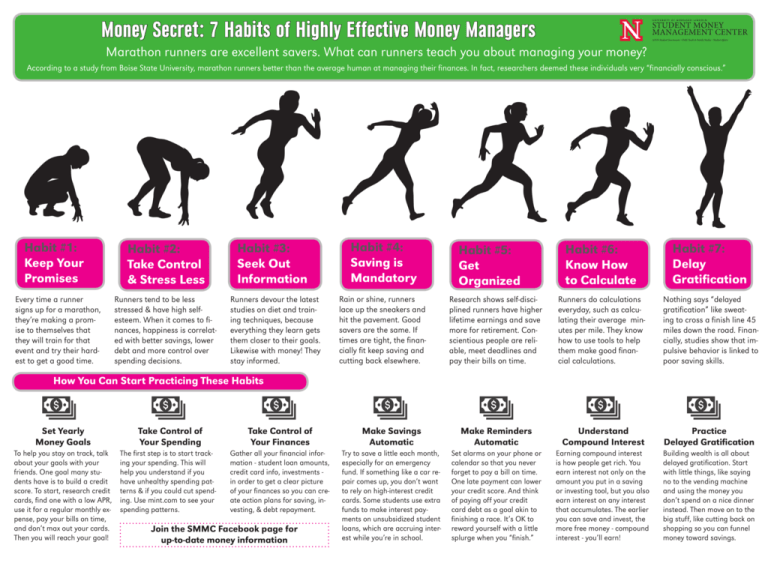

Money Secret: 7 Habits of Highly Effective Money Managers

advertisement

Money Secret: 7 Habits of Highly Effective Money Managers Marathon runners are excellent savers. What can runners teach you about managing your money? According to a study from Boise State University, marathon runners better than the average human at managing their finances. In fact, researchers deemed these individuals very “financially conscious.” Habit #1: Keep Your Promises Every time a runner signs up for a marathon, they’re making a promise to themselves that they will train for that event and try their hardest to get a good time. Habit #2: Take Control & Stress Less Runners tend to be less stressed & have high selfesteem. When it comes to finances, happiness is correlated with better savings, lower debt and more control over spending decisions. Habit #3: Seek Out Information Runners devour the latest studies on diet and training techniques, because everything they learn gets them closer to their goals. Likewise with money! They stay informed. Habit #4: Saving is Mandatory Rain or shine, runners lace up the sneakers and hit the pavement. Good savers are the same. If times are tight, the financially fit keep saving and cutting back elsewhere. Habit #6: Know How to Calculate Habit #7: Delay Gratification Research shows self-disciplined runners have higher lifetime earnings and save more for retirement. Conscientious people are reliable, meet deadlines and pay their bills on time. Runners do calculations everyday, such as calculating their average minutes per mile. They know how to use tools to help them make good financial calculations. Nothing says “delayed gratification” like sweating to cross a finish line 45 miles down the road. Financially, studies show that impulsive behavior is linked to poor saving skills. Habit #5: Get Organized How You Can Start Practicing These Habits Set Yearly Money Goals Take Control of Your Spending Take Control of Your Finances Make Savings Automatic Make Reminders Automatic Understand Compound Interest Practice Delayed Gratification To help you stay on track, talk about your gaols with your friends. One goal many students have is to build a credit score. To start, research credit cards, find one with a low APR, use it for a regular monthly expense, pay your bills on time, and don’t max out your cards. Then you will reach your goal! The first step is to start tracking your spending. This will help you understand if you have unhealthy spending patterns & if you could cut spending. Use mint.com to see your spending patterns. Gather all your financial information - student loan amounts, credit card info, investments in order to get a clear picture of your finances so you can create action plans for saving, investing, & debt repayment. Try to save a little each month, especially for an emergency fund. If something like a car repair comes up, you don’t want to rely on high-interest credit cards. Some students use extra funds to make interest payments on unsubsidized student loans, which are accruing interest while you’re in school. Set alarms on your phone or calendar so that you never forget to pay a bill on time. One late payment can lower your credit score. And think of paying off your credit card debt as a goal akin to finishing a race. It’s OK to reward yourself with a little splurge when you “finish.” Earning compound interest is how people get rich. You earn interest not only on the amount you put in a saving or investing tool, but you also earn interest on any interest that accumulates. The earlier you can save and invest, the more free money - compound interest - you’ll earn! Building wealth is all about delayed gratification. Start with little things, like saying no to the vending machine and using the money you don’t spend on a nice dinner instead. Then move on to the big stuff, like cutting back on shopping so you can funnel money toward savings. Join the SMMC Facebook page for up-to-date money information