MASSEY FERGUSON Ltd. (1980)

advertisement

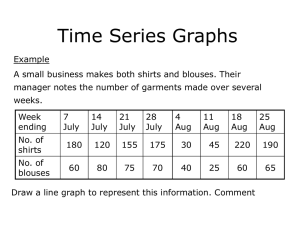

January ‘11 MASSEY FERGUSON Ltd. (1980) Case Study Professor Obiyathulla Ismath Bacha Corporate Finance, FN5033 by: Wan Fadzil Azamat Nazarbaev Fikri Ali Mohammed Adam Ruslan Nagayev INCEIF: The Global University of Islamic Finance Massey Ferguson ltd (1980) TABLE OF CONTENTS 1. INTRODUCTION .............................................................................................................................. 3 2. PROBLEMS ...................................................................................................................................... 3 3. FACTORS AFFECTED ................................................................................................................... 3 3.1. INTERNAL FACTORS .................................................................................................................... 3 3.1.1. Too fast expansion and growth (M&A) .......................................................................... 3 3.1.2. Inefficient working capital ................................................................................................ 3 3.1.3. Capital structure ................................................................................................................ 3 3.1.4. Product market alignment ............................................................................................... 4 3.2. EXTERNAL FACTORS .................................................................................................................. 4 3.2.1. Interest rate ........................................................................................................................ 4 3.2.2. Demand .............................................................................................................................. 4 3.2.3. Currency exchange .......................................................................................................... 4 3.2.4. Political risk ........................................................................................................................ 4 3.2.5. Extreme climate ................................................................................................................ 4 4. POSSIBLE SOLUTIONS ................................................................................................................ 5 5. CONCLUSION .................................................................................................................................. 5 APPENDIX ............................................................................................................................................ 6 2 1. INTRODUCTION Founded in 1847, Massey Ferguson (MF), a division of Argus Corporation, is one of the leaders in farm equipment production in the world. In 1953, MF merged with the Ferguson Company, the former UK farm equipment producer, to become MasseyHarris-Ferguson, before finally taking on its current name in 1958. By 1980 it had manufacturing and assembling facilities in 31 countries and its products were sold in 140 countries. Main products are tractors, diesel engines and industrial machinery. 2. PROBLEMS In late 1970s Massey Ferguson experienced severe financial losses and in fact reported an unprecedented year-end loss of 262 million USD in 1978. We have attempted to identify the problems the company was faced with and divided them into two groups: internal factors or firm specific and external factors, or market-wide. 3. FACTORS AFFECTED 3.1. Internal Factors 3.1.1. Too fast expansion and growth (M&A) The company has made many acquisitions in different countries without taking time to stand firmly in terms of marketing decisions, procedures, etc. It seems that the priority was given to expansion – strategic decisions without implementation of a proper operational framework. (see Table 3 in the Appendix) 3.1.2. Inefficient working capital MF adopted an aggressive financing strategy. The expensive short term financing was utilized to finance non-earning assets: inventories and accounts receivables. Later, in 1980, the company started to offer a hire-purchase contract to its customers, rather than facilitating bank loans for them. (see Figure 5, and 6). 3.1.3. Capital structure The company was highly leveraged compared to its peers. (see Chart 1). MFʼs high dependence on short-term debt played its significant role in the companyʼs severe financial distress leading it to default in early 1981 as the company was unable to meet its short run obligations. The company attemted to issue preferred stocks in April 1980; however its major stakeholder AGCO blocked the decision. On the whole, MF could not issue equity and, thus, obtain long term capital. Therefore, it had to depend on short-term debt. 3 3.1.4. Product market alignment Not only MF suffered from imbalanced capital structure but also from misaligned product market. It produced machines in highly developed countries and sold them in less developed states. (See Figure 8, 9, and 10). 3.2. External Factors 3.2.1. Interest rate The US economy and other major economies were hit by high inflation in 1974/75 and 1979/80 (see Figure 10). The majority of economists state that the 1973/74 and 1979/80 oil crises were the main cause of the economic downturn. However, others view the roots of that economic hardship in excessive global liquidity. In particular, after the demise of the Bretton Woods System in 1971 the Japanese and European central banks intervened heavily to prop up the dollar and greatly boosted money supply. Nevertheless, OPEC oil price hike was indeed evident. To contain the high inflation Paul Volcker, the chairman of the Fed, tightened the Fed funds rate by increasing it from 11% in 1979 to 20.5% by January 1981. Massey Ferguson was hit hard since its operations were mainly financed by short-term debt, thus its financing costs went up dramatically. 3.2.2. Demand MF's renewed drive into the North American market in the late 1970s regrettably happened in line with the aggregate demand fall in the U.S. economy as the country was entering deep recession. The U.S. GDP in 1980 and 1982 stood at just below zero growth and far below at -4% respectively. Private consumption also fell considerably. 3.2.3. Currency exchange With the enlarged production of the North Sea oil in the late 1970s the UK pound sterling appreciated significantly against the other major currencies including the currencies in which Massey Ferguson traded its products (see Table 4). 3.2.4. Political risk Despite MF was successful in negotiating with less developed countries and the Eastern European governments, the company was still susceptible to unstable political conditions in those countries. For example, the 1979 Iranian revolution, or Pakistanʼs regional problems in 1970s. 3.2.5. Extreme climate In June-September 1980 anomalous heat and drought covered vast territories of the USA. Total deaths amounted 10,000 people. Agriculture and related industries were estimated to have lost $20.00 billion. 4 4. POSSIBLE SOLUTIONS • • • • • Restructuring/refinancing: to avoid disruption of operations. This involves paring down debt towards optimum capital structure by rescheduling and having debt-equity swap. The nature of MFʼs industry would necessitate a more conservative strategy with preference for long term funding. Re-evaluation: to determine a set of core businesses in which it should further invest to ensure its growth, possibly with governmental policy assistance. Merger & acquisition: but in the light of negative performance of MF, it is highly unlikely. Liquidation: it would cause shareholders to lose full amount of their investment, job cuts, disappearance of an important investor in their respective countries, and deprive lenders of full recovery. Government bailout: “too big to fail” – the most feasible option. 5. CONCLUSION The above facts about MFʼs financial status in the late ʻ70s revealed their problems, which was clear for sound decision makers either investors or creditors. Investors, on the one hand, aim to benefit from capital gain which is the growth of company value and hence the stock prices. On the other had, some investors are interested in dividends for coming periods by buying shares of a company. In the case of MF, neither capital gain nor dividends were expected. On contrary, the company was demonstrating all the signs of a near bankruptcy and in fact it began fiscal year 1981 in default on its total debt of $2.5 billion. Finance leverage was too high comparing to its competitors. MF stopped paying dividends to its shareholders in 1978 while its capital loss per share reached $12.79 in 1980. The company also lost 69% of its market value from 1976 to 1980. In general, Massey Ferguson had poor performance, particularly due to bad financial management and planning. The company also had cross-default provisions on its debt obligations, meaning that a single default on one loan contract would have led to an automatic default on all its debt obligations. Taking into account all these reasons, we believe it would have been not right decision for both existing and prospective shareholders to invest into MF in the late ʻ70s. To sum up, neither long term debt nor equity was available for MF due to its high financial leverage, poor financial management and position in the late 1970s; thus, it was forced to raise short-term funds. In other words, MF was far beyond its optimal capital structure. This fact played one the of the main roles in the companyʼs financial distress. 5 APPENDIX Figure 1: Stock performance OPER. PROFIT / SALES NET INCOME / SALES 9.0% 15.0% 6.8% 11.3% 4.5% 7.5% 2.3% 0% 3.8% -2.3% 0% -4.5% -3.8% -7.5% -6.8% 1976 1977 1978 1979 1980 -9.0% 6 1976 1977 1978 1979 1980 Table 1: Balance Sheet (in millions of USD) DESCRIPTION 1978 ASSETS Cash Receivables Inventories Prepaid expenses, other Current assets Investments Fixed assets, net Other assets and deferred charges Total Assets USD 23.4 531.3 1,083.80 63.8 1,702.30 213.3 602.2 29.3 2,547.10 1979 1980 Δ% 0.92% 20.86% 42.55% 2.50% 66.83% 8.37% 23.64% 1.15% 100% USD 17.2 731.1 1,097.60 89.8 1,935.70 217.1 568.7 24 2,745.50 Δ% 0.63% 26.63% 39.98% 3.27% 70.50% 7.91% 20.71% 0.87% 100% USD 56.2 968.2 988.9 93 2,106.30 205.8 488.2 27.3 2,827.60 Δ% 1.99% 34.24% 34.97% 3.29% 74.49% 7.28% 17.27% 0.97% 100% LIABILITIES USD Bank borrowings 362.3 Long-­‐‑term debt, current portion 115 Accounts payable and accrued charges 778.7 Other 16.1 Current Liabilities 1272.1 Deferred income tax 64.3 Long-­‐‑term debt (less current portion) 651.8 Minority interest in subsidiaries 18.4 Total liabilities 2006.6 Redeemable preferred shares 95.8 Common (18,250,350 shares) 176.9 Retained earnings 267.8 Shareholders'ʹ equity 540.5 Δ% 14.22% 4.51% 30.57% 0.63% 49.94% 2.52% 25.59% 0.72% 78.78% 3.76% 6.95% 10.51% 21.22% USD 511.7 59.3 907.4 31.1 1509.5 13.8 624.8 19.1 2167.2 95.8 176.9 305.6 578.3 Δ% 18.64% 2.16% 33.05% 1.13% 54.98% 0.50% 22.76% 0.70% 78.94% 3.49% 6.44% 11.13% 21.06% USD 1,015.10 60.2 793.8 24.5 1893.6 14.3 562.1 4.5 2474.5 95.8 176.9 80.4 353.1 Δ% 35.90% 2.13% 28.07% 0.87% 66.97% 0.51% 19.88% 0.16% 87.51% 3.39% 6.26% 2.84% 12.49% Total liabilities and shareholders'ʹ 2,547.10 100% 2,745.50 100% 2,827.60 100% equity 7 Table 2: Income Statement (in millions USD) DESCRIPTION 1978 1979 1980 ITEMS Net sales Cost of goods sold, at average USD 2926 Δ% 100.00% USD 2973 Δ% 100.00% USD 3132 Δ% 100.00% 2371 81.03% 2382 80.12% 2569 82.02% 0.00 0.00% 19.00 0.64% 8 0.26% 2371 81.03% 2400 80.73% 2576 82.25% 372.00 12.71% 352.00 11.84% 405.00 12.93% Engineering and product Interest on long-­‐‑term debt development Other interest expenses** Interest income Exchange adjustments Minority interest Miscellaneous income Total costs and expenses 66 79 108 0 91 -­‐‑1 -­‐‑11 3,075 2.26% 2.70% 3.69% 0.00% 3.11% -­‐‑0.03% -­‐‑0.38% 105.09% 58 76 129 -­‐‑40 -­‐‑25 1 -­‐‑10 2,941 1.95% 2.56% 4.34% -­‐‑1.35% -­‐‑0.84% 0.03% -­‐‑0.34% 98.92% 60 71 230 -­‐‑42 50 0 -­‐‑14 3,336 1.92% 2.27% 7.34% -­‐‑1.34% 1.60% 0.00% -­‐‑0.45% 106.51% Profit (loss) before items shown -­‐‑150 -­‐‑5.13% 32 1.08% -­‐‑204 -­‐‑6.51% Provision for reorganization expense -­‐‑116 Income tax recovery -­‐‑12 Equity in net income of finance 16 -­‐‑3.96% -­‐‑0.41% -­‐‑95 6 -­‐‑3.20% 0.20% -­‐‑29 10 -­‐‑0.93% 0.32% 0.55% 17 0.57% 23 0.73% 5 0.17% 5 0.17% 0 0.00% -­‐‑257 -­‐‑8.78% -­‐‑35 -­‐‑1.18% -­‐‑200 -­‐‑6.39% 0 0 -­‐‑257 0.00% 0.00% -­‐‑8.78% -­‐‑23 95 37 -­‐‑0.77% 3.20% 1.24% -­‐‑26 0 -­‐‑225 -­‐‑0.83% 0.00% -­‐‑7.18% 0 0.00% -­‐‑6 -­‐‑0.20% 58 1.85% exchange rates for year Effect of foreign currency exchange rate changes* Marketing, general, and administrative below subsidiaries Equity in net income of associate companies Income (loss) from continuing operations Loss from discontinued operations Extraordinary item Net income (loss) Unfavorable (favorable) impact on continuing operations of exchange adjustments and foreign currency exchange rate changes in cost of goods sold 8 Table 3: Acquisitions Year Company Country 1955 HV Mc Kay Australia 1959 Landini Italy 1959 Perkins Engines UK 1966 Ebro Spain 1973 Eicher Germany 1974 Hanomag West Germany 1974 Contract Poland ($360mln) Figure 6: Main components of Current Assets Figure 5: Net working capital Current Assets Net Working Capital 1200 1100 800 732 1000 700 900 800 697 625 600 502 Millions of USD 700 600 500 400 300 200 500 400 439 336 430 427 372 300 212 200 100 100 0 1971 1972 1973 Cash 1974 1975 Receivables 1976 1977 1978 Inventory 1979 1980 0 Other 1971 1972 1973 1974 1975 1976 1977 1978 Chart 1: Financial leverage DEBT TO ASSETS TOTAL DEBT TO CAPITAL 90.0% 90% 67.5% 68% 1976 1977 1978 1979 45% 45.0% 23% 22.5% 0% 0% 1980 9 1976 1977 1978 1979 1980 1979 1980 SHORT-TERM DEBT TO EQUITY TOTAL DEBT TO EQUITY 60.0% 8.00 45.0% 6.00 30.0% 4.00 15.0% 2.00 0% 0 1976 1977 1978 1979 1980 1976 1977 1978 1979 1980 Figure 7: Sales in 1980 Sales: 1980 Scandinavia, 114 Turkey, 14 Pakistan, Japan, 25 29 Iran, 31 Canada, 219 South Africa, 66 Australia, 131 Argentina, 44 United States, 819 Brazil, 306 Benelux, 28 Spain, 8 West Germany, 157 Italy, 211 Mexico, 75 United Kingdom, 297 France, 227 10 Figure 8: Diesel Engines Production Capacity in 1980 Diesel Engines: 1980 United Kingdom United Kingdom France Brazil Australia Figure 9: Farm Equipment Production Capacity in 1980 Farm Equipment: 1980 Canada United Kingdom United Kingdom France Italy West Germany Brazil Argentina Australia Figure 10: US inflation in 1970-­‐‑1985 US Inflation: 1970-­‐‑1985 15 10 11 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 0 1970 5 Table 4: Currency exchange rates to 1 pound UK Year 1978 US Dollars 1.92 German Marks 3.85 French Francs 8.65 Canadian Dollars 2.19 Australian Dollars 1.68 Swish Krona 8.67 Norwegian 10.05 Italian Lira 1,628.30 Kroner 1979 2.12 3.89 9.02 2.48 1.90 9.09 10.74 1,762.20 12 1980 2.33 4.22 9.82 2.72 2.04 9.83 11.48 1,988.60 1981 2.03 4.57 10.96 2.43 1.76 10.21 11.61 2,289.90