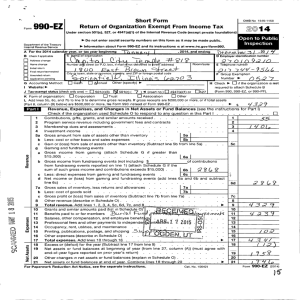

Return of Or anization Exem t From Income Tax gp

advertisement