MVNO - A new Horizon for Saudi

Telecom Sector

May 2014

Please read Disclaimer on the back

MVNO (Mobile Virtual Network Operators)

The all new headline story in the Saudi Telecom industry is the introduction of MVNO’s (Mobile Virtual network Operators).

Two new MVNOs (Jawraa Lebara, Virgin Mobile) are all set to enter the market during the year. The third MVNO Axiom

telecom was also supposed to enter the market on Zain’s network, however due to failure in submission of mandatory

documents, the authorities (Communication and Information Technology Commission) have not approved their license. In

this paper we look at the general idea behind an MVNO, and the impact they will have on the current landscape of Saudi

telecom market.

The first question that arises for us is:

“What is an MVNO?”

A Mobile Virtual Network Operator or in short an MVNO, is a mobile service provider that does not have its own infrastructure,

but operates through existing networks of the existing players in the market. A MVNO purchases minutes at a wholesale

rate from the existing network operator and sells it at a retail rate under its banner.

Simply putting it an MVNO is a reseller of an MNO (Mobile Network Operator). An MVNO is actually a customer of an MNO

rather than a competitor. An MVNO can typically set its own pricing following agreed-upon rates with its contracted MNO.

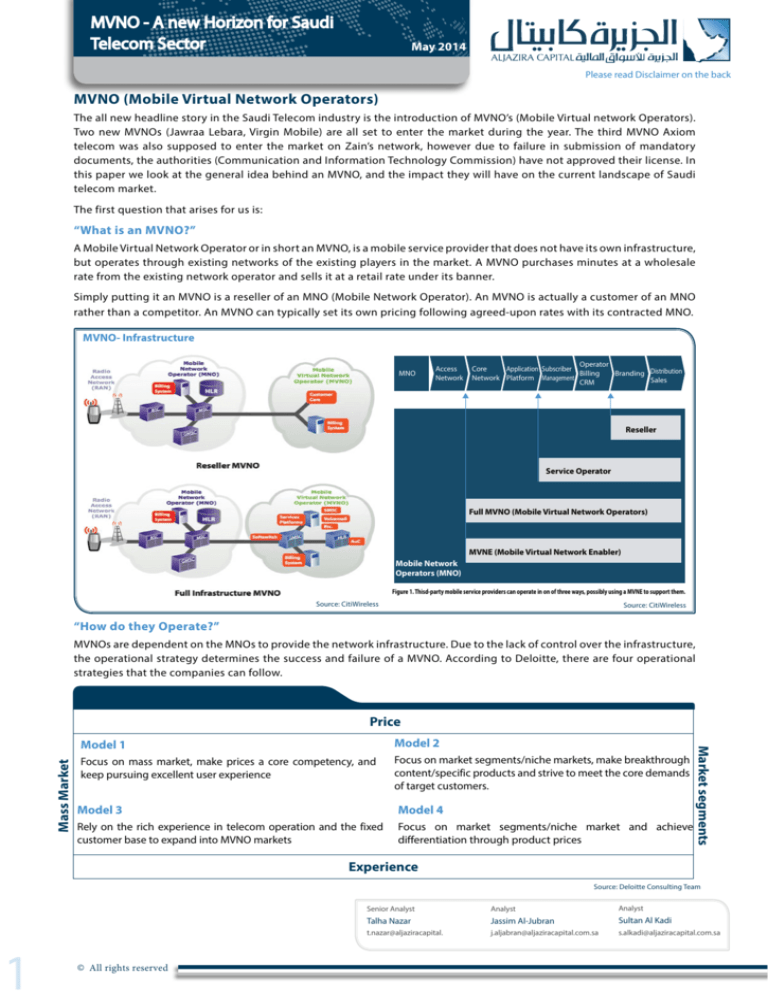

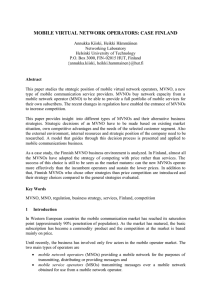

MVNO- Infrastructure

MNO

Access

Network

Operator

Core

Application Subscriber

Billing

Branding Distribution

Network Platform Management

Sales

CRM

Reseller

Service Operator

Full MVNO (Mobile Virtual Network Operators)

MVNE (Mobile Virtual Network Enabler)

Mobile Network

Operators (MNO)

Figure 1. Thisd-party mobile service providers can operate in on of three ways, possibly using a MVNE to support them.

Source: CitiWireless

Source: CitiWireless

“How do they Operate?”

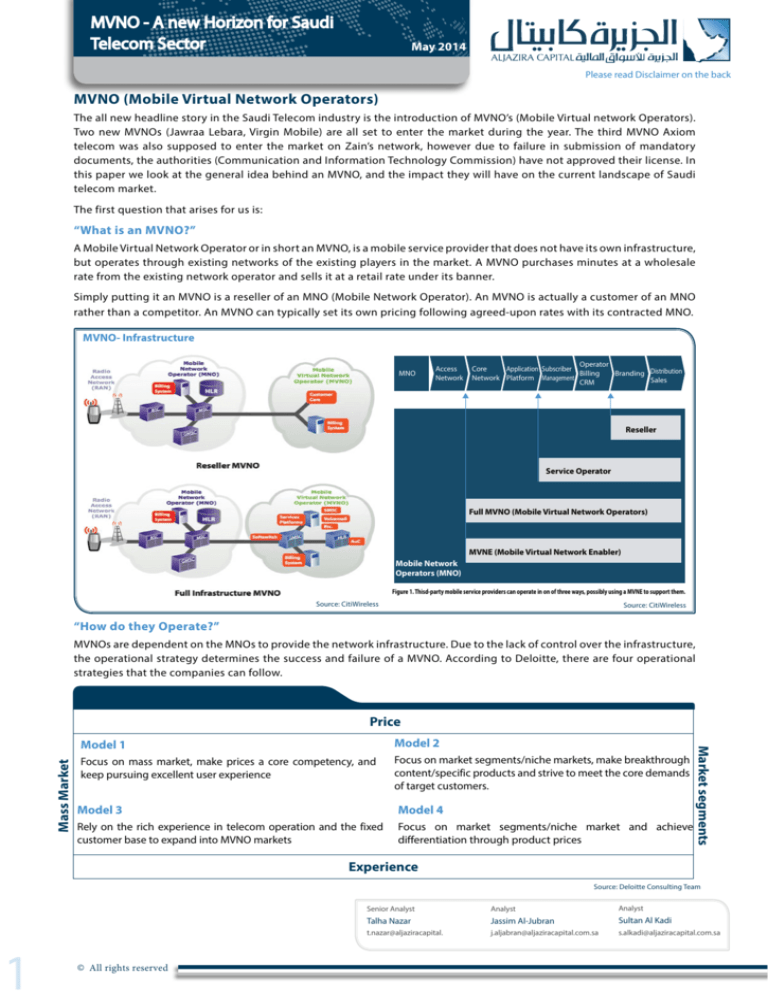

MVNOs are dependent on the MNOs to provide the network infrastructure. Due to the lack of control over the infrastructure,

the operational strategy determines the success and failure of a MVNO. According to Deloitte, there are four operational

strategies that the companies can follow.

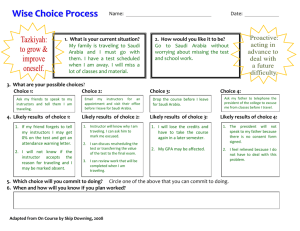

Model 1

Model 2

Focus on mass market, make prices a core competency, and

keep pursuing excellent user experience

Focus on market segments/niche markets, make breakthrough

content/specific products and strive to meet the core demands

of target customers.

Model 3

Model 4

Rely on the rich experience in telecom operation and the fixed

customer base to expand into MVNO markets

Focus on market segments/niche market and achieve

differentiation through product prices

Market segments

Mass Market

Price

Experience

Source: Deloitte Consulting Team

1

© All rights reserved

Senior Analyst

Analyst

Analyst

Talha Nazar

Jassim Al-Jubran

Sultan Al Kadi

t.nazar@aljaziracapital.

j.aljabran@aljaziracapital.com.sa

s.alkadi@aljaziracapital.com.sa

MVNO - A new Horizon for Saudi

Telecom Sector

May 2014

Please read Disclaimer on the back

Global Dynamics

There are more than 1200 MVNOs all across the globe, out of which the highest concentration is seen in the European

region, followed by Asia Pacific. In the Western and North American region, the most developed in terms of MVNOs, the

market share has reached almost 10%, which is much higher than the global average which is around the 3%- 4% mark.

Historical Market Share

MVNO as Percent of All Wireless Subscribers

MVNO’s regional distribution

North America 43 Asia Pacific 9

CIS/EU 61

Latin America 197

Middle East & Africa 174

Europe 723

10%

9%

8%

MVNO Share of Wireless Market, 2003-2013

7%

6%

5%

4%

3%

2%

1%

0%

2003 2004

2005 2006 2007

Deloitte

GCC MVNOs

The only country in the GCC with a proper penetration of

and Renna Mobile, appear to have gained any traction in the

market. The penetration level in 2012 for MVNOs dropped

to 10.7% from 12.4% in 2011, primarily due to the closure of

one of the MVNO. Total subscriber base in 2012 for MVNOs in

Oman stood at 575,193 customers. Jordan also issued a MVNO

100.0%

10.0%

12.4%

10.9%

46.9%

46.9%

43.7%

40.2%

40.7%

53.1%

47.1%

46.3%

47.4%

48.4%

2011

MVNO

2012

80.0%

70.0%

60.0%

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

2008

2009

Oman Mobile

2010

Nawras

Source: Telecommunication Regulatory Authority

any further step were not taken in the region until Saudi Arabia issued 3 new licenses in 2013.

2

2013

6.0%

90.0%

license which was taken up by Fendi Group in 2010. However

© All rights reserved

2012

Global Average

Oman Market Share of MVNO

Market Share

that they were to become MVNOs. Although only two, Friendi

2009 2010 2011

Source: Telegeography, Mobile-virtual-network

MVNOs is Oman. The Omani telecommunication authority

TRA awarded five Class II licenses in 2008 with the stipulation

2008

Rest of World

W.Europe and America

MVNO - A new Horizon for Saudi

Telecom Sector

May 2014

Please read Disclaimer on the back

TMVNO strategy- A Saudi Perspective

The three MVNO Operators that are looking to setup shop in Saudi Arabia are Jawraa Lebara, Virgin Mobile, and Axion

Telecom. For us to understand their strategy , it is mandatory for us to look at their past strategies to gain traction in the

respective markets.

Jawaraa Lebara

Lebara’s business model can be described as a low-cost international mobile service. The company provides Pay-As -You -Go

(Prepaid) SIM cards , targeting the international community and expatriate workers in the country. The company’s operation

are limited to the western European region and Australia, providing its services to countries like Denmark, France, Netherlands,

Germany, Norway, Spain Switzerland and the United Kingdom.

Given the company’s strategy, Lebara fits into the model four presented in the matrix on the first page. Where the company

looks to target a particular segment with competitive pricing.

Saudi perspective...

Lebara is launching its services in Saudi Arabia through the network of Etihad Etisalat Company (Mobily). Saudi Arabia has

the fourth largest expatriate population of 9.2 mn1 in the world, out of which 86% are earning below SAR 2000/month2,

pricing of the packages play a major role for such individuals. Lebara we believe will take advantage of such statistics, as its

business strategy fit perfectly into the demographics of the kingdom.

How it impacts Mobily and the telecom market?!?

We believe the introduction of Lebara will act as an extension to Mobily’s strategy. As Mobily’s penetration in expatriate

population is high, due to the company’s efforts to increase its penetration in the market. However for Zain, which has relied

heavily on cheap call rates in order to attract budget subscribers, will find it difficult to compete with Lebara, due to the

solid infrastructure of Mobily supporting the company.

However, how Lebara will impact STC will be a bit tricky to understand, as STC does have a an expatriate customer base,

which can mean a tough competition for STC.

SWOT ANALYSIS- of the MVNO (Lebara and Mobily)

Strengths

Weaknesses

• Lebara will have access to Mobily strong infrastructure.

• Lack of control over the network infrastructure,

• For Mobily this will mean additional revenue source.

• The calling rates in Saudi Arabia are controlled by the authority,

• Lebara has strong MVNO experience.

Opportunities

• An opportunity for Mobily to increase its customer base.

• A strong expatriate population.

which leaves little room for competing on calling rates

Threats

• Competition from other operator as Virgin and Axiom telecom

is also looking to enter the market.

• Dilution of the calling rates, however the rate are controlled

by the authority.

• High Mobile Penetration of 170% 3

1http://www.arabnews.com/news/464809

2 http://www.arabnews.com/news/467423

3 www.citc.com.sa

3

© All rights reserved

MVNO - A new Horizon for Saudi

Telecom Sector

May 2014

Please read Disclaimer on the back

Virgin Mobile

Virgin Mobile is one of the leading MVNO’s in the world. Virgin Mobile branded communication service is currently available

in Australia, Canada, Chile, Columbia, France, India, Poland, South Africa, Mexico, United Kingdom and USA.

Virgin target market is the youth, broadly defined as individuals between the ages of fifteen to thirty years. The strategy of

the company is to target this market and retain its customer base through cheap pricing and a content rich environment,

something that today’s youth demand. In our view the company’s strategy fits into Model one of the Matrix.

Saudi perspective...

Saudi Arabia has a large youth population as almost 50%4 of its population is below twenty five years, which fits beautifully

into Virgins strategy. We believe due to the highly saturated market, the company will find it difficult to attract subscriber

base. However given the low market share of MVNOs, Virgin mobiles will find a sweet spot in this content hungry youth

population, to extend its business, and consolidate its position in the Saudi market.

How it impacts STC and the telecom market?

Virgin mobile is looking to enter the Saudi market on the platform of STC’s (Saudi Telecom Company) network. The company

like all other MVNOs will buy minutes in bulk from STC and resell under their banner. STC on the other hand will have

the opportunity to increase its customer base and find further penetration in the youth population. We believe with the

introduction of Virgin, the landscape of the telecom industry will see a shift since Virgins customer-centric strategy will shift

the market space and company might just be able to find space in a saturated market. As customer service has always been

a burning issue for the subscribers. If Virgin somehow is able change the customer service culture, it will create a major shift

in the industry, and benefit STC in expanding its customer base indirectly.

SWOT ANALYSIS- of the MVNO (Virgin Mobile and STC)

Strengths

Weaknesses

• Virgin mobile will have access to STC strong infrastructure.

• Lack of control over the network infrastructure.

• For STC this will mean additional revenue source.

• The calling rates in Saudi Arabia are controlled by the regulator,

• Virgin mobile has strong MVNO experience.

Opportunities

• An opportunity for STC to further consolidate its position in the

youth market.

• 50% of Saudi population is below the age of 25.

which leaves little room for competing on calling rates

Threats

• Competition from other operator as Lebara/Mobily

• Dilution of the calling rates, however the rate are controlled by

the authority.

• High Mobile Penetration.

4 Central Department of Statistics and Information

4

© All rights reserved

MVNO - A new Horizon for Saudi

Telecom Sector

May 2014

Please read Disclaimer on the back

Porter’s Five Forces Analysis

Porter’s five forces model provides a simple perspective for analyzing and assessing the competitive strength and position

of a corporation. The model can be used to analyze the industry context in which the firm operates. The Porter Five Forces

model is a simple yet an effective tool for understanding where the strength of the business lies.

Bargaining Power of Buyers

• Buyers concentration

Threat of New Entrants

• Dependency on distribution

• Barriers to Entry

• Brand Equity

• Economies of Product differences

Threat of New

Entrants

• Switching Cost

channels

• Buyer switching cost

• Information availability

• Force down prices

• Capital requirement

• Substitute products

• Absolute cost

• Price Sensitivity of Buyer

• Industry Profitability

• Differential advantage

Bargaining

Power of

Suppliers

Competitive

Rivalry

Bargaining Power of Suppliers

Threats of Substitutes

• Supplier switching cost relative to

• Buyer propensity to substitute

firm switching cost

• Relative Price Performance of

• Impact of inputs on cost or

differentiation

• Substitute inputs

• Strength of distribution channel

Bargaining

Power of Buyers

substitute

Threat of

Substitutes

• Supplier concentration

• Buyer switching cost

• Production differentiation

• Ease of substitution

• Substandard Products

• Quality Depreciation

Competitive Rivalry

• Sustainable competitive advantage

through innovation

• Competition between online and

offline companies

• Level of advertising expense

• Powerful competitive strategy

• Firm concentration ratio

5

© All rights reserved

MVNO - A new Horizon for Saudi

Telecom Sector

May 2014

Please read Disclaimer on the back

MVNO according to the Porters Five Forces Model

Threat of New Entrants: Medium to Low

• The telecommunication industry in Saudi Arabia is tightly controlled by the CITC (Communication and Information

Technology Commission). Therefore for any new player to come into the market it will need the ministries approval,

which could be a relatively long and bureaucratic process.

• In order to remain competitive, a MVNO has to have a minimum subscriber base to breakeven in this highly-penetrated

market (penetration levels are above 170%).

• Due to the high capital-intensive nature of the industry, new MNO will find it difficult to become competitive compared

to the existing players. However, MVNO’s can still penetrate the market as capital requirement is low.

Threats of Substitutes: Medium

• The threat of substitutes in our view for the telecom industry is medium, as there are other services in Saudi Arabia that

can provide voice and data services, albeit indirectly.

• Although Application such as Whats app and Skype can be treated a substitutes for voice and data, however usage

of these services are entirely dependent on data availability which in turn means a revenue opportunity for telecom

operators.

Bargaining Power of Customers: High

• As more telecom operators enter the market be it an MNO or an MVNO, the bargaining power of the local customers’

increases along, especially since basic call and data service are treated as commodities. Given the uniformity of services,

the customer tends to look for cheaper price options.

• For MVNOs to remain competitive, they need to retain high-quality customer service and competitive pricing policies,

which will always be a challenge to their margins.

Bargaining Power of Suppliers: High

• For MVNOs, supply side is controlled by the MNO, meaning MVNOs have very little control over the network and the

pricing of the minutes.

• The whole sale rates for the minutes and data are decided by the MNO.

• In time of peak hours, the MNO’s can allocate high bandwidth to its own network which can result in weak reception

for MVNO clients.

• Talented human capital in MVNO field are scarce in Saudi Arabia, which give them negotiation power.

Rivalry among Competitors: High

• With high penetration levels (+170%) in the telecom industry, the competition amongst its players is very intense.

• For the company to attract customers, they have to offer cheap attractive bundles, which can result in lower ARPU

(Average Revenue per Unit).

Conclusion

Based on the above information and our analysis of the sector, we believe that MVNOs will face a challenging environment

to succeed in the competitive Saudi telecom market. However, saying that, we do not intend to downplay the role that

MVNOs in the kingdom. For an MVNO to be successful in Saudi Arabia, its focus should be on filling the gaps such as

customer service, enhanced data bundling, and innovative solutions to niche groups of society. The Saudi market is

currently controlled by two major players, STC and Mobily. If the integration between the MVNO and MNO is smooth,

we believe MNO can treat the MVNO as an extension of its services, which will give it greater leverage to compete in

the market. The other scenario is for an MVNO to become a replacement of MNO, which will create cultural clash and

eventually could collapse the agreement between the two parties.

At the micro level, we believe Mobily’s alliance with Lebara will give the earlier an opportunity to consolidate its position

among the expatriate population in Saudi Arabia, given that the 86% of expat population is earning below SAR 2000/

month , for whom competitive calling rates is essential. However, what remains to be seen is how the CITC will go about

the calling rates.

On the other hand, the alliance of STC and Virgin mobiles is equally interesting. Our analysis shows that Virgin and STC

could build a successful partnership if Virgin fill the gap for STC in terms of attracting more youth and expatriates to their

customer base. Furthermore, STC could benefit significantly from Virgin’s experience in enhancing their customer services.

Virgin would provide these synergies to STC while benefiting from the wide access and large customer base of STC to

manage their profitability margins.

Zain is expected to suffer from the above developments, as its MVNO license is still facing headwinds with the regulator.

6

© All rights reserved

RESEARCH DIVISION

BROKERAGE AND INVESTMENT

CENTERS DIVISION

RESEARCH

DIVISION

Senior Analyst

Analyst

Abdullah Alawi

Syed Taimure Akhtar

Sultan Al Kadi

+966 11 2256250

a.alawi@aljaziracapital.com.sa

+966 12 6618271

s.akhtar@aljaziracapital.com.sa

+966 12 6618370

s.alkadi@aljaziracapital.com.sa

Senior Analyst

Analyst

Analyst

Talha Nazar

Saleh Al-Quati

Jassim Al-Jubran

+966 12 6618603

t.nazar@aljaziracapital.com.sa

+966 12 6618253

s.alquati@aljaziracapital.com.sa

+966 11 2256248

j.aljabran@aljaziracapital.com.sa

General manager - brokerage services and sales

AGM-Head of international and institutional

AGM- Head of Western and Southern Region Investment Centers & ADC

Ala’a Al-Yousef

brokerage

Brokerage

+966 11 2256000

a.yousef@aljaziracapital.com.sa

Luay Jawad Al-Motawa

Abdullah Q. Al-Misbani

+966 11 2256277

lalmutawa@aljaziracapital.com.sa

+966 12 6618400

a.almisbahi@aljaziracapital.com.sa

AGM-Head of Sales And Investment Centers

AGM-Head of Qassim & Eastern Province

AGM - Head of Institutional Brokerage

Central Region

Abdullah Al-Rahit

Samer Al- Joauni

Sultan Ibrahim AL-Mutawa

+966 16 3617547

aalrahit@aljaziracapital.com.sa

+966 1 225 6352

s.alJoauni@aljaziracapital.com.sa

+966 11 2256364

s.almutawa@aljaziracapital.com.sa

AlJazira Capital, the investment arm of Bank AlJazira, is a Shariaa Compliant Saudi Closed Joint Stock company and

operating under the regulatory supervision of the Capital Market Authority. AlJazira Capital is licensed to conduct

securities business in all securities business as authorized by CMA, including dealing, managing, arranging, advisory,

and custody. AlJazira Capital is the continuation of a long success story in the Saudi Tadawul market, having occupied

the market leadership position for several years. With an objective to maintain its market leadership position, AlJazira

Capital is expanding its brokerage capabilities to offer further value-added services, brokerage across MENA and

International markets, as well as offering a full suite of securities business.

1.

RATING

TERMINOLOGY

AGM - Head of Research

2.

3.

4.

Overweight: This rating implies that the stock is currently trading at a discount to its 12 months price target.

Stocks rated “Overweight” will typically provide an upside potential of over 10% from the current price levels

over next twelve months.

Underweight: This rating implies that the stock is currently trading at a premium to its 12 months price target.

Stocks rated “Underweight” would typically decline by over 10% from the current price levels over next twelve

months.

Neutral: The rating implies that the stock is trading in the proximate range of its 12 months price target. Stocks

rated “Neutral” is expected to stagnate within +/- 10% range from the current price levels over next twelve

months.

Suspension of rating or rating on hold (SR/RH): This basically implies suspension of a rating pending further

analysis of a material change in the fundamentals of the company.

Disclaimer

The purpose of producing this report is to present a general view on the company/economic sector/economic subject under research, and not to recommend a buy/sell/hold for

any security or any other assets. Based on that, this report does not take into consideration the specific financial position of every investor and/or his/her risk appetite in relation

to investing in the security or any other assets, and hence, may not be suitable for all clients depending on their financial position and their ability and willingness to undertake

risks. It is advised that every potential investor seek professional advice from several sources concerning investment decision and should study the impact of such decisions on

his/her financial/legal/tax position and other concerns before getting into such investments or liquidate them partially or fully. The market of stocks, bonds, macroeconomic or

microeconomic variables are of a volatile nature and could witness sudden changes without any prior warning, therefore, the investor in securities or other assets might face

some unexpected risks and fluctuations. All the information, views and expectations and fair values or target prices contained in this report have been compiled or arrived at by

Aljazira Capital from sources believed to be reliable, but Aljazira Capital has not independently verified the contents obtained from these sources and such information may be

condensed or incomplete. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on the fairness, accuracy, completeness

or correctness of the information and opinions contained in this report. Aljazira Capital shall not be liable for any loss as that may arise from the use of this report or its contents or

otherwise arising in connection therewith. The past performance of any investment is not an indicator of future performance. Any financial projections, fair value estimates or price

targets and statements regarding future prospects contained in this document may not be realized. The value of the security or any other assets or the return from them might

increase or decrease. Any change in currency rates may have a positive or negative impact on the value/return on the stock or securities mentioned in the report. The investor might

get an amount less than the amount invested in some cases. Some stocks or securities maybe, by nature, of low volume/trades or may become like that unexpectedly in special

circumstances and this might increase the risk on the investor. Some fees might be levied on some investments in securities. This report has been written by professional employees

in Aljazira Capital, and they undertake that neither them, nor their wives or children hold positions directly in any listed shares or securities contained in this report during the

time of publication of this report, however, The authors and/or their wives/children of this document may own securities in funds open to the public that invest in the securities

mentioned in this document as part of a diversified portfolio over which they have no discretion. This report has been produced independently and separately by the Research

Division at Aljazira Capital and no party (in-house or outside) who might have interest whether direct or indirect have seen the contents of this report before its publishing, except

for those whom corporate positions allow them to do so, and/or third-party persons/institutions who signed a non-disclosure agreement with Aljazira Capital. Funds managed by

Aljazira Capital and its subsidiaries for third parties may own the securities that are the subject of this document. Aljazira Capital or its subsidiaries may own securities in one or more

of the aforementioned companies, and/or indirectly through funds managed by third parties. The Investment Banking division of Aljazira Capital maybe in the process of soliciting

or executing fee earning mandates for companies that is either the subject of this document or is mentioned in this document. One or more of Aljazira Capital board members or

executive managers could be also a board member or member of the executive management at the company or companies mentioned in this report, or their associated companies.

No part of this report may be reproduced whether inside or outside the Kingdom of Saudi Arabia without the written permission of Aljazira Capital. Persons who receive this report

should make themselves aware, of and adhere to, any such restrictions. By accepting this report, the recipient agrees to be bound by the foregoing limitations.

Asset Management | Brokerage | Corporate Finance | Custody | Advisory

Head Office: Madinah Road, Mosadia، P.O. Box: 6277, Jeddah 21442, Saudi Arabia، Tel: 02 6692669 - Fax: 02 669 7761

Aljazira Capital is a Saudi Investment Company licensed by the Capital Market Authority (CMA), license No. 07076-37