Piecemeal Distribution of Cash - Ghanshyamdas Saraf College of

advertisement

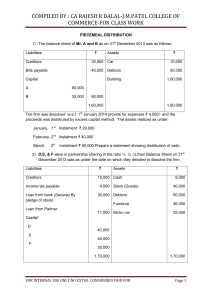

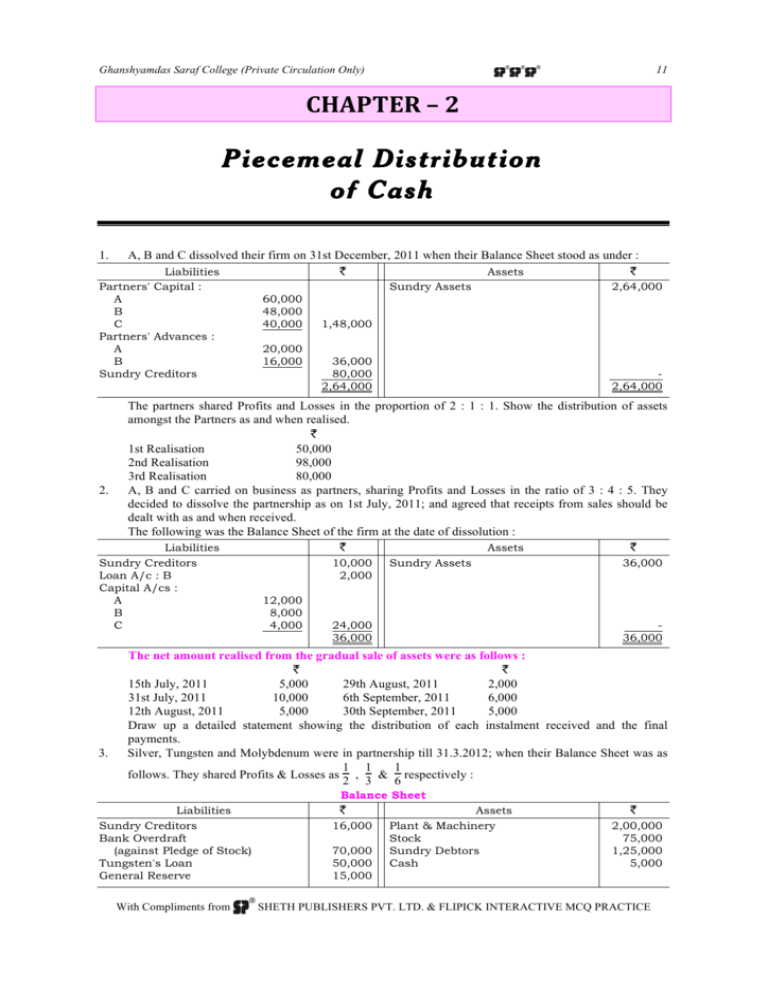

Ghanshyamdas Saraf College (Private Circulation Only) 11 CHAPTER – 2 Piecemeal Distribution of Cash 1. A, B and C dissolved their firm on 31st December, 2011 when their Balance Sheet stood as under : Liabilities ` Assets ` Partners' Capital : A B C Partners' Advances : A B Sundry Creditors 2. 20,000 16,000 2,64,000 1,48,000 36,000 80,000 2,64,000 2,64,000 The partners shared Profits and Losses in the proportion of 2 : 1 : 1. Show the distribution of assets amongst the Partners as and when realised. ` 1st Realisation 50,000 2nd Realisation 98,000 3rd Realisation 80,000 A, B and C carried on business as partners, sharing Profits and Losses in the ratio of 3 : 4 : 5. They decided to dissolve the partnership as on 1st July, 2011; and agreed that receipts from sales should be dealt with as and when received. The following was the Balance Sheet of the firm at the date of dissolution : Liabilities ` Assets ` Sundry Creditors Loan A/c : B Capital A/cs : A B C 3. Sundry Assets 60,000 48,000 40,000 10,000 2,000 12,000 8,000 4,000 Sundry Assets 24,000 36,000 36,000 36,000 The net amount realised from the gradual sale of assets were as follows : ` ` 15th July, 2011 5,000 29th August, 2011 2,000 31st July, 2011 10,000 6th September, 2011 6,000 12th August, 2011 5,000 30th September, 2011 5,000 Draw up a detailed statement showing the distribution of each instalment received and the final payments. Silver, Tungsten and Molybdenum were in partnership till 31.3.2012; when their Balance Sheet was as 1 1 1 follows. They shared Profits & Losses as , & respectively : 2 3 6 Balance Sheet Liabilities Sundry Creditors Bank Overdraft (against Pledge of Stock) Tungsten's Loan General Reserve With Compliments from ` 16,000 70,000 50,000 15,000 Assets Plant & Machinery Stock Sundry Debtors Cash ` 2,00,000 75,000 1,25,000 5,000 SHETH PUBLISHERS PVT. LTD. & FLIPICK INTERACTIVE MCQ PRACTICE 12 Ghanshyamdas Saraf College (Private Circulation Only) Capital Accounts : Silver Tungsten Molybdenum 4. 1,54,000 50,000 50,000 2,54,000 4,05,000 4,05,000 Bankers could realise only ` 68,000 on sale of pledged Stock. Other Assets were realised as follows : May 2012 Plant & Machinery realised ` 1,75,000 after meeting Brokerage ` 5,000. June 2012 Debtors realised ` 75,000. July 2012 Debtors realised ` 15,000. The remaining Debtors were taken over for ` 5,000 by Molybdenum who contributed the said amount in Cash. A sum of ` 2,500 was kept reserved for meeting realisation expenses and actual expenses of ` 2,000 were met finally on 15th July, 2012. A Creditor for ` 8,000 agreed to forego ` 2,000 while claim of an unrecorded Creditor for ` 1,000 had to be admitted. The partners decide to distribute Cash as and when realised. You are required to show the distribution of cash on the basis of "highest relative Capital". Show also the final journal entry for closing the books of the firm. Ignore interest on Tungsten's Loan. A, B and C were in partnership sharing Profits and Losses in proportion to their respective Capitals. They agreed to dissolve the partnership on 30th June, 2011; at which date their Assets and Liabilities were as under : Liabilities ` Assets ` Sundry Creditors Capital A/cs : A B C 38,000 60,000 45,000 30,000 Bank Sundry Debtors Stock Plant & Machinery 3,600 69,000 75,400 25,000 1,73,000 1,35,000 1,73,000 It was also agreed, that after the Sundry Creditors had been paid in full, the net proceeds of realisation should be distributed monthly by 15th July, 2011; sufficient Assets had been realised to permit the Sundry Creditors to be paid in full and they were, therefore, paid on that date. The gross proceeds and expenses of realisation were : Debtors (`) Plant & Machinery (`) Stock (`) Expenses (`) July August September 5. 30,000 20,000 10,000 10,000 8,500 37,000 23,000 1,000 3,000 2,000 At 30th September, the only remaining Assets were outstanding Debtors' Accounts amounting to 9,000 and it was mutually agreed that B should take them over at 50% of their book value. You are required to set out Realisation Account, the relevant part of Cash Book showing distribution to Partner's and Partner's Capital Accounts upto the close of the business. The Balance Sheet of the firm of A, B and C as on 30th June, 2011 was as under : Liabilities ` Assets ` Creditors Capital Accounts : A B C 17,000 67,000 45,000 31,500 1,60,500 Cash at Bank Debtors Stock Plant & Equipment Loan A Loan B 6,000 22,000 14,000 99,000 12,000 7,500 1,60,500 i) The partners share profits & losses in the ratio of 5 : 3 : 2. ii) Cash is distributed among the partners at the end of each month. iii) Liquidation transactions : July 2011 : ` 16,500 Collected from debtors, balance is collectable. ` 10,000 Received from sale of entire stock. ` 1,000 Liquidation expenses paid. ` 8,000 Cash retained in the business at the end of the month. With Compliments from SHETH PUBLISHERS PVT. LTD. & FLIPICK INTERACTIVE MCQ PRACTICE Ghanshyamdas Saraf College (Private Circulation Only) 13 August 2011 : ` 1,500 Liquidation expenses paid. As part of payment of his capital, C accepted a piece of equipment for 10,000 (B.V. ` 4,000). ` 2,500 Cash retained in the business at the end of the month. September 2011 : ` 75,000 Received on sale of remaining plant and equipment. ` 1,000 Liquidation expenses paid. No cash is retained in the business. Prepare a statement of piecemeal distribution of cash. 6. The following is the Balance Sheet of A, B and C (who share Profits and Losses in the ratio of 4:3:1) on 31st March, 2012; on which date they dissolve partnership. Their Capitals are to be repaid as and when the Assets realised. Balance Sheet as at 31st March, 2012 ` Liabilities Sundry Creditors Bank Overdraft Capital Accounts : A B C 26,250 8,750 70,000 30,000 50,000 Assets Buildings Machinery Stock Sundry Debtors 1,50,000 1,85,000 ` 50,000 55,000 20,000 60,000 1,85,000 Bank Overdraft is secured against stock. The Assets realised the following amounts which were immediately distributed : May 31 : Debtors ` 20,000 July 31 : Stock ` 15,000 September 30 : Debtors ` 25,000 October 31 : Machinery ` 40,000 December 31 : Buildings ` 65,000 No further sums could be realised. Prepare a statement showing the distribution. 7. A, B, and C trade in partnership sharing Profits and Losses in the proportion of 3 : 2 : 1. They decide to dissolve the firm with effect from 1st January, when the firm's Balance Sheet stood as follows : Liabilities ` Assets ` Capital Accounts : A B C Sundry Creditors Bank Overdraft (unsecured) 60,000 40,000 25,000 1,25,000 90,000 30,000 2,45,000 Land & Building Furniture & Fittings Plant & Machinery Stock in trade Sundry Debtors Investments Cash and Bank Balance 80,000 12,000 30,000 18,000 60,000 35,000 10,000 2,45,000 The Assets are being realised gradually. After meeting the expenses of realisation, the first instalment of realisation (including Cash and Bank balances) fetches ` 75,000; the second – ` 32,000; he third – ` 62,000; the fourth – ` 43,000 and the fifth and last – ` 21,000. If distribution amongst the partners is to be made after each instalment of realisation show the statement of distribution to partners at each instalment. 8. 1 1 1 , and 2 3 6 respectively. Their firm was dissolved as on 31st December, 2011 on which date the Balance Sheet of the firm was as under : Lata, Usha and Meena were in partnership, sharing profits and losses in the ratio of Balance Sheet as at 31st December, 2011 Liabilities Capitals : Lata Usha Meena With Compliments from ` 17,000 8,000 1,000 Assets Cash Debtors Stock ` 4,000 42,000 16,000 SHETH PUBLISHERS PVT. LTD. & FLIPICK INTERACTIVE MCQ PRACTICE 14 Ghanshyamdas Saraf College (Private Circulation Only) General Reserve Loans : Lata Usha Creditors 6,000 6,000 4,000 20,000 62,000 62,000 It was agreed that the net realization should be distributed in their due order at the end of each fortnight. The realisations and expenses were as under : Debtors Stock Expenses ` ` ` 4,500 500 8,500 500 3,050 1,000 500 1,000 400 600 15th January, 2012 31st January, 2012 15th February, 2012 28th February, 2012 15th March, 2012 7,500 10,500 8,500 10,500 2,050 Stock was completely disposed of and the remaining debtors were to be taken over by Meena at an agreed amount of 600. Show the statement of distribution of cash, following Highest Relative Capitals Method. 9. Rahim, Antony and Prasad were in partnership sharing Profits and Losses in proportion of 5:4:3. They agreed to dissolve the firm on 1st January, 2012; on which date their Assets and Liabilities were as under : Balance Sheet ` Liabilities Sundry Creditors Loan from Antony Capital Accounts : Rahim Antony Prasad 76,000 9,000 1,20,000 90,000 60,000 Assets Sundry Debtors Stock Plant Furniture 2,70,000 3,55,000 ` 1,45,000 1,50,000 50,000 10,000 3,55,000 The Assets were realised in the following instalment and the proceeds were distributed as and when realised : ` 1st Instalment 50,000 2nd Instalment 30,000 3rd Instalment 21,000 4th Instalment 90,000 5th Instalment 84,000 The cost of dissolution was estimated at ` 5,000 and the amount was kept as reserve before distribution of the proceeds until the 3rd Instalment when the actual cost of ` 4,000 was met. Prepare a statement showing the distribution of each Instalment realised and the final journal entry for closing the books of the firm. 10. A, B and C were partners sharing profit & losses in the ratio of 1 : 1 : 2 respectively. Their Balance Sheet was as follows : Balance Sheet as on 31st March, 2012 ` Liabilities Capitals A B C A's Loan B's Loan Creditors Govt. Taxes With Compliments from 12,000 9,000 6,000 3,750 2,500 Assets Buildings Plant and Machinery Stock ` 19,750 11,750 6,250 27,000 6,250 3,000 1,500 37,750 37,750 SHETH PUBLISHERS PVT. LTD. & FLIPICK INTERACTIVE MCQ PRACTICE Ghanshyamdas Saraf College (Private Circulation Only) 11. 15 A Bills payable of ` 2,000 maturing on 10th April, 2012 was dishonoured by the firm. It was mutually agreed that the realisation of assets should be distributed at the end of each month. The monthwise realisation and expenses was as follows : 2012 Assets Realised ` Expenses of Realisation ` 30th April 7,360 360 31st May 9,100 350 30th June 7,800 300 31st July 4,780 280 All the assets were fully realised by 31st July, 2012. The Bills Payable dishonoured was duly met by the firm on 30th April, 2012. Prepare a statement of piecemeal distribution of cash. 4 5 1 A, B and C share profits and losses in the proportion of , and . Their Balance Sheet as on 10 10 10 31st December, 2012; was as follows : Balance Sheet ` Liabilities Sundry Creditors A's Loan B's Loan Reserve fund Contingency Reserve Capital A/cs : A B C 10,000 6,000 3,000 6,000 4,000 Assets Cash in hand Other Assets 15,000 12,000 3,000 59,000 ` 3,000 56,000 59,000 The partnership is dissolved and the assets are realised as follows : ` First Realisation 10,000 Second Realisation 20,000 Third Realisation 17,000 On the date of dissolution, there was contingent liability of ` 1,000 against the firm which was settled at ` 700 at the time of second realisation. Realisation expenses were estimated at ` 2,000 but actually came to ` 1,500. C took stock worth ` 500 at the time of third realisation. Prepare a statement showing how the distribution should be made by following proportionate capital method. 12. Ajay, Vijay and Vishal were in partnership sharing profits & losses in the ratio of 5 : 3 : 2. The partnership was dissolved on 31st March, 2012, when the position was as under : Liabilities ` Assets ` Capital A/cs : Ajay Vijay Ajay's Loan Mrs. Deepika's Loan Bank Loan Creditors 40,000 Nil 40,000 14,000 16,000 4,000 30,000 1,04,000 Cash at Bank Debtors Stock Vishal's Capital 500 44,000 49,500 10,000 1,04,000 Realisations should be distributed as safely as possible. The realisations were : Date Realisation 2012 15th April 19,500 31st May 10,000 30th June 30,000 31st July 20,000 31st August 6,000 30th September 8,000 Vishal brought necessary cash at the time of last realisation. Show distribution of cash to each claimant. With Compliments from SHETH PUBLISHERS PVT. LTD. & FLIPICK INTERACTIVE MCQ PRACTICE