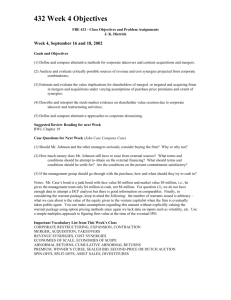

Doctorado en MERGERS AND ACQUISITIONS: A SURVEY OF

advertisement