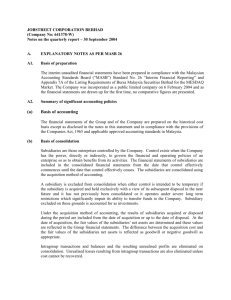

notes to the financial statements

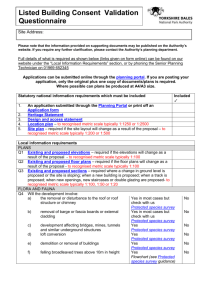

advertisement