Carolina Journal - Volume 22, Number 6

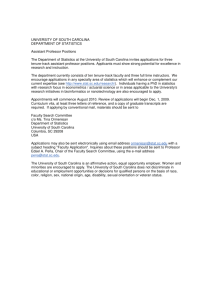

advertisement