Strategic Formulations & Recommended Implementation

advertisement

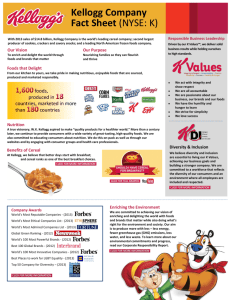

Sa Ex m ce ple rp t Strategic Formulations & Recommended Implementation Submitted by Ric Osuna June 21, 2009: CONFIDENTIAL June 21, 2009 1 Table of Contents June 21, 2009: CONFIDENTIAL Sa Ex m ce ple rp t Introduction ......................................................... 3 Company Background ................................................... 3 Part One: Kellogg – Kashi Analysis ................................... 4 SWOT Analysis ...................................................... 4 Porter’s Five Forces in Action ..................................... 4 Remote Environmental Factors ....................................... 4 Economic Factors ................................................. 4 Social Factors ................................................... 5 Political Factors ................................................ 5 Technological Factors ............................................ 5 Ecological Factors ............................................... 5 Industry and Competitive Environments .............................. 6 Operating Environment .............................................. 7 International Environment .......................................... 7 Resource-Based View of Kashi Foods ................................. 7 Value Chain Analysis ............................................... 9 Primary Activities ............................................... 9 Support Activities .............................................. 10 Financial Statement Analysis of Kashi Foods ....................... 10 Profitability ..................................................... 11 Liquidity ......................................................... 12 Leverage .......................................................... 12 Activity .......................................................... 13 Summary of Financial Findings ..................................... 13 Part Two: Competitive Analysis ...................................... 14 Qualitative Analysis .............................................. 14 Quantitative Data Analysis ........................................ 15 Summary of Competitive Analysis ................................... 17 Part Three: Strategic Formulation ................................... 17 Grand Strategies in the Long Term ................................. 18 Generic Strategies in the Short Term .............................. 19 Implementation Plans .............................................. 20 Monitoring the Strategy ........................................... 21 Conclusion .......................................................... 21 References .......................................................... 23 Appendix ............................................................ 24 Appendix A ........................................................ 25 Appendix B ........................................................ 26 Appendix C ........................................................ 27 2 Introduction The purpose of this company analysis is to formulate a strategic response to external and internal market conditions in order to preserve the Kellogg Company’s standing in the packaged food industry, while helping its subsidiary, Kashi Foods, achieve broader market success. Sa Ex m ce ple rp t According to Pearce and Robinson's text, entitled Strategic Management and Financial Ratio Analysis (2009), an examination of factors will assist Kashi Foods’ strategic planning. Since Kashi Foods is a subsidiary of the Kellogg Company, detailed information will be derived from Kellogg’s annual reports and earnings, which incorporates all of its subsidiary information. The Kellogg Company allows Kashi Foods to operate independently while adhering to the Kellogg values and corporate guidelines, which closely reflect Kashi Foods’ own. Therefore, any strategic recommendations suggested are aimed at Kashi Foods and the Kellogg Company. Company Background Because of its founding philosophies that minimally processed foods should be obtainable by everyone, Kashi Foods is rooted in a deep value system (Pearce and Robinson, 2009). This value system helps to differentiate its product, so consumers will feel connected to a company that is seemingly putting their health in front of its profits. Kashi Foods’ successful mission statement may define its market – health food – but preempts its vision, which outlines where it wants to go. Kashi Foods’ vision statement fits this criteria, as it defines the organization’s need "to provide good tasting and innovative foods, made with all-natural ingredients, that enable people to achieve optimal health, wellness and weight management goals," (Kashi Foods, 2009). June 21, 2009: CONFIDENTIAL A mission statement serves as the foundation of the strategic roadmap of an organization and should set itself apart by defining an organization’s scope and expertise. Of course, as with any corporatelevel directive, a mission statement should be inclusive of stakeholder expectations, unifying purpose and strategic objectives (Pearce and Robinson, 2009). “Everyone has the right to healthy food,” the mission statement for Kashi Foods, embodies the characteristics of a successful mission statement while reflecting the organization’s intent to secure its survival through growth and profitability (Pearce and Robinson, 2009). 3 The understanding of this value system is imperative for any strategic implementation in order to ensure the strategy recommendations are inline. Part One: Kellogg – Kashi Analysis SWOT Analysis Sa Ex m ce ple rp t Within the appendix section and attached as Appendix A is a SWOT analysis of Kashi Foods. By outlining the strengths, weaknesses, opportunities and threats that externally (and internally) face Kashi Foods, additional risks and/or factors will be brought to light (Mulcahy, 2008). Kashi’s strengths include brand loyalty, access to large resources and it recognition as a market leader in nutritional foods. A crucial strength discovered in the internal analysis is how Kashi Foods and the Kellogg Company promote diversity within its suppliers and employees (Kellogg Company, 2009). Weaknesses, on the other hand, center on high prices, abnormal distribution levels and potential competition. Opportunities it can exploit involve expanding distribution and allowing its strength in diversity to open new global communities for the companies. Threats Kashi Foods face come directly from competitors in the forms of rival products and lower prices, but these can be countered through brand loyalty. Furthermore, Kashi Foods can be threatened by supply issues including fluctuation of costs, high gasoline prices and impact of eco-friendly packaging delays. Porter’s Five Forces (Appendix B) was utilized to determine Kashi Foods’ positional strengths (Mindtools, 1995). The analysis of Porter’s Five Forces in Action will continue throughout this section. A comparison between the previous SWOT analysis and Porter’s Five Forces in Action shows a direct correlation between the two. Remote Environmental Factors Economic Factors The greatest economic factors facing Kashi Foods deal with the cost of raw materials to produce organic products, delivery of finished goods June 21, 2009: CONFIDENTIAL Porter’s Five Forces in Action 4 Support Activities There are number of secondary activities that Kashi Foods and the Kellogg Company benefit from, as is typical in organizations of this size. These include general administration, human resource management, research and technology and procurement. Sa Ex m ce ple rp t Human resources are a specific value to Kashi Foods in the terms that its employees promote the products by their own use. The Kellogg Company goes even further by recruiting diverse candidates to further their employee communities (Kellogg Company, 2009). Citing the Kellogg Company’s corporate website (2009), the organization writes: People make all the difference, and Kellogg employees around the world really are our single most important competitive advantage. Our goal is to provide an environment in which each of our employees can succeed. This requires constant diligence and the evolution of our developmental process. As Mr. Kellogg recognized a century ago, the success of our company is dependent on the success of our employees. Financial Statement Analysis of Kashi Foods Utilizing data from the Kellogg Company’s 2006, 2007 and 2008 annual shareholder reports available at its corporate website, an analysis was conducted to indicate the health and vitality of the companies as compared to the packaged food industry as a whole. When available, industry averages were derived from CNBC’s Real Market Quotes (2009) available online to the public. A three-year ratio analysis was conducted for the specified years of 2006, 2007 and 2008. It was based on four financial groups of profitability, liquidity, leverage and activity. The table below presents the final data of the financial analysis. To afford a concise document, all input data (raw numbers) is located within Appendix C. What follows is a summation of crucial output data that will help formulate the strategic recommendation and following implementation. June 21, 2009: CONFIDENTIAL Kashi Foods’ financial data is woven within Kellogg’s, so all financial statistics are derived from the parent company. According to Pearce and Robinson’s Strategic Management (2009), a financial analysis measures a company’s performance over a span of several years in comparison with its industry. 1 0 Ratios 2006 2007 2008 Profitability Return on Sales Ratio 0.092 0.094 0.090 -- Return on Shareholders’ Equity 0.49 0.44 0.79 0.01 Earnings per Share $2.53 $2.79 $3.01 $2.56 Sa Ex m ce ple rp t Financial Group 2007 Industry Average (Median) Liquidity Leverage Activity Dividends per Share $1.14 $1.20 $1.30 $1.00 Current Ratio 0.60 0.67 0.71 1.20 Quick Ratio 0.40 0.44 0.46 -- Debt to Assets 1.00 1.00 1.00 -- LT Debt to Equity 3.24 2.91 5.11 0.79 Accounts Receivable Turnover 11.54 11.65 11.22 1.12 Average Collection Period 31.18 30.91 32.09 -- Profitability The following is a summation of the profitability ratios presented in the financial analysis table above: Dividends per Share indicates the Kellogg Company has consistently achieved higher-than industry average returns for its shareholders. With the industry average at approximately $1.00 a share, Kellogg’s offered shareholders a dividend per share of $1.30 (CNBC, 2009). Earnings per Share (how much profit was made on each stock) shows that in the last two years, Kellogg’s has again exceeded industry averages. Return on Sales Ratio, calculated by dividing net earnings by sales, indicates a consistent profitability of per dollar amount averaging around 0.09. June 21, 2009: CONFIDENTIAL Profitability data is a quick snapshot of effective (or ineffective) policies and decisions envisioned at the strategic level and put into place at the tactical level by an organization's management (Pearce and Robinson, 2009). 1 1 $1,148,000. This data, combined with the profitability ratios of dividends per share and return on shareholders’ equity indicate the Kellogg Company provides higher-than-normal returns for investors while remaining profitable. Sa Ex m ce ple rp t Although the Kellogg Company extends credit to wholesalers that wish to market its products, the quick collection period and turnover seems to indicate credit accounts are paid quickly. The Kellogg Company seems to have lessened the amount of risk associated with extending credit to wholesalers and distributors. However, given the current economic crisis with retail markets, this positive can quickly become a liability. According to the 2008 letter to shareholders, Kellogg’s has reinvested $0.14 of earnings per share for “up-front costs of savings initiatives” (Kellogg Company, 2009). Although in 2007 and 2008, the company continued to expand, it anticipates by 2011 an annual costsavings of $1 billion (Kellogg Company, 2009). Part Two: Competitive Analysis The competitive analysis will focus on a qualitative and quantitative comparison of both companies. From the qualitative side, a comparison of the recent letters to shareholders will be examined. Financial data is analyzed in a side-by-side comparison for the quantitative examination. General Mills faces many of the internal and external factors found in the Kellogg’s analysis, specifically market conditions, distribution costs, raw material challenges and human resource values. What follows is a brief analysis of the areas that largely reflect the main differences and similarities with the strategic direction of both companies. Qualitative Analysis The letters to shareholders offer a nearly identical strategy of marginal growth, sustainable profits, moderate expansion and introduction of cost-saving measures for both the Kellogg Company and General Mills. For General Mills, 2008 saw an increase of net sales by June 21, 2009: CONFIDENTIAL The purpose of this analysis is to compare Kashi Foods’ parent company, the Kellogg Company, with its largest rival, General Mills. According to Pearce and Robinson (2009), successful strategic surveillance of General Mills provides broad-based vigilance that can help shape Kellogg’s and Kashi’s strategy. 1 4 Summary of Competitive Analysis In conclusion, both companies align themselves with their mission statements (and visions). Narrative elements within the letters to shareholders and examination of financial analysis ratios confirm that the companies are strategically aligned with is market and customer base while fulfilling core missions. Sa Ex m ce ple rp t However, from a financial analysis, General Mills has clearly outperformed the Kellogg Company. Kellogg’s boasts a sound philosophy of “manage by cash” in order to drive sustainable growth and prevent overextension into global markets. It has greatly reduced shareholder equity than its chief competitor, General Mills—approximately 3 to 1. From a shareholder perspective, General Mill’s increased dividends per share are more or less the reason to select its stock. From a longterm growth strategy, Kellogg’s may be the better bet since its sustainable growth strategy is slow and methodical to avoid uncertain market disruptions, if current economic conditions do not impact it. Pearce and Robinson (2009) describe long term objectives as obtaining success in seven areas that include profitability, productivity, competitive position, employee development, employee relations, technological leadership and public responsibility. The Kellogg Company and Kashi Foods have achieved incredible results within all seven areas, as already stated within this document. Therefore, what follows is blend of generic strategies -- core philosophies to best compete in a market – aimed at Kashi Foods and grand strategies -- a master plan that provides a strategic action to achieve business objectives – directed toward its parent company Kellogg’s (Pearce and Robinson, 2009). June 21, 2009: CONFIDENTIAL Part Three: Strategic Formulation 1 7