ASX CODE : WFE - Winmar Resources

advertisement

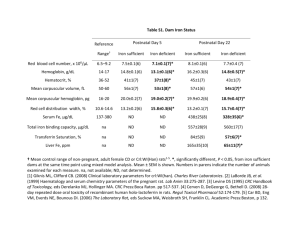

ASX CODE : WFE PILBARA IRON ORE EXPLORATION 1 Board of Directors Mr Albert Yue-Ling Wong BComm (UNSW), F Fin, MSDIA, FAICD Chairman Formerly a stockbroker for 21 years, Mr Wong is a corporate adviser and investment banker with over 30 years experience in the finance industry. He was admitted a Member of the Australian Stock Exchange in 1988 and was the principal of Intersuisse Limited until 1995 when he established and listed on ASX the Barton Capital group of companies including eStar Online. Mr Wong was also a founding Director of both Pluton Resources Limited and Gujarat NRE Resources NL. Mr Wong is currently Chairman of Cabral Resources Limited and Deputy Chairman of Prima Biomed Limited. Mr Wong has been widely involved in philanthropic activities including current directorships on UNSW Foundation Limited, Ian Thorpe’s Fountain for Youth Foundation, and Honorary Life Governor and Deputy President of the Science Foundation for Physics at the University of Sydney. Mr Wong remains a Fellow of Financial Services Institute of Australasia, he is a Member (Master Stockbroking) of the Stockbrokers Association of Australia and a Fellow of the Australian Institute of Company Directors. Mr Alex Alexander Non-Executive Director Mr Alexander is the founder and Managing Director of Summit Equities Limited, a boutique financial advisory firm with particular focus on resources and commodities. Prior to this role, Mr Alexander was the director and Head of Equities at Cube Financial Group in Sydney, and Associate Director, Equities Division at ABN AMRO. Mr Alexander is a Certified Practicing Account (CPA) and holds a Masters Degree in Management from Moscow State Academy of Management, as well and Graduate Diplomas in Accounting (Macquarie University) and Applied Finance & Investments (Securities Institute of Australia). Mr Neville Kenneth Wran AC CNZM QC (Hon.) LLD FRSA Non-Executive Director Mr Wran graduated from the University of Sydney Law School in 1948. He was admitted to the Bar in 1957, appointed Queens’s Counsel in 1968 and received his Honorary Doctorate of Laws from the University of Sydney in May 1995 and Honorary Doctorate of Laws from the University of New South Wales in May 2006. Mr Wran was the Premier of New South Wales from May 1976 until his resignation in July 1986. He also held various other portfolios including Minister for Mineral Resources. Mr Wran is a non-executive director of a number of companies including Brazilian Iron Ore company Cabral Resources Limited. He was the Chairman of CSIRO from 1986 until 1991. Mr Wran represented Australia as Member on the Eminent Persons Group (EPG) Of A.P.E.C (Asia Pacific Economic Cooperation) 1993-95. He is a Governor of the Australia-Israel Chamber of Commerce and past Honorary Chairman of the Trans-Tasman Business Circle. He initiated the Sister State relationship between Guangdong, The People’s Republic of China and New South Wales 2 Board of Directors, continued Mr David Matthew Coad BSc Hon, MBT Executive Director Mr Coad graduated from the Australian National University with a Bachelor of Science (Honours) degree (Geology) and a Masters Degree in Business and Technology from the University of New South Wales. Mr Coad is a Director of Tradelands Pty Ltd, a private consulting company and former Director of Mawson Metal Group Limited. He has held senior executive positions in commodity and industrial chemical industries . Mr Coad worked for Minchem Pty Ltd (member of Metallgesellschaft AG Group) and was a founding member of the team that built Farmoz Pty Ltd to a $100m company prior to its buyout by Makhteshim-Agan. Previous employment included Chief Operations Officer, Australia and New Zealand of Ospray Pty Ltd (a Cheminova A/S company). Mr Coad has considerable experience in Management and Business development. Mr Coad has worked extensively throughout Australia and China and with experience in the mining, agriculture and finance industries. Capital Structure as of 30 June 2011 Market Cap A$ 10.84M Ordinary Shares 69,931,616 Unlisted options 10,000,000 Cash at Bank A $931,000 Carolyn Patman Company Secretary Carolyn Patman is a Director of Business Services at HLB Mann Judd in Sydney and has been a Chartered Accountant for over 17 years. Carolyn has built an enviable reputation for work within and across a wide variety of small businesses from various industry sectors including prior company secretarial experience for small ASX listed companies. Mr Philip Kirchlechner Marketing Consultant Philip has 20 years experience in marketing and business development in the iron ore and steel industry, gained through positions with Hamersley Iron, Rio Tinto Iron Ore, Voest-Alphine (VAI) and J.P. Morgan. Prior to taking on this role with Cazaly, Philip worked for Australian iron ore company Aurox Resources, where he successfully identified, negotiated with and ultimately secured off-take agreements with Chinese partners for its Balla Balla Iron Ore Project in Western Australia. 3 Top 20 Shareholders (30 June 2011) % Cuml Units Total Units %Issue Capital 2,500,000 3.575 2,500,000 3.575 3.391 4,871,117 6.966 2,371,117 3.391 1,825,426 2.61 6,696,543 9.576 1,825,426 2.61 BARTON PLACE PTY LIMITED 1,240,803 1.774 7,937,346 11.35 1,240,803 1.774 5 MR ALEX ALEXANDER & MRS LIANG XIE 1,231,105 1.76 9,168,451 13.11 1,231,105 1.76 6 BOOM SECURITIES (HK) LTD 1,201,010 1.717 10,369,461 14.827 1,201,010 1.717 7 RINGSFORD PTY LTD 1,100,000 1.573 11,469,461 16.4 1,100,000 1.573 8 MEGATOP NOMINEES PTY LTD 900,000 1.287 12,369,461 17.687 900,000 1.287 9 ISIWOOD PTY LIMITED 877,958 1.255 13,247,419 18.942 877,958 1.255 10 KINGSREEF PTY LTD 790,760 1.131 14,038,179 20.073 877,958 1.131 11 MR SAM ROBERTSON ESPIE 670,000 0.958 14,708,179 21.031 790,760 0.958 12 ESPERANZA RESOURCES PTY LTD 658,045 0.941 15,366,224 21.972 670,000 0.941 13 MR BRETT GRAHAM WALKER 650,000 0.929 16,016,224 22.901 658,045 0.929 14 CITCON AUSTRALIA PTY LTD 650,000 0.929 16,666,224 23.83 650,000 0.929 15 STATE ONE NOMINESS 624,055 0.892 17,290,279 24.722 650,000 0.892 16 MS SOPHIA WONG 610,996 0.874 17,901,275 25.596 624,055 0.874 17 RJD INVESTMENTS 600,000 0.858 18,501,275 26.454 610,996 0.858 18 MR GRAHAM JOHNSON 600,000 0.858 19,098,537 27.312 600,000 0.858 19 MR MARK UNG 597,262 0.854 19,693,837 28.166 597,262 0.854 20 JACOBS CORPORATION PTY LTD 595,300 0.851 19,693,837 29.017 595,300 0.851 RANK % Issue Cumulative Units Capital SHAREHOLDER Total Units 1 CAZALY RESOURCES LTD 2,500,000 3.575 2 MR CORNEL UNG & MRS YOLANDA UNG 2,371,117 3 C N M A AUSTRALIA PTY LTD 4 4 WINMAR’S HAMERSLEY DEPOSIT ADVANCED PROJECT • JORC inferred resource 241Mt @ 54.3% Fe (57.6% CaFe) • CID zone comprises 169Mt @ 55.6% Fe (59% CaFe) INFRASTRUCTURE ADVANTAGES • Adjacent to FMG’s massive Solomon Project – 2.85Bt resource • FMG and RIO rail within 40 kilometres • Near Tom Price – good logistics and infrastructure EXPLORATION UPSIDE • Exploration Target 350Mt -400Mt @ 56-60%CaFe • Northern target not drilled – rock chips over 60%Fe PATHWAY TO 100% OWNERSHIP • An agreement for the right to acquire 51% of the Hamersley Project from Cazaly Iron Pty Ltd (Cazaly Iron) has been consummated by Winmar through an initial payment of $A4 million and the issue of 2.5 million Winmar Shares Winmar Hamersley Project WA 5 WINMAR HAMERSLEY DEPOSIT Winmar Resources Ltd is firmly focused on developing its Hamersley Deposit which contains: • Inferred Resource of 241.6Mt @ 54.3% Fe • Main CID zone comprises 169.1Mt@ 55.6% Fe • Anticipated resource of 350Mt - 400Mt Fe The Hamersley Project comprises of: • Exploration License (E47/1617)–58km2 • Mining Lease (M47/1450)–10km2 Rail Infrastructure – Pilbara The Project is located approximately 50 km northeast of the Tom Price township in the Pilbara Region of Western Australia and lies immediately south of Fortescue Metals Group's (FMG) Solomon project. 6 WINMAR’S HAMERSLEY DEPOSIT – IN THE HEART OF THE PILBARA 7 WINMAR’S HAMERSLEY DEPOSIT – Proximity to FMG Solomon Project 8 HAMERSLEY Mineralisation Styles Three styles are present in the inferred deposit, an upper detrital zone (DID), a mid level channel iron deposits (CID), and a basement bedded iron deposits (BID). Of these the CID mineralisation is the most pervasive and important. Detrital Iron Deposits Detrital Iron Deposits (DIDs) are accumulated in colluvial fans directly flanking Banded Iron Formations. Channel Iron Deposits Channel Iron Deposits (CIDs) are prominent in the Pilbara Region of Western Australia. Examples include the Marillana and Robe Formations (Mesa J) and deposition took place during the Tertiary in incised, meandering, mature river channels draining the Hamersley Ranges. Bedded Iron Deposits In-situ bedded iron deposits (BIDs) have formed by a process of enrichment of BIF in both the Brockman Iron Formation and the Marra Mamba Iron Formation. (Vicinity of Hamersley Project WA) Hamersley Ore body. WINMAR’s Hematite-Goethitic mineralisation found in its CIDs is in demand from Japan and now China, as they focus on high ‘Value in use’ ores such as WINMAR’s ore 9 Winmar Resources Ltd displays incredible potential for market capitalisation growth considering its current iron ore JORC of 240Mt. Fortescue Mining Group Ltd ASX Code *Market Capital AUD ~EV/t Tenement Pilbara total Solomon Hub FMG 20,110M $ 0.95 Indicated Inferred Serenity/Sheila Solomon East Mt 10,000 3118 56.2 552 56.4 1672 56.1 1204 56.0 1746 56.3 1528 173 Indicated 1154 Inferred 201 $ 0.29 Total 101.9 CID Indicated 84.2 CID Inferred 17.7 TOTAL 1630 TOTAL 748 Indicated $ 0.34 475.1 Inferred 272.5 TOTAL 347 Measured 32.9 $ 0.59 Indicated 248 Inferred 66.2 Total 1019 Iron Valley indicated 259 Central Satellites $ 0.23 208 Bungaroo South 242 Maitland River 310 (Vicinity of Hamersley WA) TOTAL Inferred Project241 $ 0.04 Inferred CID 169.1 TOTAL Benefication BC Iron (BCI) and Rico Resources (RRI) are the closest competitors, albeit more mature, but with an EV/t many times that of Winmar. Opportunity for Winmar to progress to an anticipated 350Mt - 400Mt resource, on the back of current drilling program. Peer comparison on 240Mt of iron ore resource @ 53%-56% Fe, to position market cap for Winmar at ~ AUD 200M. Measured Brockman Resources BRM 478M Flinders Mines Ltd FMS 254.9M FerrAus Limited FRS 206.7M Iron Ore Holdings Ltd IOH 230M WINMAR Resources WFE 10.1M Nullagine JV (BCI 50% ) BC Iron BCI 257.3M $ 1.86 Measured Indicated Inferred Rico Resources RRI 55.1M $ 0.70 Wonmunna DSO Fe % HAMERSLEY IRON ORE PEDIGREE Company 138 2.2 68.8 30.6 78.3 10 42.6 41.6 43.0 40.7 55.6 55.8 54.4 44.2 55.4 54.9 56.2 56.6 58.7 58.8 55.0 56.0% 58.3 56.9 57.2 34.7 54.3 55.6 55.0 54.5 54.0 54.4 58.2 61.3 10 IRON ORE MARKET Demand continues to grow across Asia for iron ore, particularly China Global Iron Ore Imports in Mt/a • China is the largest market for iron ore and the only growth market • New iron ore suppliers to focus on China steel mills • Shortages of iron ore supplies = Chinese mills welcoming new suppliers Global Pig Iron production trends Global Pig Iron Production in Mt/a • 1.6t iron ore = 1t Pig Iron • China the dominate and growing market for pig iron production • Steel production intrinsic to China’s continuing urbanisation 11 Australian Competitiveness Market Share Distribution Costs into China per tonne China Japan Korea Taiwan Origin Australia Brazil South Africa India 40% 60% 69% 65% Landed cost $130 $138 $140 $118 Freight cost $9 $18.50 $12.50 $10 Australian Shipments Mt/a Rio BHPB FMG Atlas MG Sino MMX Cliffs 222 138 40 2.2 6.3 0.7 1.7 9.3 Total 421 Brazilian competitiveness improving through: - fleet of extra large carriers - pellet plant JVs (Zhuhai, Oman) Freight to China US$/tonne, from Brazil, Australia World Shipments Mt/a Vale 308 Kumba 33.4 ArcelorMittal 49 12 IRON ORE GROWTH Supply Response Reduced capital expenditure due to GFC Skills and capital shortage makes expansions difficult China Per capita GDP expected to increase 3-5 fold by 2030 “Go West” policy – developing western China – will drive continued urbanization, infrastructure construction and steel consumption Market Potential 2015 530-580Mt 2020 650–750Mt Development Aspirations 2015 940 Mt - Vale - Rio - BHPB 470 Mt 330 Mt 220 Mt 2020 1160 Mt Growth Projects 9 producers with expansions 10-12 at various Feasibility Study stages 60 exploration stage BHP plans to increase to 350 Mt but not confirmed FMG has ambitious expansion plans but faces barriers Mid-West is in a mess and magnetite projects face prohibitive capital costs 13 THE WINNING PLAN 1) Metallurgy Work Program Year 1 and Year 2 Focus will be given to improving recoveries and maximising grade, the following techniques will be investigated: • Cyclosing of fines • Desliming • Magnetic and gravity separation • Drilling diamond holes to acquire samples for Metallurgical test work on extensions of the Winmar Resource. 2) Resource Growth, Validation and Exploration Year 1 and Year 2 The RC Drilling program is complete, and results are indicating a350Mt - 400Mt @ 54–56% Fe, 57-60% CaFe Exploration Potential Target in Winmar’S Hamersley Deposit. This will be followed by targeted exploration in the underlying Brockman Iron Formation and other Regional targets. • PQ Drilling is underway, with the Metallurgy program continuing • Additional analysis of drilling results to upgrade resource to Indicated and then Measured JORC Category Exploration Potential - Winmar Deposit Based upon the results to date and the geometric extent of the target, there is an exploration target for the deposit of 350Mt to 400Mt @ 54-56% Fe (57-60% CaFe) of iron ore, including direct shipping ore (DSO). 14 Results are in – Highlights 2011 RC Drill program now completed with a total of 93 holes drilled for 12,805metres: • Assays continue to confirm high grade intersections of high quality bedded and channel iron mineralisation • Results from outside current resource area as well as infill New Global Inferred Resource Estimate for Winmar • 241.6mt @ 54.3% Fe (57.6% CaFe) • CID Zone comprises 169.3mt @ 55.6% Fe (59.0% CaFe) • Revised Project Exploration Target of 350 – 400mt @ 54 – 56% Fe Metallurgical PQ Diamond drilling commenced. Winmar enters MOU to place 10 million shares at 30c per share with Santosh Lad of the VS Lad Group to raise $3million Winmar appoints Summit Equities as Corporate Advisor Details of Order of Magnitude Study expected by August 2011 Appointment of Iron Ore Expert – Philip Kirchlechner 15