Feasibility Study of Closed-Containment Options for the British

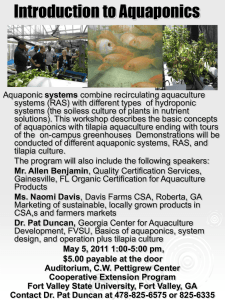

advertisement