2.6 Mb PDF of presentation

advertisement

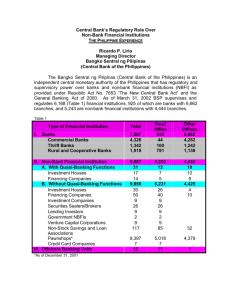

Bangko Sentral ng Pilipinas Central Bank’s Regulatory Role over NBFIs: The Philippine Experience Mr. Ricardo P. Lirio Managing Director, SE II FINANCIAL INSTITUTIONS UNDER BSP SUPERVISION/REGULATION As of March 31, 2002 Type of Financial Institution Total Head Office Other Offices 7,587 4,326 1,342 1,919 925 44 100 781 6,662 4,282 1,242 1,138 9,687 5,243 4,444 A. With Quasi-Banking Functions 31 12 19 Investment Houses Financing Companies B. Without Quasi-Banking Functions Investment Houses Financing Companies Investment Companies Securities Dealers/Brokers Lending Investors Government NBFIs Venture Capital Corporations Non-Stock Savings and Loan Associations Pawnshops * Credit Card Companies III. Offshore Banking Units 17 14 9,656 30 50 9 26 9 2 9 117 9,397 7 12 7 5 5,231 26 40 9 26 9 2 9 85 5,018 7 11 10 9 4,425 4 10 I. Banks Commercial Banks Thrift Banks Rural and Cooperative Banks II. Non-Bank Financial Institutions *As of December 31, 2001 32 4,379 1 Bangko Sentral ng Pilipinas Banks with NBFI Subsidiaries/Affiliates Name of Bank with QB without QB Invest. Financing Inv. Financing Securities Credit Venture Invest. House Company House Company Dealers Card Capital Company Bank of the Philippine Islands 1 2 2 Metrobank 2 1 2 1 2 1 Equitable-PCI Bank Philippine National Bank RCBC 1 1 3 2 1 1 1 2 1 1 1 1 1 1 1 1 1 Bangko Sentral ng Pilipinas REGULATORY and SUPERVISORY AUTHORITY RA 7653 RA 8791 The New Central Bank Act Supervision and examination of banks and quasi-banks including their subsidiaries and affiliates engaged in allied activities The General Banking Act 2000 Regulation of the organization and operations of banks, trust entities and for other purposes Bangko Sentral ng Pilipinas Banks Demand Deposits/ Checking Accounts Savings Deposits (Passboo k) Time Certificat e of Deposits Deposit Instruments NBFIs Promisso ry Notes Repurchas e Agreement Certificates s of Participatio n/Assignme nt Deposit-Substitute Instruments Bangko Sentral ng Pilipinas Non-Bank Financial Institutions With Quasi-Banking Function Entity is borrowing from 20 or more persons or entities Without Quasi-Banking Function Bangko Sentral ng Pilipinas Issuance of deposit substitutes or borrowing instruments by an NBFI to 20 or more persons or entities irrespective of outstanding amounts is considered borrowing from PUBLIC Bangko Sentral ng Pilipinas NBFIs Regulatory Framework 1970s Development and growth of NBFIS REQUIRED GOVERNMENT INTERVENTION 1971 Formation of Joint Central Bank of the Philippines & IMF Banking Survey Commission NBFIs should be under the authority of the Central Bank for effective administration of credit Bangko Sentral ng Pilipinas 1972 to 1974 Central Bank of the Philippines required all NBFIs to register 1973 PAWNSHOPS placed under regulatory authority of CBP granted exclusive authority to all INVESTMENT HOUSES to underwrite SECURITIES PD 114 Pawnshop Regulation Act PD 129 Investment Houses Law Bangko Sentral ng Pilipinas NBFIs Regulatory Framework 1982 1980s Rules governing operations of NBFIs were consolidated as Book IV of the Manual of Regulations Intensified competition among financial institutions Increased availability of long term funds through direct and indirect financing to increase stability of the financial system Bangko Sentral ng Pilipinas 1990s Foreign Investments Act 1991 Full liberalization of foreign exchange Greater leeway and fewer restrictions for foreign investors 1992 Unification of 2 Stock Exchanges Bangko Sentral ng Pilipinas 1990s 1993 Entry of foreign banks 1993 Entry of foreign insurance firms Bangko Sentral ng Pilipinas 1990s 1997 RA 8366 RA 8367 Increased foreign equity participation and minimum capitalization for IHs NSSLA ACT Bangko Sentral ng Pilipinas 1997 INCREASED CAPITALIZATION Aids in ensuring strong solvency positions and automatically weeds out weak players in the industry Bangko Sentral ng Pilipinas 1990s 1998 RA 8556 “FINANCING COMPANY ACT OF 1998” An Act amending RA 5980, as Amended Otherwise Known as the Financing Company Act (1969) Bangko Sentral ng Pilipinas 2000 Anti-Money Laundering Bill Issuance of Circulars providing rules and regulations to combat money-laundering Bangko Sentral ng Pilipinas NBFI Quasi-Banks Investment House Financing Company Trust Entities Investment House Financing Company Other Trust Entities Governing Law RA 8791 - The General Banking Law RA 7653 - The New Central Bank Act Bangko Sentral ng Pilipinas NBFI Governing Law Subsidiaries/Affiliates of a Bank/QB RA 8791 - The General Banking Law Investment House w/o QB RA 7653 - The New Central Bank Act Financing Company w/o QB Investment Companies Securities Dealers/Brokers Lending Investors Venture Capital Corporation Enterprise Wholly or Majority Owned by a Bank Non-Financial Allied Undertaking Non-Stock Savings and Loan Associations Pawnshops TIDCOR SBGFC Bangko Sentral ng Pilipinas NBFI Governing Law Investment House PD 129 The Investment Houses Law Financing Company RA 8556 Financing Company Act of 1988 Non-Stock Savings and Loan Associations RA 8367 Revised NSSLA Act of 1997 Pawnshops TIDCOR PD 114 Pawnshop Regulation Act RA 8494 An act further amending Presidential Decree #1080, as amended, by reorganizing and renaming the Philippine Export and Foreign Loan Guarantee Corporation, expanding its primary purpose SBGFC RA 6977 Magna Carta for SMEs Bangko Sentral ng Pilipinas Bangko Sentral ng Pilipinas Central Bank’s Regulatory Role over NBFIs: The Philippine Experience Mr. Ricardo P. Lirio Managing Director, SE II