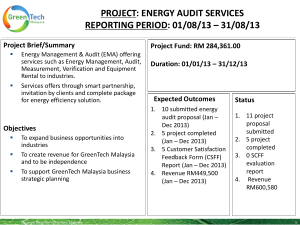

auditor general's report

advertisement