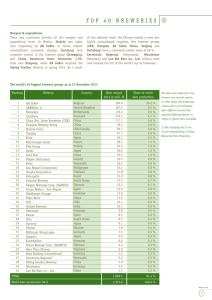

I. Consolidated Profit Forecast of Tsingtao Brewery

advertisement

Tsingtao Brewery Company Limited

The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this

announcement, makes no representation as to its accuracy or completeness and expressly disclaims

any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any

part of the contents of this announcement.

TSINGTAO BREWERY COMPANY LIMITED

(a joint stock limited company established in the People's Republic of China)

ISSUE OF A MAXIMUM OF 100,000,000 A SHARES

OF PAR VALUE OF RMB1.00 EACH

IN THE PRC

SUMMARY

Following the 2000 Extraordinary General Meeting, which had approved, among others, the

application for and implementation of the issue of additional A Shares and proposed listing of such

additional A Shares on the SSE in the PRC, the Board is pleased to announce that the approval of

the A Share Issue was granted by the CSRC on 17 January, 2001. An intended prospectus (the

"Intended Prospectus") of the A Share Issue has been published in the PRC newspapers on 20

January, 2001 and application will be made to the SSE for the listing of the A Shares.

The Company has written to the Stock Exchange of Hong Kong Limited requesting for suspension

of dealings of H Shares on 22 January 2001 pending the issue in Hong Kong of this announcement

and has applied for resumption of dealings of H Shares on 23 January 2001 (i.e. the day on which

this announcement is published).

Reference is made to the announcements of the Company dated 19 September, 2000 and 7

November, 2000 regarding, respectively, the proposed application for the issue of additional A

Shares of the Company and the resolutions passed at the Extraordinary General Meeting. Following

the 2000 Extraordinary General Meeting, which had approved, among others, the application for

and implementation of the issue of additional A Shares and proposed listing of such additional A

Shares on the SSE in the PRC, the Board is pleased to announce that the approval of the A Share

Issue was granted by the CSRC on 17 January, 2001. The Intended Prospectus of the A Share

Issue has been published in the PRC newspapers on 20 January, 2001 and application will be

made to the SSE for the listing of the A Shares. The Intended Prospectus of the A Share Issue

included a profit forecast of the Company for the years ended 31 December, 2000 and 31

December, 2001 (the "Profit Forecast") and the financial estimate of the current acquisitions.

Tsingtao Brewery Company Limited

22/1/2001

1

Tsingtao Brewery Company Limited

The Profit Forecast, which is compiled on the basis of the assumptions made by the directors

of the Company, has been prepared under the basis of the relevant generally accepted

accounting principles and regulations applicable to PRC enterprises ("PRC GAAP") and

accounting policies consistent in all material respects with those adopted by the Company as

set out in the Intended Prospectus of the A Share Issue. The preparation of the Profit Forecast

is the sole responsibility of the Company. The directors of the Company confirm that the

Profit Forecast and the financial estimate of the current acquisitions have been stated herein

after due and careful enquiry. The compilation and calculations of the Profit Forecast have

been reviewed by the Company's PRC auditors, Arthur Andersen -Hua Qiang Certified

Public Accountants. The Profit Forecast and the financial estimate of the current acquisitions

have not been reviewed by any independent financial adviser or auditor in Hong Kong and

may be subject to adjustment if they were to be compiled based on accounting principles

generally accepted in Hong Kong ("HK GAAP").

The directors of the Company assume responsibility for the correctness, accuracy and completeness

of the content of the Intended Prospectus of the A Share Issue. Any decision made by the securities

regulatory authority in the PRC in respect of the A Share Issue does not represent any substantive

judgement on or assurance of the value of the shares publicly offered by the Company or the

investment return for investors. Any representation to the contrary in the Intended Prospectus of the

A Share Issue would be a false and untrue statement.

A summary of the Intended Prospectus of the A Share Issue is set out below:

Stock

: SSE

exchange

for

the

proposed

listing of the

A Shares

Type

securities

of : Domestically listed ordinary shares denominated in Renminbi (A Shares)

Stock code in : 600600

domesticallylisted stock

exchange

Nominal value : RMB1.00 per share

Target

subscribers

Number

shares

: Domestic natural persons and institutional investors, including domestic legal

persons and securities investment funds other than those prohibited under the State

laws and regulations.

of : Maximum 100,000,000 A Shares; the ultimate

Tsingtao Brewery Company Limited

22/1/2001

2

Tsingtao Brewery Company Limited

to

issued

be number of shares issued shall be determined according to the applications to be

made under the Current Issue, and will be announced in the announcement of

results of the A Share Issue after the closing of application.

Structure

of : A combination of "book-building" process

the

A

Share outside the system network of SSE ("Network") targeting at institutional investors

Issue

outside the Network, and "book-building" process within the Network targeting at

public investors, within an indicative price range.

In order to qualify for the pre-emptive right in the proportion of 10:3, the

shareholders whose names appearing in the register of the members of the A

Shares of the Company in issue ("Existing Shareholders") at the close of business

on the date of entitlements.

Determination : The upper limit of the indicative price range will

of

the

be set at the simple arithmetic average of the

indicative

Price Range closing price of Tsingtao Beer A Share in the 20 trading days prior to the issue of

the Intended Prospectus of Tsingtao Brewery Company Limited, that is

RMB10.87 per Share, and the lower limit shall be set at 70% of the maximum

price, that is RMB7.61/Share. The indicative price range of the A Share Issue is

therefore RMB7.61/Share-RMB10.87/Share. The final issue price shall be

determined by the Issuer and the lead underwriter by reference to the results of the

book-building process targetting at institutional investors outside the Network, and

certain times of over-subscriptions.

Estimated

: It is estimated that the gross proceeds from the

gross

proceeds

A Share Issue will be RMB800,000,000 (inclusive

(inclusive of of issue expenses).

issue

expenses)

Use

proceeds

of : The capital deployment order of the investment projects is arranged according to

their significance to the Company and urgency for the use of the proceeds.

After receiving the proceeds, the Company will invest in the projects by stages

depending on their progress. The proceeds which are not for immediate use will be

used as additional working capital of the Company.

Expected Timetable for the A Share Issue

Time

Description

January 20

Publication of the Intended Prospectus and notices outside the Network

February 5

Publication of reminder and roadshow notices

Tsingtao Brewery Company Limited

22/1/2001

3

Tsingtao Brewery Company Limited

February 8

Registration of entitlements

February 6- Commencement of roadshows live and within the

February 8 network

February 9

Book-building targeting at institutional investors outside the Network

February 12 Assessment of applications and statistics of the book-building process and

determination of the issue price and number of shares to be issued

February 13 Announcement of the book-building results and the price determination

February 14 Price determination for applications by public investors

February 15 Proceeds made available

February 16 Capital verification

February 19 Announcement of ballot rates and the placing ratio applicable to institutional

investors

February 20 Announcement of ballot results, refunds, actual number of placing shares and making

up the difference by institutional investors

In the event of force majeure, the above schedule shall be postponed accordingly.

Expected Total issue expenses

Expenses relating to the A Share Issue include underwriting fee, registered accountant's fee

(auditing, capital verification and review of profit forecast, etc.), legal charges, issue expenses

within Network, listing sponsorship expenses, roadshow expenses and other expenses, total

approximately RMB29.54 million.

(RMB10,000)

Underwriting fee

1,740

Registered accountant's fee

350

Payable to both Arthur Andersen

and Arthur Andersen -Hua Qiang

Certified Public Accountants

Legal charges (of which RMB400,000 is PRC lawyer's fees) 80

Issue expenses within Network

284

Listing sponsorship expenses

100

Roadshow expenses

200

Other expenses

200

Total

Approx.

2,954

Changes of shareholding structure of the Company before and after the A Share Issue are as

Tsingtao Brewery Company Limited

22/1/2001

4

Tsingtao Brewery Company Limited

follows:

As the quantity and issue price of the A Share Issue are not yet determined, changes of the

shareholding of the Company will be disclosed after completion of the Current Issue.

(I) Use of the Proceeds

1. Not more than 100,000,000 additional A Shares will be issued by the Company. It is expected

that the proceeds from the issue will amount to RMB800 million (before deducting issue expenses)

and such proceeds have been planned to be used as follows:

(1) RMB339.99 million will be used to acquire the foreign investor equity in certain Sino-foreign

equity joint venture brewery production enterprises, which includes:

-RMB153.75 million will be used for the acquisition of the 75% foreign investor equity in

Carlsbrew Shanghai;

-an investment of RMB186.24 million will be made for the acquisition of 62.64% foreign investor

equity in Five Star Co. and 54% foreign investor equity in Three Ring Co.

(2) RMB423 million will be used to implement technology renovation for the wholly-owned

factories and subsidiaries of the Company, which includes:

-RMB68 million will be applied to the technology renovation project for the pure and draught beer

production line of Tsingtao Brewery Factory No.2;

-RMB120 million will be applied to the technology renovation project for the production line of

Xi'an Co. with annual production capacity of 50,000 tonnes of draught beer;

-RMB77 million will be applied to the technology renovation project Phase I for Ma'anshan Co.

with annual production capacity of 100,000 tonnes of beer;

-RMB58 million will be applied to the technology renovation project for Zhuhai Co. with annual

production capacity of 150,000 tonnes of beer;

-RMB90 million will be applied to the technology renovation project for Sanshui Co. with annual

production capacity of 200,000 tonnes of beer;

-RMB10 million will be used to establish an electronic sale network of the Company.

2.

Approval for individual project of the investments

Approval for

Project Name

individual project

Remarks

Acquisition of the 75%

Wai Jing Mao Bu (2000)

Approval from MOFTEC

foreign investor equity

Wai Jing Mao Zi Er

in Carlsbrew Shanghai

Han Zi No.982

Acquisition of the 62.64% Agreement

Approval procedures are

and 54% foreign

underway

investor equity in

Five Star Co. and

Three Ring Co

respectively

Technology renovation

Tsing Jing Ji Gai (2000)

Approving and reviewing

project for the pure

No. 557

the feasibility study report

and draught beer

Tsing Jing Ji Gai (2000)

-ditto production line of the

No. 556

Tsingtao Brewery

Tsingtao Brewery Company Limited

22/1/2001

5

Tsingtao Brewery Company Limited

Factory No.2

Technology renovation

Shi Jing Fa (2000) No.249 Approving and reviewing

project for the production the feasibility study report

line of Xi'an Co. with

Shi Jing Fa (2000) No.250 -ditto annual capacity of 50,000 Shi Jing Fa (2000) No.251 -ditto –

tonnes of pure and

Shi Jing Fa (2000) No.252 -ditto –

draught beer

Shi Jing Fa (2000) No.253 -ditto –

Shi Jing Fa (2000) No.254 -ditto Technology renovation

Wan Jin Mao Ji (2000)

Approving and reviewing

project phase I for

No.553

the project proposal

Ma'anshan Co. with

Jing Mao (2000) No.67

-ditto –

annual production

Jing Mao (2000) No.9

-ditto –

capacity of 100,000

tonnes of beer

Technology renovation

Zhu Ji Gong Ji (2000)

Approving and reviewing

project for Zhuhai Co.

No.31

the feasibility study report

with annual production Zhu Ji Gong Ji (2000)

-ditto –

capacity of 150,000

No.32

tonnes of beer

Technology renovation

Fo Jing Gai (1999) No.37 Approving and Reviewing

project for Sanshui Co.

the project proposal

with annual production Fo Jing Gai (2000) No.38 -ditto –

capacity of 200,000

Fo Jing Gai (2000) No.45 -ditto –

tonnes of beer

Fo Jing Gai (2000) No.102 -ditto Establishment of electronic Qing Jing Ji Gai (2000)

Approving and reviewing

sale network

No.631

the project proposal

of the Company

3. Basic information about the investment projects

RMB339.99 million will be used to acquire the equity interests held by foreign investors in certain

Sino-foreign equity joint venture brewery of the Acquisitions.

Objectives of the acquisitions

Beijing and Shanghai are two international cities in China with the largest population and most

developed economically. In recent years, as China further opens to the rest of the world, an

increasing number of foreign brewery enterprises have invested and set up production plants in the

mainland to produce beers of international brandnames, which have to a certain extent created

competition with the development of the domestic brewery industry. Taking the opportunity of the

withdrawal of ASIMCO I, ASIMCO VIII and Carlsberg HK from their disappointing investments

in Beijing and Shanghai, the Company acquired at low cost the foreign equity interests in Five Star

Co., Three Ring Co. and expand its operation scale, in an effort to protect the national brewery

industry, build up the reputation of Chinese beer brandnames as well as to increase the

competitiveness of domestic beer in the international market. The implementation of this

development strategy not only can contribute to the national brewery industry, but also serves to

create a new "platform" for rapidly enhancing the image of the Company's brandname. The

acquisitions will save time for the Company in the investment and establishment of new plants in

other regions. Through merging with its competitors in taking up a significant share in the domestic

market in a most efficient manner, the Company has founded solid base for rapidly upgrading

Tsingtao Brewery Company Limited

22/1/2001

6

Tsingtao Brewery Company Limited

"Tsingtao Beer" as an internationally recognised brandname of beers.

1. Acquisition of 75% foreign investor equity of Carlsbrew Shanghai

(i) Introduction of the company to be acquired

The investment amount of the project is RMB153.75 million and will be fully financed from the

proceeds of the A Share Issue. The Equity Transfer Agreement entered into between the Company

and Carlsberg HK has been approved by MOFTEC and has become effective.

Carlsbrew Shanghai is a Sino-foreign equity joint venture jointly invested and established by

Carlsberg HK and Songjiang Co. Its construction commenced in 1996 and was completed in 1998

for commercial production. The registered capital of the company is US$36,640,000, of which 95%

equity interests as to Carlsberg HK and 5% equity interests as to Songjiang Co. Its principal

activity is manufacturing and sales of beers. Its existing annual capacity is 100,000 tonnes.

According to the audit report Pu Hua Yong Dao (00) No. 28 issued by 普華永道中天會計師事務有限公司, as at 28th June, 2000, total assets of Shanghai Jialiang were RMB597.53 million with

total liabilities of RMB601.71 million, making negative net assets of RMB4.18 million. Sales

revenue for the year amounted to RMB45.13 million and net loss was RMB93.05 million.

(ii) Method of Acquisition and Consideration

According to the 上海財瑞資產評估有限公司 Hu Cai Ping Zi (2000) No.073 "Overall Asset

Valuation Report", the total value of the assets of Carlsbrew Shanghai was 390.36 million as at the

assessment date 28 June, 2000 with assessed aggregate liabilities of RMB524,330,000 and assessed

net asset of a negative amount of RMB133,970,000. Pursuant to the Equity Transfer Agreement

entered into between the Company and Carlsberg HK and the relevant documents. Carlsberg HK

agreed to the asset and debt restructuring whereby all debts of Carlsbrew Shanghai will be assumed

by Carlsberg HK, while only the assessed net asset of RMB265,000,000 will eventually remain

with Carlsbreg HK. The company intended to acquire the 75% equity interests of Carlsbrew

Shanghai held by Carlsberg HK upon reorganisation at a consideration of RMB153.75 million.

Meanwhile, Carlsberg HK would also perform the obligation to acquire 5% equity interests of

Carlsbrew Shanghai held by Songjiang Co.. Upon completion of the current acquisition, as far as

the shareholding structure of Carlsbrew Shanghai is concerned 75% equity interest will be held by

the Company and 25% Carlsberg HK. Moreover, Carlsbrew Shanghai will change its name to 青島

啤酒上海松江有限公司 and will continue to be entitled to the benefits enjoyed by Sino-foreign

equity joint ventures.

(iii) Financial estimate of the current acquisition

Upon the completion of the current acquisition, Tsingtao Brewery Shanghai Songjiang Co., Ltd.

will not assume any liabilities of Carlsbrew Shanghai prior to the acquisition. What the Company

actually purchases will be 75% of the productive assets and facilities of Carlsbrew Shanghai, which

will be used to produce Tsingtao beer and embark on marketing business. Production and operation

of Tsingtao Brewery Shanghai Songjiang Co., Ltd will have no continuity with Carlsbrew Shanghai

prior to acquisition.

It is estimated that Tsingtao Brewery Shanghai Songjiang Co., Ltd. will have annual capacity of

Tsingtao Brewery Company Limited

22/1/2001

7

Tsingtao Brewery Company Limited

100,000 tonnes of beers by 2002 with realized product sales revenue RMB368.09 million, total

profits RMB28,260,000 and payback period of 4.4 years.

(2) Acquisition of 62.64% and 54% foreign investor equity interests in Five Star Co. and

Three Ring Co. respectively

(i) Introduction of the company to be acquired

Five Star Co. is a Sino-foreign equity joint venture jointly invested and established by Five Star

Group and ASIMCO I and was established on 12 January, 1995. The registered capital of Five Star

Co. is RMB862 million, of which 37.36% equity interest is held by Five Star Group and 62.64%

ASIMCO I. Its principal activity is manufacturing of beer under the brandname "五星" and its

existing annual production capacity is 200,000 tonnes of beer. Three Ring Co. is a Sino-foreign

equity joint venture jointly invested and established by Five Star Three Ring Co. and ASIMCO VIII

and was established on 5 January, 1995. The registered capital of Three Ring Co. is US$29.8

million, of which 46% equity interests as is held Five Star Three Ring Co. and 54% ASIMCO VIII.

Its principal activity is manufacturing of beer under the brandname "雲湖" and its existing annual

production capacity is 200,000 tonnes of beer.

The shareholding structure of Five Star Co. and Three Ring Co. is as follows:

Five Star Co. currently owns two branch factories. Factory I is situated at Guang An Men Wei,

Xuan Wu District, Beijing with a site area 55 acres. Factory No 2 is located in the rural area of

Beijing called Xian Ping. The predecessor of Three County had a Ring Co. is 北京三環啤酒廠

which is situated at Miyun County, Beijing. It was established and commenced production in 1990

and had a site area of 203 acres.

According to the Accounting Report and Audit Report from Registered Accountants for the period

1 January, 2000 to 25 June, 2000 for Five Star Co. issued by Arthur Anderson 嘕 ua Qiang Certified

Public Accountants, total assets of Five Star Co. was RMB786.16 million, total liabilities was

RMB317.15 million, net assets was RMB469.01 million, sales revenue for the year amounted to

RMB40.40 million and net loss was RMB91.57 million.

According to the Accounting Report and Audit Report from Registered Accountants for the period

1 January 2000 to 25 June 2000 for Three Ring Co., issued by Arthur Anderson 嘕 ua Qiang

Certified Public Accountants, total assets of Three Ring Co. was RMB412.24 million, total

liabilities was RMB220.44 million, net assets was RMB191.80 million, sales revenue for the year

amounted to RMB101.32 million and net loss was RMB62.26 million.

Tsingtao Brewery Company Limited

22/1/2001

8

Tsingtao Brewery Company Limited

(ii) Method of Acquisition and Consideration

According to the Asset Valuation Report 中資資產評估有限公司 Zhong Zi Ping Bao Ji (2000)

No.051-1, as at the assessment date of 30 June, 2000, the net asset value of Five Star Co. was

RMB150.13 million. Based on such net asset value, the current transfer value of 62.64% equity

interest owned by its foreign investor, ASIMCO I is RMB94.04 million. Pursuant to the Equity

Transfer Agreement entered into between the Company and ASIMCO I, the Company intends to

acquire the 37.64% equity interest in Five Star Co. held by ASIMCO I with a consideration of

RMB6.01 million as 青島啤酒香港貿易有限公司, a wholly-owned subsidiary of the Company,

intend to acquire 25% equity interest in Five Star Co. as held by ASIMCO I at a consideration of

US$3.99 million.

According to the Asset Valuation Report 中資資產評估有限公司 Zhong Zi Ping Bao Ji (2000)

No.051-2, as at the assessment date of 30 June, 2000, the net asset value of Three Ring Co. was

RMB203.56 million. Based on such net asset value, the current transfer value of 54% equity

interest in Three Ring Co. as owned by its foreign investor ASIMCO VIII amounts RMB109.92

million. Pursuant to the Equity Transfer Agreement entered into between the Company and

ASIMCO VIII, the Company intend to acquire the 54% equity interest in Three Ring Co. as held by

ASIMCO VIII at a consideration of US$12.5 million.

In the above two transactions, the total current transfer value of the equity interest owned by the

foreign investors amounts to RMB203.96 million and the Company intends to apply US$22.5

million (equivalent to RMB186.24 million) to acquire the said equity interest.

(iii) Approvals

The above two transactions have been approved by the board of directors of the target company

meeting in accordance with its Articles of Association. The relevant contracts have been submitted

to the MOFTEC and the BFETC for approval. Upon completion of the acquisition, Five Star Co.

will maintain the status of Sino-foreign equity joint venture while Three Ring Co. will be

transformed from a Sino-foreign equity joint venture to a domestic enterprise.

(iv) Financial estimate for the current acquisition

It is estimated that Five Star Co. and Three Ring Co. will have realized product sales revenue of

RMB951.1 million (of which RMB458.94 million as to Five Star Co. and RMB492.16 million as to

Three Ring Co.), total profits of RMB58.12 million of which RMB19.79 million as to Five Star Co.

and RMB38.33 million as to Three Ring Co.) and the investment payback period of Five Star Co.

and Three Ring Co. is 4.23 years and 4.5 years respectively.

(3) Technology renovation project for pure and draught beer production line of Tsingtao

Brewery No.2 Factory

The total investment amount of the project is RMB68 million, of which RMB60.04 million is fixed

assets investment and RMB7.96 million is ancillary current capital. The project comprises of the

technology renovation and expansion of Tsingtao Brewery No.2 Factory and the 24,000

bottles/hour filling bottle production line of pure and draught bottle beers of Tsingtao Brewery No.2

Factory. The fixed asset investment of the 24,000 bottles/hour filling bottle production line of pure

Tsingtao Brewery Company Limited

22/1/2001

9

Tsingtao Brewery Company Limited

and draught bottle beers and technology renovation and expansion projects amounts to RMB41.43

million and RMB18.61 million respectively.

Approvals of the feasibility study reports for the projects for the 24,000 bottles/hour filling bottle

production line of pure and draught bottle beers and technology renovation and expansion have

been granted by the QABSA by documents Qing Jing Ji Gai (2000) No.556 and No.557,

respectively.

The construction period for the projects will last for 12 months. Upon the completion of the

projects, it will generate additional annual sales revenue of RMB247.55 million and profits of

RMB24.08 million.

(4) Technological renovation for the production lines of Xi'an Co. with an annual production

capacity of 50,000 tonnes of pure and draught beer

Total investment of the project amounts to RMB172.50. According to the resolutions passed at the

general meeting of Xi'an Co. held on 8 October 2000, the Company intends to make unilateral

contribution of RMB120 million out of the proceeds of the amount issue of A Shares to Xi'an Co.

for implementation of the project. The project comprises by the following six items: fresh beer

production lines, storage capacity, packaging production lines, storage capacity, packaging

production lines, supporting engineering, infrastructural and utilities engineering and barley juice

production lines. The Xian Municipal Economic Commission has approved the feasibility study

reports for the various technological renovation projects by its respective approval document ref.

Shi Jing Fa (2000) No.249, 250, 251, 252, 253 and 254.

The investment amounts of each of the said sub-project are as follow:

Technological Renovation Sub-Projects Investment

(RMB)

Fresh beer production lines

29,000,000

Storage capacity

29,000,000

Packaging production line

29,950,000

Supporting engineering

25,150,000

Infrastructural and utilities engineering 29,500,000

Barley juice production line

29,900,000

Total

172,500,000

Upon completion of the project, there will be an annual increase of RMB269 million in sales

revenue and RMB53.43 million in profit.

(5) Technological renovation Phase 1 for Ma' anshan Co. with an annual production

capacity of 100,000 tonnes

Total investment of the project amounts to RMB79.37 million. Pursuant to a resolution passed at

the general meeting of Ma' anshan Co. held on 8 October, 2000, the Company intends to make

unilateral contribution of RMB77 million out of the proceeds of the Current Issue of A Shares to

Ma' anshan Co., for implementation of the project. The project consists of four subprojects of

technological renovation: in the saccharification and fermentation system, air compression and

refrigeration, sewage treatment and packing. Approval for the project proposals for the subprojects

Tsingtao Brewery Company Limited

22/1/2001

10

Tsingtao Brewery Company Limited

has been granted by the Anhui Provincial Economic and Trade Commission in its document Wan

Jing Mao Ji (2000) No.553 and by the Maanshan Municipal Economic and Trade Commission in its

approval documents Jing Mao (2000) Nos.9 and 67.

The investment amounts for each of the said sub-project are as futures:

Technological Renovation sub-projects

Project Name

Investment

(RMB)

Saccharification

and

fermentation 29,910,000

system

Air compression and refrigeration

29,900,000

Sewage treatment

9,600,000

Packing

9,960,000

Total

79,370,000

Upon its completion, the investment project will result in an annual production capacity of 50,000

tonnes and an annual increase in sales revenue and profit of RMB153.72 million and RMB23.21

million respectively. It will also contribute to the gradual building up of full support for achieving

an annual production capacity of 100,000 tonnes.

(6) Technological renovation for annual production capacity of 150,000 tonnes of beer

Total investment of the project amounts to RMB58.15 million. Pursuant to a resolution passed at

the general meeting of Zhuhai Co. held on 8 October, 2000, the Company intends to the project

make unilateral contribution of RMB58 million out of the proceeds of the Current Issue of A Shares

to Zhuhai Co. for implementation of the project. The project consists of the core and the utilities

projects with investment amounts of RMB29.90 million and RMB28.25 million respectively.

Approval for the proposed subprojects has been granted by the Zhuhai Municipal Planning

Commission in its documents Zhu Ji Gong Zi (2000) Nos. 31 and 32.

Upon its completion, the investment project will result in an annual production capacity of 100,000

tonnes and an annual increase in sales revenue and profit of RMB169.96 million and RMB27.92

million respectively. It will also contribute to the gradual building up of full support for achieving

an annual production capacity of 150,000 tonnes.

(7) Technological renovation for annual production capacity of 200,000 tonnes of beer

Total investment of the project amounts to RMB119.672 million. Pursuant to a resolution passed at

the board meeting of Sanshui Co. held on 8 October, 2000, the Company and the other shareholder

of Sanshui Co. called 加拿大 EVG 企業有限公司 will implement the project by further

investment in proportion to their respective shareholdings in Sanshui Co. The Company will inject

RMB90 million, In this regard, while approval of the MOFTEC in the further investment by the

said foreign investor is still being awaited. The project consists of four subprojects of technological

renovation, relation to the saccharification, facilities in support of the annual beer production of

200,000 tonnes, environmental protection and utilities, as well as the fermentation system.

Approval for the project proposals for the subprojects has been granted by the Foshan Municipal

Tsingtao Brewery Company Limited

22/1/2001

11

Tsingtao Brewery Company Limited

Economic Commission in its documents Fo Jing Gai (1999) No. 37, Fo Jing Gai (2000) Nos. 38

and 45 and Fo Jing Gong (2000) No. 102.

The investment amounts of each sub-subprojects are as follow:

Technological Renovation of the said sub-Projects

Investment

(RMB)

Saccharification

29,871,700

Facilities in support of the annual

beer production of 200,000 tonnes 29,887,700

Environmental

protection

and 29,952,600

utilities

Fermentation system

29,960,000

Total

119,672,000

Upon its completion, the investment project will result in an annual production capacity of 150,000

tonnes and an annual increase in sales revenue and profit of RMB285 million and RMB36.61

million respectively. It will also contribute to the gradual building up of full support for achieving

an annual production capacity of 200,000 tonnes.

(8) Establishment electronic sale network

Total investment of the proposed project, the project proposal which has been approved by the

Qingdao Municipal Economic Commission in its approval document (2000) No.631, amounts to

RMB10 million. The project primarily involves the application of computer and network

technologies in building up an electronic sale network for the Company to link up its sales offices

across the PRC. Through the re-planning and design of processes such as planning, warehousing

and transportation, network management of logistics and monetary settlement has been achieved

and the path into B2B E-commerce operation is followed. Upon completion of the project, the

required area for storage of products of the Company will be reduced, turnover rate of products will

increase, transportation and wastage. Upon completion of the project, annual savings of storage and

selling expenses will amount to RMB35 million and RMB5 million respectively.

Schedule of investment, expected profit-generating year and payback period for the investment

projects:

Investment

funded by

Profitproceeds Planned

gener- Payuse

Total

from

of proceeds

ating back

Project

investment share issue 2001

2002

year period

(RMB)

(RMB)

(RMB)

(RMB)

(year(s))

Acquisition of 75%

153,750,000 153,750,000 153,750,000 2001 4.4

foreign investor equity

interest in

Carlsbrew Shanghai

Projects of acquisition

186,240,000 186,240,000 186,240,000 2001 4.23

Tsingtao Brewery Company Limited

22/1/2001

12

Tsingtao Brewery Company Limited

of 62.64% foreign

investor equity

interests in Five Star

Co. and 54%

foreign investor

equity interest in

Three Ring Co.

Technological renovation 68,000,000 68,000,000 40,000,000

project for production

lines of Tsingtao

Brewery No.2 Factory

Technological renovation 172,500,000 120,000,000 120,000,000

projects of production

lines of Xi'an Co. with

an annual capacity of

50,000 tonnes of

pure and draught beer

Technological renovation 79,370,000 77,000,000 77,000,000

project phase I for

Ma'anshan Co. with an

annual capacity of

100,000 tonnes of beer

Technological renovation 58,150,000 58,000,000 46,520,000

project for Zhuhai Co.

with an annual capacity

of 150,000 tonnes of

beer

Technological renovation 119,672,000 90,000,000 90,000,000

project for Sanshui Co.

with an annual capacity

of 200,000 tonnes beer

Establishment

of 10,000,000 10,000,000 7,000,000

electronic

sales network

of the Company

Total

(

Five Star Co)

4.5

(Three

Ring Co.)

28,000,000 2003

5.05

-

2003

3.27

-

2001

4.73

11,480,000 2002

4.96

-

5.36

2002

3,000,000 2001

3

847,682,000 762,990,000 720,510,000 42,480,000

Investments in the above projects totally RMB847.682 million of which RMB762.99 million is

intended to be funded by the proceeds of the Current Issue. Proceeds from the Current Issue

RMB251.63 million in excess of the required capital injection will be used as the working capital

of the Company, while any shortfall will be satisfied by the Company itself.

The application of the said proceeds in the above projects will be subject to their priority. It is

expected that the of the Company will increase its annual sales revenue and profit by RMB2.44442

billion and RMB251.63 million upon full operation of all the projects financed by the proceeds.

The use of proceeds from the Current Issue of the Company is to continue its advanced

development, and low-cost expansion strategies, and to increase its core competitiveness. Through

technological renovation of affiliates and subsidiaries, adjustment and optimisation of the product

Tsingtao Brewery Company Limited

22/1/2001

13

Tsingtao Brewery Company Limited

mix and resource allocation; management and technological expertise will further be enhanced by

technological renovation of the corporate marketing network and network information technology.

All the investment projects are in line with the State industry policy and are expected to achieve

promising returns. The implementation of the projects will further expand the scale of production

of the Company and its market share, which will in turn facilitate the adjustment of the national

beer industry structure and enhance the international competitiveness of the domestic beer industry.

Description of the use of the previous proceeds

(Notice of which has already been sent to holders of H Shares by the Company on 22 September

2000)

Profit Forecast

Investors are reminded that owing to the uncertainty of the assumptions on which the Profit

Forecast is based, investors should not rely on the forecast in making investment decisions. The

said profit forecast has been reviewed by Arthur Andersen -Hua Qiang Certified Public

Accountants and their report, the text of which is translated from Chinese, is set out below.

Profit Forecast Review Report

To the Shareholders of Tsingtao Brewery Company Limited

Arthur Andersen -Hua Qiang Certified Public Accountants ("We") have been appointed to review

the basic assumptions on which the Profit Forecast of Tsingtao Brewery Company Limited (the

"Company") and its subsidiaries (the "Group") for the fiscal years 2000 and 2001 is based, the

accounting policies adopted and the basis of preparation and calculation methods. The management

of the Company and the Group is solely responsible for the reasonableness of the assumptions on

which the Profit Forecast is based, the consistency of the accounting policies adopted, the

appropriateness of the basis of preparation and calculation methods and the realization of the

forecast objectives. We are not responsible and do not warrant the realizability of the forecasted

results. Our responsibility is to express an opinion on the basic assumptions on which the Profit

Forecast is based, the accounting policies adopted, the basis of preparation and the calculation

methods based on our review. We have conducted our review in accordance with "Independent

Auditing Practice Notice No. 4 -Review of Profit Forecast" issued by the Chinese Institute of

Certified Public Accountants, and have carried out all the review procedures we consider necessary.

In our opinion, the basic assumptions on which the Profit Forecast for the fiscal years 2000 and

2001 is based, the accounting policies adopted, and the basis of preparation as mentioned above

have been adequately disclosed, and there is no evidence that these basic assumptions, basis of

preparation and calculation methods are unreasonable. The Profit Forecast has been prepared on the

disclosed basis of preparation and the accounting policies and calculation methods used are

consistent in all material aspects with those normally adopted by the Company and the Group.

Arthur Andersen -Hua Qiang

Certified Public Accountants

Luo Zhan En

PRC Certified

Public Accountant

Tsingtao Brewery Company Limited

22/1/2001

14

Zhang Xiang Ji

PRC Certified

Public Accountant

Tsingtao Brewery Company Limited

Beijing, the PRC

17 November, 2000

The following information is extracted from the Profit Forecast

I. Consolidated Profit Forecast of Tsingtao Brewery Company Limited and Its Subsidiaries

(Prepared in accordance with PRC accounting standards and regulations)

Forecast Period: Fiscal Years 2000 and 2001

January 1 ,

to June 30,

1999

2000

2000

2001

Items

(audited)

(audited) (forecast) (forecast)

In 10,000 Yuan (except the earnings

per share, which is in RMB)

1. Turnover

244,544

186,354

390,803

590,339

Less: Cost of sales

146,382

113,368

244,384

360,119

Taxes and surcharges

20,683

16,181

31,481

51,886

2. Gross profit

77,479

56,805

114,938

178,334

Add: Profit from other operations

6

927

993

166

Less: Provision for diminution

in values of inventories

267

506

800

500

Selling expenses

43,168

30,795

59,446

90,682

General and administration expenses 19,967

14,799

31,498

44,780

Financial expenses, net

5,411

4,117

10,816

12,420

3. Operating profit

8,672

7,515

13,371

30,118

Add: Investment income

1,006

518

740

740

Subsidy income

3,854

1,177

2,730

-Non-operating income

574

187

775

Less: Non-operating expenses

1,011

108

419

4. Profit before tax and minority 13,095

9,289

17,197

30,858

interests

Less: Income tax

3,784

2,050

4,993

7,836

Less: Minority interests

364

951

2,446

5,971

5. Net profit

8,947

6,288

9,758

17,051

6. Earnings per share

RMB0.0994 RMB0.0699 RMB0.1084 RMB0.1705

Legal Representative: Li Gui Rong

Financial Controller: Sun Yu Guo

Prepared by: Yu Zhu Ming

II. Basis of preparation

This Profit Forecast has been prepared based on the operating results of Tsingtao Brewery

Company Limited (the "Company") and its subsidiaries (the "Group") for the three years ended 31

December, 1999 and the six months ended 30 June, 2000, together with the production and

operation plans of the Company and the Group for the fiscal years 2000 and 2001, and the existing

production and technological conditions after taking into consideration the market condition and

the plans for business pursuit. The accounting principles adopted for this Profit Forecast have

complied in all material aspects with the relevant provisions of the existing PRC laws, regulations

and the financial accounting system, and are consistent with the accounting policies and the basis of

Tsingtao Brewery Company Limited

22/1/2001

15

Tsingtao Brewery Company Limited

preparation of financial statements adopted by the Company and the Group.

III. Basic assumptions

The basic assumptions adopted in the Profit Forecast of the Company and the Group for the fiscal

years 2000 and 2001 are as follows:

(1) there will be no material change in the existing PRC laws, regulations and policies with which

the Company and the Group shall comply, and the social environment of the region where the

Group is located;

(2) there will be no material change in the existing relevant political, economic, legal conditions

and regulations, policies and economic environment of the countries or territories where the

Company and the Group operate;

(3) there will be no material change in the supply of the major raw materials, energy and the

markets for the sale of goods of the Company and the Group, which is unforeseeable and will have

material adverse impacts on the supply of major raw materials, energy and the prices of the goods;

(4) there will be no material adverse impact on the operations and the results of the Company and

the Group caused by unforeseeable actions of the government, the industry or labour disputes;

(5) there will be no material adverse impact on the anticipated sales and selling prices of goods of

the Company and the Group caused by unforeseeable factors;

(6) there will be no material change in the tax rates, exchange rates, interest rates and market

conditions during the forecast period; and

(7) there will be no material adverse impact caused by force majeure and unforeseeable factors.

IV. Statement of Profit Forecast of Tsingtao Brewery Company Limited and Its Subsidiaries

for the Fiscal Years 2000 and 2001

1. Description of the Company

The predecessor of the Company is the State-owned Qingdao Brewery Factory which was founded

in 1903 and is the earliest-established brewery factory in China. The Company was incorporated on

16 June, 1993, with the State-owned Qingdao Brewery Factory as its promoter and absorbing

Tsingtao Brewery No. 2 Factory and Tsingtao Brewery No. 4 Factory. Its scope of business includes

manufacture and sales of beer and related businesses. In the same year, the Company issued H

Shares in Hong Kong and was listed on the Stock Exchange of Hong Kong Limited on 15 July,

becoming the first PRC enterprise listed in Hong Kong. Later on, the Company issued A Shares in

the PRC and was listed on the SSE on 27 August in the same year. The total share capital of the

Company amounts to RMB900 million, 44.42% of which is State-owned shares, 5.93% of which is

legal person shares, 11.11% of which is domestically listed A Shares, and 38.54% of which is

overseas listed H Shares. There has been no additional issuance or placing of shares since the

listing of the Company seven years ago.

In 1999, the Company's total production capacity amounted to 1.07 million tonnes. The operating

results as audited by Arthur Andersen -Hua Qiang Certified Public Accountants is as follows: the

consolidated total assets amounted to RMB5.173 billion; the consolidated turnover amounted to

RMB2.445 billion; the consolidated profit before tax and minority interests amounted to RMB131

Tsingtao Brewery Company Limited

22/1/2001

16

Tsingtao Brewery Company Limited

million; and the consolidated net profit amounted to RMB89 million.

2. Basis and methodology of preparation for Profit Forecast

The operating results of the Company and the Group for each of the three years ended 31 December,

1997, 1998 and 1999 and the six months ended 30 June, 2000 (the "Relevant Periods"), in relation

to their manufacture and sale of beer and related businesses, are included in the financial statements

for the Relevant Periods. The Profit Forecast is prepared on the same basis and methodology as

adopted for the Relevant Periods.

3. Principal Accounting Policies, Accounting Estimates and Basis of Preparation for Profit

Forecast

(1) Accounting standards

The Company and its subsidiaries (collectively referred to as the "Group") have adopted use of the

"Accounting Standards for Joint Stock Limited Companies" of the PRC. The books and records are

maintained on the accrual basis using the the historical cost convention.

(2) Financial year

The financial year runs from 1 January to 31 December of each calendar year.

(3) Reporting currency and foreign currency translation

The Group maintains its books and records in Renminbi ("RMB"). Foreign currency transactions

are translated into RMB at the average exchange rate announced by the People's Bank of China

("Market Rate") on the dates of the transactions. On the last day of each month, monetary assets

and liabilities denominated in foreign currencies are translated into RMB at the Market Rate

prevailing at the end of each month. The exchange differences arising from the translation are dealt

with in the statements of income.

(4) Bases of entries and valuation

The Group maintains its books and records on an accrual basis. All assets are stated at their actual

costs when they are acquired or constructed, except those subject to revaluation, which will be

stated at revaluation.

(5) Turnover

The Group and the Company provided delivery services to major distributors and the sales prices of

its products (invoiced value of goods) were adjusted to cover the necessary transportation costs.

Sales are recognised when title of goods passes to customers.

(6) Bad debts

The Group makes provision for bad debts. Generally, receivable balances aged three years or above

would be fully provided for. For receivables aged between one to three years, a general provision of

10% to 50% is provided. Moreover, specific provision is made against individual receivable

balances as required.

(7) Inventories

Inventories are stated at the lower of cost, calculated using the weighted average method, and net

realisable value. Costs of work-in-progress and finished goods comprise direct materials, direct

labour, and an attributable proportion of production overheads. Net realisable value represents the

Tsingtao Brewery Company Limited

22/1/2001

17

Tsingtao Brewery Company Limited

estimated selling price less all further costs to completion and costs to be incurred in marketing and

distribution. Low-value consumables are amortised into expenses over 2-5 years using the

straight-line method.

(8) Long-term equity investments

Investment in other enterprises are accounted for using the equity method in the Company's

financial statements and is consolidated in preparing the consolidated financial statements if the

investment represents a 50% above holding in the voting capital of the investee.

If the investment represents less than 20% of the voting capital of the investee, or a holding of 20%

or above of the voting capital but the Company is not able to exercise significant influence over the

investee, it is stated at cost less provision for permanent diminution in value. If the investment

represents a 20% or above holding of the voting capital of the investee, or a less than 20% holding

of the voting capital but the Company is able to exercise significant influence over the investee, it is

accounted uisng the equity method.

For investees accounted for using the equity method, the difference between the acquisition cost of

the investments and the Group's share of the shareholders' equity of the investees ("Goodwill") is

amortised into the statements of income over 10 years.

Dividend income from other long-term investments is recognised when cash is received.

(9) Long-term debt investments

Long-term debt investments are stated at cost less provision for any permanent diminution in value.

The discount or premium on purchases of bonds is amortised against interest income over the

period to maturity of the bonds. Interest income arising from bonds is accounted for using the

accrual basis.

(10) Fixed assets and depreciation

Fixed assets are stated at cost or revalued amount less accumulated depreciation. Depreciation is

provided on a straight-line basis to write off the cost of fixed assets over their estimated useful lives,

after taking into account their estimated residual value of 3% of cost. The estimated useful lives of

fixed assets are as follows:

Buildings

20-40 years

Plant

and 10-14 years

machinery

Motor vehicles

5-12 years

Certain fixed asset were injected by the founding shareholders into the Company on 16 June, 1993

at the value agreed amongst the founding shareholders and as approved by the State Owned Assets

Administration Bureau of the PRC as a result of a group reorganisation. Since that date,

depreciation of these fixed assets is provided on a straight-line basis to write off the revalued

amount of the assets over their remaining estimated useful lives. All fixed assets acquired or

constructed subsequent to that date are stated at cost.

(11) Construction-in-progress

Construction-in-progress represents factory buildings, plant and machinery and other fixed assets

under construction and is stated at cost. Cost includes direct cost of construction as well as interest

Tsingtao Brewery Company Limited

22/1/2001

18

Tsingtao Brewery Company Limited

charges used to finance the construction during the construction, installation and testing periods.

Construction-in-progress is transferred to fixed assets when it is in a condition for use in

commercial production.

(12) Intangible assets

Intangible assets include mainly the "TSINGTAO BEER" trademark injected by the founding

shareholders as capital during the reorganisation of the Group. The recorded value of the trademark

was based on the valuation amount approved by the State Owned Assets Administration Bureau of

the PRC. Intangible assets also include the recorded value of land use rights which was based on

actual consideration paid or valuation, and the brewing technology know-how of the subsidiaries.

Intangible assets are amortised into general and administrative expenses over the period of use or

estimated useful lives of the assets using the straight-line method. The periods of amortisation are

as follows:

Trademark

40 years

Land use rights

50 years

Technology know-how

10 years

(13) Pre-operating expenses

Pre-operating expenses represent the expenses incurred during the period prior to operation and

during transfer of assets into subsidiaries. They are amortised into general and administrative

expenses over five years using the straight-line method, starting from the commencement of normal

production.

(14) Long-term deferred expenses

Long-term deferred expenses represent various expenses (excluding pre-operating expenses) with

an amortisation period over 1 year. They are generally amortised into general and administrative

expenses over 2 to 5 years using the straight-line method.

(15) Taxation

1. Enterprise income tax

Income tax is levied on the assessable income of the year calculated in accordance with the relevant

regulations of the PRC after considering all the available tax benefits from refunds and allowances.

Income tax is accounted for using the tax payable method.

In accordance with an approval document dated 18 April, 1994 issued by the State Administration

for Taxation ("SAT") of the PRC, net profit earned by the Company is subject to income tax at 15%

effective from the date of establishment of the Company. This rate will remain effective until and

unless the enterprise income tax law and regulations provide otherwise. The Company received

confirmation of continuation of application of the preferential tax from the Qingdao Ministry of

Finance on 23 March, 1997 but this preferential tax rate is not applicable to the other subsidiaries.

Except for Tsingtao Brewery Xi'an Company Limited which received approval from Xi'an

Municipal government at the time of its acquisition to use 15% as the income tax rate, other

subsidiaries are subject to income tax at 33%.

2. Value-added tax

Under the current tax regulations, the Company is subject to value-added tax ("VAT") which is the

Tsingtao Brewery Company Limited

22/1/2001

19

Tsingtao Brewery Company Limited

principal indirect tax on the sale of goods and the provision of certain specified services ("output

VAT"). Output VAT is calculated at 17% of the invoiced value of sales and is payable by the

customer in addition to the invoiced value of sales. The Company pays VAT on its purchases

("input VAT") which is deducted against output VAT in arriving at the net VAT amount payable to

the government. All VAT paid and collected are recorded through the VAT payable account

included in tax payable on the balance sheet.

3. Consumption tax

Pursuant to the SAT regulations, consumption tax of RMB220 per tonne is charged on the sale of

beer.

4. Deferred taxation

Deferred taxation is provided for using the liability method in respect of the tax effects of

significant timing differences between profit as computed for taxation purposes and profits as

stated in financial statements to the extent that a liability is likely to crystallise in the foreseeable

future. Deferred tax assets are not recognised, except when the deferred tax assets are likely to

crystallise in the foreseeable future.

4. Description of Profit Forecast Items

Description of Consolidated Profit Forecast

The consolidated Profit Forecast has been prepared on the basis of the profit forecast of the

Company and its subsidiaries for the fiscal years of 2000 and 2001 adopting the consistent method

of preparation of the consolidated financial statements of the Group. All significant intra-group

transactions have been eliminated in the preparation of the consolidated Profit Forecast.

As compared with the year of 2000, the scope of consolidation for 2001 has been extended with the

addition of the following subsidiaries:

i. Beijing Asia Shuang He Sheng Five Star Beer Co., Ltd. (company's name to be changed)

ii. Beijing Three Ring Asia Pacific Company Limited (company's name to be changed)

iii. Carlsbreg Brewery (Shanghai) Limited (company's name to be changed)

iv. Tsingtao Brewery (No.5) Company Limited

(1) The sale and products mix

The sales of the Group for the year of 1999 was 1.05 million tonnes while its sales for the six

months ended 30 June, 2000 was 0.7 million tonnes, with an estimated sales for the whole year

being 1.41 million tonnes, representing an increase of 34% or 360,000 tonnes as compared with

that of the year of 1999. By year 2001, it is expected that the sales of the Group will reach 2.1

million tonnes, representing an increase of 49% or 0.69 million tonnes as compared with that of the

year of 2000, This is mainly a result of additional investments and expansion as by the Group.

In the year of 2001, the total sales of Tsingtao Beer is expected to be 0.82 million tonnes (or 39% of

the expected total sales volume), representing an increase of 49% or 0.27 million tonnes as

compared with that of the year 2000. The increase is mainly attributable to new and expanded

projects. Sales volume of the Company products under other brandnames is expected to reach 1.28

million tonnes (or 61% of the expected total turnover), representing an increase of 49% or 0.42

Tsingtao Brewery Company Limited

22/1/2001

20

Tsingtao Brewery Company Limited

million tonnes over year 2000.

There will be no significant increase or change in the sales volume and the products mix of the

Company and its subsidiaries in 2001 as compared with those of 2000, except for certain new and

expansion projects as particularly mentioned below.

(2) Turnover

The consolidated turnover for the year 1999 was RMB2,445.44 million. For the six months ended

30 June, 2000, the consolidated turnover was RMB1,863.54 million, with a forecast consolidated

turnover for the whole year of RMB3,908.03 million, representing an increase of 60% or

RMB1,462.59 million as compared with that of 1999. The principal reason for the growth is that in

the past two years, the Group acquired at low cost twenty odd brewery factories in various places of

the country including the Shandong Province and engaged in massive marketing activities. Its

production and market capacity were hence increased.

The forecasted consolidated turnover for the year 2001 is RMB5,903.39 million, an increase of

51% or RMB1,995.36 million as compared with that of 2000. The principal reason for the growth

is that the scale of the Group continues to expand. The new and expansion projects mentioned

below are expected to increase the consolidated turnover of 2001 by RMB1,587.66 million which

constitutes 80% of the increase. There will also be an increase of 20% or RMB407 million from the

Company and other subsidiaries, representing a normal growth.

(3) Consolidated Cost of sales

The consolidated cost of sales of the Group for the year 1999 was RMB1.46382 billion. For the six

months ended 30 June, 2000, the consolidated cost of sales of the Group was RMB1,133.68 million

with a forecasted cost of sales for the whole year of 2000 is RMB2,443.84 million, an increase of

67% or RMB980.02 million compared to that of year 1999. The increase is mainly attributed to the

increase in sales volume and the increase in number of the subsidiaries. At the same time, owing to

the impact of the technological renovation and the expanded projects in 2000 on normal production,

the cost of production in respect of certain subsidiaries increased at a relatively higher rate. It is

expected that in the coming year when each of the subsidiaries enter normal operation, the average

cost may decrease.

The forecasted consolidated cost of sales for the year 2001 is RMB3,601.19 million, representing

an increase of 47% or RMB1,157.35 million over that of year 2000. The principal reason for the

increase is that the scale of the Group continues to expand. The new and expansion projects

mentioned below are expected to increase the consolidated cost of sales of 2001 by RMB922.51

million, which contribute 80% of the increase. There will only be an increase of 20% or

RMB234.84 million for the Company and its subsidiaries, representing a normal increase.

(4) Tax and surcharge on principal operating activities

The tax and surcharge includes consumption tax and city maintenance and construction tax and

education surcharge calculated on the basis of sales tax and value-added tax.

(5) Gross profit

The gross profit of the Group for the year 1999 was RMB774.79 million, representing an average

Tsingtao Brewery Company Limited

22/1/2001

21

Tsingtao Brewery Company Limited

gross profit margin of 32%. For the six months ended 30 June, 2000, the gross profit of the Group

was RMB568.05 million, representing an average gross profit margin of 30%. The forecasted gross

profit for the whole year of 2000 is RMB1,149.38 million, representing an average gross profit

margin of 29%. The increase in gross profit is primarily attributed to the increase in the turnover.

But at the same time, since the increase is mainly derived from the middle to low-end markets,

there is a decrease in the average gross profit margin.

The forecasted gross profit of the Group for the year 2001 is 1,783.34 million, representing an

average gross profit margin of 30% compared to the year 2000, this represents a growth in the gross

profit margin. The growth is primarily attributed to the fact that the new and expansion projects are

concentrated in the high to middle-end markets. A higher profit can therefore be attained.

(6) Selling expenses

In 1999, the selling expenses of the Group was RMB431.68 million (representing 18% of the

consolidated turnover). For the six months ended 30 June, 2000, the selling expenses of the Group

was RMB307.95 million (representing 17% of the consolidated turnover). The forecasted expenses

for the whole year of 2000 is RMB594.46 million (representing 15% of the forecasted consolidated

turnover), representing an increase of 38% or RMB162.78 million as compared with that of 1999.

The major reason for the increase is that there are vigorous marketing activities with a view to

increase the turnover and build a foundation for the future development of the newly developed

markets. Since there is a substantial increase in the turnover and the Group has already established

itself in certain markets, the proportion of the selling expenses out of the turnover has decreased.

In 2001, the forecasted selling expenses of the Group is RMB906.82 million (or 15% of the

forecasted consolidated turnover), representing an increase of 53% or RMB312.36 million as

compared with that of 2000. The major reason for the increase is the continual expansion of the

Group and the rapid increase in the sales volume, there comes an increase in the cost of

advertisements, the cost of transportation, the cost of after sales services and other related expenses.

The new and expansion projects mentioned below are expected to increase the selling expenses of

2001 by RMB275.87 million representing 88% of the increase. There will only be an increase of

10% or RMB36.49 million in the Company and its other subsidiaries, representing normal

increases.

(7) General and administration expenses

In 1999, the general and administration expenses of the Group was RMB199.67 million. For the six

months ended 30 June, 2000, the general and administration expenses of the Group was

RMB147.99 million. The forecasted general and administrative expenses for the whole year of

2000 is RMB314.98 million, representing an increase of 58% or RMB115.31 million as compared

with that of year 1999. The increase is primarily attributed to the increase in the number of

subsidiaries, which in turn, increases the administration costs and other related expenses.

The forecasted general and administration expenses of the Group for year 2001 is RMB447.8

million, representing an increase of 42% or RMB132.82 million as compared with that of year

2000. The major reason is that in 2001, the Group is expected to increase its acquisition and

Tsingtao Brewery Company Limited

22/1/2001

22

Tsingtao Brewery Company Limited

construction projects. With the continual increase in scale and the rapid increase in production and

sales, there will be corresponding increases in the salaries and other salary-related expenses for the

additional manpower, depreciation of fixed assets, general overhead costs, product development

costs, and the cost of amortisation of various assets. The new and expansion projects mentioned

below are expected to increase the general and administration expenses of 2001 by RMB97.13

million, representing 73% of the increase. There will also be an increase of 24% or RMB35.69

million in the Company and other subsidiaries. The main reason is that the Company intends to

implement various comprehensive management measures for each of its subsidiaries, which will

result in an increase in part of the general and administration expenses. However, with the

improved cost control system and the full adherence to the management principles of the Group,

the expenses will be controlled and reduced remarkably in future.

(8) Financial expenses

In 1999, the financial expenses of the Group was RMB54.11 million. For the six months ended 30

June, 2000, the financial expenses of the Group was RMB41.17 million, the forecasted financial

expenses for the whole year of 2000 is RMB108.16 million, representing an increase of 100% or

RMB54.05 million as compared with that of 1999. The reason for the increase is that, with the

continual expansion of the scale of the Group and injection of capital, there will be an increase in

banking facilities and related interest expenses.

The forecasted financial expenses of the Group for year 2001 is RMB124.2 million, an increase of

15% over that of year 2000, which is mainly attributable to the greater working capital requirement

upon the increase in the scale of subsidiaries.

(9) Subsidy income

As part of the merger with or acquisition of subsidiaries by the Group in the current year and prior

years, the Group entered into agreements with the relevant municipal governments. Under the

terms of agreements, these subsidiaries will various financial incentives granted by the relevant

municipal governments, the main one being financial subsidies granted based upon the amount of

tax paid by the subsidiaries.

The income is recognized when it is actually received. Owing to the uncertainties of such income, it

is not included in the profit forecast of the Group for year 2001.

(10) Profit tax

Since the Company is listed in Hong Kong and is considered as a Sino-foreign joint venture, it is

subject to profit tax 15%. The income tax of each of the subsidiaries is provided on the basis of

their assessable profit of that year in accordance with relevant regulations.

(11) Profit

As summarized from above, the forecasted profit before tax and minority interest of the Group for

year 2000 is RMB171.97 million and net profit is RMB97.58 million. The forecasted profit before

tax minority interests for 2001 is RMB308.58 million and net profit is RMB170.51 million.

(12) Minority interest

The minority interest is calculated based on the interests of the minority shareholders in the

Tsingtao Brewery Company Limited

22/1/2001

23

Tsingtao Brewery Company Limited

subsidiaries and the forecasted profit of the subsidiaries for that year.

(13) Calculation of earnings per share

It is expected that the proceeds will be available in January, 2001. The earnings per share for 2000

are arrived at after dividing the forecasted net profit in 2000 by 900 million shares. The earnings

per share for 2001 are arrived at after dividing the forecast net profit for 2001 by 1 billion shares, of

which 100 million shares are the additional A Shares expected to be issued on this occasion.

Development plan for the company

1. Strategy for production and operation development

In order to raise the core competitive strength, the Company makes wide use of information

technology, upgrades plant and equipment and production techniques and modernized management;

and puts in place scientific effective personnel training. In the shortest possible time, our national

brand name -Tsingtao Beer will rank within the ten biggest in the industry all over the world.

High level development: the Company will select suitable location, adopt advanced beer production

techniques and establish some modern enterprises to produce high quality Tsingtao Beer. The

market share at the higher end will be increased.

Low cost expansion: The Company will consistently follow "low cost expansion" strategy. In

selecting targets for acquisition and merger, the Company will especially consider location with

great market capacity, high consumption level and good water quality. In the process of acquisition

and merger, the Company will use its best endeavours to eliminate inferior equipment, decrease

exaggerated assets, obtain preferential treatment so as to achieve "low cost" expansion.

Expansion and reorganization: The Company will undergo technical reorganization of the

enterprises just purchased or merged so as to achieve economies of scale, good peripheral

enterprises will be absorbed around the centre of the Company. In this way, competitive advantages

at a certain location will be increased.

Multi-development: With beer production at the core, the Company will go for vertical integration,

producing beer flowers, rye sprouts and mineral water at the upper end as well as observing

bio-pharmaceutics at the lower end. Therefore, new profit centres will be generated.

2. Development objectives and scale

The development objectives for the Company up to the year of 2003 are: 3 million tonnes of beer

production and sales, 10% market share (including sales of over 1.2 million tonnes of Tsingtao

Beer). This will further consolidate the position of the Company as the leading beer production

enterprise in the country, and their stable competitive advantages will enhance their position as one

of the ten biggest enterprises in the world, the long term objectives of the Company up to the year

of 2005 are: 5 million tonnes beer production, 12% to 15% market share of which 40% are Tsingtao

Beer. This will make the Company as one of the most important beer producers in the world.

3. Market development plan

The Company follow the principle of "common network, share resources" for the leading

brandnames "Tsingtao Beer" and other brandnames. The traditional sales system will be modified

with electronic network management for materials, information and cash flows. Meanwhile, the

Tsingtao Brewery Company Limited

22/1/2001

24

Tsingtao Brewery Company Limited

Company will endeavour to increase their market share in eastern and coastal regions, and raise

their sales gradually in central and western regions.

4. Sales plan

Up to 2003, the annual beer sales of the Company amount to 3 million tonnes, of which 1.2 million

tonnes are Tsingtao Beer and 1,800,000 tonnes other brandnames. The sales system of the

Company will also follow the principle of "common network, share resource" for fully dimensional

domestic market. In addition, the market segments will further be subdivided to aim at the younger

generation, promotion will be done with strong advertising campaigns.

Product exports: In the next four to five years' time, the Company will, on the basis of present

market, expand into some important markets such as Hong Kong, Macau, Europe, South Africa and

U.S.A. Feasibility studies on overseas plant establishments will also be completed.

5. Production and operation plan

The Company will carry out the development and sales plans to reach the objectives; set up

scientific assessment system related to market performance; develop strict quality control and

brandname recognition strategy. In 2001, the Company will fully implement ISO9000-2000

standard, and start ISO14000 environment management so as to make green production spaces for

the factories of the Company and major subsidiaries within the next three to five years.

The Company will raise operational efficiency with information technology such as e-commerce. It

will be implemented in three stages: Firstly, sales management and financial management systems;

secondly, gradual electronic management of supply, production, human resources and customers

information; thirdly, B2B e-commerce on the basis of internal information system.

6. Investment plan for fixed assets and renewed equipment

In the next five years, the production scale will be expanded, the enterprises just purchased or

merged will, upon market research, develop in areas with abundant water resources according to

their capabilities the equipment will be replaced with new domestic products, and some strategic

equipment will be imported the total investment for the five years will be about RMB450 million,

7. Workforce expansion plan

The Company currently has 19,146 staff. In the coming three to five years, the Company plans to

maintain a steady growth in the total number of staff, increasing both the profitability and

productivity per staff. Regarding existing staff, the Company aims to optimize its workforce, raise

work efficiency by cutting redundant manpower and fitting the right person for the right post. The

Company will use between fly the right person for the right post. The Company will use scientific

human resources recruitment mechanism to absorb high calibre personnel for suitable vacancies

through open recruitment.

8. Fund raising and utilization plan

The Company will make the best use of the proceeds from the A Share Issue. In order to satisfy, the

funding requirements for various development projects, the Company intends to raise capital from

different sources, primarily through the capital market for long-term funding, and the use of

internal resources and short-term funding, and the use of internal resources and short-time bank

Tsingtao Brewery Company Limited

22/1/2001

25

Tsingtao Brewery Company Limited

loans to meet the immediate funding requirement. In the process of fund raising, the Company will

look for opportunities in getting favourable terms with financial institutions to reduce its cost of

funding as well as to minimize its debt expenses.

Material Contracts and Significant Litigations

Material Contracts

The material contracts that shall be performed, are being performed and had been performed by the