Time Deposit Account

advertisement

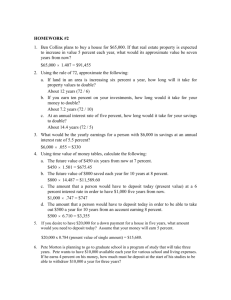

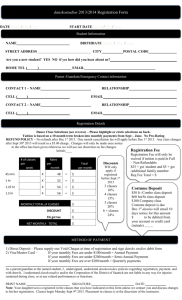

Effective January 1, 2010 Time Deposit Account Disclosure and Agreement Table of Contents Introduction..............................................................................................1 Interest.......................................................................................................1 Limitations on Time Deposit Accounts (Non-Retirement).......2 Limitations on Retirement Time Deposit Accounts.....................2 Minimum Opening Deposit................................................................3 Promotional Rate Time Deposits......................................................3 Fees............................................................................................................4 Automatic Renewal Provision............................................................4 Early Withdrawal Fee and Compensating Fee..............................4 Other Fees and Charges......................................................................6 Other Agreements................................................................................8 Introduction The enclosed Maturity Notice describes the maturity date of your time deposit or Retirement Time Deposit account. If applicable, this notice also includes the new maturity date and grace period for a withdrawal. If the new interest rate and Annual Percentage Yield have not yet been determined, the Maturity Notice gives you the date when the rates will be available and a telephone number to call for this information. If the new interest rate and Annual Percentage Yield are already available, they appear on your Maturity Notice. We will send you a renewal notice with the new interest rate and Annual Percentage Yield the day after your time deposit or Retirement Time Deposit matures. Interest Time Deposit Accounts (Non-Retirement). The interest rate on Custom Time Deposits and Payment Bond Time Deposits is subject to market conditions and your account’s balance and term, and is set at our discretion. The interest rate and Annual Percentage Yield are fixed during the new term of your deposit, but are subject to change with each additional renewal. You will be paid this rate until the new maturity date, which is shown on the Maturity Notice. Interest on your Custom Time Deposit may be paid to your time deposit account, or deposited to your Union Bank checking, savings or money market account, or a cashier’s check can be issued. Interest on your Payment Bond Time Deposit may be deposited to your Union Bank checking, savings or money market account, or a cashier’s check can be issued. Retirement Time Deposit Accounts. The interest rate on your Fixed Rate Time Deposits is shown on your Time Deposit Account Receipt. When you open this account, you agree to keep the principal in the account on deposit with us for the entire term. The interest rate and Annual Percentage Yield are fixed during the new term of your deposit but are subject to change with each additional renewal. You will be paid this rate until the new maturity date, which is shown on the Time Deposit Account Receipt. The terms for the Fixed Rate Time Deposits are 90 days through 120 months. Time deposits opened before February 17, 2007, with terms less than 90 days may continue to be held and renewed for the original term, but new or additional time deposit contributions must have terms of at least 90 days. 18-Month Variable Rate IRA Time Deposit – Union Bank® offers an 18-month term deposit account. The interest rate on the 18-Month Variable Rate Time Deposit is indexed to U.S. Treasury One-Month Constant Maturity Bills, less 0.85%; will not be less than that rate; will never be less than zero; is reset monthly; and is set at our direction. (This index can be accessed through the Federal Reserve Statistical Release at http://www.federalreserve.gov/Releases/H15/update.) 1 12-Month Variable Rate Time Deposit – The interest rate on the 12Month Variable Rate Time Deposit, called the Retirement Income IRA CD, is indexed to U.S. Treasury One-Month Constant Maturity Bills, less 0.75%; will not be less than that rate; will never be less than zero; is reset monthly; and is set at our direction. (This index can be accessed through the Federal Reserve Statistical Release at http://www.federalreserve.gov/Releases/H15/update.) All Time Deposit and Retirement Time Deposit Accounts. The Annual Percentage Yield for your time deposit account assumes interest will remain on deposit until maturity. Withdrawing interest before maturity will reduce earnings. Time deposit and Retirement Time Deposit accounts are non-negotiable. Interest on time deposit and Retirement Time Deposit accounts with a principal balance of less than $1,000,000 is compounded daily. However, interest on time deposits of $1,000,000 or more is simple interest. The frequency with which you may choose to receive your interest payment depends on your account’s term. For time deposits with terms of 7 days through 31 days, interest may be paid only at maturity; for terms of 32 days to 1 year, interest may be paid monthly, quarterly, semiannually, annually, or at maturity; for terms greater than one year, interest must be paid at least annually, but may be paid monthly, quarterly, or semiannually. For Retirement Time Deposit accounts with terms of 90 days through 120 months, interest may be paid monthly or quarterly. Note: Any portion of a time deposit withdrawn due to the death or legal incompetence of the owner is not subject to an Early Withdrawal Fee or Compensating Fee. In addition, withdrawals from a Retirement Time Deposit account made after you have reached age 59 1/2 , or made after you have reached age 70 1/2 and as part of a prearranged schedule of systematic payments made on a monthly, quarterly, semiannual, or annual basis, are exempt from an Early Withdrawal Fee or Compensating Fee. Withdrawals from a Retirement Income IRA CD account (12-Month Variable IRA) are exempt from the Early Withdrawal Fee or Compensating Fee. A Bonus Rate IRA Rollover is a Fixed Rate Retirement Time Deposit with a bonus rate of interest for the first 12 or 24 months of its first term. The term you choose determines how many months your account will initially earn interest at the “bonus” rate, which is 1/4% above the rate that applies for the remaining portion of the term. Upon renewal, the terms and conditions for the Fixed Rate Retirement Time Deposit account will apply. Minimum Opening Deposit Time Deposit Accounts (Non-Retirement) ●● 7–31 Days......................................................................................$ 2,500.00 32 Days–60 Months.................................................................$ 350.00 ●● We use the daily balance method to calculate interest for all time deposit and Retirement Time Deposit accounts. This method applies a daily periodic rate to the principal in the account each day. Limitations on Time Deposit Accounts (Non-Retirement) After a Custom Time Deposit, Payment Bond Time Deposit, or Fixed Rate Time Deposit account is established, you may not make additional deposits into the account until the new maturity date. Custom Time Deposit Payment Bond Time Deposit 7–31 Days......................................................................................$ 2,500.00 32–364 Days................................................................................$ 1,000.00 12–60 Months.............................................................................$ 500.00 ●● Retirement Time Deposit Accounts Fixed Rate Time Deposit.........................................................$ 350.00 12-Month Variable Rate Time Deposit...............................$25,000.00 18-Month Variable Rate Time Deposit...............................$ 500.00 The same amount required to open any time deposit account must remain in the account when it renews. Limitations on Retirement Time Deposit Accounts After an 18-Month Variable Rate Time Deposit account or a 12-Month Variable Rate Time Deposit (Retirement Income IRA CD) is established, you may continue to make additional deposits. Each additional electronic deposit must be at least $10. Each additional nonelectronic deposit must be at least $25. Interest begins to accrue on the Business Day you make an additional deposit of cash or non-cash items (for example, checks) to your 18-Month or 12-Month Variable Rate Time Deposit. After an 18-Month Variable Rate Time Deposit is renewed, you may not generally make withdrawals from the account until the new maturity date without incurring an Early Withdrawal Fee or Compensating Fee. Withdrawals from a 12-Month Variable Rate Time Deposit (Retirement Income IRA CD) are allowed at any time without incurring an Early Withdrawal Fee or Compensating Fee. 2 Promotional Rate Time Deposits From time to time, we may offer special rates on time deposit accounts for specific terms. These time deposit accounts are considered “Promotional Rate Time Deposits” and may not be offered at all times. Promotional Rate Time Deposits have different minimum balance requirements, depending on rate, which are disclosed on the Interest Rate Sheet provided at the time of account opening. Your Promotional Rate Time Deposit account will be automatically renewed for the same term, at the non-promotional, or standard, interest rate in effect on the account’s maturity date. Interest rates are set at our discretion and are subject to market conditions, your account balance and term, and your continuing to maintain a Union Bank checking account. You are required to maintain a Union Bank checking account in order to qualify for a Promotional Rate Time Deposit. For descriptions of our checking products, please refer to the Checking Accounts section of our All About Personal Accounts & Services Disclosure and Agreement. 3 The interest rate on a Promotional Rate Time Deposit is fixed during the term of your deposit, as long as you maintain your Union Bank checking account but is subject to change with each renewal and may be reduced if the required checking account is closed. The interest rate and Annual Percentage Yield (APY) for your deposit are shown on your Time Deposit Account Receipt. Terminating the Qualifying Checking Account. If you close your checking account or allow it to have a zero balance at any time, we may change the interest rate on your Promotional Rate Time Deposit to the standard rate that was in effect on the day you originated your Promotional Rate Time Deposit. This standard interest rate and corresponding APY are provided to you at the time of account opening on the Interest Rate Sheet. If the interest rate is changed due to the closure of your Union Bank checking account, the new interest rate will then be fixed for the remainder of your term. Except as described above, Promotional Rate Time Deposit accounts are subject to the terms and conditions of our Custom Time Deposit. Product/Offer Termination. Union Bank reserves the right to terminate this program/offer at any time with or without notice. Fees Note: Any portion of a time deposit withdrawn due to the death or legal incompetence of the owner is not subject to an Early Withdrawal Fee or Compensating Fee. In addition, withdrawals from a Retirement Time Deposit account made after you have reached age 59 1/2 , or made after you have reached age 70 1/2 and as part of a prearranged schedule of systematic payments made on a monthly, quarterly, semiannual, or annual basis, are exempt from an Early Withdrawal Fee or Compensating Fee. Withdrawals from a Retirement Income IRA CD account (12-Month Variable IRA) are exempt from the Early Withdrawal Fee or Compensating Fee. Early Withdrawal Fee. The Bank’s Early Withdrawal Fee will be assessed as follows: For terms of 7 days through 31 days, the Early Withdrawal Fee is an amount equal to the largest of: a.All interest earned on the amount withdrawn; b.An amount equal to 7 days’ interest on the amount withdrawn; or c.An amount equal to the interest that could have been earned on the amount withdrawn for one-half the term. For terms of 32 days to 91 days, the Early Withdrawal Fee is 31 days’ simple interest at the rate being paid on the amount withdrawn, or the Compensating Fee explained below, whichever is greater. For terms of 92 days to one year, the Early Withdrawal Fee is 91 days’ simple interest at the rate being paid on the amount withdrawn, or the Compensating Fee explained below, whichever is greater. For terms over 1 year, the Early Withdrawal Fee is 181 days’ simple interest at the rate being paid on the amount withdrawn or the Compensating Fee explained below, whichever is greater. ●● ●● ●● All time deposit accounts are subject to fees shown in the Other Fees and Charges section of this notice. Automatic Renewal Provision ●● Time deposit accounts with an automatic renewal provision and with a term of 32 days or more will be automatically renewed for the same term, and at the interest rate in effect on the account’s maturity date, unless the funds are withdrawn on that date or within 10 calendar days after that date. Accounts with a term of 31 days or less will be automatically renewed from the maturity date, and at the interest rate in effect on the account’s maturity date, unless the funds are withdrawn within 3 calendar days after that date. This policy will also apply to any subsequent maturity date. If your time deposit has a term of more than 31 days, we will notify you in writing before the original and all subsequent maturity dates. We reserve the right to close any time deposit account on the original or any subsequent maturity date or change the terms or the method of interest calculation on any of these maturity dates after giving you written notice of our intention to do so. Compensating Fee. The Compensating Fee is designed to protect the Bank during periods of increasing interest rates. The Compensating Fee is calculated by first determining the rate differential. The rate differential is determined by subtracting the interest rate being paid on your time deposit from the rate we would pay on a new time deposit, for an amount equal to your original principal and for a term equal to the number of days remaining in your current term. Then the Compensating Fee is determined by calculating the amount of simple interest that could have been earned for the number of days remaining in your current term at the interest rate equal to the rate differential determined above on the amount withdrawn. Please see the example below. Early Withdrawal Fee and Compensating Fee When you renew a time deposit or Retirement Time Deposit account, you agree to keep the principal in the account on deposit with us for the new term. If you withdraw all or a portion of the principal prior to the new maturity date of the account, the Bank may assess an Early Withdrawal Fee or a Compensating Fee, whichever is greater. It may be necessary to deduct all or a portion of the fee from the principal amount of the account. Example: If a $2,000 time deposit established for 3 years (36 months) at 4% is withdrawn after 1 year (12 months), we would first determine the rate for a new $2,000 24-month time deposit (the remaining term of the time deposit). If this rate were 7%, we would calculate a fee equal to 24 months’ simple interest on $2,000 at 3% (the rate differential is 7% minus 4%). The Compensating Fee is $120.00. We would also calculate 181 days’ simple interest on $2,000 at 4%. The Early Withdrawal Fee is $39.67. For this example, the $120.00 Compensating Fee would be the greater of the two and would be assessed. 4 5 The fee for withdrawing funds before the account’s maturity date is the greater of the Early Withdrawal Fee or the Compensating Fee. Other Wire Fees Other Fees and Charges Legal Process Fees Banking Centralized Office & Customer Direct Service Unit Access* (CCSU) Levy from All Agencies...........................................................................................................$ 75.00 California Agency..................................................................... $ State Civil Case......................................................................... $ Federal Agency......................................................................... $ Federal Civil Case..................................................................... $ Internal Revenue Service....................................................... $ Research 24.00/hour 24.00/hour 11.00/hour 11.00/hour 8.50/hour Copying .10/sheet .10/sheet .25/sheet .25/sheet .20/sheet Returned Deposited/Cashed Items..................................................................................$ 6.00 Automatic Re-Clear of Returned Items........................................................per item $ 1.50 Signature Guarantee...............................................................................................per visit $ 5.00 Research Fee . ...........................................................................................................per hour $ 30.00 ($30 minimum, copy fees will apply.) Wire Transfer Fees Foreign or Domestic correspondent bank charges may apply. We may deduct our fees from your account or the amount of the transfer. Banking Office & Direct Access* Centralized Customer Service Unit (CCSU) Incoming Wire Transfer Domestic...................................................................................each $ 13.00 N/A International (USD)...............................................................each $ 13.00 N/A International (Foreign Currency).......................................each $ 13.00 N/A Outgoing Wire Transfer Domestic Repetitive..............................................................................each $ 20.00 33.00 Non-Repetitive....................................................................each $ 28.00 33.00 International (USD) Repetitive..............................................................................each $ 35.00 35.00 Non-Repetitive....................................................................each $ 40.00 40.00 International (Foreign Currency) Repetitive..............................................................................each $ 30.00 50.00 Non-Repetitive....................................................................each $ 35.00 50.00 Standing Order Domestic...............................................................................each $ 10.00 10.00 International (USD)............................................................each $ 15.00 15.00 International (Foreign Currency)...................................each $ 15.00 15.00 Drawdown Reverse Wire (outgoing 1031 only)..................................each $ 20.00 50.00 Drawdown Request from Federal Reserve (with Outgoing Wire)........................................................each $ 25.00 25.00 International (USD)............................................................each $ 15.00 15.00 International (Foreign Currency)...................................each $ 15.00 15.00 Internal Transfer.......................................................................each $ 6.00 30.00 Investigations (plus cable if needed)................................each $ 20.00 20.00 Phone.........................................................................................each $ 15.00 15.00 Payments by Cash or Check...............................................each $ 10.00 N/A *Wires initiated directly through Direct Access in the Wire Services department. 6 Wire Notification (in addition to periodic statement) Mail Notification (incoming or outgoing)...............per notice $ 2.00 2.00 Facsimile Notification....................................................per notice $ 6.00 6.00 Fast Fax..............................................................................per notice $ 45.00 45.00 Telephone Notification..................................................per notice $ 20.00 20.00 Charges to Sender.................................................................... each $ 15.00 15.00 Exception/Repair...................................................................... each $ 10.00 10.00 SecurID Token Token (1–2).............................................................................................$ No charge No charge Token (3+)................................................................................... each $ 100.00 100.00 Replacement/Expired Token.................................................. each $ 100.00 100.00 Other Intermediary Bank fees may apply. *Wires initiated directly through Direct Access in the Wire Services department. Domestic Collection Items Incoming and Outgoing Clean..........................................................................................................................................$ 30.00 Documentary..........................................................................................................................$ 30.00 International Collection Fee (varies) (minimum $100.00)........................................$ 100.00 Trustee to Trustee (Transfer Out) Fee for Retirement Time Deposit Accounts. Each time we receive instructions from you to transfer all or a portion of your IRA or Retirement Plan to another trustee or custodian, a transfer fee will be assessed. We will assess the fee from your IRA, SEP, SIMPLE, Small Business Retirement Plan, or Coverdell ESA for each transfer letter. Deposit Transfer Fee (transfers out only) .......................................................................$ 25.00 Brokerage Transfer Fee (transfers out only)...................................................................$ 75.00 Annual Custodial/Trustee Fee for Retirement Time Deposit Accounts. You will be charged an annual custodial/trustee fee for each IRA plan that you have open any time during the calendar year. Individual Retirement Account Annual Custodial Fee.......................... per plan $ 15.00 SEP and SIMPLE Plan Annual Custodial Fee............................................... per plan $ 25.00 Small Business Retirement Plan Annual Trustee Fee............................ per plan $ 25.00 Fee waiver policies apply to Individual Retirement Accounts only. For more information, ask your banking office for a copy of the Individual Retirement Accounts and Small Business Retirement Plans Services and Fee Schedule includes Coverdell Education Savings Accounts. Except as outlined above, or as required by law, Union Bank, N.A., reserves the right to change any of the information contained in fee schedules and disclosure booklets and the rules of the Bank at any time. 7 Other Agreements Your renewed time deposit or Retirement Time Deposit Account is also subject to certain other terms in our All About Personal Accounts & Services Disclosure and Agreement; All About Business Accounts & Services Disclosure and Agreement; Business Fee Schedules; All About Traditional, Rollover, and Roth IRAs Disclosure and Agreement; All About Coverdell Education Savings Accounts Disclosure and Agreement; and/ or All About Small Business Retirement Plan Disclosure and Agreement. Copies are available through your banking office. 8 ©2009 Union Bank, N.A. unionbank.com 89362 (11/09)