Northfield Hotel Report

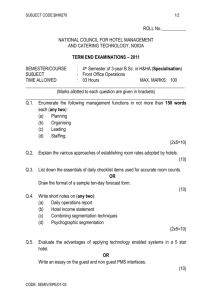

advertisement