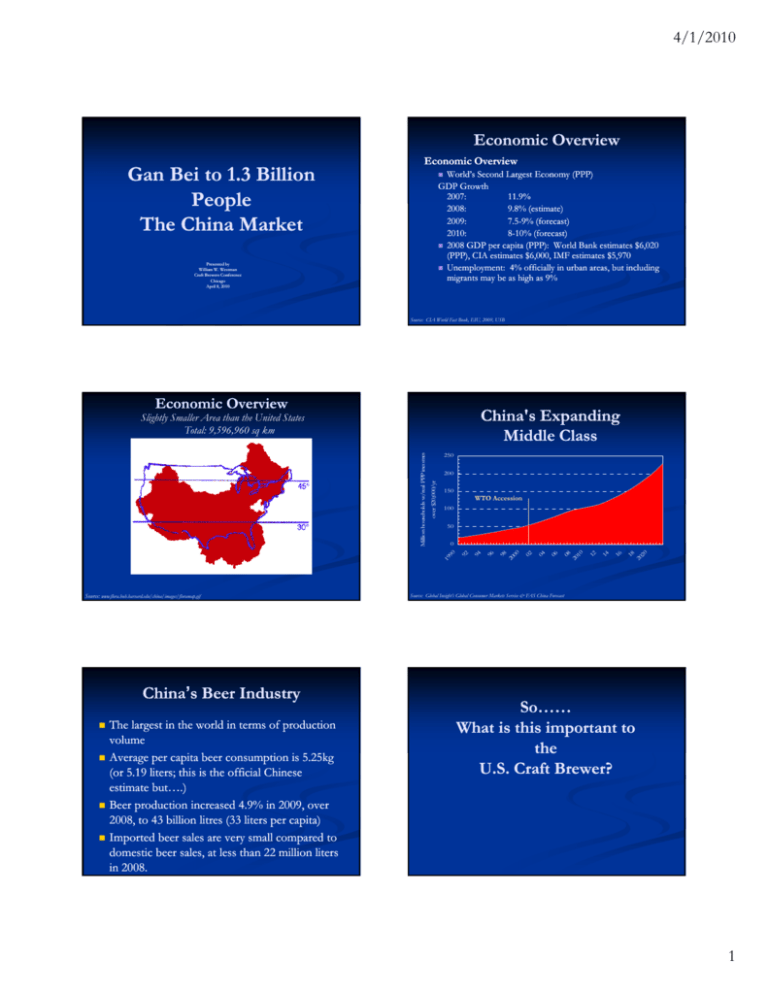

Gan Bei to 1.3 Billion People Th Chi M k t e China Market The China

advertisement

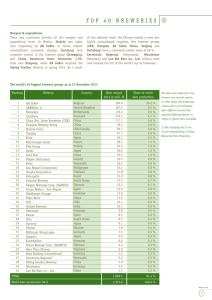

4/1/2010 Economic Overview Gan Bei to 1.3 Billion People Th China The Chi M Market k t Economic Overview World’s Second Largest Economy (PPP) GDP Growth 2007: 11.9% 2008: 9.8% (estimate) 2009: 7.57 5-9% (forecast) 7.5 2010: 8-10% (forecast) 2008 GDP per capita (PPP): World Bank estimates $6,020 (PPP), CIA estimates $6,000, IMF estimates $5,970 Unemployment: 4% officially in urban areas, but including migrants may be as high as 9% Presented by William W. Westman Craft Brewers Conference Chicago April 8, 2010 Source: CIA World Fact Book, EIU, 2009, USB Economic Overview China's Expanding Middle Class 250 150 WTO Accession A i 100 50 Source: www.flora.huh.harvard.edu/china/images/floramap.gif China’’s Beer Industry China The largest in the world in terms of production volume Average per capita beer consumption is 5.25kg (or 55.19 19 liters; this is the official Chinese estimate but… but….) Beer production increased 4.9% in 2009, over 2008, to 43 billion litres (33 liters per capita) Imported beer sales are very small compared to domestic beer sales, at less than 22 million liters in 2008. 18 20 20 16 14 12 08 20 10 06 04 02 98 20 00 96 94 0 92 over $20,0 000/yr 200 19 90 Million households w w/real PPP incomes Slightly Smaller Area than the United States Total: 9,596,960 sq km Source: Global Insight’s Global Consumer Markets Service & FAS China Forecast So…… What is this important to the U.S. Craft Brewer? 1 4/1/2010 Opportunities for Imported Beers Rising disposable incomes and a developing taste Imported, specialty items will spur demand Favorable Environment I Increase iin fforeign i community it in i China Chi andd China’s Chi ’ emergence in the world economy Accession to the WTO has benefited Chinese industries across the board Gradual removal of market barriers and trade restrictions creating increased competition among domestic and foreign operators Opportunity to introduce high-value, imported American Craft Beers The Saddle Restaurant Beijing Looking Ahead China’s huge population, coupled with the China’ market’’s immaturity and sound longmarket long-term economic structure, all serve to create a very appealing market market. China’’s economic recovery remains firmly on China track Craft Brew Market in China Expat community is well established and growing in China Many more int’l students studying Chinese as interns then seeking work in China Increase in international restaurants Sports bars open 2424-hours per day, 7 days/week English Premier League, Cricket, Australian Rules Football, World Cup, ATP Tennis Circuit, NFL and MLB (esp. the Yankees on Chinese channels) 2 4/1/2010 International Influence Solana’s Tsingtao Brew Pub The NBA and CBA – Yao Ming in the USA; Stephan Marbury in China. Chinese students studying abroad, in the USA! I Increasing i destination d i i malls: ll The Village in Sanlitun (Addidas, Blue Frog, Union Grill, Element Fresh, Apple Store) Lufthansa Center (high end designer stores + Paulaner Brew Pub) Solana Mall (Tsingtao brewery, All American Sports Bar, Bling, ice skating rink) The Night Life 1308 Beijing Night clubs and bars open all night International DJs and theme nights Fashion and Style— Style—The World of Suzie Wong, A Apartment 8 in i Chaoyang, Ch Cl Clubs/Bars b /B iin Fi Five SStar Hotels Chinese culture and KTV. German Brew Pub 3 4/1/2010 Retail Market Increasing incomes – consumers shop in Carrefour, Wal Wal--Mart, City Shop, and Jenny Lou’s— Lou’s —opportunities of imported craft beers. Emphasis on food safety safety, packaging packaging, international selection of beverages and food products. Wine market expanding very fast. Cheeses and yogurt. 4 4/1/2010 Market Development Strategies Emphasis on the Expat community More sophisticated and wealthy Chinese consumers who travel frequently E Emerging i Ci City M Markets k – Distribution Di ib i N Networks k Rising incomes have driven the consumer foodservice market, and also the development of pubs and bars Food Food--beverage pairing promotions for fivefive-star chefs in hotels and international restaurants Educational seminars on U.S. craft beers 5 4/1/2010 Techniques Effective promotion tools: --Simple -Simple promotional items in popular expat locations plus developing relationships with key F&B managers and bartenders. bartenders --Sales -Sales girls hired by beer manufacturers in bars and restaurants are effective tools to push sales, and to introduce new or premium imported American Craft Beer and Ale to Chinese consumers. Additional Market Information Beer Sales Regional Differences Off-trade accounts for 68% of total volume Offsales in 2008/2009, which includes domestic and imported beer. On--trade channel sales is growing faster On faster, due d e to the strong development of the consumer foodservice market. Consumer preferences vary in different regions in China. People in Northwest China tend to prefer stronger tasting and high--strength beers. high beers. The majority of Chinese consumers prefer lighter tasting and lowerlowerstrength beers. Growth of Imported Premium Lager (>Y20 ($2.93) per bottle) Pricing Sector 2008/2009 20042004-2009 CAGR Pricing Premium Above RMB20 per liter Standard RMB7RMB7-20 per liter Economy Below RMB7 per liter Growth of sales volume 3 6% 3.6% -4.6% 4 6% Growth of Value 5.7% 5.7 % -2.0% 2.0% Source: Official statistics, Trade associations, Trade press, Company research, Store checks 6 4/1/2010 Pricing Pricing Standard lager brands (RMB7(RMB7-20 per litre) recorded the strongest growth during 2009. The leading standard lager brand in China is Tsingtao which recorded a vol Tsingtao, volume me share of 32% in 2009, with demand being fuelled by rising demand for higher quality amongst increasingly sophisticated consumers. Demand for premium lager brands (> RMB20 per litre) remains limited in China, with such products recording a total volume share of just 2% in 2009 2009. Premium lager sales are dominated by multinational brands like Budweiser, Heineken, Tiger, and Carlsberg, with the majority of sales being made on on--trade. Brand Shares of Top Ten Domestic Brand Beer 2006006-2009 Domestic Competition Brand Top Six Domestic companies in beer sector China Resources Enterprise Co., Ltd with production capacity of around 10 billion liters. Tsingtao Brewery Co., Ltd Beijing Yanjing Brewing Corp Harbin Brewery Group Co., Ltd Henan Jinxing Brewery Group Guangzhou Zhujiang Brewery Co. Ltd No official micro brewers in China. There is a China Food Industry Association’s Beer Chapter. The official website is http://www.haicent.com/ Company 2006 2007 2008 2009 Snow China Resources 8.8% 13.3% 15% 17% Tsingtao Tsingtao Brewery 4.5% 4.8% 5.8% 6.1% Yanjing Beijing Yanjing Brewery 4.5% 4.6% 4.9% 5.2% Harbin (Anheuser(AnheuserBusch InBev NV) Harbin Brewery Group Ltd 0 0 4.5% 4.7% Zhujiang Guangzhou Zhujiang Brewery Co. ltd 3.8% 3.5% 3.0% 2.9% Hans Tsingtao Brewery 1.7% 2.0% 2.6% 2.8% Jinxing Henan Xinxing Brewery Group 2.9% 2.8% 2.7% 2.7% Liquan Beijing Yanjing Brewery 1.6% 1.9% 2.2% 2.6% Sedrin (Anheruser(AnheruserBusch InBev NV) Inbev Sedrin Brewery Co. - - 3.1% 2.6% Laoshan Tsingtao Brewery Co. Ltd 1.5% 1.7% 2.2% 2.4% Others 51.1% Source: Official Statistics, Company Research Company Shares of Top Ten Global Beer Brands 22006 006--2009 % total Volume 2005 2006 2007 2008 Beer Imports by Country/Region of Origin (Liter) Country 2009 World 2007 2008 2009 % Change 43.96 21,828,148 28,132,881 40,501,332 China Resources enterprise 13.1 15.4 17.9 17.9 19.2 Germany 7,325,490 8,238,110 12,414,016 Tsingtao Brewery 13.4 12.9 12.9 13 13.4 Mexico 7,924,683 9,012,035 10,235,487 Taiwan 1,783 255,511 4,639,305 2,112,223 3,678,992 3,913,456 433,535 680,667 1,484,690 Anheuser--Busch InBev NV Anheuser - - - 12.1 10.8 Beijing Yanjing Brewery Co. 10.2 10.2 10.4 10.4 10.7 South Korea Belgium Henan Jinxing Brewery Group 4.2 4.6 4.3 4.2 4.1 France Guangzhou Zhujiang Brewery Co. 4.0 3.8 3.5 3.0 2.9 Malaysia Suntory Holdings Ltd 2.4 2.8 2.6 2.4 2.5 Russia Carlsberg A/S 1.8 1.9 1.9 1.8 1.8 Netherlands Kingway Brewery Holdings Ltd 1.4 1.4 1.4 1.5 1.6 Ireland Asahi Breweries Ltd 1.7 1.9 1.9 1.6 1.4 Source: Official Statistics, Company research 50.69 13.58 1,715.70 6.37 118.12 61.42 191,465 875,230 1,412,790 1,303,114 1,352,099 1,269,969 282,684 1,341,810 1,132,262 632,584 840,707 890,100 390,240 499,448 515,917 -6.07 -15.62 5.88 3.3 Source: World Trade Atlas, Beer made from Malt. 7 4/1/2010 Beer Sales Volume through On-trade and Off OnOff--trade Channel Beer Production, Imports and Exports Million Liters 2004 2005 2006 2007 2008 Production 29,100.5 30,620 35,151.5 38,905.7 41,030.9 Apparent Consumpti on 28,986.1 30,494.2 34,995.3 38,721.9 40,817.4 Exports 141.3 147 177.5 205.7 241.6 Imports 26.8 21.1 21.3 21.8 28.1 Source: Global Trade Information Service (GTIS) Million liters Domestic beer manufacturers dominate beer sales in China, with the top six domestic manufacturers accounting for 52.6% of total beer volume sales in the country country. Increasing acquisition and improved distribution channel in wider areas made domestic market share larger than before. Multinational manufacturers such as Carlsberg and Heineken are increasingly focused on China. Carlsberg acquired a beer hop manufacturer in Xinjiang province in West China in April 2009 2009,, and is developing its operations in West China. Leading Taiwanese brand Taiwan Beer also entered mainland China in 2009. 2009. 2006 2007 2008 2009 18 834 18,834 20 711 20,711 23 484 23,484 26 179 26,179 27 509 27,509 29 050 29,050 Food Service 8,765 9,726 11,110 12,462 13,165 13,952 Total 27,599 30,437 34,594 38,641 40,674 43,002 Source: Official statistics, trade associations, trade interviews and estimates Example of Acquisition Competition 2005 R il Retail Competition 2004 Snow is a 51:49 joint venture between Hong Kong’s China Resources Enterprises and Anglo Anglo--South African Brewing SABMiller. In April 2009, China Resources Snow Breweries, the country’s leading brewer by volume acquired ShandongShandong-based Amber B Breweries i for f US$41.78mn(CNY285mn) US$41 78 (CNY285 ) in i a bid to become b a truly national player in China and to beat its fierce competitor Tsingtao. The acquisition not only increased Snow’s production capacity but to establish a manufacturing presence in a market dominated by its rivals rivals--Tsingtao. Which Shandong province accounts to nearly 50% of Tsingtao’s total revenues. Opportunities To increase profit margins, manufacturers are reducing packaging from standard 630630-640ml to 500ml, or 600ml, and the smaller packs are more popular in the market market. 8 4/1/2010 Opportunities Chinese are yet to adapt to the relatively bitter taste of ales, dark beer and stout. Local consumers prefer low priced locallylocallybrewed lagers ($0.30 ($0 30 per 500 ml in local Beijing kiosks). Off--trade or retail sales are limited. Off 9