daily technical analysis

advertisement

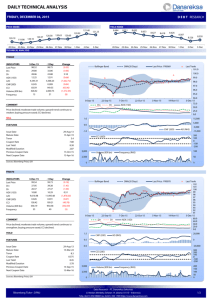

DAILY TECHNICAL ANALYSIS MONDAY, NOVEMBER 30, 2015 D E B T RESEARCH . PRICE INDEX 120.22 119.93 119.93 120.10 120.19 120.37 119.98 120.58 YIELD INDEX 8.713 8.715 120.63 8.679 120.10 16-Nov 17-Nov 18-Nov 19-Nov 20-Nov 23-Nov 24-Nov 25-Nov 26-Nov 27-Nov TECHNICAL ANALYSIS 8.696 8.684 8.711 8.692 8.653 8.627 8.618 16-Nov 17-Nov 18-Nov 19-Nov 20-Nov 23-Nov 24-Nov 25-Nov 26-Nov 27-Nov FR0069 INDICATORS Last Price DI+ DIADX (15D) A/D CMF(20D) CCI Volume (IDR bn) Frequency 27-Nov-15 98.62 37.33 21.93 12.54 4,735.90 0.282 136.01 1,024.21 10 -1 Day 98.60 37.28 22.74 11.58 3,595.07 0.211 131.40 517.27 13 Change 0.02 0.05 (0.81) 0.96 1,140.83 0.07 4.61 506.94 (3) Bollinger Band SMA(20 Days) Last Price : FR0069 Last Trade 101.0 100.0 99.0 98.0 97.0 96.0 95.0 2-Sep-15 COMMENT 16-Sep-15 DI+ 1-Oct-15 DI- 16-Oct-15 30-Oct-15 13-Nov-15 ADX (15D) 94.0 27-Nov-15 75.0 50.0 Price increased slightly; heavy trade volume; upward trend continues to strengthen; buying pressure increased; CCI increased. HOLD FEATURES 25.0 0.0 0.5 15,000 0.0 5,000 -0.5 Issue Date Mature Date Tenor Coupon Rate Last Yield Modified Duration Previous Coupon Date Next Coupon Date 29-Aug-13 15-Apr-19 3.4 7.88 8.35 2.89 15-Oct-15 15-Apr-16 Sources: Bloomberg (Price); IDX CMF (20D) -1.0 -5,000 -15,000 200 100 0 -100 -200 CCI (20D) 5,000 AD (RHS) Volume (IDR bn) 100 Frequency (RHS) 2,500 50 0 0 FR0070 INDICATORS Last Price DI+ DIADX (15D) A/D CMF(20D) CCI Volume (IDR bn) Frequency 27-Nov-15 98.98 36.79 27.46 10.62 12,079.60 0.505 87.65 1,022.59 20 -1 Day 98.98 36.81 27.85 10.34 12,239.43 0.523 86.79 871.39 44 Change (0.00) (0.02) (0.39) 0.28 (159.82) (0.02) 0.86 151.20 (24) Bollinger Band 2-Sep-15 COMMENT SMA(20 Days) 16-Sep-15 DI+ 1-Oct-15 DI- 16-Oct-15 ADX (15D) Price declined slightly; heavy trade volume; upward trend continues to strengthen; buying pressure eased; CCI increased. Last Price : FR0070 30-Oct-15 13-Nov-15 Last Trade 102 101 100 99 98 97 96 95 94 93 92 91 27-Nov-15 80.0 60.0 40.0 20.0 0.0 HOLD 1.5 FEATURES 0.5 0 -0.5 -20,000 Issue Date Mature Date Tenor Coupon Rate Last Yield Modified Duration Previous Coupon Date Next Coupon Date Sources: Bloomberg (Price); IDX Bloomberg Ticker : DFMJ 29-Aug-13 15-Mar-24 8.3 8.375 8.55 5.79 15-Sep-15 15-Mar-16 CMF (20D) AD (RHS) 200 100 0 -100 -200 CCI (20D) 5,000 Volume (IDR bn) 20,000 Frequency (RHS) 2,500 0 Debt Research - PT. Danareksa Sekuritas Jl. Medan Merdeka Selatan 14 Jakarta 10110 - Indonesia Telp. (6221) 350 9888 Fax. (6221) 350 1709 http://www.danareksa.com 200 150 100 50 0 1/2 DAILY TECHNICAL ANALYSIS MONDAY, NOVEMBER 30, 2015 D E B T RESEARCH . FR0071 INDICATORS Last Price DI+ DIADX (15D) A/D CMF(20D) CCI Volume (IDR bn) Frequency 27-Nov-15 102.43 41.32 21.72 19.53 7,792.74 0.507 98.60 792.89 37 -1 Day 102.42 41.85 22.00 18.70 6,257.14 0.400 101.23 1,109.16 81 Change 0.01 (0.52) (0.28) 0.83 1,535.60 0.11 (2.63) (316.28) (44) Bollinger Band SMA(20 Days) Last Price : FR0071 Last Trade 106.0 104.0 102.0 100.0 98.0 96.0 94.0 2-Sep-15 COMMENT 16-Sep-15 DI+ 1-Oct-15 DI- 16-Oct-15 30-Oct-15 13-Nov-15 ADX (15D) 92.0 27-Nov-15 75.0 50.0 Price increased slightly; heavy trade volume; upward trend continues to strengthen; buying pressure increased; CCI declined. 25.0 0.0 HOLD 1.0 FEATURES 0.0 Issue Date Mature Date Tenor Coupon Rate Last Yield Modified Duration Previous Coupon Date Next Coupon Date 12-Sep-13 15-Mar-29 13.3 9.00 8.69 7.61 15-Sep-15 15-Mar-16 Sources: Bloomberg (Price); IDX CMF (20D) 10,000 AD (RHS) 0 -1.0 -10,000 200 100 0 -100 -200 CCI (20D) 2,000 Volume (IDR bn) Frequency (RHS) 1,000 200 100 0 0 FR0068 INDICATORS Last Price DI+ DIADX (15D) A/D CMF(20D) CCI Volume (IDR bn) Frequency 27-Nov-15 96.24 40.62 23.15 18.82 5,258.87 0.385 73.94 231.64 31 -1 Day 96.23 40.83 23.27 18.21 3,586.40 0.237 77.78 164.18 22 Change 0.00 (0.21) (0.12) 0.61 1,672.47 0.15 (3.84) 67.46 9 Bollinger Band Last Price : FR0068 Last Trade 101 99 97 95 93 91 89 87 2-Sep-15 COMMENT SMA(20 Days) 16-Sep-15 DI+ 1-Oct-15 DI- 16-Oct-15 30-Oct-15 ADX (15D) 13-Nov-15 85 27-Nov-15 75.0 50.0 Price increased slightly; moderate trade volume; upward trend continues to strengthen; buying pressure increased; CCI declined. 25.0 0.0 SELL 1.0 FEATURES Issue Date Mature Date Tenor (year) Coupon Rate Last Yield Modified Duration Previous Coupon Date Next Coupon Date CMF (20D) 16,000 AD (RHS) 0.0 1-Aug-13 15-Mar-34 18.3 8.38 8.79 8.95 15-Sep-15 15-Mar-16 Sources: Bloomberg (Price); IDX 0 -1.0 -16,000 200 100 0 -100 -200 CCI (20D) 3,000 2,000 1,000 0 Volume (IDR bn) Frequency (RHS) 150 50 -50 Analysts: Rifki Rizal (3404) & Amir A. Dalimunthe (3405) DISCLAIMER: The information contained in this report has been taken from sources which we deem reliable. However, none of P.T. Danareksa Sekuritas and/or its affiliated companies and/or their respective employees and/or agents makes any representation or warranty (express or implied) or accepts any responsibility or liability as to, or in relation to, the accuracy or completeness of the information and opinions contained in this report or as to any information contained in this report or any other such information or opinions remaining unchanged after the issue thereof. We expressly disclaim any responsibility or liability (express or implied) of P.T. Danareksa Sekuritas, its affiliated companies and their respective employees and agents whatsoever and howsoever arising (including, without limitation for any claims, proceedings, action , suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of acting in reliance upon the whole or any part of the contents of this report and neither P.T. Danareksa Sekuritas, its affiliated companies or their respective employees or agents accepts liability for any errors, omissions or mis-statements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission therefrom which might otherwise arise is hereby expresses disclaimed. The information contained in this report is not be taken as any recommendation made by P.T. Danareksa Sekuritas or any other person to enter into any agreement with regard to any investment mentioned in this document. This report is prepared for general circulation. It does not have regards to the specific person who may receive this report. In considering any investments you should make your own independent assessment and seek your own professional financial and legal advice. Bloomberg Ticker : DFMJ Debt Research - PT. Danareksa Sekuritas Jl. Medan Merdeka Selatan 14 Jakarta 10110 - Indonesia Telp. (6221) 350 9888 Fax. (6221) 350 1709 http://www.danareksa.com 2/2