundering Bill was supplemented by the Bangko Sentral ng Pilipinas by the issuance of Circulars providing rules and regulations to combat money-laundering. The Philippine financial system is dependent on public’s trust. It is in this light that BSP, as a regulatory body exercise its authority to supervise and issue regulations that would strengthen and protect the integrity of the system. (List of the types of NBFIs under BSP regulatory authority and the corresponding governing laws is attached as Annex A).