MasterCard Best Practice Case Study

advertisement

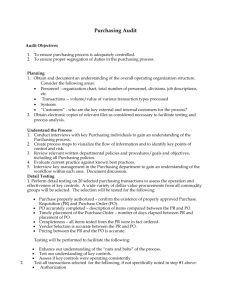

C A S E S T U D Y MasterCard Best Practice Case Study - Harvard University A T - A - G L A N C E Harvard’s GE MasterCard Corporate Purchasing CardTM delivers a range of benefits such as expense reduction with improved efficiency, tighter cost control and saved manhours: • Ease of use and improved productivity for employee • Reduced bank fees • Reduced check costs and related invoice processing costs • No rework- 100% first pass yield • Improved employee satisfaction • Decreased cycle time -from 22 days to 2 days • Enhanced supplier relationships -reimbursement within 48 hours • Enhanced data capture and more accurate accounting information • Accelerated purchasing process • More efficient A/P team -- 30% reduction in check issuance • Fewer vendor records added to the ERP system • Less activity in the customer service group regarding: problem resolution - 20% reduction in supplier calls www.mastercard.com/gov GE Capital's implementation of the MasterCard Corporate Purchasing CardTM solution at Harvard University has resulted in direct cost savings for the organization, greater employee productivity, enhanced efficiency, improved supplier relations, reduced rework and improved cycle times. The GE Capital MasterCard Corporate Purchasing Card has helped the university more effectively manage and control its payment processes. Harvard University, founded in 1636, is the oldest educational institution in the United States. The university currently has more than 18,000 enrolled students with approximately 13,000 more students attending one or more classes at the Harvard Extension School. There are 10 graduate and professional schools with more than 2,000 faculty, and approximately 7,000 more faculty appointments in various affiliated teaching hospitals. Overall, there are 14,000 employees. The GE Capital MasterCard Corporate Purchasing Card has helped the university more effectively manage and control its payment processes. Harvard is managed as a decentralized organization with a Dean appointed by each school’s President. The Dean is responsible for managing his or her respective organization. Every individual business unit or school deploys its own purchasing activity; although there is a central Procurement Management group responsible for supplier consolidation and vendor certification. This centralized group is also responsible for the overall management of suppliers and the leveraging of vendor relationships for the greater good of the organization. Management group wasted a lot of time in rework and troubleshooting. Approximately 80% of the vendor payments made by Harvard University were for less than $500. Yet this high The Problem transaction activity accounts for only 9% of total spending; currently $700 million annually; excluding salary and benefits. Approximately 46,000 transactions are still processed by Accounts Payable each month. These transactions consist of faceapproved invoices, local (or site) purchase orders, petty cash requests, check requests, and travel and expense reimbursements to employees. Approximately 29 Accounts Payable staff are required to process these 552,000 annual Harvard had a number of payment issues, including high administrative costs for processing low-value payments, long payment cycle times and strained supplier relations. Supplier payment was slow. It was difficult for suppliers to track down their invoices to expedite payment because of the decentralized environment and the cumbersome accounts payable processes. Suppliers, Accounts Payable and the Procurement Harvard had a number of payment issues, including high administrative costs for processing low-value payments, long payment cycle times and strained supplier relations. transactions. Like many organizations, many of Harvard University suppliers are only paid once. Yet even one-time suppliers require considerable effort, time, and cost to create the vendor record in the accounts payable system. Petty cash is also available and used, but is not encouraged as a payment process. Less than $50,000 is funded in petty cash at any given time. In addition to these issues, a new ERP system was being implemented. Oftentimes, payments were delayed due to efforts devoted to this project. A sizeable backlog of invoices was quick to appear. To complicate matters further for accounts payable, the travel and expense program was revamped and reimbursements to employees were slowed as well. In short, there was a bottleneck in accounts payable processing activity. The Solution The GE MasterCard Corporate Purchasing Card program was championed by the central Procurement Management group as a way to solve the payment issues. It was not mandated by the University because of the decentralized organizational structure but positioned as a tool that could help all of Harvard's schools effectively deal with their payment processing. Every Harvard employee who purchases goods and services on the job is issued a GE MasterCard Corporate Purchasing Card. By using the Corporate Purchasing Card, most purchases are “defaulted” to the appropriate pre-determined general ledger accounting lines, requiring little more than a review and quick edit if necessary. Items such as testing materials, Federal Express shipping, materials for executive education programs, meeting costs, office supplies and scientific supplies are a few examples of purchases made with the Corporate Purchasing Card. Employee convenience and ease of use has encouraged continued issuance of the Corporate Purchasing Card throughout the organization. Word of mouth endorsements and favorable experiences with the Corporate Purchasing Card drives usage and draws in new cardholders regularly. There are very few vendor exclusions on purchasing card usage at Harvard University. Cardholders are strongly encouraged to review their transactions and edit any accounting information prior to the general ledger update. All cardholders are encouraged to use “certified Harvard University (suppliers) partners” whenever possible. Spending on the card was originally focused on small dollar transactions less than $500, but many cardholders now have single transaction limits of $1,000 or $2,500. Most new cardholders are now encouraged to assume a single transaction limit of $2,500. Monthly limits vary, but most monthly limits are within the $40,000 - $50,000 range, with $100,000 currently at the upper end. The GE MasterCard Corporate Purchasing Card was actively promoted at all levels of the University administration as a simple and effective means of paying vendors that would take the pressure off the new ERP and travel systems until they were stabilized. An active campaign of face to face meetings from early adopters promoted the acceptance and usage of the Corporate Purchasing Card. Also important to the purchasing card program growth was the fact that technology was widely available and utilized throughout the organization. The GE MasterCard Word of mouth endorsements and favorable experiences with the Corporate Purchasing Card drives usage and draws in new cardholders regularly. Corporate Purchasing Card obtained strong executive support as the preferred settlement tool for low value payments (defined as payments $500 or less) as Harvard University re-engineered their business processes, introduced their ERP system, and revamped their employee travel and expense reimbursement system. In addition to being closely associated with these re-engineering efforts, regular communications about the GE MasterCard Corporate Purchasing Card contributed to its success. The Implementation Prior to ERP system implementation, all business practices were examined and evaluated. This review enabled the purchasing card concept to gain a foothold as the preferred purchasing and payment tool for low value payments. The GE MasterCard Corporate Purchasing Card was communicated to executive management as a means of controlling the cost of higher education by reducing administrative cost. Effectively communicating the advantages of the MasterCard Corporate Purchasing Card solution to each employee was critical since there was not a “hard mandate” for usage. The Procurement team relied heavily on GE Capital’s experience with purchasing card programs. Word of mouth and face to face meetings to “sell” the purchasing card solution were used exten- sively to ensure “buy-in” by all stakeholders. Effectively communicating “GE Capital incorporates a the advantages of the consultative, team-focused MasterCard Corporate approach to solving business problems,” explains GE Purchasing Card solution Capital's Bill Hoyt. “This to each employee was means that cost savings and critical since there was efficiencies are maximized as soon as possible.” Utilizing a not a “hard mandate” disciplined approach to profor usage. ject planning and execution, GE Capital identifies opportunity areas. Various individuals Partnership Business Plans, Six Sigma quality rigor, and and teams from within the other types of programs drive business ensure timely and the purchasing card initiative proper account set up, roll and ensure an overall quality out, deployment, and ongoprogram accepted and used ing account management. by all targeted employees. Chris Yule, the National In addition, “action workAccount Manger servicing outs” are also used to underHarvard University describes stand the customer’s business her primary role as “coordienvironment, develop nating the numerous GE “actionable work plans”, Capital resources to my accelerate the desired behavclient’s fullest advantage.” ioral changes throughout the From the customer’s perorganization, and ensure spective, input on “how are “buy-in” from all levels of we doing?” is regularly management. It is during this requested. “Pulse” surveys process that goals are set and and other “voice of the cusmeasurement tools are tomer” instruments continuselected. ally monitor customer Harvard University responded satisfaction. If needed, adjustments are made immediately. favorably to the approaches suggested by GE Capital. Tools such as CAP, or There was good synergy Change Acceleration Process, between the two organizations. customer dashboards, In particular, Hoyt says, “GE Capital did an exceptional job of communicating with our suppliers and encouraging MasterCard sign up…particularly with Level III upgrades.” Procurement also developed dashboards and metrics so that the GE MasterCard Corporate Purchasing Card usage could be measured and reported, by an individual school, on a regular basis. Updates about the Corporate Purchasing Card and suggestions for use were shared via the Procurement team’s newsletter. A policy manual was created and shared throughout the organization, but adopted and revised by the individual schools, as they deemed appropriate. Volume, transactions, and spend against total “opportunity” or potential market share is reported regularly to the schools' Financial Deans. The Results The first GE Capital MasterCard Corporate Purchasing Card transaction at Harvard University occurred in November of 1997. Approximately 200 cards were originally issued and about 500 transactions were processed during this first calendar year. During this stabilization period, the cycle time for invoice processing dropped from 22 days to 2 days for invoices in the backlog queue. Employee reimbursements were significantly decreased because now the Corporate Purchasing Card was used in lieu of the travel and expense program for odds and ends purchasing. Suppliers who accept the GE MasterCard Corporate Purchasing Card are now reimbursed within 48 hours. There was no rework or additional cost required on their part to collect monies owed. Local merchants in particular responded favorably to the purchasing card and supplier relationships were “much improved” in a very short timeframe. Suppliers are pleased with the “guaranteed sale” and prompt payment terms that the GE MasterCard Corporate Purchasing card offers. Relationships with vendors, particularly local merchants, have significantly improved. Accounts Payable no longer is buried in overdue invoices. A significant percentage of the travel and expense reimbursement activity has been eliminated through the purchasing card use as well. The number of checks issued has decreased by nearly 30%, significantly reducing processing costs and banking fees. A recent Harvard study has shown that the cost of processing an invoice through Accounts Payable was eight times higher than the same transaction processed through the MasterCard Corporate Purchasing Card. In addition, the customer service unit has experienced a 20% plus decrease in supplier calls and no longer has to work with employees to resolve invoice discrepancies and/or expedite late payments for purchasing card transactions. And the cost of creating new vendor records has been controlled. The staff in Accounts Payable has been re-deployed within the organization since the need for processing activities has slowed. Although the purchasing card was originally used for all University spending less than $500, there has been growing interest in increasing that threshold to $2,500. E-commerce is quickly emerging at Harvard University as well, particularly with the vendor partnerships. According to GE Capital's Hoyt “We view the purchasing card as an important building block in our buy-side B2B e-commerce strategy.” The experience of the Kennedy School of Government is typical of the positive results that the Purchasing card has achieved: The school has successfully converted 90% of their low value transactions to the GE MasterCard Corporate Purchasing Card. Purchases include office supplies, express mail, materials for executive education programs, furnishings, and food. One goal of the Procurement team for the Corporate Purchasing Card program is to further reduce transactions in accounts payable by yet another 30%-40%. Assuming each school participates at the level of the Kennedy School, this goal will be quickly surpassed and accounts payable will be used to process the smaller number of high-value payments where financial oversight and control is most important. The 2000 goal for total purchasing card dollar volume is targeted at $6 million per month, approximately double the current activity rate. With the GE MasterCard Corporate Purchasing Card, Harvard University has benefited from direct cost savings, improved supplier relations, empowered employees, enhanced productivity, reduced rework, and decreased cycle times. Since its beginnings, the purchasing card program has grown significantly. During the month of April 2000, more than 18,500 transactions occurred with a dollar volume in excess of $2.8 million. There are now more than 3,000 GE MasterCard Corporate Purchasing Cards in force. www.mastercard.com/gov NOTES Public Sector Payment Solutions Public Sector Payment Solutions For more information: publicsector@mastercard.com 800.704.2390 or visit us at www.mastercard.com/gov