new mauritius hotels limited ANNUAL REPORT 2013

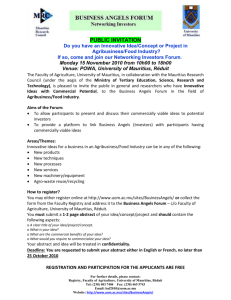

advertisement