February 17, 2014

Company Update

Pakistan Research

Consumers

EFOODS: Valuations still to reflect end of supernormal growth

EFOODS PA SELL

Price Target: PKR75/Share

Closing Price: PKR103.0/Share

Key Data

162.2 – 80.4

12m Price Range (PKR)

79,036.1

Market Cap (PKRmn)

766.4

Outstanding Shares (mn)

2.6

Avg Daily Volume mn (6m)

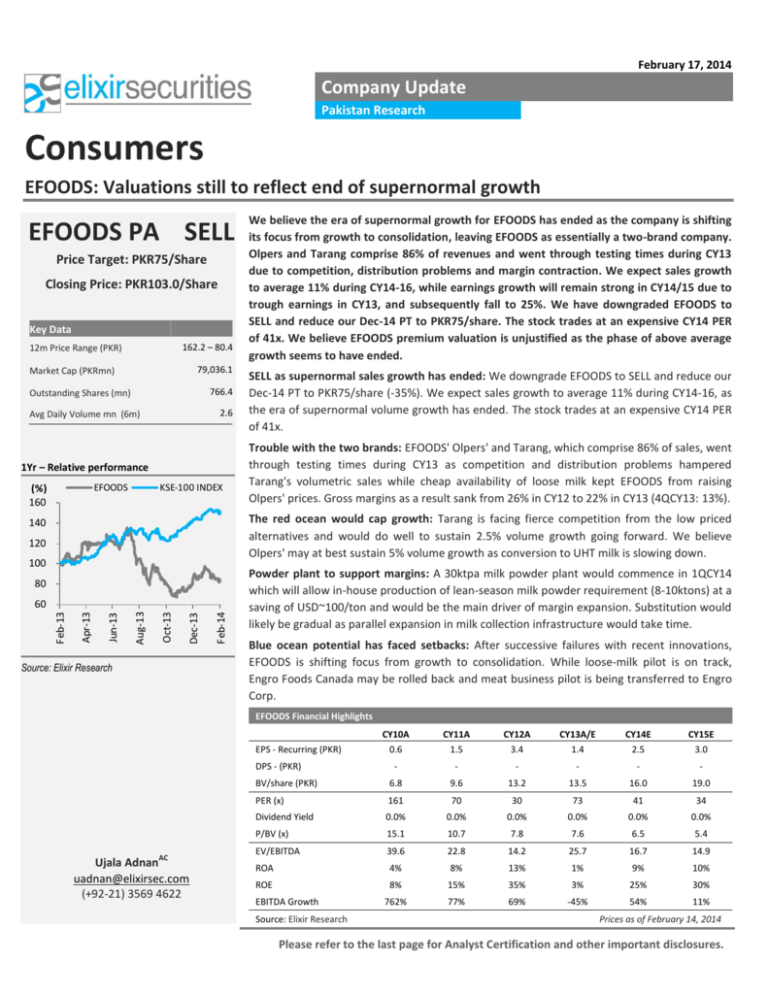

1Yr – Relative performance

EFOODS

(%)

160

KSE-100 INDEX

We believe the era of supernormal growth for EFOODS has ended as the company is shifting

its focus from growth to consolidation, leaving EFOODS as essentially a two-brand company.

Olpers and Tarang comprise 86% of revenues and went through testing times during CY13

due to competition, distribution problems and margin contraction. We expect sales growth

to average 11% during CY14-16, while earnings growth will remain strong in CY14/15 due to

trough earnings in CY13, and subsequently fall to 25%. We have downgraded EFOODS to

SELL and reduce our Dec-14 PT to PKR75/share. The stock trades at an expensive CY14 PER

of 41x. We believe EFOODS premium valuation is unjustified as the phase of above average

growth seems to have ended.

SELL as supernormal sales growth has ended: We downgrade EFOODS to SELL and reduce our

Dec-14 PT to PKR75/share (-35%). We expect sales growth to average 11% during CY14-16, as

the era of supernormal volume growth has ended. The stock trades at an expensive CY14 PER

of 41x.

Trouble with the two brands: EFOODS' Olpers' and Tarang, which comprise 86% of sales, went

through testing times during CY13 as competition and distribution problems hampered

Tarang's volumetric sales while cheap availability of loose milk kept EFOODS from raising

Olpers' prices. Gross margins as a result sank from 26% in CY12 to 22% in CY13 (4QCY13: 13%).

The red ocean would cap growth: Tarang is facing fierce competition from the low priced

alternatives and would do well to sustain 2.5% volume growth going forward. We believe

Olpers' may at best sustain 5% volume growth as conversion to UHT milk is slowing down.

140

120

100

80

Source: Elixir Research

Feb-14

Dec-13

Oct-13

Aug-13

Jun-13

Apr-13

Feb-13

60

Powder plant to support margins: A 30ktpa milk powder plant would commence in 1QCY14

which will allow in-house production of lean-season milk powder requirement (8-10ktons) at a

saving of USD~100/ton and would be the main driver of margin expansion. Substitution would

likely be gradual as parallel expansion in milk collection infrastructure would take time.

Blue ocean potential has faced setbacks: After successive failures with recent innovations,

EFOODS is shifting focus from growth to consolidation. While loose-milk pilot is on track,

Engro Foods Canada may be rolled back and meat business pilot is being transferred to Engro

Corp.

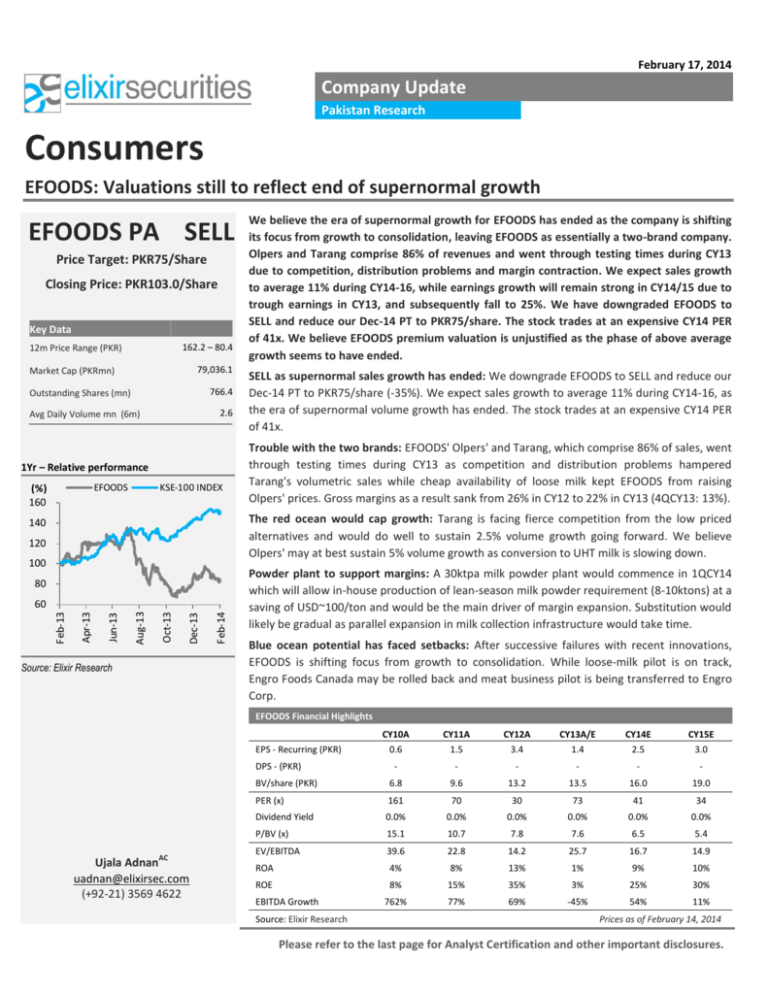

EFOODS Financial Highlights

EPS - Recurring (PKR)

DPS - (PKR)

BV/share (PKR)

AC

Ujala Adnan

uadnan@elixirsec.com

(+92-21) 3569 4622

CY10A

CY11A

CY12A

CY13A/E

CY14E

CY15E

0.6

1.5

3.4

1.4

2.5

3.0

-

-

-

-

-

-

6.8

9.6

13.2

13.5

16.0

19.0

PER (x)

161

70

30

73

41

34

Dividend Yield

0.0%

0.0%

0.0%

0.0%

0.0%

0.0%

P/BV (x)

15.1

10.7

7.8

7.6

6.5

5.4

EV/EBITDA

39.6

22.8

14.2

25.7

16.7

14.9

ROA

4%

8%

13%

1%

9%

10%

8%

15%

35%

3%

25%

30%

762%

77%

69%

-45%

54%

11%

ROE

EBITDA Growth

Source: Elixir Research

Prices as of February 14, 2014

Please refer to the last page for Analyst Certification and other important disclosures.

Company Update

EFOODS

Downgrade to ‘SELL’

We have switched our valuation methodology from relative valuation to discounted cash flows

valuation as we believe that the entire consumer space in Pakistan is overpriced (please refer

to our publication ‘The Consumer Bubble’ released on Friday February 14, 2014). We have

used a risk free rate of 10%, a beta of 1.0 and a market risk premium of 7% for our valuation.

We have used a terminal growth rate of 10% (Elixir Universe 2% to 5%) to account for the high

growth potential in consumer segment. Our Dec-14 PT of PKR75/sh offers a huge downside of

25%. EFOODS is currently trading at very expensive CY14E PER of 41x. We believe EFOODS

premium valuation is unjustified as the phase of above average growth seems to have ended.

Valuation

CY14

CY15

CY16

CY17

CY18

CY19

CY20

CY21

CY22

CY23

CY24

Assumption

Risk free rate

10.0%

Risk Premium

7.0%

Beta (x)

1.0

Req. return on Equity

17.0%

Terminal Growth

10.0%

FCFE

557

879

1,294

2,383

4,523

4,655

5,682

6,800

8,106

9,633

11,418

Discount Factor

-

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

10.0

Discounted FCFE

557

751

945

1,488

2,414

2,123

2,215

2,266

2,308

2,345

2,375

PV of cash flows

19,788

PV of terminal value

37,326

Equity Value

57,114

Price Target (PKR)

75

Source: Elixir Research

Supernormal sales growth have ended; earnings growth would normalize CY16

onwards

After successive failures with recent innovations, EFOODS is shifting focus from growth to

consolidation, leaving EFOODS as essentially a two-brand company. This means higher

susceptibility of overall sales and earnings to individual brands as Olpers and Tarang comprise

86% of revenues, combined and both have turned into mature brands with limited growth

potential. We expect sales growth to average 11% during CY14-16, driven by 7% growth in

volumes and 5% in prices as the era of supernormal volume growth has ended. Competition

from competing brands and cheaper loose milk would inhibit EFOODS' capacity to take price

increases. Earnings growth will however remain strong in CY14/15 due to CY13 trough

earnings and subsequently average 25% during CY16-19.

2

Elixir Securities

February 17, 2014

Company Update

EFOODS

PKRMn

47

40

40

43

38

30

30

21

20

70%

4.0

60%

3.5

50%

3.0

40%

2.5

30%

2.0

20%

1.5

10%

1.0

0%

0.5

-10%

0.0

15

10

CY18E

CY17E

CY16E

CY15E

CY14E

CY13A

CY12A

CY11A

CY10A

CY09A

-

4.6

Source: Company Accounts, Elixir Research

3.7

3.0

2.6

2.3

1.9

1.1

0.2

CY17E

50

4.5

CY16E

52

80%

PAT

CY15E

57

5.0

CY13A

63

60

90%

CY12A

Growth YOY (RHS) %

CY11A

Total sales

70

CY10A

PKRBn

CY10-18 Net Profit growth

CY14E

CY10-18 Sales growth

Source: Company Accounts, Elixir Research

Recent trouble with the two brands

EFOODS' Olpers' and Tarang, which comprise 86% of sales, went through testing times during

CY13 as volumes fell for Tarang while both Olpers' and Tarang witnessed margin contraction.

EFOODS faced significant distribution problems as it lost its major distributors during early

CY13. Simultaneously, perceived value proposition of UHT milk weakened due to weak loose

milk prices as a result of abundant milk production during 1HCY13. Sales of Tarang were

further dampened by the introduction of low priced alternatives by competition. Management

remained busy in fixing the distribution network and attempted to revive sales through price

offs during 2HCY13 which further dented margins. Gross margins as a result continued to

plummet during the year and fell from the peak of 29.5% in 1QCY13 to 12.8% in 4QCY13, while

full year average fell from 26% in CY12 to 22% in CY13.

Low volumes during CY13

Bn Ltrs/Year

Dairy and juices off-takes

Milk Volumes

30%

0.55

Volume growth %

27%

25%

23%

23%

0.50

20%

0.45

15%

11%

Source: Company Accounts, Elixir Research

3

Elixir Securities

CY14E

CY13A

CY12A

CY11A

CY10A

4%

CY18E

CY14E

CY13E

CY12E

CY11E

CY10E

-5%

4%

-7%

0%

0.30

5%

CY17E

0.35

4%

CY16E

5%

CY15E

10%

0.40

-10%

Source: Company Accounts, Elixir Research

February 17, 2014

Company Update

EFOODS

The red ocean would cap volume growth

Tarang is facing fierce competition in a price sensitive market from the low priced alternatives

introduced by Haleeb Foods, Nurpur and Shakarganj and would do well to sustain 2.5% volume

growth after rebounding by 10% in CY14. We believe Olpers' may at best sustain 5% volume

growth as UHT conversion is slowing down due to affordability issues, cheaper loose milk and

availability of pasteurized milk brands. Despite the setback with Punjab Food Authority

(discussed below) we believe Omung would grow by 20% due to its low existing base. We

expect overall dairy segment volumes of EFOODS to grow by 11% in CY15 and then

subsequently sustain a 4% annual growth.

Margins trend

Tarang vs. competitors

Gross margin

26%

Price comparison - SKU 200ml

18

25.7%

25%

24.4%

24.7%

24.0%

24%

17

17

17

23.4%

22.9%

22.8%

23%

22.1%

16

16

22%

21.6%

21%

15

15

15

Chai Mix

Chaika

20%

Source: Company Accounts, Elixir Research

CY18E

CY17E

CY16E

CY15E

CY14E

CY13A

CY12A

CY11A

CY10A

19%

14

Everyday

Tarang

Tea Max

Source: Company Accounts, Elixir Research

Dairy Omung issue in Punjab

Punjab provincial food regulatory department (Punjab Food Authority) seized some stock of

Dairy Omung in Nov-13 claiming that it does not qualify as milk due certain contents. Dairy

Omung is labeled as "dairy drink" rather than milk, while the company management also

contends that Dairy Omung is not UHT milk and is a dairy drink with high calcium content.

However, Omung marketing communications promotes Omung as an alternate to milk. The

company was required to withdraw the entire stock of the product from Lahore district. This

attracted a lot of negative publicity to the product. The matter has been pushed aside for now

as Supreme Court has given stay order in favour of EFOODS.

Powder plant to support margins

Low loose milk prices and fierce competition from other brands would barely allow enough

price hikes to pass through further cost increases and we do not expect price hikes (barring

end of current price offs) to contribute much to margins. As such, support to margins would

likely come from cost reductions. EFOODS plans to commence a 30ktpa milk powder plant in

1QCY14. This will allow the company to produce its lean-season milk powder requirement (810ktons) in-house which would likely yield savings of approximately USD100/ton, and would

be the main driver of margin expansion going forward. Substitution would likely be gradual as

powder production would require parallel expansion in milk collection infrastructure.

4

Elixir Securities

February 17, 2014

Company Update

EFOODS

% of powder requirement met by own plant

Savings from milk powder plant

Powder requirement met by in-house facility

PKRBn

1.2

120%

100%

100%

Savings from powder plant

1.0

1.0

85%

0.8

0.8

80%

66%

0.6

0.6

60%

46%

0.4

0.4

Source: Company Accounts, Elixir Research

CY18E

CY17E

0.2

CY14E

CY18E

CY16E

CY17E

0.0

CY15E

0%

CY14E

0.2

CY16E

24%

20%

CY15E

40%

Source: Company Accounts, Elixir Research

Blue ocean potential has faced several setbacks

After successes with Olpers', Tarang and partial success with Dairy Omung, most of the recent

innovations have not done well. This includes, Lassi, Juices and Engro Foods Canada (North

American meat business). After successive failures with recent innovations, EFOODS is shifting

focus from growth to consolidation. While Engro Foods Canada (North American meat

business) may well be rolled back, domestic meat business experiment is now being carried

out under the parent company (ENGRO) while EFOODS is going ahead with the pilot of Karachi

Dairy project of loose milk under the brand name of Mabrook.

Brands

Status

Olpers’

Successful

Tarang

Successful

Omung

Potential still unclear

O’more

Unsuccessful

Omung Lasii

Unsuccessful

Olfrut

Unsuccessful

Mubrook

Introduction stage

Source: Elixir Research

Ice cream business is still making losses

EFOODS’ ice cream segment has a 7% contribution in the top line. Although EFOODS’ ice

cream brand, Omore, had been successful in gaining the second highest market share of 25%

after ‘Walls’, it is still not profitable. Multiple products launched under the brand name turned

out to be huge failures and the company had to discontinue them. EFOODS ice cream sales

volume declined by ~16% during CY13 owing to its lower geographical penetration together

with overall slowdown in ice-cream consumption within the country. The business segment

has for the first time managed to breakeven in the 4QCY13. EFOODS does have any major

plans to for this business segment during CY14. We expect that EFOODS’ ice-cream segment

will continue to make losses during the current year.

5

Elixir Securities

February 17, 2014

Company Update

EFOODS

Ice cream Losses PKRmn

2.6

CY13A

2.8

CY10A

2.8

CY09A

3.0

Profit after tax

PKRMn

CY12A

Sales Revenue

PKRbn

CY11A

Ice cream sales revenue

0.0

2.5

2.0

-100.0

1.6

1.5

-200.0

1.0

0.7

-300.0

0.5

-321

-353

-400.0

CY13A

CY12A

CY11A

CY10A

CY09A

0.0

Source: Company Accounts, Elixir Research

-417

-405

-445

-500.0

Source: Company Accounts, Elixir Research

Karachi Dairy project

EFOODS has recently launched its pasteurized milk pilot project in Karachi. This involves

tapping into loose milk market in Karachi by providing door-to-door service and delivering

pasteurized milk which is healthier and cleaner than loose milk. This basically entails

eliminating the involvement of middle men and approaching the target market directly. Total

capex for the pilot project is ~PKR200mn spread across CY13 and CY14. The pilot is being

carried out under the brand name of ‘Mubrook’ which mean good news. EFOODS has already

commenced 6 franchises while it plans to take total number of franchises to 30 during the

current year. Mabrook has a low capex business model where the franchisee is required to

carry out the capex for outlet infrastructure. We have incorporated 30 Mubrook franchises in

our estimates and have not taken further growth in network. EFOODS estimates that the total

expected market size for this project would be around PKR100bn. As per our analysis, Karachi

has a total milk consumption of 11k tons per day or PKR200bn per annum.

Upside risks

We highlight the following risk that could derive a higher valuation for EFOODS going forward:

6

Elixir Securities

1.

Karachi dairy project, if successful, would significantly push valuation upwards. 1%

share in Karachi’s dairy market would add PKR2.3bn (6%) to company’s revenue.

2.

EFOODS faced failure in certain products such as Omung Lassi (summer drink), Olfrute

(juices) and Omore (Ice-cream) as market for these products were under developed.

However the possibility of an increase in demand for these products cannot be

ignored and might result in upward revision in the value.

February 17, 2014

Company Update

EFOODS

Financials

Income Statement

PKRmn

CY10A

CY11A

CY12A

CY13A/E

CY14E

CY15E

Net Sales

21,249

30,079

40,167

37,891

43,382

46,736

Operating costs

19,224

26,488

34,091

34,549

38,250

41,015

EBITDA

2,025

3,591

6,076

3,341

5,131

5,721

EBIT

1,311

2,628

4,869

2,190

3,880

4,394

Other Income/Finance cost

(77)

4

(47)

(1,109)

(420)

(348)

Net Profit - Recurring

480

1,111

2,611

1,081

1,905

2,309

EPS – Recurring (PKR)

0.64

1.48

3.41

1.4

2.48

3.01

Net Profit – Reported

480

1,111

2,611

211

1,905

2,309

EPS – Reported (PKR)

0.6

1.5

3.4

0.3

2.5

3.0

PKRmn

CY10A

CY11A

CY12A

CY13A/E

CY14E

CY15E

Paid up Capital

7,000

7,518

7,615

7,660

7,660

7,660

Reserves + Unapp profit

(1,876)

(281)

2,472

2,665

4,569

6,878

Shareholders’ Funds

5,124

7,237

10,087

10,325

12,229

14,538

Long Term Loans

4,814

5,921

7,693

7,025

5,379

3,517

Current Liabilities

2,522

3,480

4,441

3,637

4,691

4,782

Capital & Liabilities

12,460

16,638

22,221

20,987

22,299

22,836

Net Fixed Assets

8,722

10,270

12,676

12,606

11,981

11,064

Source: Elixir Research

Balance Sheet

Current Assets

3,738

6,368

9,528

8,381

10,319

11,772

Total Assets

12,460

16,638

22,204

20,987

22,299

22,836

CY10A

CY11A

CY12A

CY13A/E

CY14E

CY15E

Recurring Net Profit

480

1,111

2,611

211

1,905

2,309

Depreciation

714

963

1,207

1,151

1,251

1,327

Working Capital Changes

(505)

(1,755)

(1,944)

370

(873)

(1,346)

Operating Cash Flows

690

320

1,875

1,732

2,283

2,289

(3,000)

(2,511)

(3,613)

(1,081)

(626)

(409)

Source: Elixir Research

Cash Flow Statement

PKRmn

Capex

Add: Interest (after tax)

429

682

575

510

481

486

Others

1,273

1,002

221

44

-

-

FCFF

(609)

(508)

(942)

1,205

2,137

2,366

Less: Interest (after tax)

(429)

(682)

(575)

(510)

(481)

(486)

Net debt

1,069

1,359

1,605

(673)

(1,634)

(1,856)

32

169

88

22

23

24

-

-

-

-

-

-

Net Cash Flow

32

169

88

22

23

24

Beginning cash

148

180

349

438

459

482

Ending cash & equivalents

180

349

438

459

482

506

FCFE

Dividends Paid

Source: Company Accounts, Elixir Research

7

Elixir Securities

February 17, 2014

Company Update

EFOODS

Financial Ratios

CY10A

CY11A

CY12A

CY13A/E

CY14E

CY15E

0.6

1.5

3.4

1.4

2.5

3.0

DPS

-

-

-

-

-

-

BVPS

6.8

9.6

13.2

13.5

16.0

19.0

PER

161

70

30

73

41

34

EV/EBITDA

39.6

22.8

14.2

25.7

16.7

14.9

P/BV

15.1

10.7

7.8

7.6

6.5

5.4

Div Yield

0%

0%

0%

0%

0%

0%

ROCE

6%

9%

12%

3%

9%

10%

ROA

4%

8%

13%

1%

9%

10%

ROE

8%

15%

35%

3%

25%

30%

Gearing

0.9

0.6

0.5

0.4

0.2

(0.0)

Turnover Growth

45%

42%

34%

-6%

14%

8%

EBITDA Growth

762%

77%

69%

-45%

54%

11%

n.a

131%

135%

-92%

802%

21%

EPS - rec

Net Profit Growth

Source: Elixir Research

8

Elixir Securities

February 17, 2014

Company Update

EFOODS

Chief Executive Officer

Junaid Iqbal

(92-21) 3569 4617

jiqbal@elixirsec.com

Pakistan Research Team

Institutional Equities

Retail Equities

Azfer Naseem, CFA

Head of Research

(92-21) 3569 4716

anaseem@elixirsec.com

Faisal Bilwani

Head of Equities - FII

(92-21) 3569 3919

fbilwani@elixirsec.com

Muhammad Ali Taufiq

Head of Equity Strategy Retail

(92-21) 3569 3922

alitaufiq@elixirsec.com

Sateesh Balani

(92-21) 3569 4679

sbalani@elixirsec.com

M. Sibtain Mustafa

Head of Equities - LII

(92-21) 3569 3911

smustafa@elixirsec.com

Sikandar Rahim

(92-21) 3569 3914

srahim@elixirsec.com

Ujala Adnan

(92-21) 35694622

Uadnan@elixirsec.com

Jawwad Aboobakar

(92-21) 3565 3182

jawwad@elixirsec.com

Kamran Kaludi

(92-21) 3569 3920

kkaludi@elixirsec.com

Mubashir Anis Silat

(92-21) 3569 4622

manis@elixirsec.com

Muhammad Raza Rawjani

(92-21) 3569 3911

rrawjani@elixirsec.com

Adil Abid

(92-21) 3569 4666

aabid@elixirsec.com

Syed Nasir Rizvi

(92-21) 3569 4679

snarizvi@elixirsec.com

HNW & Family Offices

Harris Ahmed Batla

(92-21) 3569 4706

habatla@elixirsec.com

Khurram Malik

(92-21) 3569 4602

kmalik@elixirsec.com

Ibad-ur-Rehman

(92-21) 3569 4622

irehman@elixirsec.com

Syed Tahseen

(92-21) 3569 4622

tjaved@elixirsec.com

9

Elixir Securities

Lahore Office

Tahir Maqbool

(92-42) 3577 2643

tmaqbool@elixirsec.com

Islamabad Office

Asim Ghafoor Qureshi

(92-51) 227 2341

aghafoor@elixirsec.com

Faisalabad Office

Syed Baqar Hassan

(92-41) 254 1001-4

sbhassan@elixirsec.com

February 17, 2014

Company Update

EFOODS

Analyst Certification

The Elixir Research Team certifies that (1) the views expressed in this report accurately reflect their personal views about all of the subject

companies/securities and (2) no part of their compensation was, is or will be directly or indirectly related to the specific recommendations or

views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions

contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith.

Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its

accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company

or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as,

an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner

through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the

same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions,

research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their

respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or

other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a

purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities

Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers

described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten

the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price,

or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies

effectively assume currency risk.

© Copyright 2014, Elixir Securities Pakistan (Pvt.) Ltd. All rights reserved. This report or any portion hereof may not be reproduced,

distributed, published or sent to a third party without prior consent of Elixir Securities Pakistan (Pvt.) Ltd.

10

Elixir Securities

February 17, 2014