GLEN Half Year Report 2014 Presentation

H1 2014 results

London, 20 August 2014

Basis of preparation and disclaimer

Basis of preparation

The reported financial information has been prepared on the basis as outlined in note 2 of the interim financial statements. The unaudited and unreviewed pro forma financial information for 2013 and where otherwise noted has been prepared as if the acquisition of Xstrata plc and full consolidation of such had taken place as of 1 January 2013 to illustrate the effects of the acquisition on the profit from continuing operations and cash flow statement for the six month period ended June 2013.

The unaudited and unreviewed pro forma financial information has been prepared in a manner consistent with the accounting policies applicable for periods ending on or after 1 January

2013 as outlined in note 2 of the financial statements with the exception of the accounting treatment applied to certain associates and joint ventures for which Glencore’s attributable share of revenues and expenses are presented (see note 3) and reflects the final fair value adjustments arising from the acquisition of Xstrata on 2 May 2013 as if the acquisition of

Xstrata plc and full consolidation of such had taken place as of 1 January 2013. These adjustments primarily relate to depreciation, amortisation and the unwind of onerous and unfavourable contract provisions. The pro forma financial information has been prepared for illustrative purposes only and, because of its nature, addresses a hypothetical situation and therefore does not reflect the Group’s actual financial position or results.

A reconciliation of the pro forma results to the reported results for the six months ended 30 June 2013 is included in the Appendix on page 73 of the 2014 Half-Year Report.

The reported and pro forma financial information is presented in the Financial Review section before significant items unless otherwise stated to provide an enhanced understanding and comparative basis of the underlying financial performance. Significant items (refer to page 6 of the 2014 Half-Year Report) are items of income and expense which, due to their financial impact and nature or the expected infrequency of the events giving rise to them, are separated for internal reporting and analysis of Glencore’s results.

Forward looking statements

This document contains statements that are, or may be deemed to be, “forward looking statements” which are prospective in nature. These forward looking statements may be identified by the use of forward looking terminology, or the negative thereof such as "plans", "expects" or "does not expect", "is expected", "continues", "assumes", "is subject to", "budget",

"scheduled", "estimates", "aims", "forecasts", "risks", "intends", "positioned", "predicts", "anticipates" or "does not anticipate", or "believes", or variations of such words or comparable terminology and phrases or statements that certain actions, events or results "may", "could", "should", “shall”, "would", "might" or "will" be taken, occur or be achieved. Such statements are qualified in their entirety by the inherent risks and uncertainties surrounding future expectations. Forward-looking statements are not based on historical facts, but rather on current predictions, expectations, beliefs, opinions, plans, objectives, goals, intentions and projections about future events, results of operations, prospects, financial condition and discussions of strategy.

By their nature, forward looking statements involve known and unknown risks and uncertainties, many of which are beyond Glencore’s control. Forward looking statements are not guarantees of future performance and may and often do differ materially from actual results. Important factors that could cause these uncertainties include, but are not limited to, those discussed under “Principal risks and uncertainties” of Glencore’s Annual Report 2013 and “Risks and uncertainties” in Glencore’s 2014 Half-Year Report.

Neither Glencore nor any of its associates or directors, officers or advisers, provides any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements in this document will actually occur. You are cautioned not to place undue reliance on these forward-looking statements which only speak as of the date of this document. Other than in accordance with its legal or regulatory obligations (including under the UK Listing Rules and the Disclosure and Transparency Rules of the Financial

Conduct Authority and the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited and the Listing Requirements of the Johannesburg Stock Exchange

Limited), Glencore is not under any obligation and Glencore and its affiliates expressly disclaim any intention, obligation or undertaking to update or revise any forward looking statements, whether as a result of new information, future events or otherwise. This document shall not, under any circumstances, create any implication that there has been no change in the business or affairs of Glencore since the date of this document or that the information contained herein is correct as at any time subsequent to its date.

No statement in this document is intended as a profit forecast or a profit estimate and no statement in this document should be interpreted to mean that earnings per Glencore share for the current or future financial years would necessarily match or exceed the historical published earnings per Glencore share.

This document does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for any securities. The making of this document does not constitute a recommendation regarding any securities.

2

Glendell Mine, Australia

Ivan Glasenberg

Chief Executive Officer

Attendees

Ivan Glasenberg CEO

Steven Kalmin CFO

Chris Mahoney Agricultural Products

Andrew Caplan Aluminium

Telis Mistakidis Copper

Tor Peterson Coal Marketing

Peter Freyberg Coal Industrial

Kenny Ives Nickel Marketing

Alex Beard

Daniel Maté

Oil

Zinc Marketing

4

H1 2014 – demonstrating confidence in our future

•

Strong financial performance in H1 2014

– marketing EBIT +27% y/y to $1.5bn

– industrial EBITDA +3% y/y to $4.8bn

– Net income +8% y/y to $2bn

– FFO +15% y/y to $4.9bn

•

Balance sheet robust with improving outlook

•

Capex declining towards maintenance levels

•

Underlying commodity supply/demand balances continue to tighten, especially in our markets

•

Numerous organic and other growth opportunities to pursue when appropriate

•

Our objective remains the efficient deployment of capital to grow earnings, cashflow and dividend per share

•

Capital return is/will remain a key element of this

– $1bn additional buy back and 11% dividend increase, on top of $639M of convertible bonds bought back during H1 2014

– $3.9bn total capital return actioned in 2014 or $29 cents per share

– since IPO Glencore capital return has exceeded IPO proceeds of $7.9bn

– capital structure will be constantly reviewed

5

SD/Governance

Safety remains our top priority

• All fatal incidents investigated and subsequently reviewed by the Board

• SafeWork in process of being rolled-out across the Group

• Expertise from well-performing divisions leveraged across the organisation

• 10 fatalities H1 2014

• Continued improvement in LTIFR: 3.0 (2009) to 1.88 (H1 2014)

• 74% of assets performing ahead of 2014 targets

Environment

• No serious environmental incident in H1 2014

• Mopani smelter upgrade completed in April 2014

Communities and stakeholder engagement

• Community programmes continue to focus on health, education and infrastructure

• Pro-active engagement with governments, communities and

NGOs

Policy setting and memberships

• ICMM membership received in April 2014 after independent expert review

• Membership of the Dow Jones Sustainability Index since 2013

• Signatory of the UN Global Compact since June 2014

• Endorsement and implementation of Voluntary Principles on

Security and Human Rights in March 2014 (admission pending)

LTIFR (1) 2009 to H1 2014

3.5

3.0

2.5

3.00

2.74

2.51

2.05

2.0

1.89 1.88

1.5

2009 2010 2011 2012 2013 H1

2014

Note: (1) Lost time incidents (LTIs) are recorded when an employee or contractor is unable to work following an incident. Glencore records LTIs which result in lost days from the next calendar day after the incident whilst Xstrata recorded LTIs which resulted in lost days from the next rostered day after the incident – therefore the combined LTI figure is not based on data of consistent definition. LTIFR is the total number of LTIs recorded per million working hours.

6

Harvester at Balaklava, Australia

Steven Kalmin

Chief Financial Officer

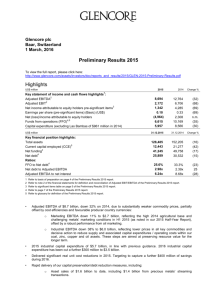

Financial highlights

US$M

Adjusted EBITDA

(2)

Adjusted EBIT

(2)

Net income attributable to equity holders pre-significant items

(3)

Funds from operations (FFO)

(4)

Capex (excluding Las Bambas)

EPS – basic ($/share)

Effective tax rate

H1 2014 H1 2013

6,464

3,624

2,010

4,909

4,027

0.15

27.2%

(1)

6,002

3,182

1,860

4,264

5,653

0.14

17.5%

% change

8

14

8

15

(29)

7

US$M

Net debt

(4)

FFO to Net debt

(4) (7)

Net debt to Adjusted EBITDA

(7)

Adjusted EBITDA to Net interest

(7)

Adjusted for Las

Bambas / Caracal

(5)

32,595

33.8%

2.41x

30.06.2014 31.12.2013

37,595

29.3%

2.78x

9.45x

(2)

35,798

29.0%

2.74x

9.12x

Notes:

(1) Refer to basis of preparation on page 4 of 2014 Half-year Report.

(2) Refer to Glossary (page 75) for definitions and reconciliation of Adjusted EBIT/EBITDA to note 3 of the interim financial statements.

(3) Refer to significant items table on page 6 of 2014 Half-year Report.

(4) Refer to Net debt and FFO tables on page 8 of 2014 Half-year Report.

(5) Net debt adjusted by $5 billion, including the effects, in July 2014, of the net proceeds received on sale of Las Bambas less the consideration paid for Caracal.

(6) Change %, calculated post $5 billion impact of the net consideration received on sale of Las Bambas less consideration paid for Caracal.

(7) H1 2014 ratio based on last 12 months’ FFO and Adjusted EBITDA and 2013 ratios based on pro forma results.

% change

(9)

(6)

17

(6)

(12)

(6)

4

8

Marketing H1 2014 financial performance

Adjusted EBIT H1 2013 vs H1 2014 (US$M)

Robust contribution from marketing. Adjusted

EBITDA and EBIT up 23% and 27% respectively over

H1 2013, reflecting supportive market conditions in many commodities and synergy benefits from Xstrata and

Viterra

1,600

1,400

+27%

1,512

1,200

1,186

1,000

800

600

400

200

0

H1 2013

Total

H1 2014

Metals & Minerals: higher volumes,

Xstrata synergies and generally favourable markets boosted EBIT by 25% to $888M

711

H1 2013

+25%

888

H1 2014

Metals & Minerals

Energy: decrease in EBIT reflects fewer trading opportunities and low volatility in oil pricing/curve structure

501

(55)%

227

H1 2013 H1 2014

Energy

Agriculture: strong contribution from

Viterra’s grain handling operations, following record crops in Canada and an above average crop in South Australia.

Comparable period performance was unusually weak

15

473

H1 2013 H1 2014

Agriculture

9

Industrial H1 2014 financial performance

Adjusted pro forma EBITDA/EBIT H1 2013 vs H1 2014 (US$M)

Strong industrial first half performance with higher copper, coal and oil volumes, cost reductions and favourable FX movements more than offsetting challenging pricing conditions for key commodities.

Adjusted EBITDA and EBIT up

3% and 6% respectively

Metals & Minerals:

EBITDA and EBIT

+11% and +26% respectively. Strong copper volumes

(+13%), improved ferroalloys results & higher nickel prices more than offset the impact of the mid-2013 zinc mine closures

Energy:

At EBITDA level the negative impact of weaker coal prices was substantially mitigated by higher low-cost coal volumes and weaker

AUD and ZAR. Oil

EBITDA up 45% to

$266M as a result of higher West Africa production volumes

4,800

4,680

+3%

4,840

3,800 +11%

3,512

2,800

EBITDA

3,153

1,800

800

-200

1,996

EBIT

+6%

2,112

H1 2013

Total

H1 2014

1,508

H1 2013

+26%

1,902

H1 2014

Metals & Minerals

(6)%

1,566

1,468

581

(32)%

394

H1 2013 H1 2014

Energy

Agriculture:

Significant improvement in earnings supported by

33% increase in processing/production

3

-35

73

35

H1 2013 H1 2014

Agriculture

10

Price weakness in key commodities more than offset by volume, cost efficiencies and favourable FX

Industrial pro forma adjusted EBIT pre-exceptional items – H1 2013 vs H1 2014 (US$M)

2,500

567 (44)

2,300 (136)

2,112

2,100

1,996 (980)

551 (262)

1,900

1,700

420 1,500

1,300

1,100

900

700

500

H1 2013

Adj. EBIT

Price Volume Net cost Inflation FX

Metals and minerals

Energy products

Agricultural products

D&A Other H1 2014

Adj. EBIT

11

Robust balance sheet

Key debt metrics (1)

US$bn

Net funding

Net debt (3)

FFO to Net debt

(3) (5)

Net debt to Adjusted

EBITDA

(2) (3) (5)

Adjusted EBITDA (2) to net interest

(5)

Weighted average funding cost (%)

4.5

4.0

3.5

3.0

30.6.2014

Adjusted (4)

49.4

32.6

33.8%

2.41x

30.6.2014 31.12.2013

54.4

37.6

29.3%

2.78x

9.45x

52.2

35.8

29.0%

2.74x

9.12x

• Robust liquidity position with $9.2bn of committed undrawn credit facilities and cash as of 30 June 2014 (pre Las Bambas)

• Strong cashflow coverage ratios:

(post Las Bambas)

• FFO to Net debt of 33.8%

• Net debt to Adjusted EBITDA of 2.41x

• 2014 debt activities

• April: issued $2bn and EUR1.1bn of bonds

• June: new $15.3bn committed RCF in three tranches

• June: repurchased and cancelled 25% of convertible bonds due December 2014

• Moody’s and S&P’s investment grade credit ratings at Baa2 (stable) and BBB (stable)

• Maintenance of strong Baa/BBB levels remains a financial target/priority

• Average VaR (1 day 95%) of $30M, representing less than 0.1% of shareholders’ equity ($30M in H1 2013)

2.5

2009 2010 2011 2012 2013 2014

Notes:

(1) Refer to basis of preparation on page 4. (2) Refer to glossary (page 75) for definitions and reconciliation of Adjusted EBIT/EBITDA to note 3 of the interim financial statements.

(3) Refer to net debt and FFO tables on page 8. (4) Net debt adjusted by $5 billion, including the effects, in July 2014, of the net proceeds received on sale of Las Bambas less the consideration paid for Caracal. (5) H1 2014 ratio based on last 12 months’ FFO and Adjusted EBITDA and 2013 ratios based on pro forma results.

12

Balance sheet further strengthened

• Operational free cashflow and declining capex, together with the Las Bambas proceeds have firmly consolidated Glencore’s credit metrics within the

BBB/Baa rating

• Strong BBB/Baa considered to be our optimal capital structure

• supports marketing activities – positively differentiated credit positioning from most trading competitors

• enables Glencore to efficiently grow cashflow, earnings and dividends per share

• provides abundant access to capital markets allowing efficient and prudent balance sheet and liquidity management

35%

30%

25%

BBB/Baa illustrative target metrics (1)

FFO/Adj. Net Debt (2)

45%

Adj. Net Debt (2) /EBITDA

1.75x

2.00x

$4.9bn funds from operations in

H1 2014, up $650M year on year

40%

BBB+/

Baa1

20%

BBB/

Baa2

BBB-

/Baa3

2.25x

2.50x

2.75x

3.00x

3.25x

33.8%

FFO to Net debt

Target: >25%

2.41x

Net debt to Adjusted

EBITDA

Target: <3x

Notes: (1) Estimated rating metrics based on Glencore’s calculation of Adjusted Net debt. (2) Net debt calculated as Net Funding less Readily Marketable Inventories, including net consideration of $5 billion from the Las Bambas disposal and the Caracal acquisition in July 2014. FFO and EBITDA are last 12 months.

13

$1.7 billion reduction in Industrial capex

Metals & Minerals: $2,697M (1)

4,000

3,500

-$800M

Energy products: $999M

4,000

Expansionary

Sustaining

3,500

Total Industrial: $3,759M (1)

6,000

5,000

Full year guidance unchanged at $8.7bn

3,000 3,000

-$1.77bn

4,000

2,500 2,002 2,500 3,588

2,000

1,329

2,000 3,000

2,086

1,500 1,500

-$942M

2,000

1,516

1,000 1,000

1,495

1,368

708 1,000 1,944

500 500

1,673

0 0

425

291

H1 2013 H1 2014

0

H1 2013 H1 2014 H1 2013 H1 2014

Notes: H1 2013 is pro forma for the Xstrata merger. (1) Excluding Las Bambas expansionary capex of $798M and $899M in H1 2014 and H1 2013 respectively.

Excluding Marketing capex and capitalised project interest of $268M in H1 2014 ($121M in H1 2013).

14

Ship loading at Port Giles, Australia

Ivan Glasenberg

Chief Executive Officer

Confidence in our future

Asset portfolio optimised

Earnings power of the marketing business rebased

Balance sheet repositioned

Differentiated price outlook – exposure to the right commodities

Strong pipeline of future growth opportunities

Owner-oriented management aligned with external shareholders

Capability to sustainably grow cashflow, earnings and dividend/share

16

Asset portfolio optimised

>$1.9b industrial merger synergies and other cost savings by end

2014

Q1 first quartile cost positions for industrial assets on track for end

2015

Post-integration cost efficiencies and focus now ingrained in industrial asset structures

$6.8bn asset disposals over last 12 months (1)

Illustrative C1 metals cash cost curve / Inverse FOB cash margin thermal coal

FeCr

2015

Cu

2015

$2.5bn acquisitions over the last 12 months (2)

$35bn combined Glencore and

Xstrata expansionary capex since 2009 (3)

Zn

2015

Ni

2015

Thermal Coal

2015

Q1

Notes: (1) Including Las Bambas, Frieda River, Viterra disposals, Agmet and PT Stargate Pasific. (2) Includes Caracal, Mutanda, Clermont. (3) Excludes Las Bambas.

Q2

17

Marketing earnings power rebased

• Historical Marketing EBIT guidance of $2bn to $3bn per annum

• EBIT guidance range increased to

$2.7 – $3.7bn from 2014, following the Xstrata and Viterra transactions

• Marketing business benefits from unique scale, diversification and relationships – the clear global #1

• Unrivalled global intelligence / market knowledge and insight:

• underlying commodity supply/demand

• corporate activity/opportunities

• Earnings uplift available as physical output grows

• Low cost of capital, minimal fixed assets and stable cost base underpin, resilient and high ROE

Marketing EBIT ($M)

0 1,000

2008

2009

2010

2011

2012

2013

2014

2,000 3,000

H1 14 annualised

$700M annual EBIT guidance range increased, following the Xstrata and

Viterra transactions

H1

14

18

A differentiated outlook – exposure to the right commodities

Consensus price forecasts 2014=100

140

130

Nickel

Aluminium

Zinc

120

Thermal

Coal

110

Copper

Oil

100

90

Iron Ore

80

2014

Source: Consensus broker research

2015 2016 2017 2018

19

Key growth projects scheduled to commission 2014/2015 – strong pipeline of capital efficient growth opportunities

Commissioning 2014 Commissioning 2015 2016+ brownfield growth options

Copper

Katanga Phase V : increase to 300ktpa milling + 2*35ktpa

EW tankhouses

Zinc

McArthur River Phase 3

Expansion : increase to

370ktpa zinc in concentrate

Ferroalloys

Lion II : 360kt Premus technology smelter - complete

Copper

Nkana Synclinorium: New shaft to extend section life by

25 years

DRC Power: first 162MW refurbished turbine (G27) at

Inga

Oil

Krim (DOB/DOI): – Chad

Commissioning 2016

Coal

Ulan West : +8Mtpa export thermal

Wonderfontein : +2.7Mtpa export thermal

Tweefontein : +7Mtpa for 24 years

Oil

Mangara (DOB/DOI) – Chad

Copper

Mopani Deeps : new shaft infrastructure to provide a

25% increase in own source production and a 20% reduction in mine cash costs

Commissioning 2017

Iron Ore

Askaf : 7Mtpa iron ore mine utilising existing SNIM rail and port infrastructure

Note: Cu equivalent annual growth including above projects of c. 6% expected 2014-2017.

Copper

Coroccohuyaco

Mutanda Sulphides

Zinc

Mararovskoe

Dolinno

Nickel

Raglan 40ktpa

Raglan Phase II

Coal

Bulga life extension (OC&UG)

Mt Owen extension

Rolleston Phase II expansion

GGV expansion

Optimum / Zonnebloem

Oil: >800 MM bbls of risked prospective resource potential in Chad

Chad exploration : Doseo/Borogop,

DOBI/DOI, DOH blocks

Chad development : Kibea and nearby discoveries

Bolongo – Cameroon

Diega – Equatorial Guinea

20

Capital management framework

Excess operating free cash flow

Capital structure

maintain strong

BBB/Baa credit metrics

• Strong BBB/Baa believed to be the optimal rating target supporting the balance between our growth strategy and shareholder returns

Returns to shareholders

including ongoing buyback programme

• IPO proceeds (c.$7.9bn) fully returned to shareholders since IPO

• Ongoing buyback program should underpin EPS accretion as well as

P/E multiples

Criteria:

• risk

• return

• cash payback

M&A / Brownfield projects

screen growth options against capital allocation criteria

• High-returning opportunistic M&A and brownfield growth opportunities screened against rigorous capital allocation criteria

• Investment opportunities also screened against returns generated from buybacks

• Generates growth in profits and FCF

21

Concluding remarks

Delivering on our commitments

• Asset portfolio largely restructured

• Marketing earnings rebased

• Balance sheet strengthened

• Exposure to the right commodities

• Strong pipeline of organic growth opportunities

Confidence in outlook allows us to start returning excess capital to shareholders on a sustainable basis

• 25% of convertible bonds repurchased

• Dividend rebased – interim dividend $6 cents

• Ongoing share buyback – $1bn until 31

March 2015

IPO proceeds have already been returned to shareholders

8

7

Buyback

$1.0bn

Convertible repurchase

$639M

6

5

4

3

2

IPO proceeds

$7.9bn

Dividends since IPO

$6.3bn

IPO proceeds now already returned to shareholders

Capital structure will be constantly reviewed

1

0

Note: Dividends include the 2014 declared interim dividend. 22

Los Quenuales, Peru

Q&A

Lady Loretta mine, Australia

Appendix

Improving outlook for our key commodities

Copper Zinc Nickel Thermal Coal

Tight market conditions reflected in critically low cathode stocks

• Cathode deficit in H1

2014 - impact of supply disruptions met by reduction in exchange stocks to levels last seen in late 2008

• Forecast stronger H2 supply growth likely to be tempered by scrap shortages and risks around aging mines and delivery of new greenfield supply.

• Continued Chinese strength and improving western demand likely to keep H2 supply in check

• Capex cuts and project deferrals to generate deficit markets again from 2015

Zinc market continues to tighten

• Improving Western demand, combined with record metal imports into China during H1 has resulted in a significant draw down of zinc metal inventories worldwide

• Lower inventories, tightening spreads, increased premia all point to a zinc metal deficit already in 2014

• With the key Western mine closures forecast from 2015 and no significant new projects underway to replace them, the market deficit will only widen further

Rebalancing near-term, then sizeable deficit emerging

• Indonesia’s export ban and enforcement has put more than 300kt of primary Ni production

(mostly Chinese NPI) at risk

• Record levels of raw and finished inventories will initially limit the impact of the ban

• Amid robust forecast demand, sizeable deficits forecast to emerge as ore stockpiles and exchange stocks are run down.

• Permitting / infrastructure will limit the pace of Indonesian

NPI build out

Growing pressure for supply cuts

• Despite continuing strong demand from the major Pacific and Atlantic consumers, the market remains oversupplied due to a slow supply response

• c.35% of seaborne supply is cash negative and more than two thirds of Chinese domestic producers are believed to be suffering losses

• Growing likelihood of production cuts amid Indonesian efforts to tackle illegal exports and Chinese measures aimed at curbing overcapacity

• Capex cuts and project deferrals will help to accelerate the necessary rebalancing

• Medium/long-term confidence in market upside – demand supported by role as lowest cost fuel choice

25

A strong board

Anthony Hayward

Chairman H

• Former CEO of BP

• CEO of Genel Energy (LON)

Leonhard Fischer

Non Executive Director A(C), N, R

• CEO of RHJ International (parent of the Kleinwort Benson Group)

(EBR)

• NED of Julius Baer (VTX)

Ivan Glasenberg, CEO

Executive Director H

• CEO of Glencore since 2002

• 30 years with Glencore

• NED of Rusal (HKEx)

• NED of Pirelli

Peter Coates

Non Executive Director H(C)

• 40 years of experience in the resource industry

• NED of Santos and

Amalgamated Holdings (both

ASX)

Peter Grauer

Senior Independent

Non Executive Director N(C), A

• Chairman of Bloomberg

• NED of Davita Healthcare

(NYSE)

• Member of International

Business Council of WEF

Committees: A Audit; H HSEC; N Nomination; R Remuneration; C Chair

William Macaulay

John Mack

Patrice Merrin

Non Executive Director A, R

• Chairman and CEO of First

Reserve

• Chairman of Dresser-Rand and

CHC Group (both NYSE)

• NED of Weatherford International

(NYSE)

Non Executive Director R(C),N

• Former CEO of Morgan Stanley

• Member of the Advisory Board of CIC, of International Business Council of

WEF, of NYC Financial Services

Advisory Committee and of Shanghai

International Financial Advisory Council

Non Executive Director H

• Former COO of Sherritt and former CEO of Luscar (Canada’s largest coal company)

• Former Chair of CML Healthcare (then

TSX)

• NED of Stillwater Mining (NYSE)

26

Interim distribution

• Increased interim distribution reflects confidence in our outlook and financial position

• Interim distribution of 6 cents per share declared, an 11% increase

• Payment date: 19 Sep 2014

Jersey

Distribution payments (US cents per share)

18

16

14

12

10

8

6

4

2

0

15.0

10.0

5.0

+8%

15.8

10.4

5.4

16.5

11.1

5.4

+11%

2011 2012 2013

6.0

2014

Johannesburg

22 Aug

Hong Kong

29 Aug

Interim distribution timetable

Exchange rate reference date:

Last time to trade on JSE to be recorded in the register on record date:

Last day to effect removal of shares cum div between Jersey and JSE registers:

Interim Ex-Div Date:

Last time for lodging transfers in Hong Kong:

Interim Distribution record date:

Deadline currency election (Jersey):

Removal of shares between Jersey and JSE:

Exchange rate reference date:

Final Distribution payment date:

3 Sep

5 Sep

8 Sep

10 Sep

19 Sep

29 Aug

1 Sep

5 Sep

From 8 Sep

19 Sep

3 Sep

4:30pm 4 Sep

5 Sep

10 Sep

19 Sep

Note: Dematerialisation and rematerialisation of registered share certificates in South Africa may not be effected during the period from Monday 1 September 2014 to Friday 5 September 2014, both days inclusive. Distributions will be declared and paid in U.S. dollars, although Shareholders on the Jersey register will be able to elect to receive their distribution payments in Pounds Sterling, Euros or Swiss Francs. Shareholders on the Hong Kong branch register will receive their distributions in Hong Kong dollars. Shareholders on the Johannesburg register will receive their distributions in

South African Rand.

27

A leading producer in key commodities

#1

Export thermal coal production (Mt) Mined copper production (kt)

#3

98

55

Glencore Bumi

43

BHPB

40

Siberian

35

Adaro

Energy

31

AAL

Export metallurgical coal production (Mt)

1,874 1,792

1,497

1,149

775

631

Freeport Codelco Glencore BHPB

#1

Anglo

American

Rio Tinto

Mined zinc production (kt)

#6

34

26

21

19 18

12

BHPB Mitsub.

Teck Alpha AAL

Mined nickel production (kt)

Glencore

#5

251

215

134

124

98

81

Norilsk

2015

Vale PT Aneka

Tambang

BHPB Glencore Jinchuan

Source: AME, Wood MacKenzie, CRU, Heinz Pariser, Glencore 2013 production report.

1,399

#1

848

Glencore Vedanta

615

Teck

582

299 289

China

Minmetals

Votorantim Nyrstar

Ferrochrome production (kt)

1,238

Glencore

1,117

ERG

860

434

280

189

Samancor Outokumpu Hernic ASA Metals

28

Adjusted, reported and pro-forma EBITDA

The impact of the proportionate consolidation of certain associates and joint ventures, and the pro forma adjustments, is set out in the following table:

US$ million

H1 2014

Reported

Adjustment for proportionate consolidation

H1 2014

Adjusted

Reported

H1 2013

Reported

Adjustments for proportionate consolidation and Xstrata

H1 2013

Pro forma

Revenue 114,064 1,486 115,550 112,035 9,358 121,393

Adjusted EBITDA

Adjusted EBIT

Net income attributable to equity holders – pre significant items

Significant items

Net income attributable to equity holders – post significant items

6,038

3,471

2,010

(290)

426

153

-

-

6,464

3,624

2,010

(290)

3,491

2,008

1,207

(10,593)

2,511

1,174

653

9,378

6,002

3,182

1,860

(1,215)

FFO

Capex

1,720

4,831

4,585

-

78

240

1,720

4,909

4,825

(9,386)

1,919

3,400

10,031

2,345

3,152

645

4,264

6,552

29

Oil drilling, Chad

E&P Chad

Chad – Acquisition of Caracal

Recently completed acquisition of Caracal, Glencore’s JV partner in Chad

Strategic rationale

• Larger working interest in a proven oil basin gives Glencore the opportunity to fully benefit from both development and high prospect exploration activities in Chad

• Extensive exploration portfolio of over 80 prospects and leads analogous to existing discoveries

• Continued build out of Glencore’s operated E&P platform opens up a wider spectrum of opportunities across the E&P life cycle (exploration, development & production)

• Accelerated development using existing pipeline infrastructure

Production

PSC map

• First oil from Badila field in

September 2013

• Mangara field scheduled to be on-stream during

H2 2014

Badila and Mangara EXAs

EXAs approved

Glencore: 85%

SHT (Chad NOC):15%

EEAs

Glencore: 100%

• Exited 2013 with production of 10,000 barrels of oil per day

(gross)

• Target production of 40 to

45 kbbl/day by 2015

Mangara

Badila

DOH

Borogop

Chari East Doseo

Doseo / Borogop PSC

DOB / DOI (Badila / Mangara) PSC

DOH PSC

PSC: Profit Sharing Contract; EXA: Exclusive Exploitation Authorizations; EEA: Exclusive Exploration Authorizations. 31

E&P Portfolio

E&P Portfolio location

Note: * Glencore operated

Asset Participation

Equatorial Guinea

Block I

Block O

Block X

Block V *

Block EG 05 *

Cameroon

Matanda *

Bolongo *

Tilapia

Chad

DOB/DOI *

Mangara Field *

Badila Field*

DOH *

Doseo/Borogop *

Morocco

Boujdour Offshore*

Foum Ognit Offshore

Participating

Interest

23.75%

25.00%

37.50%

80.00%

60.00%

Participating

Interest

90.00%

100.00%

33.33%

Participating

Interest

100%

85.00%

85.00%

100%

100%

Participating

Interest

38.25%

18.75%

32

Koniambo, New Caledonia

Koniambo update

Koniambo project update

H1 2014 Performance

• First half production of 4.1kt primarily impacted by power availability issues

• Early operation of the plant’s principal energy source (2 x 135MW steam turbines) uncovered a range of OEM manufacturing problems impacting heat exchanger tube bundles, combustors and fan impellers

• Plant initially operated on a de-rated basis supplemented by backup diesel turbines

• Metallurgical plant has been operating for 12 months under Glencore control

• Confidence in the technology is very high

• Operational staff now familiar with the rampup/operating challenges

• Smelter producing commercial grade ferronickel

Power update

• Sufficient power now available until steam turbines are fully operational

• Remanufacture of the heat exchanger tube bundles underway which should enable both lines to generate power at capacity during Q2

2015

Revised production guidance

• 2014: 10 to 18kt Ni

• 2015: 25 to 40kt Ni

• 2016: > 50kt Ni to nameplate capacity

Power availability no longer a constraint

• Requirement at full capacity:

• Total current power sources:

• STG 1

• CTG 1 & 2

• ENERCAL (local provider)

• 3 mobile generators

215MW

250MW

50MW

2 x 52 MW

35MW

3 x 20MW

Koniambo metallurgical plant

STG: Steam Turbine Generator; CTG: Combustion Turbine Generator.

34

Katanga KOV pit, DRC

Copper

Copper exchange stocks at lowest levels since late 2008

Global copper stocks (Mt)

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

January

2013

June 2013 January

2014

June 2014 Present

LME COMEX SHFE CHINA BONDED

Global copper stocks (Mt)

1.8

1.6

1.61

1.4

1.41

1.2

1.0

1.13

0.98

0.94

0.87

0.8

0.6

0.59

0.51

0.4

0.2

0.28

0.26

0.0

January

2013

June 2013 January

2014

June 2014

Total copper stocks

Total excluding China bonded

Present

36

Abbot Point, Australia

Coal update

Market update – thermal coal supply and demand

1,000

800

773

866

941

975

991 1,013

1,032

1,000

800

792

880

931

971

1,019

1,061

1,111

600 600

400

200

0

2011 2012 2013 2014F 2015F 2016F 2017F

Indonesia Australia

South Africa USA

Colombia

Other

Russia

Source: Glencore.

400

200

0

2011 2012 2013 2014F 2015F 2016F 2017F

China

Taiwan

India

Germany

Japan

Other

Korea

38

c.35% of seaborne thermal coal supply is cash negative

FOB thermal coal cash margins at current market prices ($/t)

20

Glencore

15

10

5

Major 1

Major 2

Major 3

Major 4

Major 5

Major 6

Major 7

Major 8

Other

-

(5)

(10)

(15)

(20)

0 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950

Million Tonnes

Source: Glencore 39

Major project update – Tweefontein Optimisation Project

Asset details

• Glencore effective ownership: 79.8%

• Capex: $823M

• Brownfields expansion of existing operations

• replacement of 3 old processing plants with modern plant

• construction of rapid loading rail terminal

• development of large open cut mine with 7 pits and owner operated fleet

• Production capacity: 13.6Mtpa ROM; 7Mtpa

Saleable

• Thermal: 75% Export; 25% Domestic

Project status

• Under construction

• Coal Processing Plant, 91.9% complete

• Full Project, 87.4% complete

• Plant operational Q4 2014

• Project completion Q2 2015

Coal Processing Plant

Rail load-out nearing completion

40

Major project update – Ravensworth North

Mine development and MIA Asset details

• 90% Glencore

• Brownfield project

• 8Mtpa, export thermal and semi-soft coking

• 23 year mine life

• Second quartile cash cost

Project details

• Project complete

• Approved 2011

• CHPP completed Q4 2013

Construction update

• CHPP fully commissioned and operational

• On time and on budget ($1.4bn)

CHPP and product stockpiles

41

Major project update – Ulan West

Asset details

• 90% Glencore

• 8Mtpa export thermal coal

• 14 year mine life

• First quartile cash cost at full production

Project details

• 92% complete

• Approved 2010

Construction update

• Longwall commenced operating in May 2014

• Project on time and on budget ($1.2bn)

Box cut and main gate entry

First longwall shear

42

Nickel crowns, Nikkelverk, Norway

Sector overview

Sector performance

Mining sector performance year to date

4%

12%

11% 11% 10%

9%

8%

7%

6%

6%

5%

4%

2% 1% 1%

0% 0%

-1% -1%

-2% -2% -2%

Mining sector performance last 3 years

50%

105%

88% 83%

69% 66% 65% 59% 58% 58%

47% 41% 41% 40% 38% 36% 33%

27% 19%

-1%

-20% -29%

Source: Bloomberg, as of 18 August 2014. 44

Supercycle over ?

Commodity demand: 2004 vs 2014F

2004

2014 13.9

21.9

2.0

52.6

1.90

976

1.2

467

16.9

10.3

30.3

1.29

Copper Zinc Iron Ore Alu Nickel Thermal Coal

Prices have generally firmed during H1 2014 led by nickel. Slowing supply growth lending support

Copper Zinc Iron ore Alu Nickel

35.0% 40.0%

30.0%

20.0%

10.0%

0.0%

-10.0%

-20.0%

-30.0%

-40.0%

-50.0%

-15.0%

-6.0%

6.0%

10.0%

-41.0%

-30.0%

-4.0%

14.0%

5.0%

Coal

Last 18 months

YTD

-12.0%

-6.0%

Source: Bloomberg as at 18 August 2014, Wood Mackenzie, Deutsche Bank, Glencore estimates 45