660.303.01 - Johns Hopkins University

advertisement

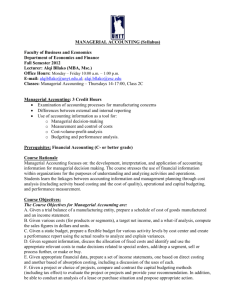

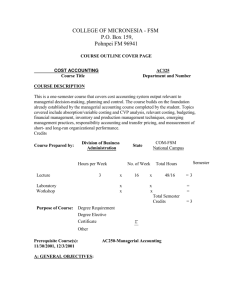

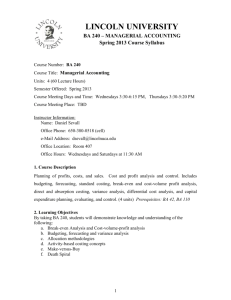

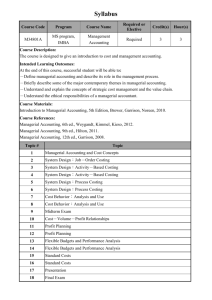

JOHNS HOPKINS UNIVERSITY CENTER FOR LEADERSHIP EDUCATION THE WILLIAM P. CAREY PROGRAM IN ENTREPRENEURSHIP AND MANAGEMENT MANAGERIAL ACCOUNTING, 660.303.01, SPRING 2015 TTH 10:30-11:45am Hodson 211 INSTRUCTOR: Annette Leps, CPA, MBA Center for Leadership Education Rm. 102, Whitehead Hall, x 7113 Email: aleps@jhu.edu Office Hours: MON 10:30 to 11:30AM TUES 1:30 to 2:30 PM WED 10:30 to 11:30AM & by appointment COURSE ASST: Simon Osipov (sosipov1@jhu.edu) Office Hours: TBA COURSE DESCRIPTION: This course introduces management accounting concepts and objectives including planning, control, and the analysis of sales, expenses, and profits. Major topics include cost behavior, cost allocation, product costing (including activity based costing), standard costing and variance analysis, relevant costs, operational and capital budgeting, and performance measurement. REQUIRED TEXT: Brewer, Garrison, Noreen, Introduction to Managerial Accounting, 5th edition, 2010, McGrawHill/Irwin, ISBN 978-0-07-352707-9. COURSE OBJECTIVES: This course focuses on communication and decision making within an organization (as opposed to financial accounting, which focuses on accounting information for decision-makers external to the firm). The quality of communication is an important determinant of success for most organizations, and much of the communication of quantitative information relies on the language and tools of managerial accounting. The overall objective of the course is to provide you with the concepts and tools needed to understand, apply, and explain accounting information for managerial decisions. In particular, this course should: • Give students an understanding and appreciation of the role of the management accountant in the organization • Help students understand and apply concepts and tools of managerial accounting to business problems • Help students improve critical thinking skills by providing practice in addressing complex business problems • Help students improve communication skills STUDENT RESPONSIBILITIES & CLASS POLICIES: (1) This is a rigorous course. As such, class attendance is vital to the successful completion of this course. Students are expected to come to class having read the chapter material referenced. (2) Students are expected to take all examinations and to complete all assignments on the required dates. Conflicts or other issues must be brought to the attention of the instructor before the scheduled test time. Make-up exams may be arranged only at the discretion of the instructor and the Department. (3) Homework (HW) will not be collected. Problems are assigned for student self-study and solutions are posted to Blackboard. (4) Problem Sets (PS) are due at the beginning of class on the assigned date; late submissions will be subject to a minimum 10% grade reduction (no email submissions will be accepted without prior approval). These assignments will be done in groups; one submission required per group. All groups must work independently. Members of different groups are not allowed to discuss the case/problems or share answers prior to class discussion. You are responsible for ensuring that the work done by your group is done independent of all other groups. Violators will earn a zero for the assignment (this refers to both group members). Questions related to Problem Sets will be distributed in class; solutions must be no longer than four typed pages (excluding exhibits and tables). Handwritten solutions will not be accepted; EXCEL must be used for problems and must layout on the printed page in an easy-to-read format. (5) This course is on Blackboard. The site will be used to deliver homework solutions, special instructional information, course announcements, and other items of student interest. Please monitor the course site regularly. Individual grades will be posted on Blackboard and any discrepancies must be brought to the attention of the CA for resolution before April 30, 2015. (6) It is the responsibility of the student to obtain notes and assignments from colleagues for any classes that were missed. (7) This course involves the use of certain mathematical formulas and functions which are preprogrammed into such business calculators as the HP 10B, 12C, and 17B and the TI BA 35, BA II Plus, etc. Use of these calculators for solving homework and test problems is allowed. However, please note that students are not expected to purchase one of these calculators for this course and there will be no instruction provided in their use. All subject material involving the time value of money can be solved using EXCEL (8) No Senior Options will be offered. Ethics The strength of the university depends on academic and personal integrity. In this course, you must be honest and truthful. Ethical violations include cheating on exams, plagiarism, reuse of assignments, improper use of the Internet and electronic devices, unauthorized collaboration, alteration of graded assignments, forgery and falsification, lying, facilitating academic dishonesty, and unfair competition. Report any violations you witness to the instructor. You can find more information about university misconduct policies on the web at these sites: • For undergraduates: http://e-catalog.jhu.edu/undergrad-students/student-life-policies/ • For graduate students: http://e-catalog.jhu.edu/grad-students/graduate-specific-policies/ Students with Disabilities Any student with a disability who may need accommodations in this class must obtain an accommodation letter from Student Disability Services, 385 Garland, (410) 516-4720, studentdisabilityservices@jhu.edu . ABET OUTCOMES · Ability to communicate effectively. · Recognition of the need for and an ability to engage in life-long learning · contemporary issues . An ability to function on multi-disciplinary teams EVALUATIONS: A 90-100 B 80-89 C 70-79 D 60-69 F Below 60 Pluses and minuses will be used at the discretion of the instructor. GRADING: Test 1 Test 2 Problem Sets Capital Budgeting Test Final Exam Total 20% 20% 35% 5% 20% 100% Knowledge of The Instructor reserves the right to change topics and assignments as needed depending upon class progress. JOHNS HOPKINS UNIVERSITY MANAGERIAL ACCOUNTING Date 1/27 1/29 Subject Managerial Accounting and Cost Concepts Managerial Accounting and Cost Concepts Ch. 1 1 HW: 1-10, 11, 13, 19, 21 HW: 13-3, 13-4, 13-8A PS#1: Cash Flow Stmt 2/3 2/5 Cash Flow Statement Cash Flow Statements/Systems Design: Job Order Costing 13 13, 2 2/10 Systems Design: Job Order Costing Systems Design: Job Order and Activity-Based Costing 2 2/12 2/17 2/19 2/24 2/26 3/3 Homework(HW) /Problem Sets(PS) HW: 2-11, 12, 15, 16, 17, 23 2/3 PS #2: Job Order Costing Exercise Systems Design: Activity-Based Costing Cost Behavior: Analysis and Use 3 HW: 3-6, 8, 10, 14, 16 PS #3: Destin Brass Products Co. Cost Behavior; Cost-VolumeProfit Cost-Volume-Profit Relationships 5/6 5 6 HW: 5-6*, 7, 8, 12, 13, 14* (* use linear regression) HW: 6-12, 17, 19, 22, 26 PS #4-Break Even 3/5 TEST #1 (chapters 1, 2, 3, 5,6 and 13) Profit Planning 7 Laptops to class 3/10 Profit Planning/Flexible Budgets 7 3/12 Flexible Budgets and Performance Analysis Laptops to class HW: 7-13, 14 HW: 8-8, 9, 10, 11, 12, 23, 24 PS: #5 Master Budget 3/17 and 3/19 7/8 SPRING BREAK 3/24 3/26 Standard Costs Standard Costs 3/31 Standard Costs/Decentralization 8/9 9 9/10 HW: 9-1, 7, 9 HW: 10-5, 8, 17, 20 4/2 4/7 4/9 Decentralization/Relevant Costs for Decision Making Relevant Costs for Decision Making Relevant Costs for Decision Making 10/11 11 PS #6: Variance Analysis HW: 11-4, 5, 6, 7, 8 11 4/14 4/16 Test #2 (chapters 7, 8 ,9, 10 &11) Capital Budgeting 12 4/21 4/23 Capital Budgeting Financial Statement Analysis 12 14 HW: 12-5, 8, 10, 15, 18, 22 PS #7: Capital Budgeting Case Study PS#8: IBC #1-3 4/28 4/30 Financial Statement Analysis Capital Budgeting Test 14 PS #8 (cont.): IBC #4-6 TBA CUMULATIVE FINAL EXAM IBC #7-individual work (part of final exam)