Value Investing

advertisement

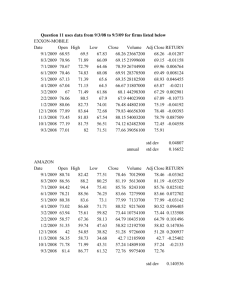

THE JOURNAL OF SUMMER 2014 VOLUME 5 NUMBER 1 | www.IIJII.com ETFs, ETPs & Indexing The Voices of Influence | iijournals.com Value Investing: Smart Beta versus Style Indexes Jason Hsu Jason Hsu is co-founding partner and vice chairman at Research Affiliates, LLC in Newport Beach, CA, and is a professor in finance at UCLA Anderson School of Management in Los Angeles, CA. hsu@rallc.com Summer 2014 M ost commercially available smart beta1 indexes contain meaning ful exposure to the value premium. In fact, almost all non-price-weighted index schemes will naturally access the value anomaly, which can be interpreted as the effect of contrarian rebalancing against long-horizon mean reversion in equity prices (Arnott et al. [2013] and Chow et al. [2011]). Because prices are prone to reverse direction in the entire cross-section of stocks, the contratrading inherent in rebalancing—buying what has fallen and selling what has risen in price—can be applied to all stocks in the equity universe. This approach to extracting the value premium is quite different from traditional investing, which is predicated, at base, on buying stocks with low priceto-book ratios (P/B) at their capitalization weights.2 The first section of this article describes how conventional, value style index construction leads to industry concentrations and explains how price-based weighting adversely affects returns. The second, short section introduces mean reversion in stock prices and presents rebalancing as the mechanism through which some of the smart beta indexes implement a more diversified value strategy. The third section evaluates evidence that, just as stock prices tend to revert toward their long-term averages, so also does the value premium. The section further demonstrates that fundamentally weighted indexes implicitly engage in dollar cost averaging to capture the full effect of mean reversion in both stock prices and the value premium. The article concludes with observations on the relative strengths of traditional and smart beta approaches to index investing. THE TRADITIONAL, VALUE STYLE OF PASSIVE INVESTING Value investing has been known since the early 1920s to deliver superior performance. In the late 1980s and early 1990s, with the growing popularity of consultants’ nine-box style matrices, index providers sought to provide investors with transparent, low cost “beta” exposure to value investing through products tied to cap-weighted indexes with predominately value characteristics. By and large, these first-generation value indexes were constructed by selecting stocks with low P/B and then weighting them in proportion to their market capitalization. Over time, the methodologies evolved to include other measures of value, as opposed to growth, and to situate stocks on a value– growth continuum. According to financial lore, the value style outperforms the market in the long run. We observe, however, that the major value style indexes have had mixed results relative The Journal of Index Investing to broad cap-weighted market indexes over the past 30 years (Exhibit 1). The hypothesis that value investing reliably leads to favorable long-term results may be wrong, or—among other possible explanations—the traditional value style strategies may not capture the full value premium. The structure of the conventional value style indexes also raises some questions. They have two important characteristics. First, their active shares relative to the market benchmark are dominated by industry bets. In traditional value indexes, growth-oriented industries are represented only to the extent value stocks have growth characteristics. The resulting indexes are unrepresentative of the underlying economic exposure, because they are poorly diversified from an industry-concentration perspective. In particular, a quick examination of traditional value indexes will find large overweights in financial and energy stocks, made possible in part by underweight positions in technology stocks. The S&P 500 Value Index and the Russell 1000 ® Value Index have significantly more exposure to financial and energy stocks, and less to technology stocks, than the corresponding broad market indexes (Exhibit 2). It is well understood today that, as value signals, ratios such as P/B and price-to-earnings (P/E) are more meaningful for comparing stocks within a more homogeneous economic sector or industry (Gaudette and Lawton [2007]). Using P/B and P/E to contrast stocks across different sectors or industries is substantially less useful. Therefore, the aggressive industry active weights, resulting from favoring stocks from industries with traditionally lower valuation ratios, are suboptimal approaches for exploiting the value effect. Second, although traditional value style indexes are reconstituted once a year, the stocks that are gathered into their value baskets are assigned index weights proportionate to their market capitalization. Consequently, the weights of the stocks in a value index f luctuate with prices. For example, prior to the global financial crisis, many of the large banks became expensive relative to their own historical valuation ratios. The cap-weighting scheme meant that these expensive banks also took on dominant weights within the value index just prior to the banking sector crisis. Conversely, at the nadir of the crisis, when banks were trading at historically low valuation multiples, their weights in the value index were substantially reduced (Exhibit 3). Due to the effect of stock prices on index weights, bank stocks contributed more heavily to the value style indexes’ losses during the crisis than they added to gains in the recovery. THE SMART BETA APPROACH It is useful to view the value investment strategy as capturing mean reversion in stock valuation ratios (Cohen et al. [2003]). Under this interpretation, rebal- EXHIBIT 1 Value Style Indexes vs. Broad Market Indexes Source: Research Affiliates, using data from FactSet and FRED. VALUE INVESTING : SMART BETA VERSUS STYLE I NDEXES JII-HSU.indd 122 SUMMER 2014 5/16/14 6:57:23 PM EXHIBIT 2 Index Sector Weights *As of February 28, 2014. Source: Research Affiliates, using data from S&P Dow Jones Indices and FactSet. EXHIBIT 3 Pre-Crisis and Pre-Recovery Weights Source: Research Affiliates, using data from FactSet. ancing against price is a critical step in exploiting long-horizon mean eversion. Cap-weighted indexes automatically adjust positions as constituents’ market prices change; there is no rebalancing to exogenous weights. Therefore, applying cap-weighting to value stocks effectively eliminates the opportunity to profit from mean reversion. By contrast, smart beta value indexes offer more powerful approaches to capturing the value premium. Let me use an index constructed in accordance with the non-cap-weighting methodology described in Arnott et al. [2005] as an illustration. In this approach, stocks are weighted by fundamentals associated with economic size, such as book value and total cash f lows. These measures are not directly related to stock prices. Nonetheless, because they track capitalization over time, the fundamentally weighted strategy generally contains industry exposures that are reasonably similar to the broad market index. As of December 31, 2013, the fundamentally weighted index held 21.2% in the financial sector and 11.8% in energy stocks (compared to 26.9% and 14.7%, respectively, in the Russell 1000 Value Index). Thus, much of the active shares of fundamentally weighted indexes are taken up by intra-industry bets—for instance, overweighting Ford and underweighting Tesla. Industry-based active shares SUMMER 2014 JII-HSU.indd 123 become meaningful only if an industry precipitously becomes substantially more or less expensive relative to its own historical valuation level. The fundamentally weighted strategy also rebalances annually against valuation ratio movements, buying what has become cheaper over the course of the year and selling what has become more expensive. The rebalancing is effected over hundreds of stocks across all industries. This contra-trading amplifies the weak time-series, price mean-reversion effect through the law of large numbers in the equity cross-section. The long-term returns earned by smart beta strategies are substantially higher than the traditional value indexes’ value-added returns. The fundamentally weighted approach to value investing results in approximately 200 bps of historical outperformance. (This outcome was first documented in Arnott et al. [2005].) Over the 30-year period ending December 31, 2013, the simulated return of the fundamentally weighted index was 13.14% per annum, more than 200 bps higher than the annualized returns of the S&P 500 Index (11.09%) and the Russell 1000 Index (11.12%). In the same period, the S&P 500 Value Index underperformed the S&P 500 by 18 bps and the Russell 1000 Value Index exceeded the Russell 1000 Index by 41 bps. The outperformance of the fundamentally weighted index is not attributable to added risk; its hypothetical 30-year return is modestly superior to the returns of the value style indexes on a risk-adjusted basis. The fundamentally weighted index had a Sharpe ratio of 0.49, compared to 0.36 for the S&P 500 Value Index and 0.41 for the Russell 1000 Value Index. THE VALUE PREMIUM IS MEAN REVERTING There is empirical evidence that, like the equity risk premium, the value premium is also mean reverting. (Asness et al. [2000] and Cohen et al. [2003]). This fact has strategic significance. The last two market cycles illustrate the return impact of reversals in P/B trends. The tech boom drove the ratio of the growth P/B to the value P/B to 14.65 in July 2000. (In other words, at that point in time the average P/B of growth stocks was 14.65 times the average P/B of value stocks.) In the subsequent three years, value cumulatively outperformed growth by 60.3%. The housing and subprime mortgage bubble drove up prices for the banking and consumer staples THE JOURNAL OF INDEX INVESTING 5/16/14 8:40:03 PM sectors, which are traditional value sectors. In January 2006 the growth stock P/B was 4.36 times the value stock P/B, and value cumulatively underperformed growth by 33.1% in the subsequent three years. The ratio expanded again as the economy recovered from the global financial crisis, reaching 11.5 times in March 2009; in the following three years, value outperformed growth by 44.4% cumulatively. Exhibit 4 summarizes these observations, and Exhibit 5 displays the ratio of growth and value P/B at each month end with the cor- EXHIBIT 4 P/B Ratios and Growth and Value Returns Source: Research Affiliates using data from CRSP and Compustat. EXHIBIT 5 Month-End P/B (1998–2013) and Subsequent Three-Year Value Premia (Annualized) Source: Research Affiliates using data from CRSP and Compustat. VALUE INVESTING : SMART BETA VERSUS STYLE I NDEXES JII-HSU.indd 124 SUMMER 2014 5/16/14 6:57:24 PM EXHIBIT 6 Risk and Return Impact of Dollar Cost Averaging, 1963–2013 Source: Research Affiliates using data from CRSP and Compustat. responding difference between annualized growth and value returns for the three years then starting. One can capture the value premium either by investing in low P/B stocks or by rebalancing from the last few years’ winner stocks (those whose prices have appreciated the most) into the losers. However, when momentum carries prices away for an extended period of time, rebalancing can cause value stocks to underperform, perhaps substantially. The larger and more prolonged the value underperformance, the bigger the spread between growth and value stock P/B. The large P/B spread is then a signal for the magnitude of the forthcoming return reversal. There is mean reversion in the mean-reversion effect. When the mean-reversion effect shows evidence of mean reversion, it makes sense to dollar cost average contrarian bets (Brennan et al. [2005]). Let me show this by comparing two portfolios: one that allocates a constant tracking error to low P/B stocks, and another that dynamically allocates more tracking error when the gap between growth and value P/B ratios widens. The first portfolio is akin to the traditional value strategies, which tilt toward cheap stocks in order to generate outperformance. The second portfolio is similar to fundamentally weighted and other simpler smart beta indexes, whose rebalancing heuristics implicitly contain dollar cost averaging. Exhibit 6 shows the simulated long-term results: The value portfolio with the dynamically adjusted tracking error (that is, the value portfolio that automatically engages in dollar cost averaging) outperforms the value portfolio whose tracking error is held static (the traditional portfolio with a value bias) by 49 bps with no incremental risk. Thus the fact that the value premium is mean reverting has strategic implications. Merely tilting toward value stocks may leave a good part of the total value premium on the table. By comparison, some smart beta approaches may squeeze much more juice from the SUMMER 2014 JII-HSU.indd 125 value apple by means of a rebalancing rule that effectively carries out dollar cost averaging. BRINGING IT ALL TOGETHER The index industry attempted to harvest the different equity risk premia long before the arrival of smart beta indexes. However, the traditional approaches are now understood to be relatively ineffective. The stylebased investing approach characterized by traditional value and growth indexes neither captures the value premium effectively in individual securities nor applies the methodology broadly enough to fully exploit the value premium across all stocks and all industries. Through the rebalancing mechanism, smart beta approaches effectively sell high and buy low, profiting more efficiently from mean reversion in stock prices. In addition, the dollar cost averaging inherent in fundamentally weighted strategies takes advantage of second-order mean reversion (that is, mean reversion in the mean reversion of the value premium). It bears mention, however, that the various approaches to index construction and maintenance within the smart beta universe represent different degrees of effectiveness in harvesting factor premia. While many of them do in fact outperform the cap-weighted market index by reaping sources of excess return other than bulk beta, their efficiency, as measured by transaction costs, investability, and underlying economic exposure, can vary appreciably. The advantages of moving away from traditional strategies such as value style investing seem obvious. Nonetheless, investors do, indeed, need to be smart when it comes to analyzing smart betas. ENDNOTES I owe an enormous debt of gratitude to Philip Lawton for his tireless editorial assistance. Thanks also go to Noah Beck, Prashant Pandey, and El Winata for research support. THE JOURNAL OF INDEX INVESTING 5/16/14 6:57:24 PM The views and opinions expressed are those of the author and not necessarily those of Research Affiliates, LLC. The material contained in this document is for informational purposes only and not intended as an offer or solicitation for the purchase or sale of any security or financial instrument nor is it advice or a recommendation to enter any transaction. 1 Towers Watson is credited with coining the phrase “smart beta” to describe non-price-weighted indexes and bulk beta for describing traditional cap-weighted indexes. The term is not meant to denigrate providers or users of the latter. Towers Watson used the word “smart” to suggest that investors need to be smart to make the right smart beta selection. 2 Almost all traditional value indexes set the stock weights as a function of market capitalization. REFERENCES Arnott, R.D., J. Hsu, and P. Moore. “Fundamental Indexation.” Financial Analysts Journal, Vol. 61, No. 2 (March–April 2005), pp. 83-99. Arnott, R.D., J. Hsu, V. Kalesnik, and P. Tindall. “The Surprising Alpha from Malkiel’s Monkey and Upside-Down Strategies.” The Journal of Portfolio Management, Vol. 39, No. 4 (Summer 2013), pp. 91-105. Asness, C.S., J.A. Friedman, R.J. Krail, and J.M. Liew. “Style Timing: Value versus Growth.” The Journal of Portfolio Management, Vol. 26, No. 3 (Spring 2000), pp. 50-60. Brennan, M.J., F. Li, and W.N. Torous. “Dollar Cost Averaging.” Review of Finance, Vol. 9, No. 4 (2005), pp. 509-535. Chow, T., J. Hsu, V. Kalesnik, and B. Little. “A Survey of Alternative Equity Index Strategies.” Financial Analysts Journal, Vol. 67, No. 5 (September–October 2011), pp. 37-57. Cohen, R.B., C. Polk, and T. Vuolteenaho. “The Value Spread.” Journal of Finance, Vol. 58, No. 2 (April 2003), pp. 609-642. Gaudette, S.C., and P. Lawton. Equity Portfolio Characteristics in Performance Analysis. Charlottesville, VA: CFA Institute, 2007. To order reprints of this article, please contact Dewey Palmieri at dpalmieri@ iijournals.com or 212-224-3675. VALUE INVESTING : SMART BETA VERSUS STYLE I NDEXES JII-HSU.indd 126 SUMMER 2014 5/16/14 6:57:24 PM