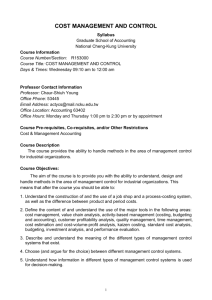

Cost Management and Control

advertisement

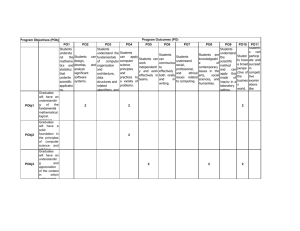

Department of Accountancy R153000 Cost Management and Control (成本管理與控制 成本管理與控制) 成本管理與控制 Spring 2010 (98 學年度第 2 學期) Explore and advance theories and practices in accounting to cultivate competitive professionals with ethical integrity, innovative capabilities and international perspective to meet business and social needs in the global economy. General Program Learning Goals (goals covered by this course are indicated): 1 Graduates should be able to communicate effectively verbally and in writing. 2 Graduates should solve strategic problems with a creative and innovative approach. 3 Graduates should demonstrate leadership skills demanded of a person in authority. 4 Graduates should possess a global economic and management perspective. 5 Graduates should possess the necessary skills and values demanded of a true professional. Course Information Course Number/Section: R153000 Course Title: COST MANAGEMENT AND CONTROL Days & Times: Tuesday 14:10 pm to 17:00 pm Professor Contact Information Professor: Chaur-Shiuh Young Office Phone: 53445 Email Address: actycs@mail.ncku.edu.tw Office Location: Accounting 63402 Office Hours: Monday and Wednesday 1:00 pm to 2:30 pm or by appointment Course Pre-requisites, Co-requisites, and/or Other Restrictions Cost & Management Accounting Course Description The course acquaints students with the latest theory, practices and research findings in the area of cost management and control for industrial organizations. Course Objectives: This course examines management accounting and related analytical methodologies for decision making and control in profit-directed organizations. It also defines product costing, budgetary control systems, and performance evaluation systems for planning, coordinating, and monitoring the performance of a business. This course defines principles of measurement and develops framework for assessing behavioral dimensions of control 1 systems; impact of different managerial styles on motivation and performance in an organization. Grading Policy To make sure you understand the material covered in the lecture, there is one exam for this course. To improve your expression ability, you will have at least once chance to make presentations in the whole semester. The overall course grade will be assigned using the following weights: Presentations Mid-term Exam Written Project Case Instructor Grade Total 20% 30% 30% 10% 10% 100% 1. You are expected to attend each exam, except under the most extreme circumstances. You will be required to submit a written letter detailing your reason for missing any exam before a make-up will be considered. 2. The content and grading criteria of the written paper will be given out in class later. 3. The 20% Instructor grade will consist of 10% of quizzes and 10% on class participation. Quizzes will be given according to the course schedule. There will be no make-ups for quizzes; however, I will drop one ‘awful’ quiz when computing your final course grade. Course Policies Make-up exams Make-up exams will be given only under extenuating circumstances arising from medical or family emergencies. Documented evidence that you were seriously ill or experienced a family emergency at the scheduled time of an exam is required. In order to be excused from an exam, you must contact me prior to the exam and be ready to provide documentation after the exam. Students who do not show up for an exam without making arrangements with me according to the preceding rules will receive an exam grade of zero. It is your responsibility to note the exam dates and let me know at the beginning of the semester if you foresee any conflicts. It is also your responsibility to ensure that you do not schedule any job interviews or travel for official or personal reasons during exam days. Class Attendance Attendance will be randomly taken. Classroom Behavior: You are expected to be in class on time. There is no eating or drinking in the classroom. Turn off cell-phone while in class. Please come to class with a pen/pencil, paper to write on, and an open mind. Courtesy and respect for your teacher and classmates is expected and required. Textbooks and Materials 2 Textbooks: Shank, J.K. 2006. Cases in Cost Management: A Strategic Emphasis. 3rd Ed. Cincinnati, Ohio: Thomson South-Western Publishing. (華泰代理) Cooper, R., and R. S. Kaplan. 1999. The Design of Cost Management Systems: Text & Cases, 2nd Ed. Upper Saddle River, New Jersey: Prentice-Hall. Hansen, D. R. and M. M. Mowen. 2006. Cost Management: Accounting and Control. 5th Ed. Mason, Ohio: Thomson South-Western. (華泰代理) Hilton, R. W., M. W. Maher, and F. H. Selto. 2006. Cost Management: Strategies for business decisions. 3rd Ed. New York, NY: McGraw-Hill/Irwin. Lev, B. 2001. Intangibles: Management, Measurement, and Reporting. N.Y., Washington, D.C.: THE BROOKINGS INSTITUTION. Sunder, S. 1997. Theory of accounting and control. Cincinnati, Ohio: South-Western Publishing. 杜榮瑞、華德、吳安妮合譯:轉捩點上的成本管理,遠流出版公司,1991 (原著:Johnson/Kaplan: Relevance Lost 1987) 陳儀譯:管理會計與決策績效:活用成本控管執行力,打造穩健經營的高獲利組織,2004, 台北:麥格羅希爾 (原著:David Young:Techniques of Management Accounting: An Essential Guide for Managers and Financial Professionals, 2003) Course Contents 1. ABC, ABM & BSC Kaplan, R. S., and R. Cooper. 1998. Cost & effect: Using integrated cost systems to drive profitability and performance. Boston, MA: Harvard Business School Press. Case 4: Allied Office Products Case 31: Sloan Styles 2. Cost System and Organizational Performance 3. Cost Behavior 4. Budgets and Variance Analysis Case 9: Boston Creamery, Inc. Case 27: Petersen Pottery 5. Performance Evaluation 6. Strategic Cost Management (SCM) Shank, J.K. 2006. Cases in Cost Management: A Strategic Emphasis. 3rd Ed. Cincinnati, Ohio: South-Western Publishing. Shank, J.K. and V. Govindarajan. 1989. Strategic Cost Analysis: The Evolution from Managerial to Strategic Accounting. Boston, MA: IRWIN. Shank, J.K. and V. Govindarajan. 1993. Strategic Cost Management: The New Tool for Competitive Advantage. New York, NY: The free press. Case 6: Baldwin Bicycle Company 7. Cost/Accounting Information and Decision Making Case 10: Brunswick Plastics 3 8. The Design of Management Accounting System 9. Compensation Design Case 19: Jones Ironworks 10. Accounting Information and Debt Contracting 11. Family Control and Corporate Governance 12. Strategic Expenditures for Intangibles 13. The valuation implications of Cost/Non-financial Measures Case 18: Graham, Inc. 14. Manipulation of Cost/Accounting Information Grading Policy/評量方式 評量方式: 評量方式 Presentations 20% COMMU Mid-term Exam 30% Project 30% 20% 20% 20% 20% Problem Solving 30% 30% Computational Skills 30% 30% Oral Commu./ Presentation CPSI LEAD Leadership & Ethic Case 10% 30% Written Communication Creativity and Innovation Instructor Grade 10% 20% 30% 30% Social responsibility GLOB Global Awareness 20% Values, Skills & Profess. VSP 20% 30% 20% 30% 30% 40% Information Technology Management Skills 4