Incoterms definition

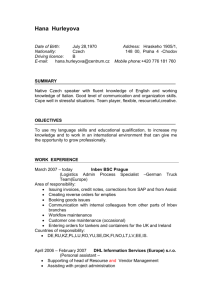

advertisement

Dear Valued Customer, We would like to inform you about the industry-wide changes to the Incoterms ® 2010 being made by the International Chamber of Commerce (ICC), as of 1st January 2011. Incoterms define the transport obligations, costs and risks for parties who buy and sell goods. This revision, the first since 2000, aims to adapt to changes in global international trade over the last ten years. The changes is a nutshell are the following. The number of terms is reduced from 13 to 11 and the number of categories is reduced from 4 to 2 as of January. The most noticeable changes are that the following terms are removed: DAF: Delivered At Frontier DES: Delivered Ex Ship DEQ: Delivered Ex Quay DDU: Delivered Duty Unpaid And the below terms are introduced: DAT: Delivered At Terminal - to replace DAF, DES, DEQ DAP: Delivered At Place - to replace DDU The 11 Incoterms valid in January 2011 are: Rules for any Mode of Transport (including international and domestic transport) EXW: ExWorks FCA: Free Carrier CPT: Carriage Paid To CIP: Carriage and Insurance Paid To DAT: Delivered At Terminal DAP: Delivered At Place DDP: Delivered Duty Paid Rules for Sea and Inland Waterway Transport FAS: Free Alongside Ship FOB: Free On Board CFR: Cost And Freight CIF: Cost, Insurance and Freight How do these changes affect DHL Express? It is important to note, that DHL Express uses Billing Terms which are not identical to Incoterms ®. Incoterms ® are used whenever a commercial transaction of goods takes place based on a contract between the Seller and the Buyer. When DHL Express contracts with either the Shipper or Receiver for the transport of those goods, our billing terms are similar in name but different in purpose. Billing Terms are used to define the contract between the payer of a shipment and DHL Express in terms of billing conditions. DTP (Duties & Taxes Paid): this service allows duties and taxes to be charged to the Sender or nominated third party. DHL Express clears the shipment at destination, pays customs charges, and invoices the duties and taxes to the account specified on the waybill. This enables the Sender to sell goods on an all-inclusive price basis. DHL ExpressMagyarország Kft. 1097 Budapest Fehérakác utca 3. Phone Fax +36 (1) 382 3499 +36 (1) 382 3348 E-Mail info@dhl.hu www.dhl.hu DHL Express then invoices the Sender for the administration of this service as well as the duties and taxes incurred at destination. DTP Billing Term is applied in case of Incoterm DDP. DTU (Duties & Taxes Unpaid): in case of this service the Recipient pays the customs duties and import VAT, while the Sender pays transportation costs. DTU Billing Term to be applied in case of Incoterm DAP. We hope that this short guide helps you to apply the new Incoterm categories in you business. We remain at your disposal for any questions. Sincerely, DHL Express Budapest, December 2010 DHL ExpressMagyarország Kft. 1097 Budapest Fehérakác utca 3. Phone Fax +36 (1) 382 3499 +36 (1) 382 3348 E-Mail info@dhl.hu www.dhl.hu